Flexible Electronics Market Share, Size, Trends & Industry Analysis Report

By Component (Displays, Batteries, Sensors, Memory Devices, and Others), By Application, and By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM4304

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

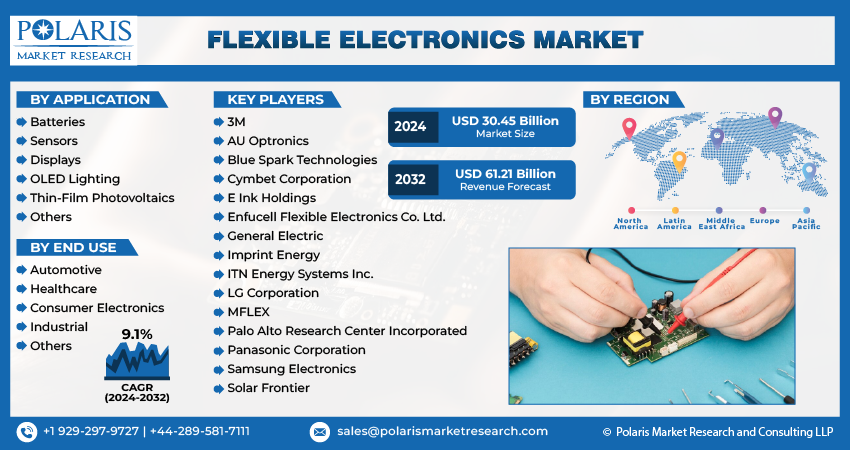

The global Flexible Electronics Market was valued at USD 35.4 billion in 2024 and is expected to grow at a CAGR of 12.50% from 2025 to 2034. Expansion is driven by demand for wearable devices, foldable smartphones, and lightweight electronics across healthcare, automotive, and consumer electronics sectors.

Key Insights

- The display segment led the global market in 2024, led by heightened demand for foldable smartphones, flexible OLED displays for wearables, and rollable TVs.

- The consumer electronics division led the market in 2024, driven by the widespread adoption of foldable phones and flexible screens in tablets.

- Asia Pacific was the leading market in 2024, driven by China's production prowess, the adoption of foldables, and spending on high-end display technology.

- North America is expected to experience rapid growth with the adoption of thin, lightweight components for healthcare wearables, including glucose monitors and smart patches.

Industry Dynamics

- The growth of connected vehicles is driving the need for flexible antennas, whose inclusion is crucial to ensuring seamless connectivity, thereby expanding market opportunities with increased global automobile manufacturing.

- The need for flexible electronics is fueled by developments in materials science, including elastic nanomaterials and conductive polymers, which enable the creation of sensors, circuits, and displays that are more durable and high-performance.

- Increased disposable incomes lead to quicker replacement cycles, as consumers shift towards newer, more convenient electronics for improved convenience and aesthetics.

- One major weakness in the industry is the high manufacturing costs and technical complexity associated with mass-producing flexible parts.

Market Statistics

2024 Market Size: USD 35.4 Billion

2034 Projected Market Size: USD 108.7 Billion

CAGR (2025-2034): 12.50%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Flexible electronics, also known as flex circuits, refer to electronic circuits assembled on flexible substrates such as plastic films, conductive polyester, metal foil, or even flexible glass. Unlike traditional rigid printed circuit boards, flexible electronics can bend, twist, stretch, and conform to various shapes without losing functionality. This is achieved by using specialized materials like conductive polymers, thin metal films, or printed conductive inks, combined with advanced manufacturing processes such as photolithography, screen printing, or inkjet printing. The usage of flexible electronics spans numerous fields due to their adaptability, lightweight nature, and durability. They are widely used in consumer electronics such as folding smartphones, wearable devices like smartwatches and fitness trackers, and electronic textiles that conform to body movements.

The rising production of automobiles globally is propelling the flexible electronics market growth. The European Automobile Manufacturers' Association stated 85.4 million motor vehicles were produced around the world in 2022, an increase of 5.7% compared to 2021. Auto manufacturers integrate flexible displays, sensors, and lighting systems into dashboards, infotainment systems, and wearable key fobs to enhance user experience and functionality. Autonomous and electric vehicles, in particular, rely heavily on flexible electronics for lightweight, durable, and space-efficient components such as flexible battery monitors and curved touchscreens. The growing trend toward connected cars also fuels demand, as flexible antenna integration becomes essential for seamless connectivity. Therefore, the rising production of automobiles globally is propelling the market opportunities.

The flexible electronics market demand is driven by the rising advancements in material science. Innovations in conductive polymers, stretchable nanomaterials, and ultrathin substrates allow manufacturers to create flexible displays, foldable circuits, and wearable sensors with enhanced durability and performance. These breakthroughs make flexible electronics more reliable and cost-effective, encouraging various industries such as healthcare, automotive, and consumer tech to adopt them in smart wearables, flexible screens, and IoT devices. Improved materials also enhance energy efficiency and thermal stability, expanding applications in harsh environments where rigid electronics fail. Thus, as material science continues to advance and innovate, businesses invest more in flexible solutions, driving market growth and accelerating the shift toward next-generation electronic devices.

Market Dynamics

Rising Adoption of Smartphones Globally

Consumers are increasingly adopting smartphones with foldable, curved-edge displays and rollable screens, all of which rely on flexible circuits, bendable OLED panels, and thin-film transistors. Additionally, the push for larger screens without increasing device size is driving the need for flexible display technology, allowing smartphones to expand or fold compactly. Flexible electronics such as antennas and stretchable sensors are also becoming essential for seamless performance as 5G smartphones grow in popularity and adoption. According to the Groupe Spéciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population owns a smartphone, including 5G smartphones. This growing consumer adoption of smartphones is propelling the investments in flexible electronics, pushing the industry toward more advanced and adaptable solutions.

Growing Disposable Income Worldwide

Rising disposable income is driving consumers to invest in innovative devices such as foldable smartphones, curved TVs, and wearable health monitors, all of which rely on flexible display and circuit technologies. As per the data published by the Bureau of Economic Analysis disposable personal income of Americans increased by 0.3% in January 2025 compared to December 2024. Consumers with high disposable income also drive demand for smart home systems, flexible automotive displays, and next-generation wearables, pushing manufacturers to adopt flexible and lightweight electronic components. Additionally, higher disposable income encourages faster replacement cycles, as buyers upgrade to the latest flexible electronics for enhanced convenience and aesthetics. This trend expands the market for advanced and latest products, encouraging companies to fuel research and production of flexible electronics to meet rising consumer expectations.

Segment Insights

Market Evaluation by Component

Based on component, the market is divided into displays, batteries, sensors, memory devices, and others. The display segment dominated the global flexible electronics market share in 2024 due to the rapid adoption of foldable smartphones, flexible OLED screens in wearables, and rollable TVs. Major tech companies such as Samsung and LG heavily invested in advanced display technologies, catering to consumer demand for high-resolution, bendable screens with improved durability. Additionally, the automotive sector is increasingly integrating curved and flexible displays into dashboards and infotainment systems, further expanding the segment's market share.

The sensor segment is expected to grow at a robust pace in the coming years, owing to the rising demand for health-monitoring wearables, such as smart patches and fitness trackers, as these devices rely on flexible sensors to measure vital signs such as heart rate and blood oxygen levels. The Internet of Things (IoT) and smart packaging industries also contribute, utilizing ultra-thin, bendable sensors for real-time environmental and structural monitoring. Innovations in printed and stretchable sensors, which offer cost-efficiency and scalability, are estimated to further accelerate the adoption of flexible sensors across healthcare, automotive, and industrial applications.

Market Insight by Application

In terms of application, the market is segregated into consumer electronics, automotive, healthcare, industrial, and others. The consumer electronics segment dominated the market in 2024 due to the widespread adoption of foldable smartphones and bendable displays in tablets. Prominent manufacturers such as Samsung, Huawei, and Apple drove demand by integrating advanced foldable screens into flagship devices, appealing to consumers seeking portability and innovation. Additionally, the wearable technology boom, including flexible smartwatches and fitness bands, further expanded the segment’s growth, as these devices require lightweight, durable components for enhanced user comfort and functionality.

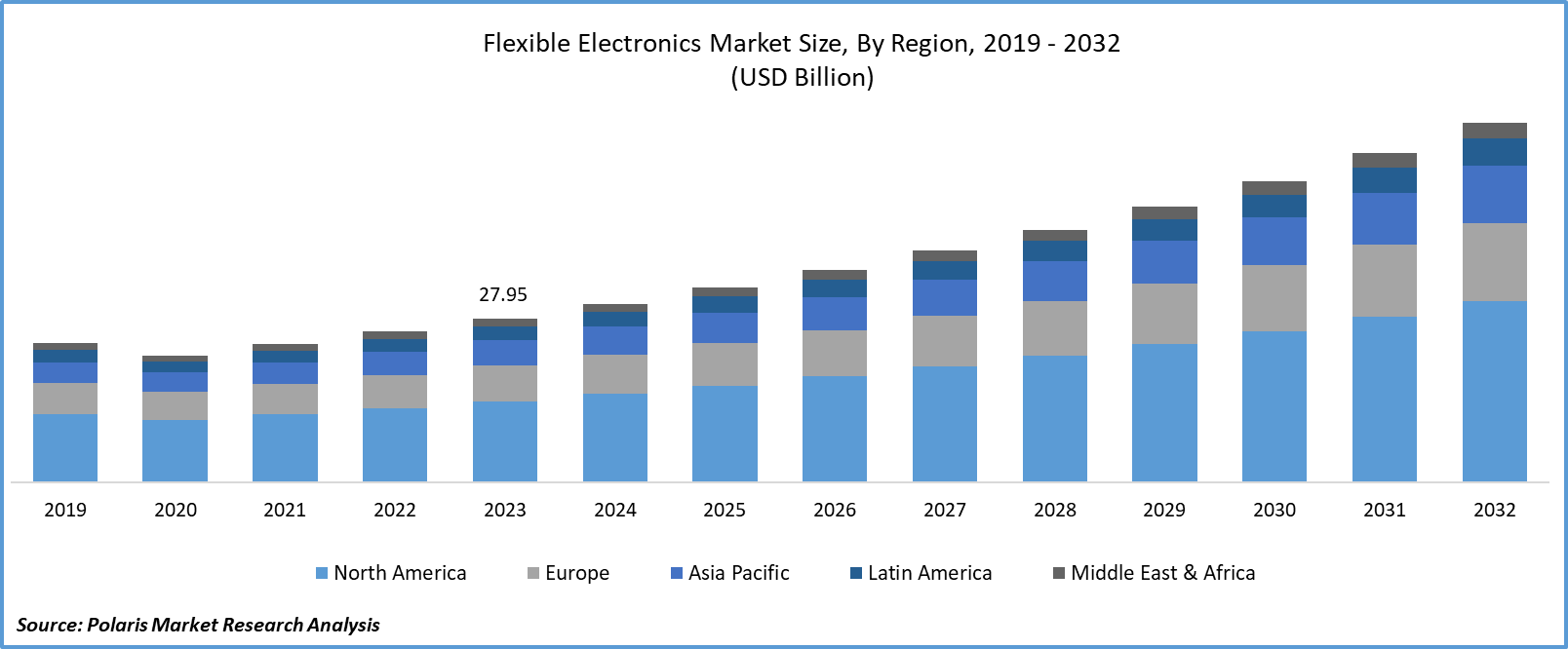

Regional Outlook

By region, the report provides flexible electronics market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to strong demand from countries such as China, South Korea, and Japan. China, in particular, dominated the region due to its robust manufacturing ecosystem, rapid adoption of foldable smartphones, and significant investments in next-generation display technologies. Major tech firms such as Samsung and Huawei accelerated production of flexible displays and wearable devices, leveraging the region’s advanced semiconductor and electronics supply chains. Government initiatives supporting innovation in materials science and printed electronics further strengthened Asia Pacific’s dominance.

The flexible electronics market in North America is expected to grow at a robust pace in the coming years, owing to the increasing integration of thin, lightweight components in healthcare wearables, such as smart patches and continuous glucose monitors. The region’s strong focus on IoT-enabled devices, military applications, and flexible energy storage solutions for electric vehicles also contributed to growth. Additionally, substantial R&D investments, supportive regulatory policies, and collaborations between academia and industry are projected to accelerate innovation and commercialization in the regional flexible electronics market.

Flexible Electronics Key Market Players & Competitive Analysis Report

The flexible electronics industry is highly competitive, with key players leveraging mergers and acquisitions (M&A), collaborations, and strategic partnerships to enhance product portfolios and expand market reach. Major companies such as Samsung, LG Electronics, and Panasonic have aggressively pursued M&A to consolidate their positions. Collaborations between industry leaders and research institutions are also shaping the market. Strategic partnerships are further driving innovation and commercialization. Additionally, companies are collaborating with military and aerospace firms to supply flexible electronics for IoT and defense applications.

The market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are AU Optronics Corp.; Blue Spark Technologies, Inc.; Cymbet Corporation; E Ink Holdings Inc.; Enfucell SoftBattery; Imprint Energy Inc.; LG Electronics; Palo Alto Research Center Incorporated; Samsung Electronics Co. Ltd.; SEMI FlexTech; and Solar Frontier.

LG Electronics, a South Korean multinational corporation headquartered in Seoul, is a prominent innovator in flexible electronics, particularly in flexible display technology. The company has made significant strides with its development of stretchable and bendable displays, pushing the boundaries beyond traditional flexible screens. LG’s flexible display innovations include the LG OLED Flex, a 42-inch 4K bendable OLED TV that can switch between flat and curved screen modes, showcasing the company’s expertise in flexible OLED technology for consumer electronics.

Samsung Electronics Co., Ltd is a global company in flexible electronics, pioneering innovations that have redefined smartphone and display technology. The company has been at the forefront of foldable smartphone development, shipping four times more foldable devices in 2021 compared to 2020. Samsung introduced the world’s first folding glass display, a breakthrough that required reengineering internal components, including a novel cooling system and dual-battery technology to maintain slim, functional designs. Samsung’s flexible OLED technology is central to its flexible electronics portfolio. The company's Flex OLED displays offer an ultra-tight 1.4R curvature, allowing sharper bends and more compact device designs while minimizing folding stress. Samsung was also the first to commercialize Ultra Thin Glass (UTG) for foldable displays, combining the durability and smoothness of glass with flexibility, elevating user experience and device performance.

List of Key Companies

- AU Optronics Corp.

- Blue Spark Technologies, Inc.

- Cymbet Corporation

- E Ink Holdings Inc.

- Enfucell SoftBattery

- Imprint Energy Inc.

- LG Electronics

- Palo Alto Research Center Incorporated

- Samsung Electronics Co. Ltd.

- SEMI FlexTech

- Solar Frontier

Flexible Electronics Industry Developments

In June 2025 – KAIST researchers unveil heat‑activated “shape‑shifting electronic ink”

June 2021: Royole Corporation, a pioneer and the global leader in flexible electronics, announced Royole RoKit, the world's first open platform flexible electronics development kit.

July 2020: SEMI FlexTech, a SEMI Technology Community, announced the launch of three new projects to advance flexible hybrid electronics

Flexible Electronics Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Displays

- Batteries

- Sensors

- Memory Devices

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Consumer Electronics

- Automotive

- Healthcare

- Industrial

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Flexible Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 35.4 Billion |

|

Market Forecast in 2025 |

USD 39.2 Billion |

|

Revenue Forecast in 2034 |

USD 108.7 Billion |

|

CAGR |

12.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 35.4 billion in 2024 and is projected to grow to USD 108.7 billion by 2034.

The global market is projected to register a CAGR of 12.50% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are AU Optronics Corp.; Blue Spark Technologies, Inc.; Cymbet Corporation; E Ink Holdings Inc.; Enfucell SoftBattery; Imprint Energy Inc.; LG Electronics; Palo Alto Research Center Incorporated; Samsung Electronics Co. Ltd.; SEMI FlexTech; and Solar Frontier.

The sensor segment dominated the market revenue share in 2024.

The consumer electronics segment is expected to grow at the fastest pace in the coming years.