Pigment Dispersion Market Share, Size, Trends, Industry Analysis Report

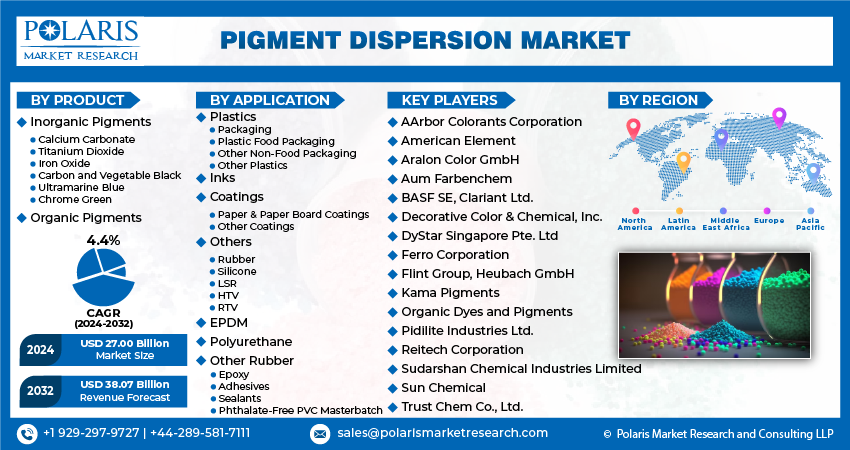

By Product (Inorganic Pigment, Organic Pigment), By Application (Plastics, Inks, Coatings, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4187

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

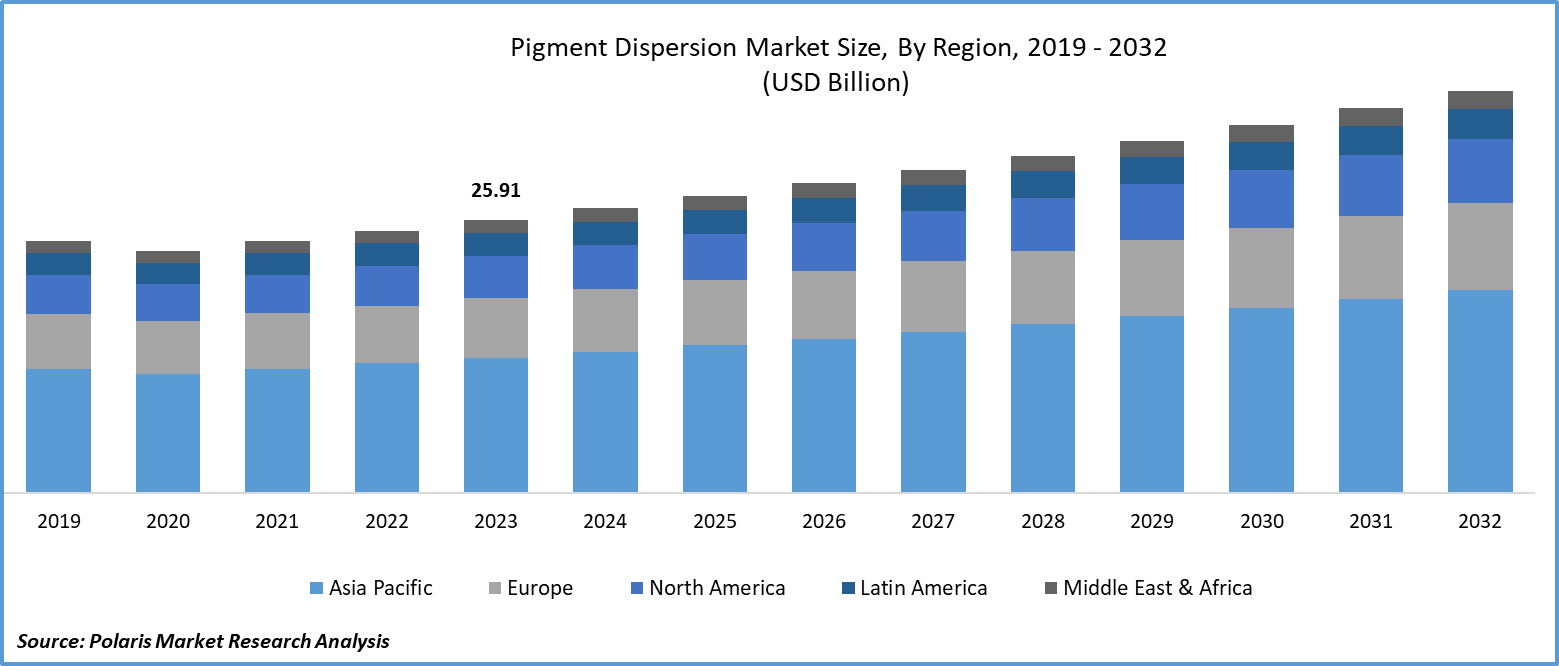

The global pigment dispersion market was valued at USD 25.91 billion in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period.

The consistent expansion of the packaging industry, encompassing both food and non-food packaging and the printing of labels, is anticipated to be a key driver for the demand for pigment dispersions in the foreseeable future. The evolving consumer purchasing patterns, particularly the preference for appealing packaging colors, are expected to contribute to the increased demand for pigment dispersions during the forecast period. The growing utilization of plastics, papers, and paperboards in packaging applications presents favorable prospects for the growth of pigments in the packaging industry.

To Understand More About this Research: Request a Free Sample Report

A notable trend in the global food industry has been the escalating use of plastic & paper board materials for the food packaging. This shift has concurrently driven the demand for the pigment dispersions, as these materials necessitate diverse colorants to enhance their appearance. The adoption of these materials in food packaging brings numerous benefits, including prolonged shelf life, heightened food safety, and enhanced convenience. Nonetheless, the extensive utilization of these materials has given rise to environmental concerns, particularly in relation to the disposal of plastic waste.

The research report offers a quantitative and qualitative analysis of the Pigment Dispersion Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The rising utilization of plastics across diverse applications, including packaging, consumer goods, and construction, has triggered a surge in the demand for pigment dispersion. The flexibility of plastics has broadened their scope in various applications for pigment dispersion. Notably, color-stable pigments are employed to create colored plastic products, such as toys, household items, and automotive components. The application of pigment dispersion plays a pivotal role in enhancing the performance of plastic products, providing attributes like UV stability, weather resistance, and flame resistance. Furthermore, the increasing demand for innovative and high-quality plastic products is steering the development of new pigment dispersion, thereby creating expanded opportunities for the pigment dispersion market.

Growth Drivers

- Rising Demand for eco-friendly pigments for disposable food packaging

Polyethylene terephthalate (PET), polypropylene (PP), & polystyrene (PS) stand out as the most favored polymers in the single-service food packaging segment. The increasing utilization of plastic, paper, and paperboard materials, coupled with the application of various colorants to create visually appealing packaging, is expected to be a driving force for the overall demand for pigments. In the quest for alternatives to some toxic inorganic pigments, organic pigments have emerged, albeit at a higher cost. However, the availability of certain pigments with superior properties remains limited. In response, manufacturers are actively engaging in research and development endeavors aimed at replacing metals in the production of red and yellow synthetic pigments, with the goal of creating environmentally friendly synthetic pigments.

Titanium dioxide stands as the most extensively utilized inorganic pigment due to its non-toxic nature, chemical stability, and versatile properties, making it suitable for application in plastic, paper, and paperboard food packaging. Zinc oxide, also a synthetically produced pigment, is regarded as having a lower toxic impact on humans. Presently, titanium dioxide, iron oxide, and zinc oxide collectively constitute the majority share of the global pigment demand for applications in plastic, paper, and paperboard used in food packaging.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Inorganic pigments segment held the largest share of the market in 2023

The inorganic pigments segment held the largest share. It is produced from the inorganic compounds employed in chemical formulations. This type of pigment dispersion finds application in diverse sectors. Notably, inorganic pigment dispersion tends to be lighter than its organic counterpart. However, in scenarios that demand heightened durability, in-organic pigment dispersion is favored over organic dispersion. A notable distinction is that continuous exposure to sunlight may cause fading in organic pigment dispersion, unlike its inorganic counterpart.

Present in the form of a white powder, calcium carbonate exhibits three polymorphs: aragonite, calcite, and vaterite. Naturally occurring in sources like limestone, chalk, seashells, and marble, it comes in a spectrum of colors, ranging from gray to yellow, contingent on the extent of impurities present. Notably, inorganic pigment dispersion proves to be a more cost-effective option than its organic counterpart. Its smaller particle size facilitates easier dispersion on various substrates. Titanium dioxide and iron oxide emerge as prominent examples among the inorganic pigment dispersions widely utilized.

Constructed from carbon chains and carbon rings, organic pigments are characterized by transparency due to their larger particle size. Among the commonly encountered types are azo pigments, phthalocyanine pigments, lake pigments, and quinacridone pigments. Organic pigments boast a significantly greater color strength compared to their inorganic counterparts; nevertheless, their growth is impeded by elevated costs and limited dispersion capabilities. Applications for organic pigments span diverse industries, including printing inks, paints & coatings, rubber, and plastics.

By Application Analysis

- Coatings segment registered the largest market share in 2023

Coatings segment accounted for the largest share. The expansion of the building and construction industry, driven by infrastructure development in several economies, is anticipated to fuel the demand for coatings throughout the forecast period. This, in turn, is expected to contribute to the overall growth. Additionally, the increasing preference for green building construction is projected to significantly boost the demand for organic pigments used in coatings.

Pigment dispersion has become a prevalent substitute for dyes in printing ink applications, as it offers superior coloring, delivering the desired outcomes for printing ink manufacturers. Inks derived from dyes typically feature a colorant completely dissolved in a carrier fluid. In contrast, printing inks based on pigment dispersion comprise fine solid particles suspended in a carrier liquid. Both organic and inorganic pigment dispersions are utilized in these inks, but the higher percentage usage of the latter is attributed to its lower cost and superior dispersion capabilities.

Pigment dispersion plays a crucial role in plastics, particularly with polyolefins, utilized in various applications such as plastic food packaging, non-food packaging, building & construction products, coverings, gutters, sheets, films, and more. In plastic applications exposed to direct sunlight, pigment dispersions are anticipated to protect from ultraviolet (UV) radiations, preventing any adverse effects on the properties of the pigment dispersion. Within the realm of packaging, the use of pigment dispersion contributes to an enhanced branding experience by improving visual design, a factor that often captures the attention of consumers.

Regional Insights

- Asia Pacific region held the largest share of the global market in 2023

Asia Pacific dominated the market. This substantial share is credited to the abundant availability of raw materials & low labor costs, making the region an attractive destination for manufacturers across various industries to establish their production facilities and reap enhanced benefits. Specifically, in South Korea, the coatings are anticipated to make the most significant contribution to the overall market growth throughout the forecast period.

North America region is projected to grow at a rapid pace. The demand for pigment dispersion in the U.S. is primarily fueled by the rising prevalence of quick-serving restaurants that incorporate pigment dispersion in food packaging. Strict regulations set by the U.S. government dictate the certain type of pigment permitted in food packaging, as few inorganic pigments can pose toxicity concerns upon contact with food products.

For instance, as per the FDA guidelines, substances approved for use as food colorants are permissible for utilization as coloring agents in food packaging and printing inks. Nevertheless, the application of pigments containing poly-nuclear aromatic hydro-carbons & benzopyrene is restricted, with levels exceeding 0.5 parts/million & 5.0 parts/million, respectively, prohibited in the food packaging.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- Aum Farbenchem

- BASF SE

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- DyStar Singapore Pte. Ltd

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Organic Dyes and Pigments

- Pidilite Industries Ltd.

- Reitech Corporation

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Trust Chem Co., Ltd.

Recent Developments

- In May 2022, Vivify Specialty Ingredients acquired Reitech Corp. This strategic move positions Vivify to diversify its product portfolio and extend its reach in the specialty dispersions market.

Pigment Dispersion Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 27.00 billion |

|

Revenue forecast in 2032 |

USD 38.07 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Gain profound insights into the 2024. Pigment Dispersion Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

FAQ's

key companies in pigment dispersion market are AArbor Colorants, American Element, Aralon Color

The global pigment dispersion market is expected to grow at a CAGR of 4.4% during the forecast period.

The pigment dispersion market report covering key segments are product, application, and region.

key driving factors in pigment dispersion market are rising demand for eco-friendly pigments for disposable food packaging

The global pigment dispersion market size is expected to reach USD 38.07 billion by 2032