Pilates & Yoga Studios Market Size, Share, Trend, Industry Analysis Report

By Activity Type (Yoga Classes, Pilates Classes, Pilates & Yoga Accreditation Training, Merchandise Sales), By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM3675

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

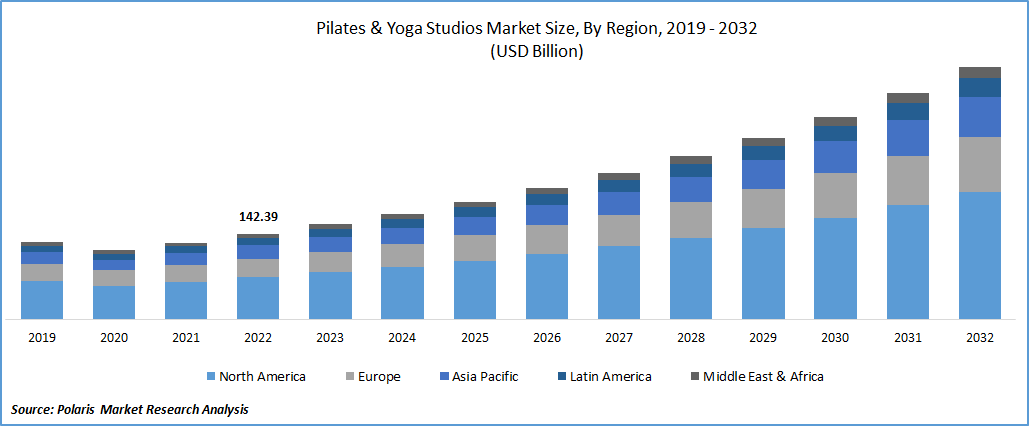

The global Pilates & yoga studios market size was valued at USD 161.98 billion in 2024 and is projected to register a CAGR of 10.47% from 2025 to 2034. The growing emphasis on health and wellness is a significant driver of the global market. Consumers are increasingly prioritizing physical fitness and mental well-being, spurred by awareness campaigns, medical recommendations, and the integration of wellness into daily lifestyles. Rising preference for Pilates & yoga boosts the industry expansion.

Key Insights

- In 2024, the yoga classes segment accounted for approximately USD 71.5 billion. It is a foundational segment offering diverse styles and techniques that cater to various skill levels, preferences, and health objectives.

- The Pilates classes segment is projected to register a CAGR of 10.63% during 2025–2034. As consumer interest in functional fitness continues to rise, the Pilates segment remains a significant driver of growth in the industry.

- In 2024, North America accounted for approximately 56.5 billion of revenue share. It is driven by the strong consumer shift toward general health and functional fitness routines.

- The Asia Pacific Pilates & yoga studios industry is projected to register a CAGR of 11.02% during the forecast period. The growth is supported by increasing disposable incomes and rising awareness of non-traditional fitness practices.

Industry Dynamics

- Due to rising income, consumers are willing to spend a significant amount on personal wellness and fitness experiences. Thus, increasing disposable income is boosting the overall industry growth.

- The growing aging population is creating demand for low-impact fitness formats, making Pilates and yoga highly appealing options. The rising demand for yoga among elderly population propels the requirement for Pilates & yoga studios.

- The growing trend of wellness and medical tourism is expected to fuel the growth of the industry.

- Competition from alternative fitness options hinders the market expansion.

Market Statistics

2024 Market Size: USD 161.98 billion

2034 Projected Market Size: USD 430.87 billion

CAGR (2025–2034): 10.47%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The Pilates & yoga studios refers to the segment of the fitness and wellness industry that focuses on providing specialized physical exercise and mindfulness services through dedicated studios offering yoga and Pilates classes to individuals for health, fitness, relaxation, and overall well-being. The integration of digital platforms has transformed the Pilates and yoga studios industry, enabling studios to extend their reach and attract a global audience. Virtual classes, live-streamed sessions, and on-demand content have become essential components of studio offerings, catering to consumers seeking convenience and flexibility.

The growing trend of wellness and medical tourism has created new opportunities for the Pilates and yoga studios industry. Destinations that combine fitness retreats with travel experiences are becoming increasingly popular, attracting tourists seeking holistic rejuvenation. Studios that collaborate with resorts, wellness centers, and tourism boards are tapping into this lucrative market by offering unique programs that blend traditional practices with cultural experiences. Additionally, sustainability has become a pivotal focus in the industry, reflecting the shifting preferences of environmentally conscious consumers. Studios adopting green practices, such as using eco-friendly materials, reducing energy consumption, and offering sustainable product lines, are gaining a competitive advantage.

Market Dynamics

Rising Disposable Income

Rising disposable income is playing a major role in boosting the overall growth. According to the US Bureau of Economic Analysis, disposable income in the U.S. increased by 0.7% in April 2025 compared to March 2025. Consumers are more willing to spend on personal wellness and fitness experiences that go beyond basic gym memberships. This shift is especially visible among urban professionals and middle-income groups who are seeking tailored services such as private sessions, small group classes, or boutique studio memberships. As income levels improve, there is greater interest in holistic health, which includes physical fitness and also stress relief and mental wellness. Studios are responding by offering value-added services such as nutritional counseling, meditation sessions, and wellness workshops. Premium offerings such as reformer Pilates and advanced yoga formats are gaining popularity, often bundled with tech-driven features such as virtual access and performance tracking. This trend is expected to continue as consumers increasingly prioritize health and are financially equipped to invest in more personalized, results-driven fitness solutions.

Growth of Aging Population

The growing aging population is creating demand for low-impact fitness formats, making Pilates and yoga highly appealing options. For instance, according to the World Health Organization, by 2030, approximately 16.6% of the global population will be aged 60 and above, rising from 1 billion in 2020 to 1.4 billion. By 2050, this demographic is expected to double to 2.1 billion, highlighting critical implications for healthcare and social services as societies adapt to aging populations. Older adults are actively seeking ways to stay mobile, manage chronic conditions, and maintain quality of life through structured physical activity. Both Pilates and yoga offer strength, flexibility, and balance training in a safe and controlled environment, making them suitable for aging bodies. Studios are adapting their programs by offering specialized classes tailored to seniors, focusing on joint health, postural alignment, and injury prevention. Certified instructors are being trained to work with this demographic, ensuring a supportive and inclusive experience. Many older adults prefer smaller class sizes and one-on-one instruction, which boutique studios are well positioned to provide. In addition, the healthcare community is increasingly recommending yoga and Pilates as part of wellness and rehabilitation plans, reinforcing their value and boosting studio memberships among older populations.

Segment Insights

Market Assessment by Activity Type

Based on activity type, the segmentation includes yoga classes, Pilates classes, Pilates & yoga accreditation training, and merchandise sales. In 2024, the yoga classes segment accounted for approximately USD 71.5 billion. Yoga classes represent a foundational segment offering diverse styles and techniques that cater to various skill levels, preferences, and health objectives. From traditional forms such as Hatha and Ashtanga yoga to modern variations such as power yoga and aerial yoga, studios provide tailored experiences that appeal to a wide audience. The preference for yoga is driven by its holistic benefits, including stress reduction, improved flexibility, and mental clarity, making it a cornerstone of wellness practices worldwide. Studios often enhance the experience with serene environments, professional instructors, and additional services such as meditation sessions or sound therapy, enriching the overall value proposition. The popularity of yoga classes has also expanded beyond traditional studio settings, with the rise of virtual classes and outdoor yoga sessions. These offerings cater to individuals seeking flexibility and convenience, further broadening the reach. The integration of technology, such as live video streamed or on-demand classes, has allowed studios to connect with a global audience, creating new revenue streams. With yoga continuing to gain traction as a lifestyle practice, the segment holds strong growth potential, bolstered by cultural recognition and endorsement from governments and health organizations worldwide

The Pilates classes segment is projected to register a CAGR of 10.63% during the forecast period. The practice is particularly popular among individuals seeking a low-impact workout that improves muscular endurance and body alignment. Studios offer a variety of Pilates formats, including Yoga and exercises mat and equipment-based sessions using tools such as reformers and stability balls. These classes cater to diverse demographics, from fitness enthusiasts and athletes to older adults and those undergoing physical rehabilitation. The focus on precision and customization makes Pilates a preferred choice for clients with specific fitness goals or physical limitations. The segment has also seen innovation with the inclusion of fusion classes that combine Pilates with other fitness elements, such as barre or yoga, creating unique and engaging experiences. With the growing awareness of Pilates' benefits for injury prevention and recovery, studios are collaborating with healthcare professionals to design therapeutic programs. This expansion into the wellness and rehabilitation space has positioned Pilates as more than just a fitness activity, attracting a broader customer base and boosting its market appeal. As consumer interest in functional fitness continues to rise, the Pilates segment remains a significant driver of growth in the industry.

In 2024, the Pilates & yoga accreditation training segment accounted for approximately USD 28 billion of the revenue share, fueled by the expanding global demand for fitness and wellness services, prompting more individuals to seek professional training as a career pathway. Many studios now offer flexible options such as online certification programs, catering to students from different geographies and schedules. Additionally, partnerships with international accreditation bodies ensure that certifications are globally recognized, increasing their value. As the industry continues to grow, the accreditation training segment plays a vital role in sustaining the industry's standards and addressing the rising need for skilled instructors. Pilates and yoga accreditation training has emerged as a critical segment, reflecting the increasing demand for certified professionals. Studios and training centers offer comprehensive courses that equip individuals with the knowledge and skills needed to become qualified instructors. These programs often cover anatomy, teaching methodologies, and the philosophy behind the practices, ensuring a holistic understanding of Pilates and yoga.

Regional Analysis

In 2024, the North America Pilates & yoga studios market accounted for approximately 56.5 billion of revenue share, driven by the strong consumer shift toward general health and functional fitness routines. According to the data published by the Centers for Disease Control and Prevention, in the US, about 1 out of 6 adults practices yoga. Many consumers in the region are opting for low-impact workouts that support both physical strength and mental well-being. The integration of digital class formats alongside traditional in-studio experiences has made these services more accessible, supporting membership growth. Corporate wellness programs and insurance incentives have also contributed to higher participation. Fitness-conscious urban populations, supported by higher disposable income and flexible work routines, are investing more in wellness memberships and private instruction. Boutique studios offering hybrid programs that blend Pilates, yoga, and mobility training are becoming more common, expanding the range of offerings and driving retention rates.

US Pilates & Yoga Studios Market Trends

In 2024, the US Pilates & yoga studios market was valued at approximately USD 45.5 billion due to rising health consciousness, mental wellness prioritization, and demand for structured stress-reduction formats. A large population base, particularly in metropolitan and suburban areas, is investing in specialized fitness experiences over generalized gym memberships. Studios that offer smaller class sizes, personalized instruction, and curated wellness experiences have attracted strong loyalty among clients. The integration of yoga and Pilates into physical therapy and rehabilitation practices has also driven sustained demand. Marketing strategies focused on lifestyle branding, influencer partnerships, and mobile scheduling have allowed studios to engage diverse demographics. Studio chains and franchises continue expanding into underserved areas, including secondary cities, strengthening national coverage and improving service availability.

Asia Pacific Pilates & Yoga Studios Market Assessment

The Asia Pacific Pilates & yoga studios market is projected to register a CAGR of 11.02% during the forecast period, supported by rapid urbanization, increasing disposable incomes, and rising awareness of non-traditional fitness practices. Major cities are seeing a rise in boutique wellness studios catering to young professionals and health-conscious individuals seeking alternatives to high-impact training. Social media trends and the influence of global fitness culture have also contributed to the popularity of Pilates and yoga. Government initiatives promoting wellness and preventative health measures are encouraging more investment in fitness infrastructure. Several regional startups and franchise operators are focusing on affordable memberships and localized programming, making these services accessible to a broader population. Mobile apps and virtual training content are enhancing studio visibility, increasing sign-ups, and improving client retention across both tier-one and tier-two cities.

China Pilates & Yoga Studios Market Insights

In 2024, China Pilates & yoga studios market accounted for approximately USD 10.7 billion in Asia Pacific, fueled by the convergence of wellness culture, digital platform integration, and the rising influence of fitness influencers. Consumer behavior in urban centers is rapidly evolving, favoring structured, mindfulness-driven workouts that align with both mental and physical well-being. Studio operators are embracing online-offline hybrid models, offering live-streamed classes, booking apps, and mobile subscription platforms. The presence of social media-based fitness challenges and influencer-led programs has accelerated penetration across younger demographics. Franchises and international brands are expanding aggressively in cities such as Shanghai, Beijing, and Shenzhen, introducing premium services such as reformer Pilates and therapeutic yoga. Local governments promoting wellness and sustainable lifestyles are also encouraging participation, especially among working professionals and women in their mid-20s to late 30s.

Europe Pilates & Yoga Studios Market Overview

The Europe Pilates & yoga studios market held 28% of the revenue share in 2024, driven by the strong integration of wellness into public health culture and lifestyle routines. Consumers across major cities are investing in mindfulness-based fitness formats, particularly those that balance physical conditioning with stress relief. The growing trend toward mental health awareness has supported the popularity of low-impact exercise methods such as Pilates and yoga. Many European studios are differentiating through specialized offerings, including prenatal yoga, rehabilitative Pilates, and fusion sessions that incorporate mobility or meditation practices. The popularity of wellness retreats and experiential fitness tourism is also contributing to studio growth. Subscription-based and membership models are evolving, combining digital access with in-person classes to improve client engagement. Eco-friendly studio designs and sustainable business practices are becoming attractive features for conscious consumers, especially in urban centers.

Germany Pilates & Yoga Studios Market Evaluation

The Germany Pilates & yoga studios market is projected to register a CAGR of 10.69% during the forecast period, supported by a strong demand for structured wellness services in both metropolitan and regional areas. A rise in the prevalence of chronic lifestyle-related conditions has pushed many individuals toward preventative fitness routines, increasing the appeal of Pilates and yoga. German consumers are valuing expert-led, technique-focused instruction, encouraging studios to invest in certified trainers and specialized programs. Interest in therapeutic Pilates and yoga for injury recovery, elderly care, and posture correction is on the rise. Studios offering smaller class sizes, customized training, and bilingual instruction are attracting diverse age groups and expatriates. The market is also benefiting from partnerships with health insurance providers that reimburse preventive health services, making memberships more financially accessible. Growth is further supported by a rising number of fitness startups offering on-demand class booking and hybrid wellness platforms.

Key Players and Competitive Analysis

The competitive landscape of the Pilates & yoga studios market is shaped by an evolving mix of boutique studios, franchise models, and digital-first platforms leveraging technology advancements to attract and retain clients. Industry analysis highlights a trend toward hybrid models that blend in-studio experiences with virtual offerings, increasing accessibility and enhancing client engagement. Expansion strategies include franchising, mobile app development, and branded wellness products that extend beyond the studio space. Strategic alliances between fitness platforms and wearable technology providers are enabling real-time performance tracking and personalized workout planning. Mergers and acquisitions are contributing to network consolidation and geographic reach, particularly in urban centers. Post-merger integration is focused on standardizing operations, expanding service portfolios, and improving customer experience. Studio operators are investing in loyalty programs, community-building events, and specialized formats such as prenatal yoga or reformer Pilates to stand out. Personalization, convenience, and brand differentiation remain central to competitive positioning globally.

List of Key Companies

- Authentic Pilates Learning Center

- Breathe Pilates Studio

- CorePower Yoga.

- Fitness Firm Yoga and Pilates Studio.

- Fitness First Ltd.

- Flex Studio Hong Kong

- Harmony Yoga Pilates Studio

- M Pilates+Yoga

- Noris Group GmbH

- Pronto Pilates

- Studio Spring

- Wild Lotus Yoga.

- YogaSix

- YogaWorks

Pilates & Yoga Studios Industry Developments

In June 2025, iFIT Inc. partnered with Xponential Fitness to provide its members access to premium Pilates and yoga content from Club Pilates and YogaSix. This collaboration enhances iFIT’s Emmy-nominated fitness library with more diverse, studio-quality workouts from popular boutique brands.

In December 2024, Bintang Capital Partners made a strategic investment in The Flow Studio through BCP Asia Fund I.

Pilates & Yoga Studios Market Segmentation

By Activity Type Outlook (Revenue USD Billion, 2020–2034)

- Yoga Classes

- Pilates Classes

- Pilates & Yoga Accreditation Training

- Merchandise Sales

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pilates & Yoga Studios Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 161.98 billion |

|

Market Size in 2025 |

USD 175.88 billion |

|

Revenue Forecast by 2034 |

USD 430.87 billion |

|

CAGR |

10.47% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 161.98 billion in 2024 and is projected to grow to USD 430.87 billion by 2034.

The global market is projected to register a CAGR of 10.47% during the forecast period.

In 2024, the North America Pilates & yoga studios market accounted for approximately 56.5 billion of revenue share, driven by the strong consumer shift toward general health and functional fitness routines.

A few of the key players are Authentic Pilates Learning Center., Breathe Pilates Studio, CorePower Yoga., Fitness Firm Yoga and Pilates Studio., Fitness First Ltd., Flex Studio Hong Kong, Harmony Yoga Pilates Studio, M Pilates+Yoga, Noris Group GmbH, Pronto Pilates, Studio Spring, Wild Lotus Yoga., YogaSix, and YogaWorks.

In 2024, the yoga classes segment accounted for approximately USD 71.5 billion. Yoga classes represent a foundational segment offering diverse styles and techniques that cater to various skill levels, preferences, and health objectives.

The Pilates classes segment is projected to register a CAGR of 10.63% during the forecast period. The practice is particularly popular among individuals seeking a low-impact workout that improves muscular endurance and body alignment.