Plastic Resins Market Share, Size, Trends, Industry Analysis Report

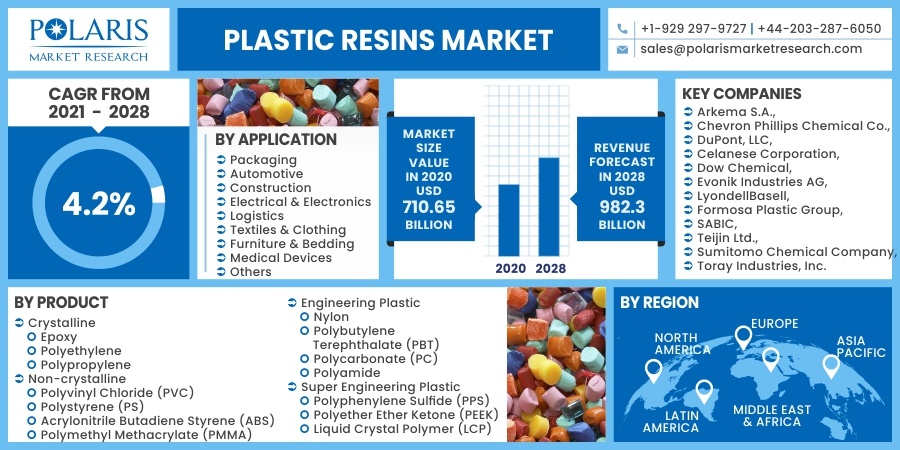

By Product (Crystalline, Non-Crystalline, Engineering Plastic, Super Engineering Plastic); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Aug-2021

- Pages: 117

- Format: PDF

- Report ID: PM1933

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

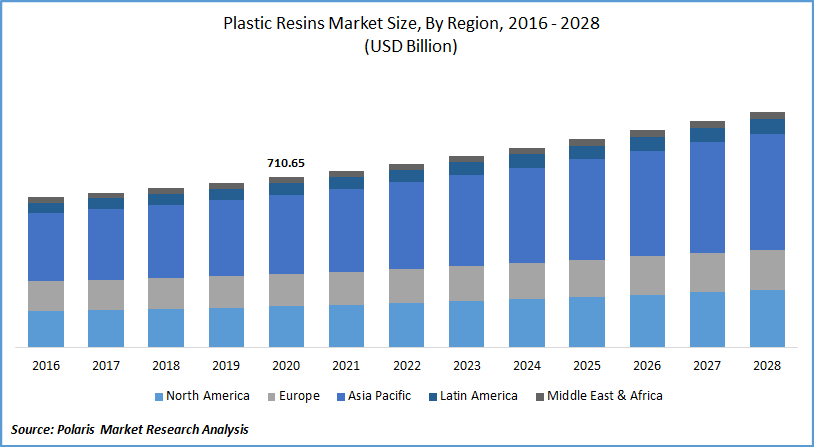

The global plastic resins market was valued at USD 710.65 billion in 2020 and is expected to grow at a CAGR of 4.2% during the forecast period owing to the increasing product demand from the automotive, construction, packaging, and electrical & electronics sectors. Plastic resins are widely used to manufacture simple as well as complex components across the aforementioned sectors.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Plastic resins are created in the cracking process by heating hydrocarbons. The system breaks down large molecules with the help of the crude oil refining process into ethylene or propylene. Polymers formed by this process are then combined to create the resins.

The increased demand for automotive applications such as exteriors, interiors, and the hood component is the key factor driving the market growth. The demand for resins is projected to rise due to the stringent regulations by the government in the use of metal and wood. The increasing demand for electric vehicles is growing the need for lightweight materials which will drive the growth of the global plastic resins market.

Polymers are cost-effective and robust and having safe properties that can be used for construction purposes. Moreover, Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration have guided favorable regulations with initiatives by the European Union on carbon emission to improve resins for fuel-efficient and lightweight vehicles. Hence, this will help to boost the demand for the product.

Due to the rising coronavirus cases, there is a considerable increase in demand for medical safety equipment such as Personal Protective Equipment (PPE), face shields, medical gowns, and several medical devices which have led to increasing the demand for plastic resins globally.

The ongoing COVID-19 pandemic and countrywide lockdown imposed by several governments have hampered the demand for resins in the global market. Moreover, it is expected to have a negative effect on the demand growth over the coming years.

Know more about this report: request for sample pages

Plastic Resins Market Report Scope

The market is primarily segmented on the basis of product, application, and region:

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based on product the segment is divided into crystalline resins, non-crystalline resins, engineering plastic, and super engineering plastic resins. The polyethylene crystalline resins sub-segment is expected to hold the largest market share during the forecast period owing to the increasing demand from the medical application, stretch wraps, food packaging, etc.

The market demand for the non-crystalline resins segment is expected to decline during the forecast period owing to the increased using of other polymers, such as polyether ether ketone, liquid crystal polymers, and polyamide.

The engineering plastic resins market segment is expected to grow more than average in the coming years as these plastics hold good thermal and mechanical properties, dimensional stability, and have wear and chemical resistance.

The super engineering resins market segment is expected to grow in the forecast period owing to its high electrical and thermal properties which are widely used in high-speed connectors packaging, semiconductor packaging, and medical applications.

Insight by Application

Based on application the market segment is divided into logistics, packaging, automobile, construction, consumer goods, furniture & bedding, medical devices, and others. The packaging segment is projected to capture the highest market share owing to the increasing demand for packaged food & beverages. Furthermore, several government agencies have announced stringent guidelines for the safe usage of these materials in food and beverage packaging.

The automotive market segment is projected to grow at a significant pace owing to the adoption of electric vehicles and the utilization of polymers in automotive components during the forecast period. The medical market segment is also expected to grow due to the wide utilization of resins as they offer biocompatibility, cost-effectiveness, and better clarity while manufacturing a medical device.

Geographic Overview

China market is accountable for the highest revenue share in this market due to the highest number of plastic manufacturing and components manufacturing facilities to meet up its demand. Furthermore, China is the largest exporter of polymers across the globe owing to the largest production base. Moreover, China and India are focusing on the development of the electronics sector owing to the increasing demand for resins in the coming years.

Strict rules and regulations imposed by the European Commission, European Chemicals Agency (ECHA), and various organizations regarding the use of plastics in Europe are estimated to hinder the market over the forecast period. North America is predicted to observe moderate growth due to the regulations imposed by EPA and FDA regarding the usage of plastic.

Competitive Landscape

The global as well as the regional market is significantly fragmented and faces intense competition due to the large numbers of manufacturers and distributors who have good knowledge about the regulations and suppliers. Major players are focusing on regions such as the Middle East & Africa and the Asia Pacific to strengthen and expand their presence.

Major players operating in this market are Arkema S.A., Chevron Phillips Chemical Co., DuPont, LLC, Celanese Corporation, Dow Chemical, Evonik Industries AG, LyondellBasell, Formosa Plastic Group, SABIC, Teijin Ltd., Sumitomo Chemical Company, and Toray Industries, Inc. In December 2018 DuPont invested around USD 80 million to set up a new plastic manufacturing facility in Shanghai, China, which is expected to start its operation by 2021.