Platelet Aggregation Devices Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Systems & Instruments and Consumables & Accessories), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1691

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

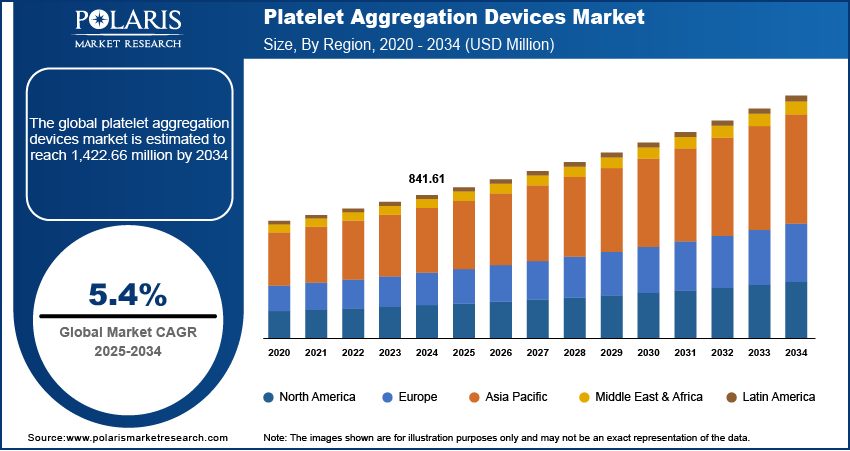

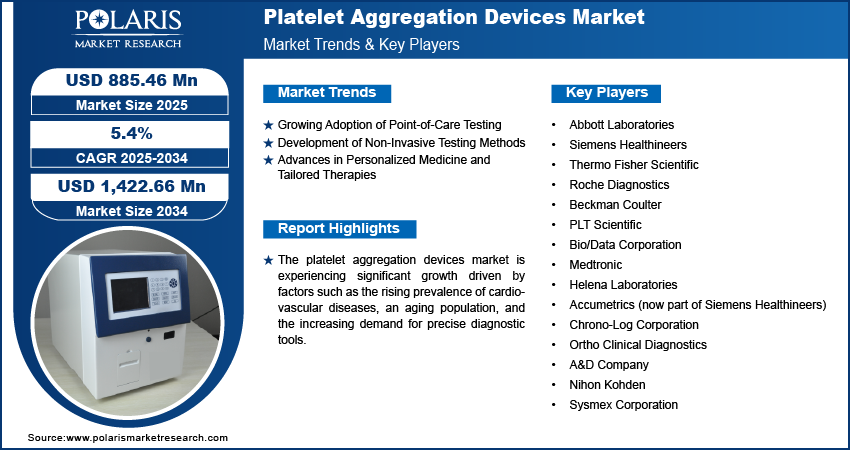

The global platelet aggregation devices market size was valued at USD 841.61 million in 2024, growing at a CAGR of 5.4% from 2025 to 2034. The market growth is primarily fueled by the growing prevalence of cardiovascular conditions and advancements in diagnostic technologies.

Key Insights

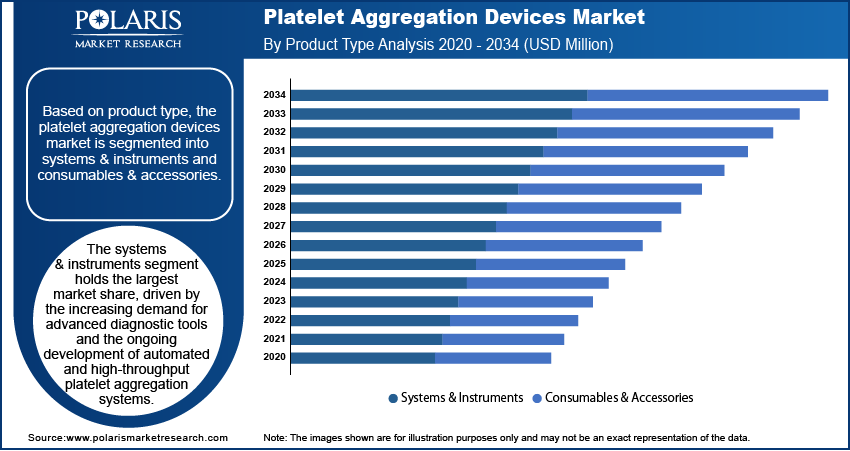

- The systems & instruments segment holds the largest market share. The segment’s dominance is largely fueled by the growing demand for advanced diagnostic tools and the ongoing development of high-throughput platelet aggregation systems.

- The research applications segment is witnessing the fastest growth due to increased focus on platelet function research and new therapy development.

- North America accounts for the largest share of the market. The region’s leading market position is driven by its advanced healthcare infrastructure and robust focus on research and development.

- Asia Pacific is witnessing rapid growth, driven by the region’s improving healthcare infrastructure and rising investments in medical technology.

Industry Dynamics

- Point-of-care (POC) testing has gained significant traction in the platelet aggregation devices market owing to its speed, convenience, and cost-effectiveness. The growing adoption of POC testing is fueling market demand.

- The introduction of non-invasive testing methods, fueled by the demand for safer and more comfortable diagnostic procedures, is driving market expansion.

- Growing focus on the development of more user-friendly devices is projected to provide several market opportunities in the coming years.

- High cost associated with platelet aggregation devices may present market challenges.

Market Statistics

Market Size in 2024: USD 841.61 million

2034 Projected Market Size: USD 1,422.66 million

CAGR (2025-2034): 5.4%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The platelet aggregation devices market involves the development and use of instruments designed to assess platelet function and clot formation in blood samples. These devices are critical for diagnosing and managing disorders related to platelet dysfunction, such as bleeding disorders and cardiovascular diseases.

The increasing prevalence of cardiovascular diseases, rising geriatric population, and advancements in diagnostic technologies are a few of the key factors driving the platelet aggregation devices market growth. The need for improved diagnostics in personalized medicine and the focus on better patient outcomes are also contributing to the market expansion.

Market Dynamics

Growing Adoption of Point-of-Care Testing

Point-of-care (POC) testing has gained significant traction in the platelet aggregation devices market due to its convenience, speed, and cost-effectiveness. Point-of-care devices allow for immediate results, eliminating the need for sending samples to centralized laboratories and waiting for results. This is especially valuable in emergency settings and in monitoring patients with chronic conditions like cardiovascular disease. The ability to perform POC tests at the bedside or in outpatient clinics also enhances patient care and decision-making, reducing delays in treatment. According to a report by the National Institutes of Health (NIH), POC testing for platelet aggregation is expected to grow significantly as healthcare systems prioritize fast, reliable diagnostics. Thus, the rising adoption of POC testing boosts the platelet aggregation devices market revenue.

Development of Non-Invasive Testing Methods

Non-invasive platelet aggregation testing is one of the key platelet aggregation devices market trends, driven by the demand for safer and more comfortable diagnostic procedures. Traditional platelet function tests often require blood samples, which may be invasive or uncomfortable for patients. New technologies, such as optical and acoustic sensors, aim to measure platelet function without the need for blood draws. Studies published in the Journal of Thrombosis and Haemostasis suggest that non-invasive methods could reduce patient anxiety and increase the frequency of platelet monitoring in both clinical and home settings. These innovations are expected to improve the efficiency of routine testing and reduce the burden on healthcare facilities.

Advances in Personalized Medicine and Tailored Therapies

With the increasing focus on personalized medicine, there is a growing need for accurate, individualized platelet function testing to guide the management of various conditions, particularly cardiovascular diseases. Platelet aggregation devices are being developed to provide more specific insights into how an individual's platelets respond to different therapies, such as antiplatelet drugs. Personalized platelet testing helps clinicians tailor treatment plans based on the patient’s specific platelet response, improving therapeutic outcomes. Research published in Circulation Research highlights that advanced platelet testing is crucial for identifying patients at high risk of thrombotic events, leading to more precise and effective treatments. As personalized therapies become more widespread, platelet aggregation devices are being increasingly integrated into the broader ecosystem of precision medicine, impacting the platelet aggregation devices market development favorably.

Market Segment Insights

Market Evaluation Based on Product Type

The platelet aggregation devices market, based on product type, is segmented into systems & instruments and consumables & accessories. The systems & instruments segment holds the largest market share, driven by the increasing demand for advanced diagnostic tools and the ongoing development of automated and high-throughput platelet aggregation systems. These systems & instrument offer accurate and reliable results, making them essential for hospitals, diagnostic labs, and research institutions. They also contribute to streamlining platelet function testing, reducing human error, and improving overall patient care. This segment benefits from continuous technological innovations, such as the integration of real-time monitoring features and enhanced data analytics capabilities.

The consumables & accessories segment is witnessing the highest growth, largely due to the recurring need for consumables in testing procedures. The demand for consumables, including reagents, test kits, and disposables, is rising as healthcare providers increasingly perform platelet aggregation tests for patient monitoring and disease management. This growth is also fueled by the expanding adoption of point-of-care testing, which requires a steady supply of consumables. The consumables segment is further benefiting from the shift towards regular and routine monitoring of patients with cardiovascular diseases and other platelet function-related disorders.

Market Assessment Based on Application

The platelet aggregation devices market, based on application, is segmented into clinical applications and research applications. The clinical applications segment dominates the platelet aggregation devices market, holding the largest market share due to the increasing prevalence of cardiovascular diseases, bleeding disorders, and other health conditions that require routine platelet function monitoring. Hospitals, diagnostic laboratories, and outpatient clinics are the primary users of platelet aggregation devices for clinical purposes, including pre-surgical screening, monitoring of antiplatelet therapy, and evaluating patients with thrombosis-related conditions. The growing demand for personalized medicine, as well as the need for accurate, real-time diagnostics, continues to drive the adoption of these devices in clinical settings, ensuring that the clinical applications segment remains the largest contributor to market revenue.

The research applications segment, though smaller in market share, is growing the fastest due to increased focus on platelet function research and new therapy development. Academic institutions, pharmaceutical companies, and research organizations use platelet aggregation devices to study platelet function, test new drugs, and understand platelet-related disorders. The demand for advanced research tools is driving this growth, supported by progress in medical research and the rise of precision medicine. This segment is also expanding due to the need for better diagnostics and new treatments for platelet dysfunction.

Market Outlook Based on End Use

The platelet aggregation devices market, based on end use, is segmented into hospital, diagnostic centers, and research & academic institutes. The hospital segment holds the largest market share, driven by the critical need for accurate platelet function monitoring in inpatient settings. Hospitals routinely use these devices for diagnosing and managing various disorders, such as cardiovascular diseases, thrombocytopathies, and bleeding disorders. The adoption of platelet aggregation devices in hospitals is further supported by the growing demand for precise diagnostic tools to monitor patients undergoing surgeries or antiplatelet therapies. The segment also benefits from advancements in hospital infrastructure, the increasing number of patients requiring specialized care, and the integration of these devices into broader hospital diagnostic systems.

The research & academic institutes segment is registering the highest growth rate due to the expanding focus on platelet function research and the exploration of novel therapies targeting platelet-related disorders. Research organizations and academic institutions rely on these devices to study the underlying mechanisms of platelet aggregation, evaluate new drugs, and advance medical knowledge in thrombosis and cardiovascular fields. With a rising interest in precision medicine and personalized healthcare, research & academic institutes are expected to drive the demand for advanced platelet aggregation testing tools. The segment growth is further fueled by increased funding for medical research and growing collaboration between academic institutions and the pharmaceutical industry to develop innovative therapeutic solutions.

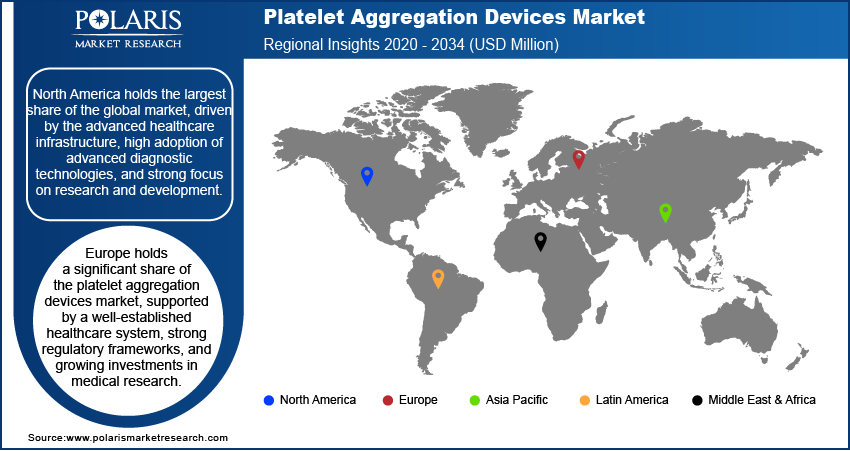

Regional Analysis

By region, the study provides platelet aggregation devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global market, driven by the advanced healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong focus on research and development. The region’s dominance is further supported by the increasing prevalence of cardiovascular diseases, a well-established healthcare system, and the presence of major industry players who are continuously innovating in platelet aggregation testing. Additionally, the growing demand for personalized medicine and advancements in point-of-care testing contribute to North America’s leading position. Europe follows closely, benefiting from a robust healthcare system and increasing investments in medical research, while Asia Pacific is expected to register the highest growth due to improving healthcare access, rising awareness, and expanding medical research capabilities.

Europe holds a significant share of the platelet aggregation devices market, supported by a well-established healthcare system, strong regulatory frameworks, and growing investments in medical research. The demand for platelet aggregation devices in Europe is driven by the increasing prevalence of cardiovascular diseases, as well as an aging population that requires regular diagnostic monitoring for platelet function. Countries like Germany, the UK, and France lead the market due to their advanced healthcare infrastructure and high adoption rates of innovative diagnostic tools. Furthermore, the growing trend toward personalized medicine and the expansion of research activities in academic and clinical settings are expected to continue driving the market in Europe.

The Asia Pacific platelet aggregation devices market is experiencing rapid growth, fueled by improving healthcare infrastructure, rising healthcare awareness, and increasing investments in medical technology. The region’s expanding population, coupled with the rising incidence of lifestyle diseases such as cardiovascular conditions and diabetes, has led to greater demand for platelet testing and diagnostics. Countries like China and India are expected to contribute significantly to market growth due to their large patient populations and increasing healthcare access. Additionally, the rising number of research activities and growing focus on precision medicine are supporting the adoption of platelet aggregation devices in the region.

Key Players and Competitive Insights

Key players in the platelet aggregation devices market include companies such as Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Roche Diagnostics, and Beckman Coulter. These companies are active in the development and manufacturing of platelet aggregation testing devices, offering both traditional and advanced diagnostic solutions. Other notable players include PLT Scientific, Bio/Data Corporation, Medtronic, and Helena Laboratories, which provide a range of instruments and consumables for platelet function testing. Additionally, companies like Accumetrics (now part of Siemens Healthineers), Chrono-Log Corporation, and Ortho Clinical Diagnostics contribute to the market with specialized platelet aggregation systems. Newer players in the market include A&D Company, Nihon Kohden, and Sysmex Corporation, which are expanding their portfolios in the diagnostic device segment.

The competitive landscape of the platelet aggregation devices market is characterized by innovation, with companies continuously working to improve the accuracy and efficiency of their devices. Players are focusing on product development, specifically in enhancing the speed of testing, integrating real-time monitoring capabilities, and expanding the range of test parameters to cater to diverse clinical and research needs. Collaboration between diagnostic companies and research institutions is becoming more prevalent, allowing for the integration of advanced technologies such as non-invasive testing methods and digital data analytics in platelet aggregation devices. This trend is fueling the development of more sophisticated and accessible testing solutions, particularly in point-of-care environments.

The market is also seeing increasing competition in the consumables segment, where companies are expanding their product offerings to meet the growing demand for routine platelet testing. With the rise of personalized medicine and the increasing emphasis on precision diagnostics, companies are introducing consumable products that cater to specific patient needs, providing more tailored testing options. Additionally, the entry of companies from emerging markets like China and India is contributing to the overall market dynamics, offering more cost-effective solutions and increasing the competitive pressure on established players. This is resulting in greater diversity in product offerings, which is beneficial for healthcare providers looking for more customized, affordable, and efficient platelet aggregation testing solutions.

Abbott Laboratories is a major player in the platelet aggregation devices market, offering diagnostic solutions that help in monitoring platelet function and managing cardiovascular diseases. Abbott’s product portfolio includes instruments for platelet testing, which are widely used in hospitals, clinics, and research settings. The company is known for its focus on developing reliable and accurate diagnostic tools for healthcare providers.

Siemens Healthineers is another key player, providing diagnostic systems used for platelet aggregation testing. Siemens offers a range of platelet function analyzers and reagents for both clinical and research applications. The company has made significant strides in integrating advanced technologies, including automation and real-time monitoring, to enhance the precision of its devices.

List of Key Companies

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific

- Roche Diagnostics

- Beckman Coulter

- PLT Scientific

- Bio/Data Corporation

- Medtronic

- Helena Laboratories

- Accumetrics (now part of Siemens Healthineers)

- Chrono-Log Corporation

- Ortho Clinical Diagnostics

- A&D Company

- Nihon Kohden

- Sysmex Corporation

Platelet Aggregation Devices Industry Developments

- In October 2024, Abbott announced the launch of an advanced diagnostic platform aimed at improving patient care in cardiovascular disease management, expanding its reach in the platelet testing space.

- In September 2024, Siemens Healthineers unveiled a new point-of-care testing device aimed at streamlining platelet function analysis in emergency settings, reinforcing its position in the market for diagnostic equipment.

Market Segmentation

By Product Type Outlook

- Systems & Instruments

- Consumables & Accessories

By Application Outlook

- Clinical Applications

- Research Applications

By End Use Outlook

- Hospital

- Diagnostic Centers

- Research & Academic Institutes

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 841.61 million |

|

Market Size Value in 2025 |

USD 885.46 million |

|

Revenue Forecast by 2034 |

USD 1,422.66 million |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The platelet aggregation devices market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the platelet aggregation devices market focuses on expanding product portfolios, enhancing device accuracy, and increasing accessibility to advanced diagnostic solutions. Key players are investing in research and development to integrate new technologies such as non-invasive testing, automation, and real-time data analytics into their devices. Collaborations with hospitals, diagnostic centers, and academic institutions are common, aiming to improve product adoption and expand market reach. Additionally, companies are targeting emerging markets by offering cost-effective, user-friendly devices to cater to a broader range of healthcare providers. Increased focus on personalized medicine is also shaping marketing strategies, promoting devices that offer tailored testing for specific patient needs.

FAQ's

? The platelet aggregation devices market size was valued at USD 841.61 million in 2024 and is projected to grow to USD 1,422.66 million by 2034.

? The market is anticipated to register a CAGR of 5.4% from 2025 to 2034.

? North America had the largest share of the market in 2024.

? A few of the key players in the market are Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Roche Diagnostics, and Beckman Coulter.

? The systems & instruments segment accounted for the largest market share in 2024.

? The clinical applications segment dominated the market in 2024.

? Platelet aggregation devices are diagnostic instruments used to assess the function of platelets in blood, specifically their ability to clump together (aggregate) in response to various stimuli. This process is crucial in the formation of blood clots, and platelet aggregation tests are commonly used to diagnose and manage conditions related to abnormal clotting, such as cardiovascular diseases, bleeding disorders, and thrombosis. These devices measure platelet response to various agonists, helping healthcare providers monitor platelet function, evaluate the effectiveness of antiplatelet therapies, and assess the risk of thrombotic events. They are widely used in clinical settings, such as hospitals and diagnostic labs, as well as in research applications to study platelet function and related disorders.

? A few key trends in the platelet aggregation devices market are described below: Increased Adoption of Point-of-Care Testing: Growing demand for faster, on-site diagnostic results is driving the adoption of point-of-care platelet aggregation testing, especially in emergency and outpatient settings. Non-Invasive Testing Methods: Development of non-invasive diagnostic technologies is gaining traction, offering more comfortable and safer alternatives to traditional blood sample-based tests. Integration of Digital and Real-Time Monitoring: Advances in digital technology are leading to the integration of real-time data monitoring and analytics in platelet aggregation devices, enhancing diagnostic accuracy and decision-making. Personalized Medicine and Tailored Therapies: The rise of personalized medicine is increasing demand for platelet aggregation devices that can offer more specific insights into individual platelet function, helping guide treatment plans.

? A new company entering the platelet aggregation devices market could focus on developing cost-effective, user-friendly solutions for point-of-care testing, addressing the increasing demand for fast, accurate diagnostics in diverse healthcare settings. Investing in non-invasive technologies and real-time data analytics could provide a competitive edge by offering more comfortable and efficient testing options. Additionally, focusing on personalized medicine by creating devices that can offer tailored insights into individual platelet functions would cater to the growing trend of precision healthcare. Targeting emerging markets with affordable yet high-quality products could also open new revenue streams while differentiating the company from established players.

? Companies manufacturing, distributing, or purchasing platelet aggregation devices and related products, and other consulting firms must buy the report.