Polyisobutylene Market Share, Size, Trends, Industry Analysis Report

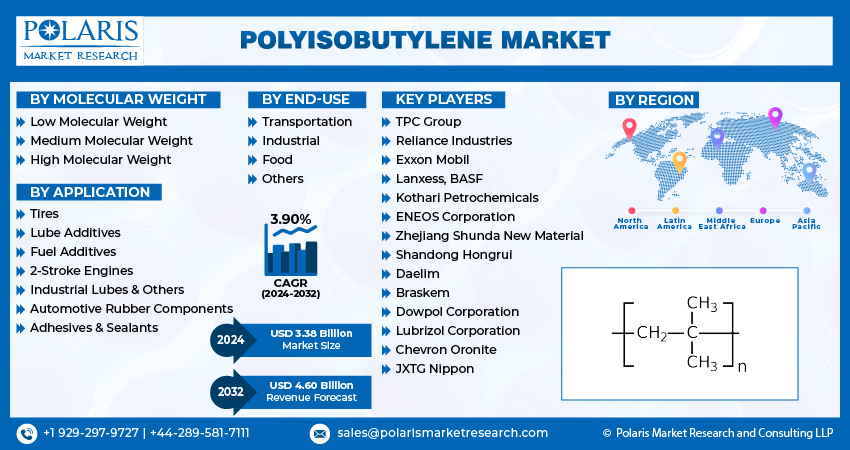

By Molecular Weight (Low Molecular Weight, Medium Molecular Weight, and High Molecular Weight); By Application; By End-Use; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3342

- Base Year: 2023

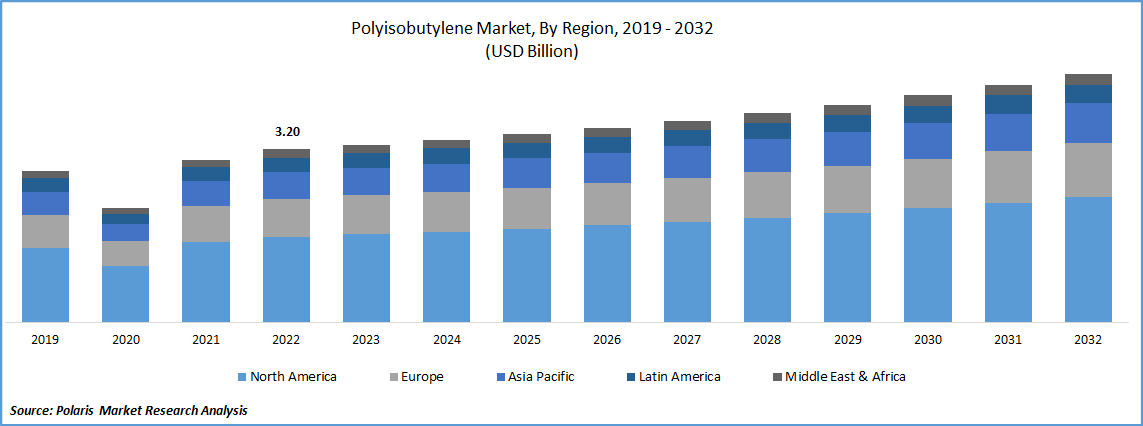

- Historical Data: 2019-2022

Report Outlook

The global polyisobutylene market was valued at USD 3.28 billion in 2023 and is expected to grow at a CAGR of 3.90% during the forecast period. Growing utilization of the product across numerous end-use industries because of its thermal stability, ozone resistance, impermeability, and superior flexibility that allow it to be used in manufacturing of construction sealants, hosepipes, pharmaceutical stoppers, and various other mechanical products are major factors driving the demand and growth of the global market. Additionally, high technological innovations in the manufacturing processes and incorporation of new techniques by major player to maximize their productivity without compromising to product quality and focus on intruding new solutions will further offer huge growth opportunities in the coming years.

To Understand More About this Research: Request a Free Sample Report

For instance, in March 2022, BASF, announced the expansion of its manufacturing capacity of Ultramid polyimide grades in Panoli, Gujrat, in order to cater the rising market demand. The capacity expansion will allow us to shortens delivery time.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the polyisobutylene market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Moreover, there has been a significant increase in the popularity and prevalence for sea freight as a key transport mode because of its high-load capacity, & highly secured transportation along with the rising government initiatives on improving port infrastructures and growth in bi-lateral trade agreements between the countries are creating huge demand for lubricant additives, which in turn, stimulate the market growth rapidly.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the polyisobutylene market. The rapid emergence of deadly coronavirus across the globe had severely affected the manufacturing of various end-use industries including automotive and cosmetics, due to imposed lockdowns and many other stringent regulations on mass movement. The closure of manufacturing and supply chain disruptions has dramatically decreased the demand and supply of various end-user products globally.

Industry Dynamics

Growth Drivers

The rapid increase in the demand for PIB in transportation industry across the globe with the rising number of both commercial and residential vehicles on the road has paved the way for greater adoption for polyisobutylene. As, approx. 70% of the total rubber produced worldwide is used in the production of tires due to its unique physical and chemical properties. It flexibility at very low temperatures and impermeability to the gases make it an ideal material to manufacture tubeless tires, and fueling the polyisobutylene market growth at significant pace.

Furthermore, the demand for the production has drastically increased in the recent years mainly in emerging economies including China, Brazil, Indonesia, Thailand, and South Korea with the growth in transportation, food, manufacturing, sporting goods, and pharmaceutical industries among others. Rapid rate of urbanization in these economies has resulted in increased investments in both manufacturing and service sectors, which creates significant growth opportunities for the market.

Report Segmentation

The market is primarily segmented based on molecular weight, application, end-use, and region.

|

By Molecular Weight |

By Application |

By End-Use |

By Region |

|

|

|

|

For Specific Research Requirements: Request for Customized Report

High Molecular Weight Segment Accounted for Largest Market Share in 2022

High molecular weight segment accounted for major global market share, and is likely to retain its market position throughout the anticipated period. The growth of the segment market can be highly attributed to increased popularity and prevalence for high molecular weight polyisobutylene, as it helps the product to retain its high elasticity and resilient properties and growing usage in wide range of applications such as stretch films, lubricants, industrial adhesives, food, and transportation sectors.

The medium molecular weight segment is expected to witness considerable growth rate during the anticipated period, on account of its widespread use in the adhesives due to its tackiness and plasticizing properties. The product has gained significant traction in food & beverage packaging because of its hydrophobic stability, adhesive nature, food safety status, and antibacterial performance, which is further likely to create huge demand and growth for the segment market.

Automotive Rubber Components Segment is Expected to Witness Highest Growth During Forecast Period

The automotive rubber components segment is expected to grow at a highest CAGR over the course of study period, which is highly accelerated by increasing demand and adoption of passenger and commercial vehicles for public and private transportations, as a result of surging population migration towards the urban areas especially in emerging economies like India and China. The polyisobutylene is being widely used as additives in the engine fuel for prevention of soot, sludge, and many other deposit precursors, thereby supporting the segment growth.

Lubricant additives segment led the industry market with largest revenue share, mainly due to increasing industrial production all over the world and increasing consumption of various types of industrial oil products across chemical and mining industries. Additionally, the emerging demand for industrial lubricants in numerous applications like hydraulics, centrifuges, compressors, bearings, and industrial engines, that is positively affecting the market.

Transportation Segment is Expected to Hold Significant Market Share in 2022

Transportation segment is expected to hold significant market revenue share over the forecast period, that is mainly driven by extensive rise in the need and prevalence for the product in transportation sector mainly due to its low gas permeability, increased electrical insulation, and high tensile strength and easy availability in various forms including lubricants, rubber, sealants, adhesives, and fuel additives among others. Food segment is also anticipated to exhibit substantial growth rate over the coming years, mainly due to the change in consumer lifestyles and high preferences for packaged food products across both developed and developing countries. As, food packaging widely utilize the product owing to its large number of beneficial characteristics over other available options, hence propelling the segment market growth at rapid pace.

Asia Pacific Region Dominated the Global Market in 2022

Global market with healthy revenue share. Increasing prevalence for the product form major key industries such as automotive, construction, aerospace, and cosmetics and surging trend among people for shifting towards the electric vehicles, which led to rise in the demand for tubeless tires to reduce drag and maintenance. In addition, the growing foreign direct investments in wide range of industrial activities taking place in major developing economies in the region such as India, China, and Malaysia, that further contributes to the market growth.

Europe region is anticipated to grow at substantial growth rate during the projected period, which is largely attributed to rapid growth in the construction activities coupled with the presence of several suitable measures like tax breaks, incentives, and subsidies undertaken by government of many countries. Moreover, the polyisobutylene-based butyl rubber is increasingly being used in the development of several types of automobile parts including gaskets, window strips, and hosepipes in countries like Germany and France.

Competitive Insight

Some of the major players operating in the global polyisobutylene market include TPC Group, Reliance Industries, Exxon Mobil, Lanxess, BASF, Kothari Petrochemicals, ENEOS Corporation, Zhejiang Shunda New Material, Shandong Hongrui, Daelim, Braskem, Dowpol Corporation, Lubrizol Corporation, Chevron Oronite, and JXTG Nippon.

Recent Developments

- In February 2021, BASF, announced the launch of its new product named OPPANOL C in North America, an easier to process and new form of polyisobutylene. Product offering is produced as 1-inch chips, and could also reduce the product development time and mitigate the manufacturing steps. It further provides wide range of features including excellent barrier, adhesion to the surfaces, & high flexibility at the low temperatures.

- In March 2020, Daelin Industrial. a South Korean petrochemical company, announced that the company has signed a strategic agreement with Lubrizol to supply its polyisobutylene production technology. The technology will be used in the production of wide range of PIBs, form conventional to the highly reactive, that will help company to expand its global capabilities.

Polyisobutylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.38 billion |

|

Revenue forecast in 2032 |

USD 4.60 billion |

|

CAGR |

3.90% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Molecular Weight, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

TPC Group, Reliance Industries, Exxon Mobil Corporation, Lanxess AG, BASF SE, Kothari Petrochemicals, ENEOS Corporation, Zhejiang Shunda New Material Co. Ltd., Shandong Hongrui New Material Technology Co. Ltd., Daelim Co. Ltd., Braskem, Dowpol Corporation, The Lubrizol Corporation, Chevron Oronite Company LLC, and JXTG Nippon & Energy Corporation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of critical illness insurance market. Besides, we have stringent data-quality checks in place to enable polyisobutylene market for you.

FAQ's

The global polyisobutylene market size is expected to reach USD 4.60 billion by 2032.

Key players in the polyisobutylene market are TPC Group, Reliance Industries, Exxon Mobil, Lanxess, BASF, Kothari Petrochemicals, ENEOS Corporation.

Asia Pacific contribute notably towards the global polyisobutylene market.

The global polyisobutylene market expected to grow at a CAGR of 3.82% during the forecast period.

The polyisobutylene market report covering key segments are molecular weight, application, end-use and region.