Polymethyl Methacrylate (PMMA) Market Share, Size, Trends, Industry Analysis Report

By Form (Pellets, Extruded Sheet, Cast Acrylic Sheet, Beads, Others); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM2513

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

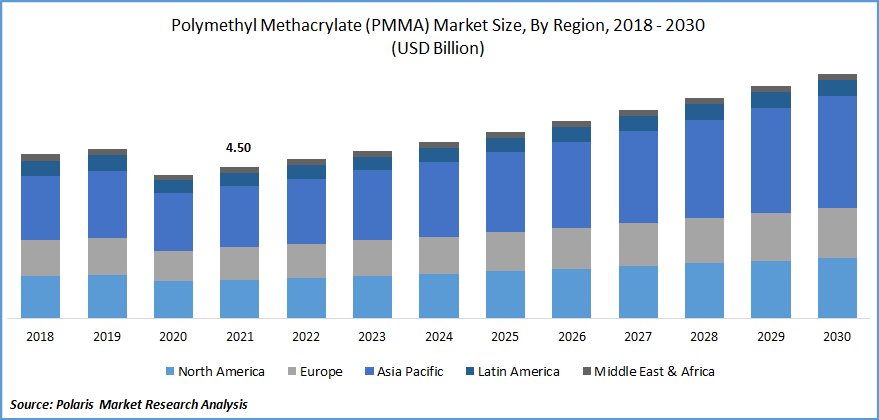

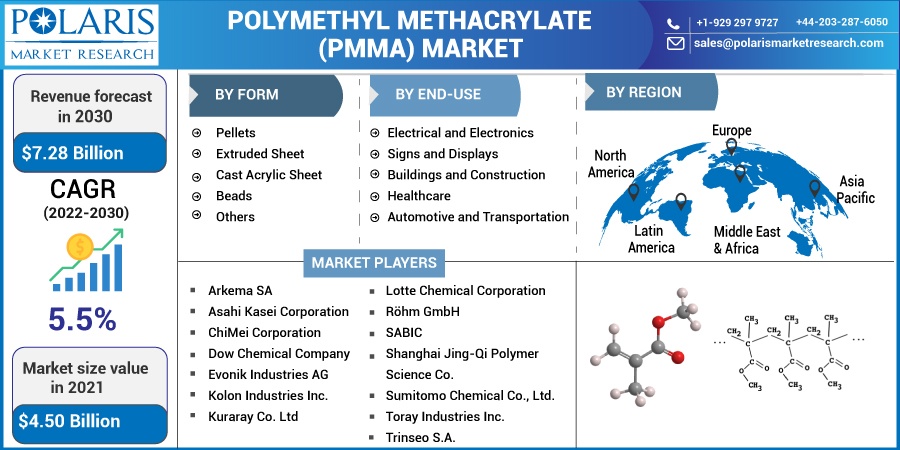

The global Polymethyl Methacrylate (PMMA) market was valued at USD 4.50 billion in 2021 and is expected to grow at a CAGR of 5.5% during the forecast period. PMMA is a transparent and rigid thermoplastic material used as a shatterproof replacement for glass. It is also known as acrylic or acrylic glass.

Know more about this report: Request for sample pages

It offers resistance to UV light and weathering, chemical resistance, durability, and excellent light transmission. PMMA is available in pellet, small granules, and sheet forms. Polymethyl methacrylate is widely used in windows, skylights, laminated signs & aircraft canopies, among others.

Polymethyl methacrylate is used in varied industries such as healthcare, automotive, electronics, construction, and solar devices, among others. Polymethyl methacrylate is used in the automotive sector for the manufacturing of car windows, windshields, car indicator covers, and panels, among others. The growing application of PMMA in electric vehicles drives the growth of the Polymethyl Methacrylate (PMMA) market.

Rising environmental awareness coupled with stringent emission regulations has resulted in increased acceptance of electric vehicles. Growth in industrialization and urbanization across the globe has led to the expansion of industries such as automotive, industrial and medical, increasing the demand for polymethyl methacrylate from these sectors.

Polymethyl methacrylate is widely used in the building and construction sector for the manufacturing of windows, doors, panels, canopies, sinks, baths, and knobs, among others. PMMA offers properties such as weather and UV resistance and endurance under harsh conditions, which has enabled its application in the building and construction sector. The growing need to build energy-efficient buildings, reduce energy costs, and use non-toxic materials has increased the applications of polymethyl. The increasing development of buildings and homes and the growing trend toward art and design have further aided Polymethyl Methacrylate (PMMA) market growth.

The COVID-19 outbreak has hindered the growth of the PMMA market. Industries such as automotive and construction have been adversely affected by the pandemic, resulting in reduced demand for PMMA from these industries. The Polymethyl Methacrylate (PMMA) market has been impacted by operational challenges, disruption of the supply chain, deferred maintenance, delayed installations, and workforce impairment. Construction activities have been impeded owing to various government regulations and social distancing norms across the globe. Consumers are purchasing essential products and postponing other activities indefinitely.

Restrictions on the movement of goods and travel bans have further limited the application of PMMA. The Polymethyl Methacrylate (PMMA) market is expected to gain traction post COVID-19, driven by factors such as supportive government regulations, favorable environmental policies, industrial recovery, and the growing application of lightweight materials.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising industrialization, urbanization, and increasing commercial activities across the globe drive the growth of the Polymethyl Methacrylate (PMMA) market. Rising disposable income and improving living standards have resulted in the growth of the building and construction sector, especially in emerging economies. The introduction of international building codes, growing investment in the construction industry, and development of public infrastructure are factors boosting the growth of the market.

Technological advancements and rising investments in the construction of offices, factories, and manufacturing units have increased the application of polymethyl methacrylate in the building and construction sector. The growing need to reduce weight in automobiles for increased performance and greater demand for modernized vehicles have increased the demand for polymethyl methacrylate from the automotive sector.

Report Segmentation

The market is primarily segmented based on form, end-use, and region.

|

By Form |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Extruded sheet accounted for a significant share in 2021

Extruded sheets accounted for a significant share in the polymethyl methacrylate market in 2021, owing to their durability, optical clarity, and weather resistance. Extruded sheets are affordable, easy to use, and durable. These sheets offer high mechanical quality, sturdiness, and toughness. Extruded sheets are widely utilized in the construction sector. The economic growth in developing countries and industrialization boost industry growth.

Extruded sheets are impact and weather-resistant, transparent, and versatile. Widely used in automotive and transportation, these sheets possess a high molecular weight for superior fabrication and forming.

Automotive segment accounted for a major revenue share

PMMA is widely used in the automotive sector for the manufacturing of body parts, lamp covers, and interior and exterior trim. PMMA offers features such as durability, weather resistance, chemical resistance, and toughness. PMMA offers a range of properties, such as superior strength, optical clarity, stiffness, and greater weathering. It is usually used in high-performance environments.

Some applications of PMMA include fighter canopies, windscreens, cabin windows, and instrument panels, among others. Polymethyl methacrylate is used in the manufacturing of automotive components to reduce weight and improve performance. Increasing demand for passenger vehicles, adoption of electric vehicles, and modernization of vehicles have increased the demand for PMMA.

The demand for PMMA is high owing to the development of efficient and lightweight components. Increasing adoption of additive manufacturing for the development of complex geometries & mass customization of parts, customization of cabin interiors, and growth in vehicle production further supplement the growth of this segment.

Polymethyl methacrylate is also widely used in the electronics industry in the display of various electronic devices such as smartphones, tv screens, and laptops, owing to its high transmittance and optical clarity.

Asia Pacific dominated the PMMA market in 2021

Asia Pacific dominated the global PMMA market in 2021. Rapid urbanization, rising research and development activities, and expansion of international players in this region drive growth in this region. The industrial growth in developing economies such as China, India, and Japan, rising automotive penetration, as well as increasing construction and development activities have resulted in greater demand for PMMA. Rising applications in the healthcare and electronics sectors have further accelerated the demand for polymethyl methacrylate in the region.

Competitive Insight

The leading players in the Polymethyl Methacrylate (PMMA) market include Arkema SA, Asahi Kasei Corporation, ChiMei Corporation, Dow Chemical Company, Evonik Industries AG, Kolon Industries Inc., Kuraray Co. Ltd, Lotte Chemical Corporation, Mitsubishi Chemical Holdings Corporation, Röhm GmbH, SABIC, Shanghai Jing-Qi Polymer Science Co., Sumitomo Chemical Co., Ltd., Toray Industries Inc., and Trinseo S.A.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Recent Developments

In April 2022, Sumitomo Chemical establish a new MMA division to expand its MMA business. The MMA business includes methyl methacrylate monomer and acrylic resin PMMA. The new division is aimed at strategy formulation and global marketing and. The company produces MMA monomer at three locations in Japan, Singapore, and Saudi Arabia, with a total production capacity of 400,000 tons per year.

Plaskolite completed the acquisition of Plazit-Polygal. Plazit-Polygal is a developer and manufacturer of engineering thermoplastic sheets. The acquisition is aimed at expanding Plaskolite’s operations in Israel, North America, South America and Europe. It also assists the company to strengthen its geographic presence, expand its offering in the market, and cater to the growing consumer demand.

Polymethyl Methacrylate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.50 billion |

|

Revenue forecast in 2030 |

USD 7.28 billion |

|

CAGR |

5.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Form, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Arkema SA, Asahi Kasei Corporation, ChiMei Corporation, Dow Chemical Company, Evonik Industries AG, Kolon Industries Inc., Kuraray Co. Ltd, Lotte Chemical Corporation, Mitsubishi Chemical Holdings Corporation, Röhm GmbH, SABIC, Shanghai Jing-Qi Polymer Science Co., Sumitomo Chemical Co., Ltd., Toray Industries Inc., and Trinseo S.A. |