Porous Ceramic Market Share, Size, Trends, Industry Analysis Report

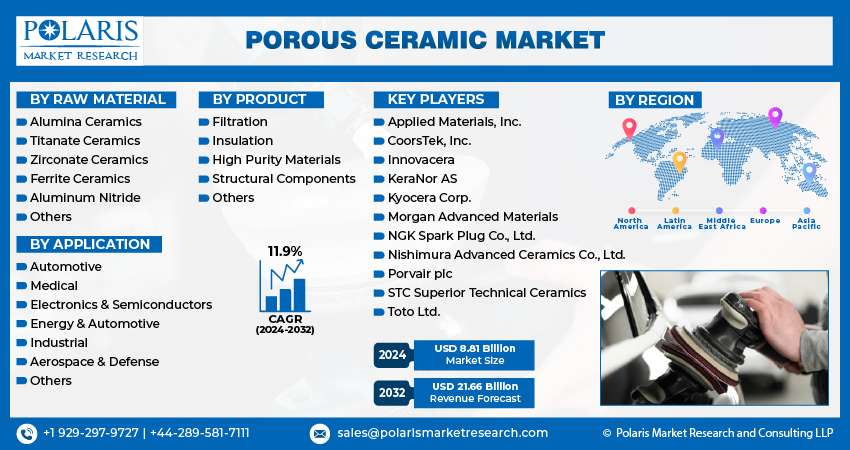

By Raw Material (Alumina, Titanate, Zirconate, Ferrite, Aluminum Nitride, Others); By Product; By Application; By Region; And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4354

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global porous ceramic market was valued at USD 7.89 billion in 2023 and is expected to grow at a CAGR of 11.9% during the forecast period.

The market is experiencing growth due to the increasing demand for filtration products and their expanding use in medical devices and equipment. The need for high-quality and functionally safe medical devices that comply with strict approval standards has driven the requirement for dependable materials like porous ceramics. This widespread application in the medical devices industry is expected to boost market growth in the foreseeable future.

High-purity porous ceramics have diverse applications in microelectronics, including the manufacturing of piezoelectric devices, custom electronic components, and substrates. The increasing demand for electronic devices, driven by factors like consumer preferences, industrial requirements, and technological advancements, is a key driver for the growth of this market. In the realm of microelectronics, high-purity porous ceramics play a vital role due to their unique properties. These ceramics are engineered to have excellent thermal stability, electrical insulation, and mechanical strength. These qualities make them ideal for applications in microelectronics where precision and reliability are paramount.

The porous ceramic market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

To Understand More About this Research: Request a Free Sample Report

The growing need for top-notch medical equipment and the necessity to meet rigorous approval standards have led to a higher demand for ceramics in the medical sector. Ceramics are favored in the medical industry due to their adaptable and customizable properties, tailored to specific application needs. Moreover, the COVID-19 pandemic further boosted the demand for porous ceramic market. For example, Saint-Gobain Performance Ceramics & Refractories innovated the Crystar air filtration technology a high porosity ceramic filter solution striking a balance between retention efficiency and air permeability.

Porous ceramic-based products are created through various technologies like partial sintering, sacrificial fugitives, & direct foaming. The manufacturing process involves techniques such as paste extrusion & additive manufacturing. However, production costs are notably high due to substantial capital investments (CAPEX) & raw material expenses. This high-cost factor is anticipated to limit market growth throughout the forecast period.

Growth Drivers

Rising the use of porous ceramic filtration in various industries

In the food, pharmaceutical, and chemical sectors, porous ceramic filtration products are employed to separate different materials from liquids and solutions, ensuring the purity and quality of the final products. The porous structure of these ceramics allows for efficient filtration, removing contaminants and unwanted particles from liquids.

Furthermore, in gas separation membranes, porous ceramics play a vital role. Their excellent permeability enables the efficient separation of gases, making them valuable components in various gas separation processes. These ceramics are known for their reliability, as they can withstand demanding conditions without compromising their filtering capabilities. Their durability ensures long-lasting performance, making them a preferred choice for applications requiring consistent and efficient gas separation.

Report Segmentation

The market is primarily segmented based on raw material, product, application, and region.

|

By Raw Material |

By Product |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Raw Material Analysis

Alumina ceramics segment held the largest share of the market in 2023

Alumina ceramics dominated the market. Alumina, also known as aluminum oxide, possesses exceptional electrical insulation properties, making it a prominent choice in advanced ceramic applications. Its resistance to wear and corrosion further enhances its appeal, making it a preferred material for various applications such as pump components, automotive sensors, and electronics.

Alumina-based products are extensively favored in semiconductor, electrical, and medical sectors due to their outstanding qualities, including low specific heat, low bulk density, and low thermal conductivity. The increasing demand for these products, combined with their exceptional properties, is driving players to invest significantly in research and development efforts for innovative product designs. This emphasis on innovation is bolstering the demand for alumina-based products in various industries.

The titanate ceramics segment will grow at a rapid pace. This growth is attributed to its utilization in creating porous piezoceramic ceramics and as a dielectric material in capacitors. Titanate ceramics are increasingly employed in microphones and transducers due to their piezoelectric properties. Additionally, the pyroelectric and ferroelectric characteristics of barium titanate are harnessed in the production of uncooled sensors used in thermal cameras.

By Application Analysis

Automotive segment accounted for the largest market share in 2023

The automotive segment accounted for the largest market share. Porous ceramics play a vital role in the automotive sector due to their exceptional properties, including high mechanical strength, abrasion resistance, chemical stability, and thermal stability. Investments in the automotive industry, particularly in the development of Electric Vehicles (EVs), are expected to drive market growth in the foreseeable future.

The electronics segment is expected to grow at a substantial pace. This is primarily due to the rising need for components like spark plugs, capacitors, resistors, sensors, chips, and substrates in devices such as smartphones, TVs, computers, and consumer appliances.

By Product Analysis

Filtration segment held the substantial share of the market in 2023

The filtration segment dominated the market. Filters based on porous ceramics are effective in removing particles from air and liquids even in extreme temperature and pressure conditions. These filters are utilized across diverse industries including automotive, chemical, pharmaceuticals, and food. The increasing demand for filtration solutions is expected to drive the demand for these products in the years to come.

The high-purity materials segment will exhibit the highest growth rate. Products crafted from high-purity materials boast a superior surface finish due to their fine average grain size. Compared to low-purity materials, they offer numerous benefits, including exceptional hardness, flexural strength, and dielectric strength. Moreover, these materials enhance the thermal shock resistance of the components manufactured from them.

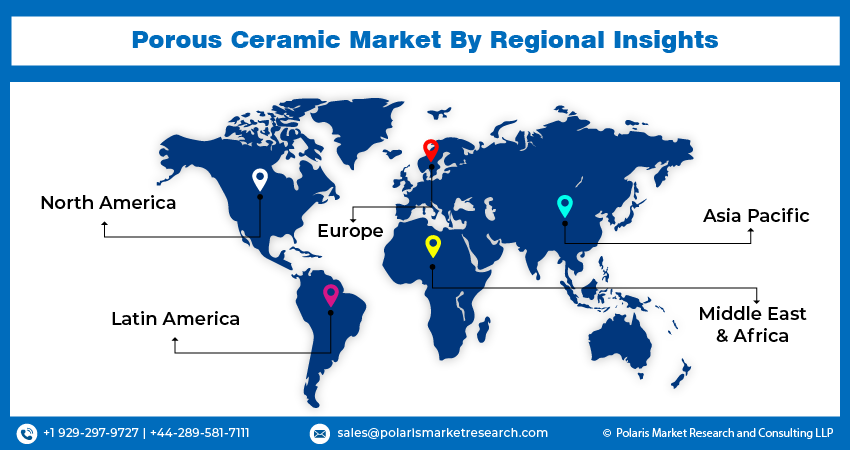

Regional Insights

Asia Pacific accounted for the largest share of global market in 2023

Asia Pacific dominated the market. Region’s growth is primarily by the rapid industrialization and strict government regulations aimed at upholding environmental standards. Additionally, stringent policies curbing excessive industrial pollution discharge are anticipated to boost the demand for water and air filtration systems, thereby contributing to the rising demand for porous ceramics in the coming years.

North America will grow at the fastest rate. Government initiatives promoting sustainable development are set to enhance the demand for ceramic filters in the region significantly. Furthermore, the integration of nanotechnology in filtration processes is expected to propel the demand for fine ceramic materials, thereby contributing to the overall market growth.

The U.S. government, under regulations like the Clean Air Act (CAA), mandates the EPA to set National Ambient Air Quality Standards (NAAQS) & regulates toxic emissions from industries. These filters are increasingly employed to remove VOCs & gaseous emissions in industrial settings. Consequently, these U.S. regulations, especially the CAA, aimed at safeguarding the public from harmful toxic gases, are anticipated to boost the demand for filters.

Key Market Players & Competitive Insights

Advancements in technology and enhancements in production methods have led to the creation of highly durable products with longer lifespans. To gain a competitive edge, market players are actively investing in mergers and acquisitions. This strategy enables them to offer advanced ceramic products at competitive prices, consolidating their position in the market.

Some of the major players operating in the global market include:

- Applied Materials, Inc.

- CoorsTek, Inc.

- Innovacera

- KeraNor AS

- Kyocera Corp.

- Morgan Advanced Materials

- NGK Spark Plug Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Porvair plc

- STC Superior Technical Ceramics

- Toto Ltd.

Recent Developments

- In October 2022, Artemis successfully acquired McDanel Advanced Ceramic Technologies, a strategic step taken to enrich their range of high-purity products and services. This move allows the company to offer consumers exceptional products known for their superior quality.

- In August 2021, XJet, recently introduced alumina technical ceramic to its expanding range of additive manufacturing materials.

Porous Ceramic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.81 billion |

|

Revenue forecast in 2032 |

USD 21.66 billion |

|

CAGR |

11.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Raw Material, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Want to check out the porous ceramic market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

FAQ's

The global porous ceramic market size is expected to reach USD 21.66 billion by 2032

Applied Materials, CoorsTek, Innovacera, KeraNor, Kyocera Corp., Morgan Advanced Materials, NGK Spark Plug, Porvair, and Toto are the top market players in the market.

Asia Pacific region contribute notably towards the global Porous Ceramic Market.

The global porous ceramic market is expected to grow at a CAGR of 11.9% during the forecast period.

The Porous Ceramic Market report covering key segments are raw material, product, application, and region.