Power Electronic Testing Market Size, Share, Industry Analysis Report

By Provision Type (Test Instruments and Equipment, Professional Testing Services), By Device Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5844

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

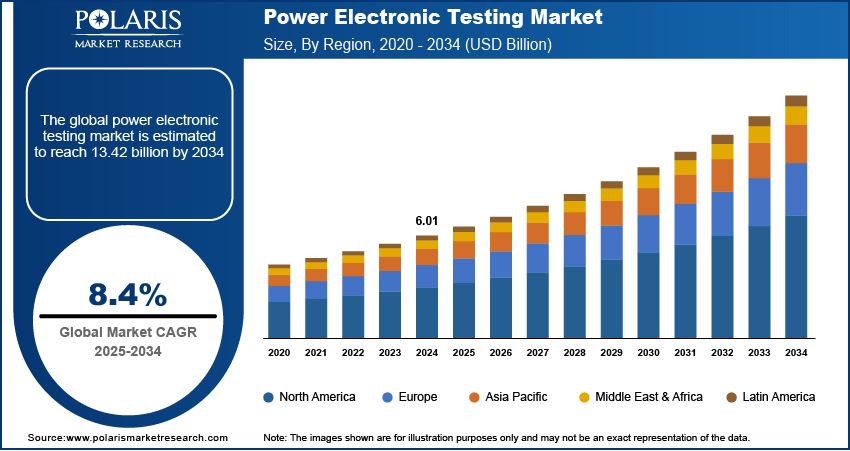

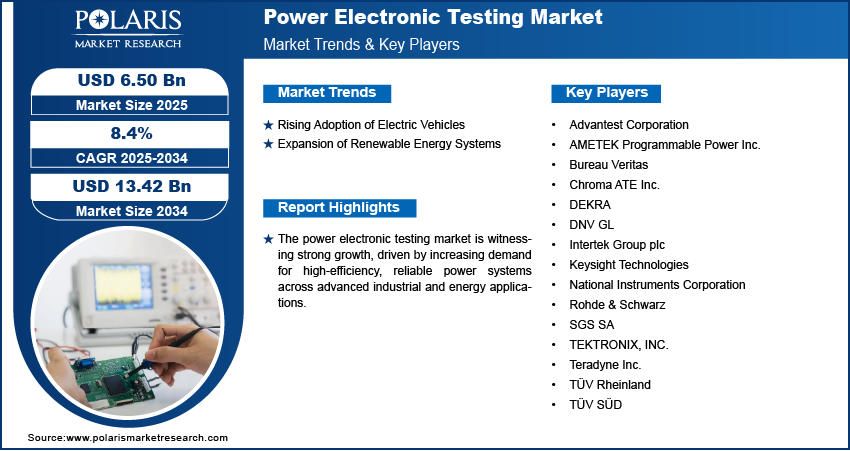

The global power electronic testing market size was valued at USD 6.01 billion in 2024, growing at a CAGR of 8.4% from 2025 to 2034. The growth is driven by the rising focus on regulatory compliance and safety standards.

Power electronic testing refers to the process of evaluating the performance, reliability, and efficiency of power electronic devices and systems under various electrical and environmental conditions. This critical function has gained prominence with the accelerating deployment of advanced technologies such as 5G services and smart grids. According to a July 2023 IEA report, the EU's 2022 energy digitalization plan projected USD 633 billion in grid investments by 2030, with USD 184 billion allocated to smart meters, automated grid management, and digital technology improvements. These next-generation infrastructures demand highly reliable, efficient, and responsive power systems. The complexity and density of power electronics used in base stations, data centers, and intelligent substations are rising as telecom operators expand 5G connectivity and utilities modernize grids. Consequently, the need for advanced testing solutions to ensure optimal system behavior, compliance with global standards, and protection against electrical failures is becoming increasingly essential.

To Understand More About this Research: Request a Free Sample Report

The robust growth in industrial automation and consumer electronics is boosting the growth opportunities. According to an April 2025 IBEF report, India's electronics production reached USD 101 billion in FY23, with the government investing USD 17 billion over the next six years in semiconductor and design, smartphones, IT hardware, and components production, reflecting industrial growth. Modern manufacturing environments rely on electronically controlled machinery, drives, and robotics, all of which require rigorous testing for performance assurance and safety. Similarly, the expansion of refined consumer devices ranging from smartphones and wearables to smart home appliances demands efficient power management systems that must be tested for quality, endurance, and compliance. The rising integration of power electronics across industrial and consumer domains fuels the demand for precise testing equipment that supports accelerated development cycles, improves product quality, and reduces risks of system malfunctions.

Industry Dynamics

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) drives the demand for power electronic testing, primarily due to the increased reliance on high-efficiency power conversion systems within EV architectures. A 2025 IEA report stated that global electric car sales exceeded 17 million units in 2024, growing by over 25% year-on-year. Components such as inverters, onboard chargers, DC-DC converters, and battery management systems require thorough testing to ensure they meet performance, safety, and durability standards. Power electronic systems are becoming more complex and compact, necessitating highly accurate and specialized testing solutions as automakers push for innovation in fast-charging technologies and extended battery life. This development creates a growing need for advanced testing capabilities to validate energy efficiency, thermal stability, and electromagnetic compatibility across a wide range of operating conditions.

Expansion of Renewable Energy Systems

The global expansion of renewable energy systems is driving demand for power electronic testing, as solar and wind installations increasingly rely on inverters, converters, and grid interface technologies. These systems convert variable power outputs into stable grid-compatible electricity, which requires stringent performance and reliability checks. Testing ensures seamless integration with existing power infrastructure and helps mitigate the challenges of intermittency, harmonics, and voltage fluctuations. The need for robust testing protocols to validate grid compliance, maximize energy output, and ensure the long-term durability of power electronic components becomes critical as renewable energy penetration deepens across grids. According to an April 2025 WEF report, global renewable energy capacity expanded by 15.1% in 2024, reaching 4,448 GW. This dynamic supports the sector’s growth as renewable systems continue to scale globally.

Segmental Insights

Provision Type Analysis

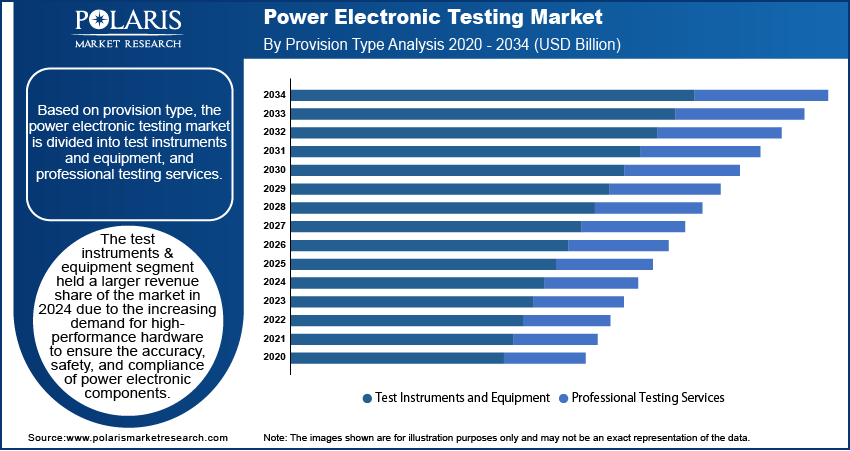

The segmentation, based on provision type, includes test instruments and equipment, and professional testing services. The test instruments & equipment segment held a larger revenue share of the market in 2024 due to the increasing demand for high-performance hardware to ensure the accuracy, safety, and compliance of power electronic components. These tools, such as oscilloscopes, signal analyzers, power analyzers, and automated test systems, are essential for product development, quality assurance, and certification processes across industries. The reliance on dedicated testing hardware boosts, as power electronics become more complex and are integrated into critical infrastructure. The segment's growth is also supported by continuous advancements in instrumentation technology, offering high precision, real-time diagnostics, and automation features that serve both R&D and production environments.

Service Analysis

The segmentation, based on service, includes individual power provision types, multi-device modules, and power management ICs. The multi-device modules services segment is expected to witness substantial growth during the forecast period, owing to the rising integration of multiple power management functions within compact semiconductor packages. These modules are increasingly adopted in high-performance applications such as EVs, data centers, and renewable energy systems, where space efficiency and power density are crucial. The increasing complexity of power modules necessitates wide testing services to evaluate their thermal performance, electromagnetic compatibility, and overall system behavior. This growing trend toward miniaturized, integrated systems fuels the demand for tailored, high-precision testing solutions, positioning this segment as a major area of expansion.

Regional Analysis

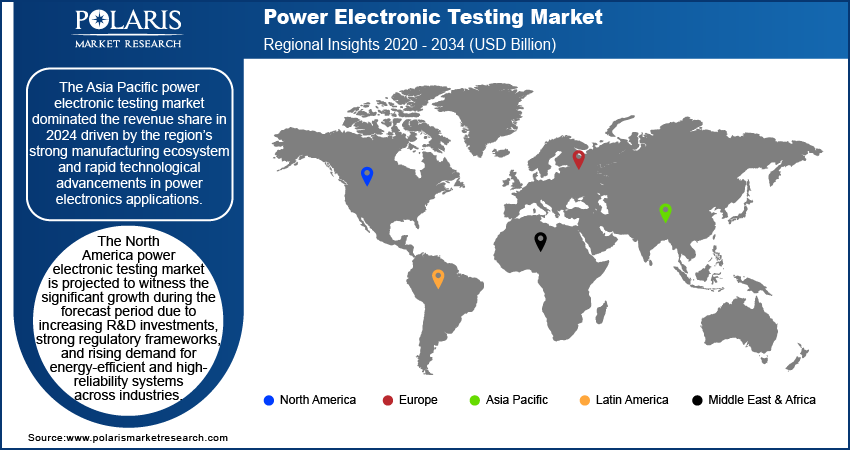

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific power electronic testing market dominated the revenue share in 2024, driven by the region’s strong manufacturing ecosystem and rapid technological advancements in power electronics applications. Countries across the region are witnessing significant investments in sectors such as consumer electronics, automotive, and renewable energy, all of which demand robust testing infrastructures. For instance, in January 2024, Tata Power invested USD 8.42 billion to build 10 GW of solar/wind capacity in Tamil Nadu within 5–7 years, targeting 70% clean energy output by 2030. Additionally, the presence of major semiconductor and power component manufacturers contributes to the high volume of testing activities. The region's focus on scaling EV production and grid modernization initiatives has further boosted the demand for power electronic testing equipment and services across Asia Pacific.

China Power Electronic Testing Market Trends

The market in China held the largest share in Asia Pacific in 2024, due to its expansive electronics manufacturing base and rapid advancements in electric mobility and renewable energy sectors. The country's strong presence in semiconductor production, coupled with large-scale deployment of 5G networks and smart grid infrastructure, has boosted the need for testing solutions. Additionally, government-led industrial modernization and electrification initiatives have created a high demand for reliable and precise power electronics testing across multiple sectors, driving China's leading position.

North America Power Electronic Testing Market Overview

The North America market is projected to witness significant growth during the forecast period, due to increasing R&D investments, strong regulatory frameworks, and rising demand for energy-efficient and high-reliability systems across industries. The region’s focus on advanced technologies in aerospace, defense, electric mobility, and data infrastructure has spurred the adoption of high-performance power systems that require rigorous testing. Additionally, the transition toward renewable energy sources and smart grid infrastructure is reinforcing the need for reliable testing services and equipment. In October 2023, the US DOE allocated up to USD 3.46 billion via its GRIP Program to fund 58 projects across 44 states, improving national electric grid resilience and reliability. These factors, combined with an established base of leading testing solution providers, support the region’s projected market expansion.

U.S. Power Electronic Testing Market Assessment

The U.S. power electronic testing sector is experiencing growth, primarily driven by increasing innovation in defense, aerospace, and EV technologies. The need for advanced testing to assure performance under strict operational conditions becomes critical as these industries demand high-reliability power systems. Moreover, the country's focus on upgrading electrical infrastructure and improving energy efficiency further boosts the demand for precision testing equipment and services, especially in grid-tied and high-voltage applications.

Europe Power Electronic Testing Market Insights

The market in Europe is projected to witness substantial growth during the forecast period, fueled by the region's decarbonization goals and increasing adoption of electrification in transportation and industry. The region is investing in sustainable power infrastructure, such as smart grids and renewable energy systems, which require advanced power electronics and corresponding testing solutions with a strong focus on energy transition. Furthermore, Europe’s focus on compliance with strict safety and performance regulations reinforces the need for precise testing procedures. The growing presence of EV manufacturing and high-efficiency industrial systems further boosts demand for testing services, supporting robust market growth.

UK Power Electronic Testing Market Analysis

The UK power electronic testing market growth is driven by the country’s focus on sustainable energy transition and electrification in transport and industrial processes. Growing investments in offshore wind energy and smart grid technology have created a strong demand for robust testing environments. Additionally, the push toward net-zero emissions and the adoption of power-dense semiconductor solutions in automotive and consumer electronics are reinforcing the need for specialized testing solutions, thereby supporting market growth.

Key Players & Competitive Analysis

The power electronics testing industry is witnessing rapid growth driven by emerging markets, technological advancements, and increasing demand for energy-efficient solutions. Companies such as Keysight Technologies, Rohde & Schwarz, and Chroma ATE Inc. lead with advanced test systems for power devices, inverters, and EV components, while compliance firms such as Intertek and TÜV SÜD ensure compliance with evolving standards. Revenue opportunities are expanding with the rise of SiC/GaN semiconductors and renewable energy systems, prompting strategic investments in automated testing and AI-driven validation. Disruptions and trends such as electrification and IoT integration are reshaping sustainable value chains, with developed markets focusing on precision testing and emerging economies scaling up infrastructure. Competitive intelligence highlights partnerships and M&As as major market entry strategies, while SMBs leverage niche expertise in modular test solutions. Future development strategies will hinge on geopolitical shifts, supply chain resilience, and expert insights into high-growth segments such as EV and grid-edge technologies.

A few key players are Advantest Corporation; AMETEK Programmable Power Inc.; Bureau Veritas; Chroma ATE Inc.; DEKRA; DNV GL; Intertek Group plc; Keysight Technologies; National Instruments Corporation; Rohde & Schwarz; SGS SA; TEKTRONIX, INC.; Teradyne Inc.; TÜV Rheinland; and TÜV SÜD.

Key Players

- Advantest Corporation

- AMETEK Programmable Power Inc.

- Bureau Veritas

- Chroma ATE Inc.

- DEKRA

- DNV GL

- Intertek Group plc

- Keysight Technologies

- National Instruments Corporation

- Rohde & Schwarz

- SGS SA

- TEKTRONIX, INC.

- Teradyne Inc.

- TÜV Rheinland

- TÜV SÜD

Industry Developments

April 2025: Rohde & Schwarz announced that they will launch its advanced power electronics testing solutions at PCIM Expo 2025, focusing on wide bandgap semiconductors (GaN/SiC). Their booth will feature advanced instruments for analyzing next-gen power components.

March 2025, Microtest Group launched the VIP ULTRA tester, a high-power device testing platform for automotive, energy storage, 5G, and data centers. It uniquely supports DC and energy stress tests up to 4kV with high parallelism.

March 2025: Keysight Technologies expanded its double-pulse test portfolio for Wide-Bandgap power semiconductors. The upgraded fixtures enable precise dynamic characterization of bare chips without soldering, minimizing parasitic, and work with both versions of Keysight's testers.

Power Electronic Testing Market Segmentation

By Provision Type Outlook (Revenue, USD Billion, 2020–2034)

- Test Instruments and Equipment

- Professional Testing Services

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Individual Power Provision Types

- Multi-Device Modules

- Power Management ICs

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Industrial Automation and Machinery

- Automotive and Mobility Solutions

- Information & Communication Technology (ICT)

- Consumer Electronics and Devices

- Renewable Power and Utility Networks

- Aerospace and Defense Applications

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Power Electronic Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.01 billion |

|

Market Size in 2025 |

USD 6.50 billion |

|

Revenue Forecast by 2034 |

USD 13.42 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.01 billion in 2024 and is projected to grow to USD 13.42 billion by 2034.

The global market is projected to register a CAGR of 8.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Advantest Corporation; AMETEK Programmable Power Inc.; Bureau Veritas; Chroma ATE Inc.; DEKRA; DNV GL; Intertek Group plc; Keysight Technologies; National Instruments Corporation; Rohde & Schwarz; SGS SA; TEKTRONIX, INC.; Teradyne Inc.; TÜV Rheinland; and TÜV SÜD.

The test instruments & equipment segment held the largest revenue share of the market in 2024.

The automotive and mobility solutions segment is expected to witness the fastest growth during the forecast period.