Power Quality Equipment Market Size, Share, Trends, Industry Analysis Report

: By Equipment (Power Quality Meters, Surge Protection Devices, Harmonic Filters, Voltage Regulators, Uninterruptable Power Supply (UPS), and Others), Phase, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM5659

- Base Year: 2024

- Historical Data: 2020-2023

Power Quality Equipment Market Overview:

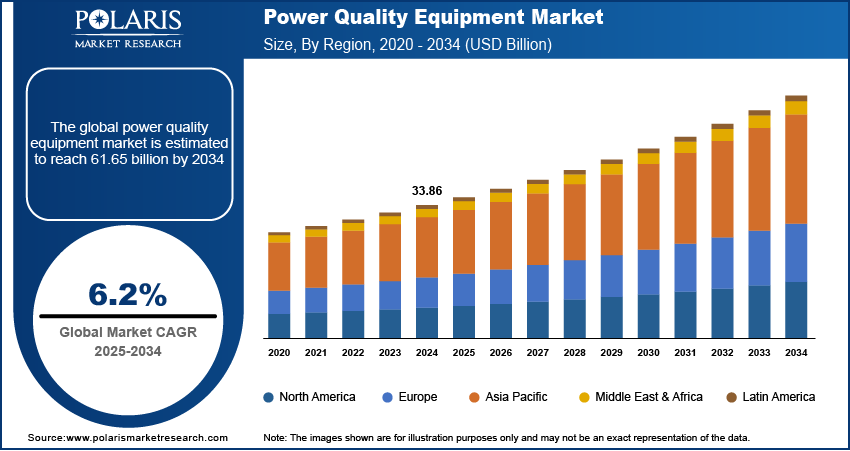

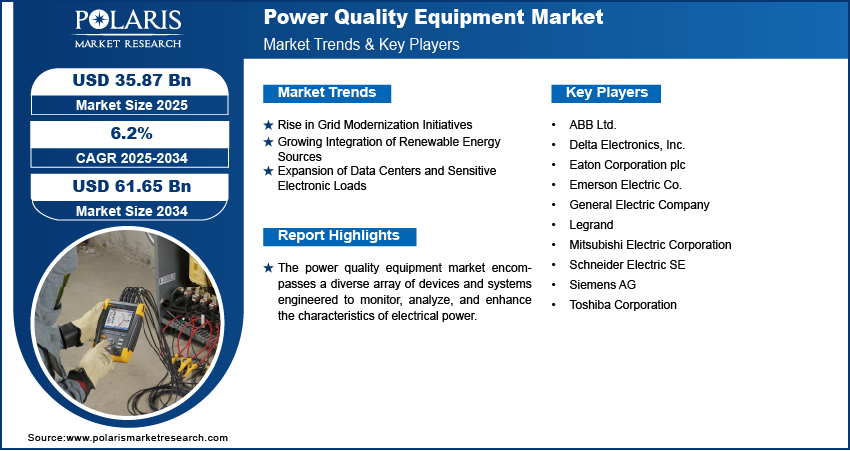

The power quality equipment market size was valued at USD 33.86 billion in 2024. The market is projected to grow from USD 35.87 billion in 2025 to USD 61.65 billion by 2034, exhibiting a CAGR of 6.2% during 2025–2034.

The power quality equipment market encompasses a range of devices designed to monitor, maintain, and enhance the quality of electrical power. These tools are essential for mitigating power disturbances such as voltage sags, swells, harmonics, and electrical noise, thereby ensuring the reliable and efficient operation of electrical and electronic equipment. The increasing reliance on sensitive electronic devices across industrial, commercial, and residential sectors is a significant market drive, fueling the market demand for power quality solutions. Furthermore, the growing emphasis on grid modernization and the integration of renewable energy sources, which can introduce variability into the power supply, are key factors propelling market development. Investments in smart grid infrastructure by governments and utilities worldwide further contribute to this market drive, necessitating sophisticated power quality equipment for high-capacity voltage regulation, harmonic filtering, and power factor correction.

Several factors are contributing to the positive market outlook for power quality equipment. The rapid pace of industrialization and urbanization globally is leading to increased electricity consumption and a greater need for stable power supplies to avoid costly downtimes and equipment failures. The expansion of data centers, driven by the growth of cloud computing, Artificial Intelligence (AI), and the Internet of Things (IoT), necessitates robust power quality solutions to ensure uninterrupted operation and prevent data loss. Additionally, the rising adoption of electric vehicles (EVs) and the development of EV charging infrastructure are creating new demands for power quality equipment to maintain grid stability. The increasing implementation of automation and IoT-based monitoring systems across various industries also highlights the importance of reliable power, further boosting the market potential and contributing to the overall market growth factors.

To Understand More About this Research: Request a Free Sample Report

Power Quality Equipment Market Dynamics:

Rise in Grid Modernization Initiatives

Globally, governments are undertaking significant initiatives to modernize their electrical grids, and this is a major market drive for power quality equipment. These modernization efforts aim to enhance grid reliability, improve efficiency, and facilitate the integration of renewable energy sources. In the US, the average age of transformers is over 40 years, increasing the risk of failures and the need for modern replacements, including power quality equipment.

For instance, China plans to invest over $100 billion between 2021 and 2025 in upgrading its power grids, which includes deploying advanced power quality solutions. The NSGM focuses on deploying advanced technologies like smart meters, power distribution units and automation systems including electric power distribution automation systems, and energy storage solutions. These technologies inherently require robust power quality equipment to ensure their stable and efficient operation. The integration of smart grid technologies, as supported by government programs like NSGM, necessitates the deployment of sophisticated power quality solutions to manage voltage fluctuations, harmonics, and other power disturbances effectively.

Growing Integration of Renewable Energy Sources

The increasing adoption of renewable energy sources such as solar and wind power is another significant market drive for power quality equipment. While these clean energy sources are crucial for achieving sustainability goals, their integration into the existing power grid poses unique challenges related to power quality. According to a research paper titled "Impact Of Renewable Energy Integration on Power Quality- Challenges and Solutions" published in the International Journal of Innovative Research in Engineering and Management in August 2024, renewable energy systems that utilize power electronics like inverters introduce harmonic distortions into the power system. The global renewable energy capacity saw a 35% increase in 2023, reaching over 470 GW. This growth necessitates significant investments in power quality equipment to ensure seamless grid integration. The intermittent nature of solar and wind power also leads to voltage and frequency fluctuations, which can impact the stability and reliability of the grid. To mitigate these power quality issues, advanced equipment such as harmonic filters, voltage regulators, and reactive power compensation devices are essential.

Expansion of Data Centers and Sensitive Electronic Loads

The rapid expansion of data centers, driven by the increasing reliance on cloud computing, big data analytics, and the Internet of Things (IoT), is a key market drive for power quality equipment. Data centers house vast amounts of sensitive electronic equipment that require a stable and high-quality power supply to ensure uninterrupted operation and prevent data loss. Any power disturbance, such as voltage sags, surges, or harmonic distortions, can lead to costly downtime, equipment damage, and data corruption. A report from MarketsandMarkets published on March 27, 2025, highlights that the Uninterruptible Power Supply (UPS) market is projected to be the most rapidly growing segment within the power quality equipment industry due to the increasing dependence on digital infrastructure, including data centers. The need for continuous and reliable power in these critical facilities necessitates the deployment of comprehensive power quality solutions, including UPS systems, voltage regulators, and surge protection devices.

Power Quality Equipment Market Segment Insights:

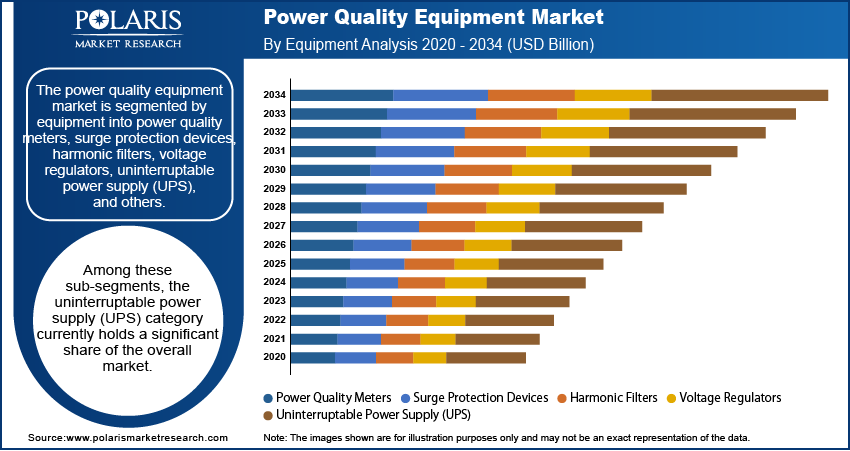

Power Quality Equipment Market Assessment – By Equipment

The power quality equipment market is segmented by equipment into power quality meters, surge protection devices, harmonic filters, voltage regulators, uninterruptable power supply (UPS), and others. Among these sub-segments, the uninterruptable power supply (UPS) category currently holds a significant share of the overall market. This substantial market presence can be attributed to the critical role UPS systems play in ensuring business continuity across various sectors. With the increasing reliance on digital infrastructure and the potential for significant financial and operational disruptions caused by power outages, the demand for UPS solutions to provide backup power and protect sensitive equipment remains consistently high. The widespread adoption of UPS systems in data centers, manufacturing facilities, healthcare institutions, and commercial buildings underscores their importance in maintaining a stable and reliable power supply, solidifying their leading position in terms of market share.

The harmonic filters sub-segment is anticipated to exhibit the highest growth rate within the power quality equipment market. This rapid growth is primarily driven by the increasing awareness and implementation of stringent power quality standards and regulations aimed at mitigating the adverse effects of harmonic distortions on electrical grids and equipment. The proliferation of non-linear loads, such as variable frequency drives (VFDs) and power electronic converters used in renewable energy systems and industrial automation, generates significant harmonic pollution. Consequently, the need for effective harmonic mitigation solutions is escalating to ensure grid stability, improve energy efficiency, and prevent equipment failures. This increasing emphasis on addressing harmonic distortions across various applications positions the harmonic filters sub-segment for the most significant growth in the foreseeable future.

Power Quality Equipment Market Evaluation– By Phase

The power quality equipment market is segmented by phase into single phase and three phase. Currently, the three phase sub-segment accounts for the largest share of the power quality equipment market. This dominance is primarily due to the widespread utilization of three-phase power systems across major industrial and commercial applications. Large-scale manufacturing facilities, heavy machinery, and extensive commercial complexes typically rely on three-phase power for their operational needs due to its efficiency in delivering higher power levels. Consequently, the demand for power quality equipment designed for three-phase systems, such as industrial-grade UPS systems, harmonic filters, and voltage regulators, remains substantial, contributing to the significant market share held by this segment.

The single phase sub-segment is expected to witness the highest growth rate in the power quality equipment market. This increasing demand is primarily fueled by the rising adoption of power quality solutions in residential and small commercial applications, coupled with the growing deployment of single-phase renewable energy systems like residential solar installations. The increasing penetration of sensitive electronic devices in households and small businesses, along with a greater awareness of power quality issues, is driving the need for single-phase surge protection devices, voltage stabilizers, and smaller UPS systems. Furthermore, the expansion of the residential electric vehicle charging infrastructure, which often utilizes single-phase power, is also contributing to the anticipated high growth rate of the single phase power quality equipment market.

Power Quality Equipment Market Evaluation– By End Use

The power quality equipment market is segmented by end use into residential, commercial, industrial & manufacturing, utilities, and transportation. Currently, the industrial & manufacturing sub-segment holds the largest share of the power quality equipment market. This significant market share is primarily driven by the extensive use of sophisticated and sensitive machinery in these sectors, where power disturbances can lead to substantial production losses, equipment damage, and safety hazards. The continuous operation and high power demands of industrial processes necessitate the deployment of comprehensive power quality solutions, including robust UPS systems, harmonic filters, voltage regulators, and surge protection devices, thereby establishing industrial & manufacturing as the leading end-use segment in terms of market share.

The transportation sub-segment is anticipated to exhibit the highest growth rate within the power quality equipment market. This rapid expansion is primarily fueled by the increasing electrification of transportation, including the growing adoption of electric vehicles (EVs), electric trains, and electric buses. The development of charging infrastructure for EVs and the power requirements of electric public transportation systems are creating a significant demand for power quality equipment to ensure stable and reliable power delivery. Furthermore, the integration of advanced electronic systems in modern vehicles and transportation infrastructure also necessitates power quality solutions to protect sensitive components and ensure operational efficiency, positioning the transportation sector for the highest growth in the power quality equipment market.

Power Quality Equipment Market – Regional Footprint

Referring to available industry reports, a broad overview of the regional landscape of the power quality equipment market reveals a global presence with varying degrees of market maturity and growth potential across different geographies. North America and Europe have historically been significant markets, characterized by established industrial infrastructure and stringent regulatory frameworks regarding power quality. The Asia Pacific region has emerged as a substantial market and a focal point for growth, driven by rapid industrialization and increasing investments in infrastructure. Latin America and the Middle East & Africa represent markets with considerable potential, influenced by growing industrialization and urbanization, albeit from a smaller base compared to the other regions. Each region's market dynamics are shaped by factors such as economic development, industrial growth, energy infrastructure investments, and the adoption of advanced technologies.

Among the various regions, Asia Pacific currently holds the largest share of the power quality equipment market. This dominance is primarily attributed to the region's rapid industrialization, particularly in countries like China and India, leading to substantial energy consumption and a heightened demand for reliable power. Furthermore, significant investments in manufacturing, infrastructure development, and the increasing adoption of advanced technologies across various sectors in the Asia Pacific region necessitate the deployment of extensive power quality solutions to ensure operational efficiency and prevent equipment failures. The sheer scale of industrial activities and the growing energy demand in this region solidify its position as the leading market in terms of overall share for power quality equipment.

The Asia Pacific region is also projected to exhibit the highest growth rate in the power quality equipment market over the forecast period. This rapid growth is fueled by a confluence of factors, including continued industrial expansion, increasing investments in smart grid infrastructure, and the growing adoption of renewable energy sources across the region. The rising awareness regarding the importance of power quality to ensure the reliable operation of sophisticated machinery and the stability of the electrical grid is further driving market expansion. Additionally, supportive government initiatives promoting industrial development and renewable energy integration are creating a strong demand for power quality equipment, positioning Asia Pacific as the region with the most significant growth potential in this market.

Power Quality Equipment Market – Key Players and Competitive Insights

ABB Ltd. (Switzerland), Schneider Electric SE (France), Siemens AG (Germany), Eaton Corporation plc (Ireland), General Electric Company (US), Toshiba Corporation (Japan), Emerson Electric Co. (United States), Legrand (France), Mitsubishi Electric Corporation (Japan), and Delta Electronics, Inc. (Taiwan). These companies provide a wide array of power quality solutions, addressing various needs across different industries and applications.

The power quality equipment market is characterized by a mix of well-established global corporations and specialized manufacturers. Competition is driven by factors such as technological innovation, product reliability, and the ability to provide customized solutions. Key players focus on expanding their product portfolios, enhancing energy efficiency, and integrating advanced technologies like IoT and AI to improve power quality management. Mergers and acquisitions also play a role in shaping the competitive landscape, as companies seek to strengthen their market position and expand their offerings.

Siemens AG is headquartered in Munich, Germany. The company offers a broad portfolio of power quality equipment, including harmonic filters, voltage regulation systems, and power factor correction solutions. Siemens AG serves a wide range of industries, including manufacturing, utilities, and data centers, with its power quality offerings.

Eaton Corporation plc is based in Dublin, Ireland. Eaton provides various power quality solutions, such as uninterruptible power supply (UPS) systems, surge protection devices, and voltage conditioners. The company caters to diverse markets, including commercial buildings, industrial facilities, and residential applications, with its power quality products.

List of Key Companies in Power Quality Equipment Market:

- ABB Ltd.

- Delta Electronics, Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- General Electric Company

- Legrand

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

Power Quality Equipment Market Industry Developments

- December 2024: ABB India announced that it had signed an agreement to acquire the power electronics business of Gamesa Electric in Spain, a subsidiary of Siemens Gamesa. This strategic acquisition aims to strengthen ABB’s position in the rapidly growing market for high-powered renewable power conversion technology.

- September 2024: Siemens has announced its agreement to acquire California-based Trayer Engineering Corporation (Trayer), a leader in the design and manufacturing of medium-voltage secondary distribution switchgear suitable for outdoor and below-ground applications.

Power Quality Equipment Market Segmentation

By Equipment Outlook (Revenue-USD Billion, 2020–2034)

- Power Quality Meters

- Surge Protection Devices

- Harmonic Filters

- Voltage Regulators

- Uninterruptable Power Supply (UPS)

- Others

By Phase Outlook (Revenue-USD Billion, 2020–2034)

- Single Phase

- Three Phase

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial & Manufacturing

- Utilities

- Transportation

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Power Quality Equipment Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.86 Billion |

|

Market Size Value in 2025 |

USD 35.87 Billion |

|

Revenue Forecast by 2034 |

USD 61.65 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The power quality equipment market has been segmented into detailed segments of equipment, phase, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth strategies in the power quality equipment market are increasingly focused on technological advancements, particularly in smart grid integration and energy efficiency. Companies are investing in research and development to offer solutions that can seamlessly integrate with renewable energy sources and provide real-time monitoring and predictive analytics for power quality issues. Market penetration is being enhanced through strategic partnerships with energy providers and industrial automation companies. Marketing efforts emphasize the cost savings and operational benefits of reliable power quality, targeting industries with sensitive equipment and high energy consumption.

FAQ's

The power quality equipment market size was valued at USD 33.86 billion in 2024 and is projected to grow to USD 61.65 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Key players in the power quality equipment market include ABB Ltd. (Switzerland), Schneider Electric SE (France), Siemens AG (Germany), Eaton Corporation plc (Ireland), General Electric Company (US), Toshiba Corporation (Japan), Emerson Electric Co. (United States), Legrand (France), Mitsubishi Electric Corporation (Japan), and Delta Electronics, Inc. (Taiwan).

The three phase segment accounted for the larger share of the market in 2024.

Following are some of the power quality equipment market trends: ? Increasing demand for uninterrupted power supply: Growing reliance on sensitive electronic equipment across industries necessitates solutions that prevent downtime and data loss. ? Rising integration of renewable energy sources: The intermittent nature of solar and wind power drives the need for power quality equipment to stabilize the grid. ? Growing adoption of smart grid technologies: Modernizing power infrastructure requires advanced power quality monitoring and control systems.

Power quality equipment refers to a range of devices and systems designed to improve and maintain the quality of electrical power delivered to various types of loads. The primary goal of this equipment is to mitigate or eliminate power disturbances that can negatively impact the performance, efficiency, lifespan, and safety of electrical and electronic devices. These disturbances can include voltage variations (sags, swells, outages), frequency deviations, harmonic distortions, transients, and noise. By addressing these issues, power quality equipment ensures a stable and clean power supply, which is increasingly crucial with the growing reliance on sensitive digital and electronic technologies across residential, commercial, industrial, utility, and transportation sectors.