Prefabricated Panels Market Size, Share, & Industry Analysis Report

: By Product (Modular, Panelized, and Others), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5777

- Base Year: 2022

- Historical Data: 2020-2023

Market Overview

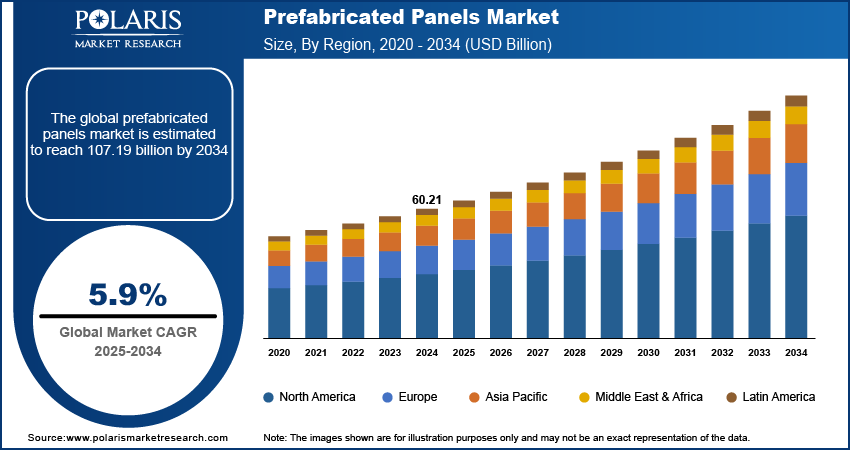

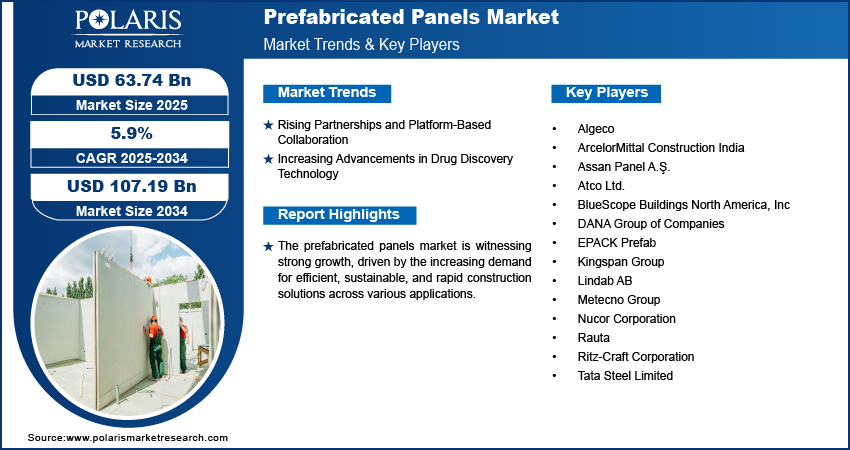

The global prefabricated panels market size was valued at USD 60.21 billion in 2024, growing at a CAGR of 5.9% during 2025–2034. The growth is driven by the need for fast and cost-efficient construction.

Prefabricated panels are pre-engineered building components designed for rapid on-site assembly, improving construction efficiency and consistency. The market for prefabricated panels is gaining momentum due to ongoing technological advancements and growing demand for cost-effective, fast, and sustainable construction methods. In December 2023, Godrej Construction built a 500 sq. ft. prefabricated office, "The Cocoon," at its Khalapur campus in 40 hours using 3D printing construction technology. Innovations in manufacturing techniques, such as automation, service robotics, and building information modeling, have advanced the precision and quality of prefabricated panels. These technologies allow the development of lightweight, thermally efficient, and structurally resilient panels, reducing construction time and material waste. As a result, the industry is witnessing a shift toward smarter, more integrated building systems that align with modern construction needs, particularly in residential and commercial applications.

Technological innovation, government support, and policy incentives would create growth opportunities during the forecast period. Many national and regional authorities are actively promoting the adoption of modular construction methods through subsidies, tax benefits, and regulatory easing to accelerate urban infrastructure development and improve housing availability. In May 2025, Newfoundland's Department of Industry, Energy, and Technology funded USD 90,000 to Rose's Concrete and Construction for modular housing production. The St. Anthony-based company will use the funds for property upgrades and equipment. These fundings are fostering domestic manufacturing capabilities and encouraging public-private partnerships in sustainable building initiatives. Prefabricated panels are emerging as a practical solution aligned with long-term policy goals with the increasing focus on green building standards and energy-efficient structures, making them a preferred choice in the evolving construction landscape.

Industry Dynamics

Rapid Urbanization and Population Growth

Rapid urbanization and population growth are driving new expansion opportunities as they create an urgent demand for scalable, efficient, and cost-effective construction solutions. According to a 2023 World Bank report, 50% of the world's population (i.e., 8.06 billion) resided in urban areas, with projections indicating urban citizens will double by 2050, reaching nearly 70% of the global population. There is a growing need for faster construction methods that do not compromise on quality or safety as cities expand and infrastructure pressure increases. Prefabricated panels offer a feasible answer by allowing quicker project timelines, reduced labor dependency, and improved site productivity. These benefits make prefabrication particularly well-suited to meet the housing and infrastructure needs in rapidly urbanizing regions, where conventional construction struggles to keep pace with population demands.

Sustainability and Green Building Initiatives

Sustainability and green building initiatives are driving the adoption of prefabricated panels in the construction industry. A February 2023 GBCI report noted that LEED certification is India's top green building standard, managed by GBCI. The government supports its adoption through tax incentives, such as 100% depreciation for solar panels and rainwater systems. Stakeholders are shifting toward construction methods that support lower carbon footprints and reduced resource consumption with increasing awareness of environmental impact and energy efficiency. Prefabricated panels, often manufactured with eco-friendly materials and optimized for thermal insulation, contribute greatly to these objectives. Additionally, the off-site manufacturing process minimizes on-site waste, lowers emissions, and improves quality control. Therefore, as green certification standards become more dominant in both public and private sector projects, the environmental advantages of prefabricated panels position them as an essential component of sustainable construction practices.

Segmental Insights

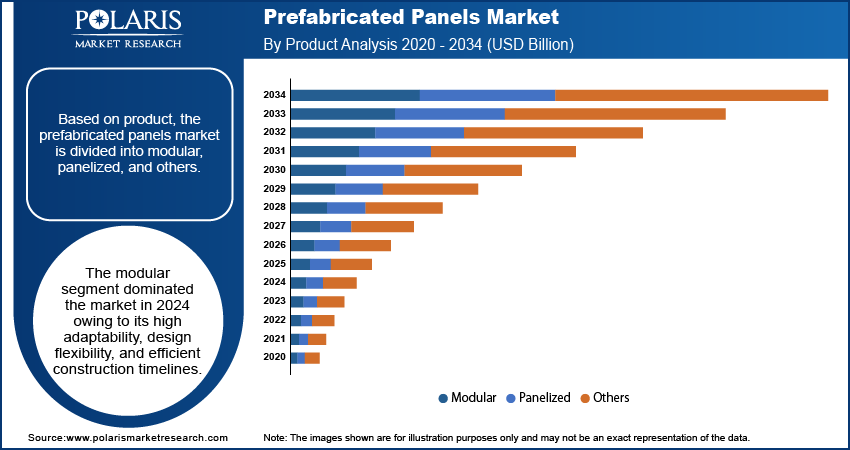

By Product Analysis

The segmentation, based on product, includes modular, panelized, and others. The modular segment dominated the market in 2024 owing to its high adaptability, design flexibility, and efficient construction timelines. Modular panels allow for complete sections of a structure to be fabricated off-site and then assembled on-site, reducing construction time and labor costs. This method assures consistent quality and minimizes disruptions in urban environments, making it particularly attractive for large-scale commercial and institutional projects. The rising preference for streamlined building processes and the ability to customize modules to suit specific architectural needs have positioned modular prefabrication as the leading product category within the sector.

By End Use Analysis

The segmentation, based on end use, includes residential and nonresidential. The nonresidential segment is expected to witness a faster growth during the forecast period due to increasing demand for commercial, healthcare, and educational infrastructure. Prefabricated panels offer a time-efficient and cost-effective solution for such projects, where rapid deployment and operational continuity are critical. The flexibility of prefabricated systems aligns well with evolving nonresidential requirements, such as the need for energy efficiency, modular expansion, and compliance with green building standards. Therefore, as industries seek to reduce downtime and achieve quicker returns on investment, the adoption of prefabricated panels in nonresidential applications is poised to accelerate during the forecast period.

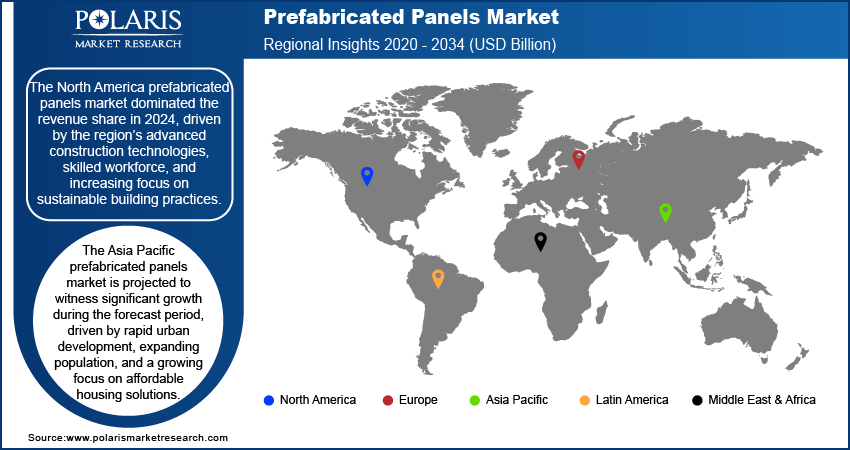

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America prefabricated panels market dominated the revenue share in 2024, driven by the region’s advanced construction technologies, skilled workforce, and increasing focus on sustainable building practices. Favorable building codes and rising investments in smart construction techniques have reinforced the region’s leadership in the prefabricated construction space. According to a June 2024 report, the US GSA allotted USD 80 million investments from the Inflation Reduction Act toward smart building technologies, marking a significant move to modernize infrastructure through climate-focused innovation. Moreover, the well-established infrastructure and strong presence of major market players have supported widespread adoption across commercial, industrial, and institutional sectors.

The US prefabricated panels market held the largest share due to its advanced construction ecosystem. The market is supported by increasing investments in commercial infrastructure and a growing focus on sustainable building practices. Additionally, the demand for faster project delivery and labor efficiency has further fueled the adoption of prefabricated construction methods across the country.

The Asia Pacific prefabricated panels market is projected to witness significant growth during the forecast period, driven by rapid urban development, expanding population, and a growing focus on affordable housing solutions. The need for mass housing and improved infrastructure in emerging economies is driving demand for time and cost-efficient construction methods. According to a July 2024 report by India's Ministry of Housing & Urban Affairs, 100 cities completed 7,188 projects (90% of the total) under the Mission, with investments worth ~USD 17.3 billion. Additionally, increasing government support for modern building technologies and a rising awareness of environmental sustainability are fostering the adoption of prefabricated panels across the region.

The China prefabricated panels market is witnessing growth, driven by infrastructure expansion and government-backed initiatives. The focus on improving housing supply, especially in densely populated urban areas, has accelerated the shift toward prefabricated building systems. Moreover, rising awareness of sustainable construction and improvements in manufacturing capabilities are contributing to the sector’s growth.

The Europe prefabricated panels market is projected to witness substantial growth during the forecast period, owing to the imposition of strict environmental regulations, strong sustainability goals, and a growing shift toward energy-efficient construction. The region's developed construction industry is actively adopting prefabrication techniques to reduce material waste and carbon emissions. Additionally, the focus on modernizing aging infrastructure and adopting circular construction practices is reinforcing the demand for prefabricated solutions across various end-use sectors, such as commercial, institutional, and industrial.

The Germany prefabricated panels market is witnessing growth due to its focus on precision engineering, energy-efficient building solutions, and environmentally responsible construction practices. The country’s developed construction sector is actively adopting prefabricated methods to meet strict sustainability standards and reduce construction time.

Key Players and Competitive Analysis

The prefabricated panels sector is experiencing growth, driven by sustainable value chains and technological advancements in modular construction. Major players such as Kingspan Group, Tata Steel, and Nucor Corporation are making strategic investments to expand production capacity and improve energy-efficient designs. Industry trends highlight rising demand in both developed markets and emerging markets, fueled by urbanization and green building policies. Growth projections suggest strong potential in residential and commercial projects, with latent demand for rapid, low-waste construction solutions.

Recent innovations highlight a shift toward future development strategies combining performance with sustainability. However, supply chain disruptions in raw materials face challenges. Competitive intelligence reveals consolidation through joint ventures and a focus on regional footprints to serve localized needs.

A few key players are Algeco; ArcelorMittal Construction India; Assan Panel A.Ş.; Atco Ltd.; BlueScope Buildings North America, Inc; DANA Group of Companies; EPACK Prefab; Kingspan Group; Lindab AB; Metecno Group; Nucor Corporation; Rauta; Ritz-Craft Corporation; and Tata Steel Limited.

Key Players

- Algeco

- ArcelorMittal Construction India

- Assan Panel A.Ş.

- Atco Ltd.

- BlueScope Buildings North America, Inc

- DANA Group of Companies

- EPACK Prefab

- Kingspan Group

- Lindab AB

- Metecno Group

- Nucor Corporation

- Rauta

- Ritz-Craft Corporation

- Tata Steel Limited

Industry Developments

September 2024: Shape Architecture partnered with B. PUBLIC Prefab to launch a series of sustainable, high-performance home designs. The collaboration will release monthly Passive House-certified plans in 2024, utilizing prefabricated panels for energy-efficient, low-carbon construction.

July 2023: UnitiWall Corporation launched its prefabricated wall panel system for new construction and retrofits. The steel-framed design integrates insulation, seals, and cladding options, offering a customizable, ready-to-install solution with built-in thermal and moisture management.

Prefabricated Panels Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Modular

- Panelized

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Non-residential

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Prefabricated Panels Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 60.21 billion |

|

Market Size in 2025 |

USD 63.74 billion |

|

Revenue Forecast by 2034 |

USD 107.19 billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 60.21 billion in 2024 and is projected to grow to USD 107.19 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Algeco; ArcelorMittal Construction India; Assan Panel A.?.; Atco Ltd.; BlueScope Buildings North America, Inc; DANA Group of Companies; EPACK Prefab; Kingspan Group; Lindab AB; Metecno Group; Nucor Corporation; Rauta; Ritz-Craft Corporation; and Tata Steel Limited.

The modular segment dominated the market in 2024.

The nonresidential segment is expected to witness a faster growth during the forecast period.