Service Robotics Market Size, Share, Trends, Industry Analysis Report

: By Type (Professional Service Robots and Personal Service Robots), End Use, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1594

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

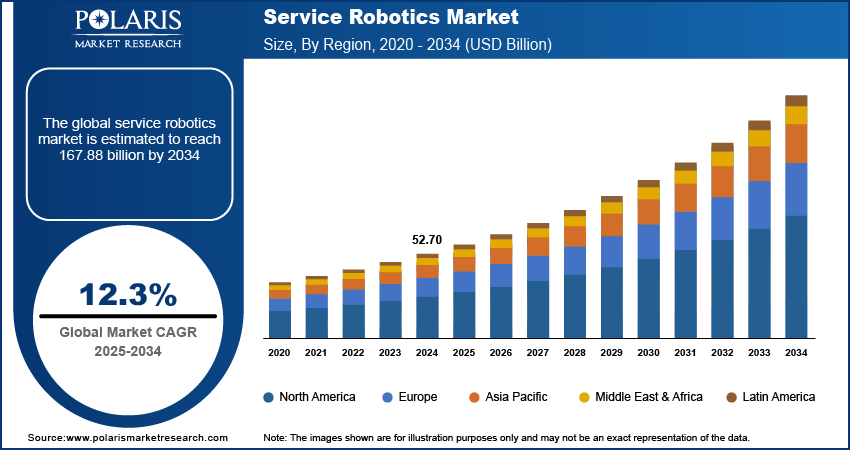

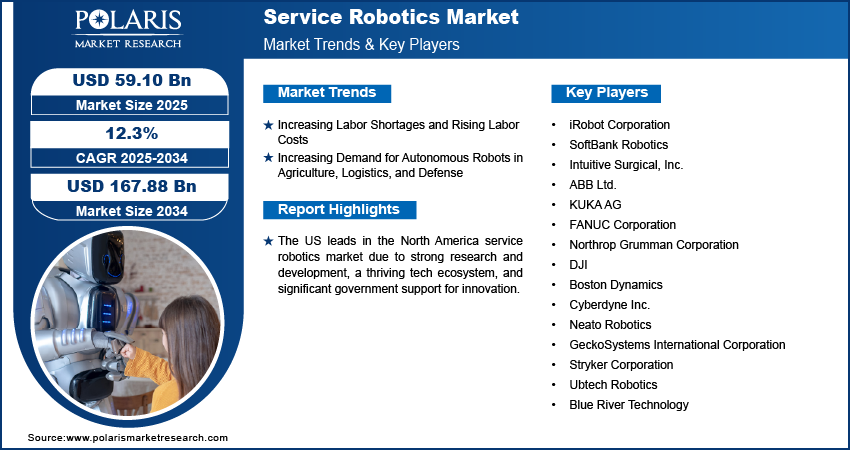

The service robotics market size was valued at USD 52.70 billion in 2024, exhibiting a CAGR of 12.3% during 2025–2034. It is fueled by growing demand for automation, AI, and sensor technologies, a labor shortage, increased operational efficiency demands, broader applications in industries such as healthcare, agriculture, and logistics, and greater connectivity with IoT and 5G.

Key Insights

- The professional service robots market led the industry in 2024 because of an increase in demand for automation and labor efficiency in agriculture and logistics.

- Mobile platforms had the largest share of revenue, driven by their widespread use in warehousing, manufacturing, and smart infrastructure.

- Market domination originated from North America through aggressive R&D, substantial technology spending, and early adoption in key sectors such as defense and healthcare.

- The Asia Pacific is the fastest-growing region, driven by industrialization, a surging e-commerce industry, and increasing demand in China and Japan.

Industry Dynamics

- Labor shortages and increasing labor costs are compelling businesses in various industries, such as retail, healthcare, and hospitality to use service robots for repetitive tasks.

- Sectors such as defense, logistics, and agriculture are increasingly utilizing autonomous robots for crop surveillance, warehouse automation, and security purposes.

- The COVID-19 pandemic accelerated the adoption of service robots in healthcare and sanitation, driving demand for contactless and self-service-based solutions.

- The combination of 5G and IoT technologies is making device-to-robot communication more efficient, thus enhancing real-time operating coordination and efficiency.

Market Statistics

2024 Market Size: USD 52.70 billion

2034 Projected Market Size: USD 167.88 billion

CAGR (2025–2034): 12.3%

North America: Largest Market Share

AI Impact

- AI enables service robots to navigate complex environments and perform tasks independently.

- AI-driven robots in healthcare assist with surgeries, patient monitoring, and elderly care.

- AI optimizes warehouse efficiency by optimizing paths, balancing loads, and minimizing errors.

- Machine learning algorithms enhance robot flexibility and learning from experience.

To Understand More About this Research: Request a Free Sample Report

The global service robotics market involves robots designed to assist humans in performing tasks across industries such as healthcare, agriculture, logistics, domestic applications, and others. These robots can be semi-autonomous or autonomous. They are developed by using advanced technologies such as artificial intelligence (AI), machine learning (ML), and computer vision. Service robots are categorized into professional and personal service robots, catering to diverse applications such as cleaning, surgery, warehouse automation, and elderly care.

The growing demand for automation, coupled with advancements in AI and sensor technologies, has driven the adoption of service robots thereby, fueling the market expansion. Industries are increasingly deploying these robots to enhance efficiency, reduce labor costs, and ensure precision in operations.

The COVID-19 pandemic accelerated the adoption of service robots, especially in healthcare and cleaning applications, as organizations prioritized hygiene and contactless operations. Moreover, the service robotics market growth is fueled by the integration of IoT and 5G connectivity, enabling seamless communication between robots and other smart devices.

Market Dynamics

Increasing Labor Shortages and Rising Labor Costs

Many sectors such as healthcare, hospitality, and retail are facing difficulties in employing staff owing to the aging workforce across the world and the challenges posed by the COVID-19 pandemic. Also, labor costs have been increasing due to higher wages and stricter labor regulations. This has prompted businesses to adopt robotic solutions to reduce reliance on human labor, increase operational efficiency, and lower long-term expenses by automating routine and repetitive tasks. Service robots, designed to perform tasks such as cleaning, delivery, and customer service, can provide these benefits, offering scalable solutions that operates continuously without the constraints of human labor. In October 2023, Amazon launched two innovative approaches to integrating robotic systems that enhance employee productivity and optimize customer delivery services. Therefore, the service robotics market demand is significantly driven by the escalating labor shortages and rising labor costs across various industries.

Increasing Demand for Autonomous Robots in Agriculture, Logistics, and Defense

Robots such as agricultural robots are increasingly being used for tasks such as crop monitoring, planting, and harvesting, which helps optimize productivity and reduce dependency on seasonal labor in the agriculture sector. In logistics, autonomous mobile robots (AMRs) are revolutionizing warehouses and supply chains by improving efficiency, reducing errors, and minimizing operational downtime. In defense, AI robot dog is being integrated into operations for surveillance, bomb disposal, and reconnaissance, reducing the risk to human personnel. The rise of autonomous systems, empowered by advancements in AI and ML, is enabling these sectors to deploy robots that can function autonomously, leading to improved safety, cost savings, and efficiency. Thus, the growing trend of automation in high-growth sectors like agriculture, logistics, and defense is anticipated to drive the demand for service robots over the forecast period.

Segment Insights

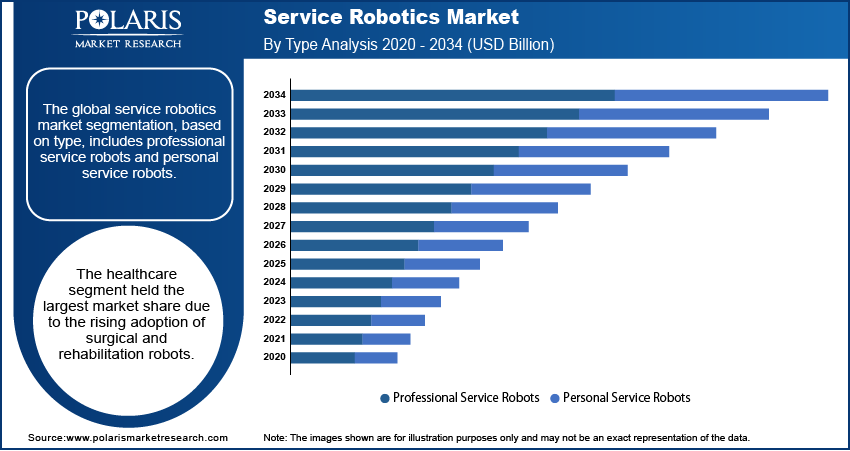

Market Assessment by Type Outlook

The global service robotics market segmentation, based on type, includes professional service robots and personal service robots. In 2024, the professional service robots segment held a larger market share, driven by their deployment in industries such as logistics and agriculture. Moreover, in warehouses, use of autonomous robot’s streamlines operations, improving efficiency and reducing costs, which contributes to the market growth. Furthermore, in agriculture, robotic systems for precision farming and crop monitoring have gained traction, addressing labor shortages and increasing productivity which is significantly driving demand for the professional service robots.

Market Evaluation by End Use Outlook

The global service robotics market, based on end use, is segmented into defense, field, medical, transportation and logistics, mobile platforms, underwater systems, construction, and others. The mobile platforms segment held the largest share of the service robotics market revenue due to its widespread adoption across industries for automation, material handling, and autonomous navigation. These robots are extensively used in warehousing, manufacturing, healthcare, and smart infrastructure to enhance operational efficiency and reduce labor costs. The rise of e-commerce and Industry 4.0 has further driven demand for autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) in logistics and supply chain management. Additionally, advancements in AI, IoT, and sensor technology have improved the capabilities of mobile platforms, making them indispensable in industrial automation and smart mobility solutions.

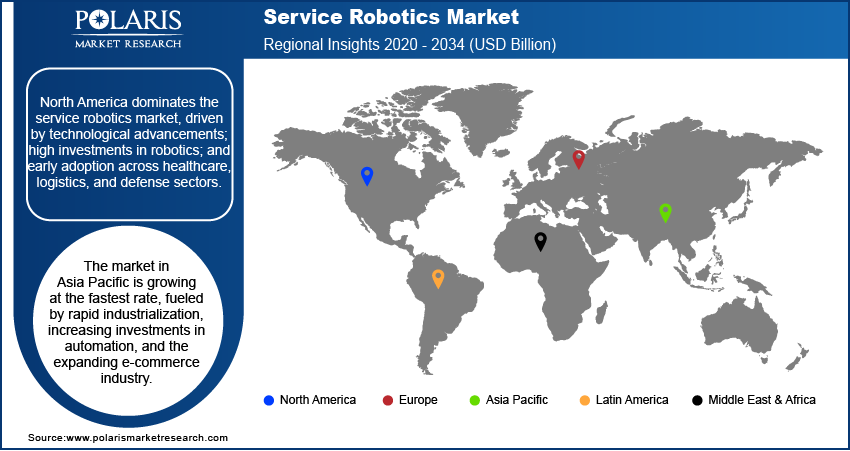

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the service robotics market revenue share, driven by technological advancements; high investments in robotics; and early adoption across healthcare, logistics, and defense sectors. The US leads the regional market due to strong research and development, a thriving tech ecosystem, and significant government support for innovation.

Asia Pacific is the fastest-growing region, fueled by rapid industrialization, increasing investments in automation, and the expanding e-commerce industry. The Southeast Asian internet economy is projected to experience significant growth, rising from USD 194 billion in 2023 to an estimated USD 330 billion by 2025. Indonesia is anticipated to maintain its leadership within the region, with a robust internet economy expected to surpass USD 82 billion by 2023. Countries such as China and Japan are leading in robotics manufacturing and adoption. China’s dominance is attributed to its robust industrial base, growing healthcare needs, and investments in AI-powered robots. Japan’s aging population has led to a high demand for assistive robots, particularly in elderly care.

Key Players and Competitive Analysis Report

The service robotics market is dominated by global leaders such as iRobot Corporation, SoftBank Robotics, and Intuitive Surgical, Inc., which leverage advanced technologies and strong distribution networks. Companies such as ABB Ltd. and KUKA AG focus on industrial and professional service robots, offering scalable solutions for logistics and manufacturing.

The market players adopt strategies such as mergers and acquisitions, and collaborations to strengthen their market presence. SoftBank Robotics partnered with e-commerce firms to integrate robots into delivery services. Meanwhile, Boston Dynamics is known for its advanced research in humanoid and quadruped robots, catering to defense and logistics.

Regional players, particularly in Asia Pacific, focus on cost-effective solutions to capture emerging markets. DJI dominates in drone manufacturing, while companies such as Cyberdyne Inc. excel in healthcare robotics. The competitive landscape is characterized by continuous innovation and an increasing focus on sustainable and AI-driven robotic solutions.

iRobot Corporation; SoftBank Robotics; Intuitive Surgical, Inc.; ABB Ltd.; KUKA AG; FANUC Corporation; Northrop Grumman Corporation; DJI; Boston Dynamics; Cyberdyne Inc.; Neato Robotics; GeckoSystems International Corporation; Stryker Corporation; Ubtech Robotics; and Blue River Technology are a few key major players in the service robotics market.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers product portfolio of switchgears under distribution solution sub segment. The Motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation offers caters various energy and process industries and also offers measurement analytics, machine automation and robotics.

Northrop Grumman offers products to various industries, including aerospace and defense. Northrop Grumman is known for its innovative technologies and products that are designed to meet the needs of customers in the defense, intelligence, and space industries. One of the key areas of focus for Northrop Grumman is unmanned systems, including drones and autonomous vehicles. The company has developed a range of unmanned systems that are used for a variety of applications, from surveillance and reconnaissance to search and rescue operations. These systems are designed to be highly reliable and capable of operating in challenging environments. Another area of expertise for Northrop Grumman is space technology.

List of Key Companies:

- iRobot Corporation

- SoftBank Robotics

- Intuitive Surgical, Inc.

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Northrop Grumman Corporation

- DJI

- Boston Dynamics

- Cyberdyne Inc.

- Neato Robotics

- GeckoSystems International Corporation

- Stryker Corporation

- Ubtech Robotics

- Blue River Technology

Service Robotics Industry Developments

In June 2024, ABB launched next-generation Robotics control platform OmniCore. The platform is faster, more precise, and more sustainable to empower, enhance, and futureproof businesses. OmniCore’s motion performance delivers robot path accuracy at a level of less than 0.6mm. This opens new automation opportunities in precision areas such as arc welding, mobile phone display assembly, gluing, and laser cutting.

In June 2024, Brick Hospitality, a major San Diego-based hospitality management company, integrated guest service robots into the daily operations of all of its hotels to enhance productivity and customer service and provide a layer of security.

In October 2023, Pudu Robotics, a global player in commercial service robotics, announced a strategic partnership with SoftBank Robotics to elevate the commercial service robotics industry, combining SoftBank Robotics’s expertise in the Japanese market with Pudu’s product and technology advantages in delivery robots and cleaning robot.

In May 2022, Amazon, a multinational technology company engaged in e-commerce, cloud computing, online advertising, digital streaming, and AI, opened a new Consumer Robotics Software Development Center in Bengaluru, India.

Service Robotics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Professional Service Robots

- Personal Service Robots

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Defense

- Field

- Medical

- Transportation and Logistics

- Mobile platforms

- Underwater systems

- Construction

- Others

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 52.70 Billion |

|

Market Size Value in 2025 |

USD 59.10 Billion |

|

Revenue Forecast by 2034 |

USD 167.88 Billion |

|

CAGR |

12.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global service robotics market size was valued at USD 52.70 billion in 2024 and is projected to grow to USD 167.88 billion by 2034.

The global market is projected to register a CAGR of 12.3% during the forecast period.

In 2024, North America dominated the service robotics market revenue share, driven by technological advancements; high investments in robotics; and early adoption across healthcare, logistics, and defense sectors.

A few key players in the market are iRobot Corporation; SoftBank Robotics; Intuitive Surgical, Inc.; ABB Ltd.; KUKA AG; FANUC Corporation; Northrop Grumman Corporation; DJI; Boston Dynamics; Cyberdyne Inc.; Neato Robotics; GeckoSystems International Corporation; Stryker Corporation; Ubtech Robotics; and Blue River Technology

In 2024, the mobile platform segment accounted for the largest market share due to its widespread adoption across industries for automation, material handling, and autonomous navigation.

In 2024, the professional service robots segment held the dominant market share, driven by their deployment in industries such as logistics and agriculture.