Delivery Robots Market Share, Size, Trends, Industry Analysis Report

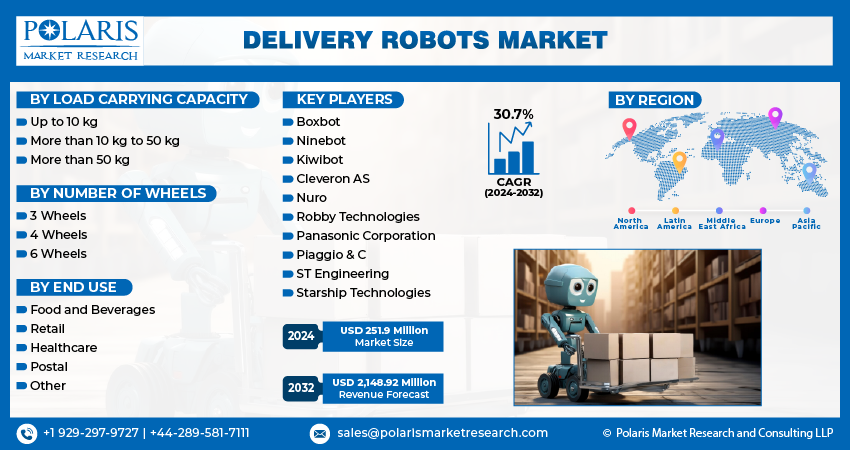

By Load Carrying Capacity (Up to 10 kg, More than 10 kg to 50 kg, and More than 50 kg); By Number of Wheels; By End Use; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3364

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

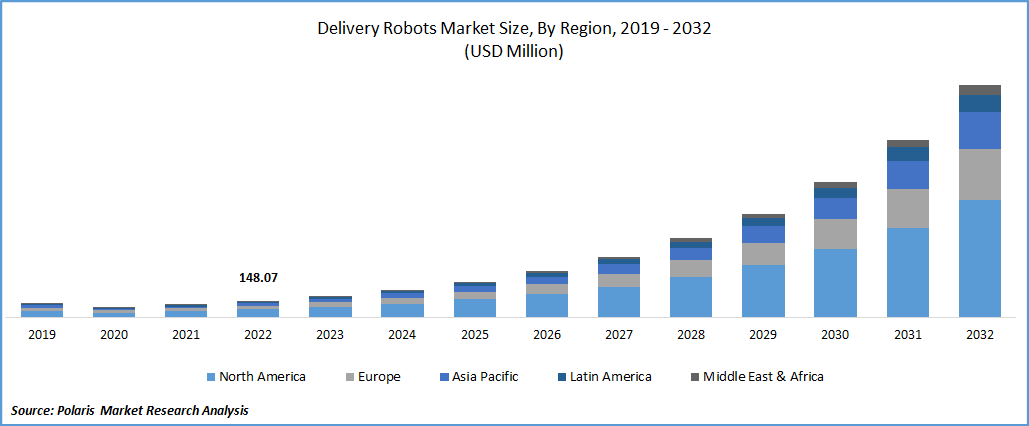

The global delivery robots market was valued at USD 193.08 million in 2023 and is expected to grow at a CAGR of 30.7% during the forecast period. Increasing venture investments among several businesses is estimated to drive the growth of the global market. To maintain their position in the competitive landscape, several companies are investing billions of dollars in the market. For example, in March 2022, Nvidia invested nearly $10 million to help Serve Robotics, an Uber spinoff, extend its sidewalk delivery robot service outside Los Angeles and San Francisco. Apart from this, various other firms are also participating in the market. This is further helping the market to grow at a rapid pace globally.

To Understand More About this Research: Request a Free Sample Report

Delivery robots are becoming an increasingly popular trend in the delivery industry due to their many benefits. With the advancement of technology, delivery robots have become more sophisticated, efficient, and affordable, making them a viable alternative to traditional delivery methods. With the help of advanced sensors and mapping technology, delivery robots can navigate complex routes and avoid obstacles, ensuring accurate and timely deliveries. Robots help reduce the risk of accidents by operating in designated lanes or pedestrian-only areas, reducing the need for human drivers. It provides real-time tracking and delivery updates, enhancing the overall customer experience.

COVID has generated structural changes leading to e-commerce, healthcare, and the food delivery industry were witnessed substantial growth, which has produced revenue for delivery robots. The pandemic has also shifted consumer behavior, with more people turning to online shopping and home delivery services. This increased the demand for faster and more efficient delivery options, further enhancing the market player’s contribution. For example, in August 2020, Bengaluru-based Invento Robotics launched a medicine and food delivery robot. Also, in June 2020, hundreds of Pudu Robotics robots Pudubot offered delivery services in hospitals worldwide during the pandemic. As a result, many companies contributed to the market during COVID-19 by providing contactless delivery options.

Industry Dynamics

Growth Drivers

Ever expanding e-commerce industry is augmenting the delivery robot market as online retailers are constantly looking for ways to improve their supply chain and delivery operations. Delivery robots can help automate the delivery process, reduce costs, and improve the speed and efficiency of deliveries. For instance, nearly 2.3 billion people were estimated to buy goods and services online in 2022. Rising internet usage and expansion in the e-commerce sector have heightened the demand for products to be purchased online. This, in turn, improves global revenue and is poised to increase in upcoming years.

With the growth of e-commerce, more and more people are shopping for groceries online, creating a demand for faster and more efficient delivery options. This factor is increasingly escalating the growth of global revenue. Delivery robots are being developed by online grocers and retailers like Flipkart, Big Basket, and Amazon to carry out last-mile deliveries of goods. For example, in January 2019, Amazon launched a new self-driving delivery device called Scout. It’s the latest improvement in Amazon’s rising logistics business. These innovations and competition in the global market are leading to the developing of more advanced and efficient delivery robots.

Report Segmentation

The market is primarily segmented based on load carrying capacity, number of wheels, end use, and region.

|

By Load Carrying Capacity |

By Number Of Wheels |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Load carrying capacity up to 10kg segment is expected to grow at fastest CAGR in projected period

The load-carrying capacity up to 10kg segment is expected to grow at the fastest CAGR during the forecast period as it covers a wide range of applications and use cases relevant to the current market demand. Many e-commerce retailers and logistics companies are focused on delivering smaller packages and parcels that typically weigh under 10kg. This segment offers a practical and versatile solution for businesses looking to automate their delivery operations and provide a better customer experience. Moreover, delivery robots that can handle loads up to 10kg are suitable for various delivery applications, such as food delivery, grocery delivery, and package delivery. As a result, they are a versatile solution that can be used in various industries and scenarios.

4 Wheels segment is dominated the global market in 2022

4 Wheels segment is dominated the global market in 2022 because the robots are suitable for a wide range of applications, including last-mile delivery, food delivery, and others. They are also often more affordable than other delivery robots, making them an attractive option for businesses looking to automate their delivery operations. For example, at Nanyang Technological University, a four-wheeled robot named FoodBot distributes lunch and dinner orders. Apart from this, many other businesses also contribute to the market to stay competitive. Four-wheeled delivery robots are more stable and carry heavier loads than two- or three-wheeled robots. As a result, this segment is leading the global market.

Food and beverages held largest share in the global market in 2022

Food and beverages held the largest market share in 2022 because it is an industry that requires fast and reliable delivery of goods to customers. Food and beverage delivery is a rapidly growing segment of the delivery industry, with more and more people ordering food and groceries online. Digital ordering is rising at around 3x higher rate than on-site ordering. More than 112 million Americans reported they’ve used a food delivery service. Robots can help automate the food and beverage delivery process, reducing the need for human labor and improving the speed and efficiency of deliveries.

To leverage the benefits of this industry, large numbers of firms are investing in delivery robots in the food and beverage sector. For example, in February 2023, Dubai launched food delivery robots. The food delivery robots, or Talbots, have been introduced by the Roads and Transport Authority, the Dubai Integrated Economic Zones Authority, and the online meal-ordering business Talabat. Similarly, in February 2023, robot food delivery was launched at the University of Notre Dame. Likewise, many other companies are also innovating, further escalating the market’s development.

North America is accounting the largest share in the global market during forecast period

North America is expected to hold largest market share during the projected period. This is primarily due to the significant presence of delivery robot manufacturing companies, increasing technological advancement, and many other factors. In the US, curbside collection, campus meal delivery, and food and grocery delivery are done by sidewalk delivery robots powered by artificial intelligence. For example, in December 2022, Uber Eats partnered with Cartken to distribute meals through robots. In October 2022, Starship Technologies partnered with Grubhub to bring robot delivery services to college campuses across the United States. As a result, various product launches and innovations in the region for multiple purposes fuel the market's growth in North America.

During the forecast period, Asia Pacific is the fastest-growing region in the global market. This is due to the region's logistics and supply chain management advancements. The region has made significant logistics and supply chain management strides, making it easier and more cost-effective to deploy delivery robots for last-mile delivery. For example, according to the China Federation of Logistics and Purchasing, social logistics increased 9.2 percent year-on-year in 2021 to nearly $52.6 trillion. With advancements in logistics and supply chain management, tracking and monitoring the delivery process from start to finish is easier. As a result, this factor is driving the growth of the region's market.

Competitive Insight

The global delivery robots market involves Boxbot, Ninebot, Kiwibot, Cleveron AS, Nuro, Robby Technologies, Panasonic Corporation, Piaggio & C, ST Engineering, and Starship Technologies

Recent Developments

- In October 2022, Delivery robots were established by a startup based in Kochi, Rosversity, to pick up packages from shops and other pickup sites and then deliver them to clients' doorsteps.

- In December 2022, Kiwibot launched 25 automated delivery robots at Loyola Marymount University. The Kiwibots created virtual maps of campus using RTK-GPS, and they established multiple routes to a drop-off point, modifying the route if there were any delays or obstacles along the way.

Delivery Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 251.9 million |

|

Revenue forecast in 2032 |

USD 2,148.92 million |

|

CAGR |

30.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Load Carrying Capacity, By Number of Wheels, By End use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Boxbot, Ninebot, Kiwibot, Cleveron AS, Nuro, Inc., Robby Technologies, Panasonic Corporation, Piaggio & C.SpA, ST Engineering, and Starship Technologies. |

FAQ's

key companies in delivery robots market are Boxbot, Ninebot, Kiwibot, Cleveron AS, Nuro, Robby Technologies, Panasonic Corporation, Piaggio & C, ST Engineering.

The global delivery robots market expected to grow at a CAGR of 30.7% during the forecast period.

The delivery robots market report covering key segments are load carrying capacity, number of wheels, end use, and region.

key driving factors in delivery robots market are Reduction in Delivery Costs in Last-mile Deliveries.

Delivery Robots Market Size Worth $2,148.92 Million By 2032.