Probiotic Cosmetic Products Market Share, Size, Trends, Industry Analysis Report

By Product (Skin Care, Hair Care), By Distribution Channel (Hypermarket & Supermarket, Pharmacy & Drug Store, E-commerce, Others), By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2043

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

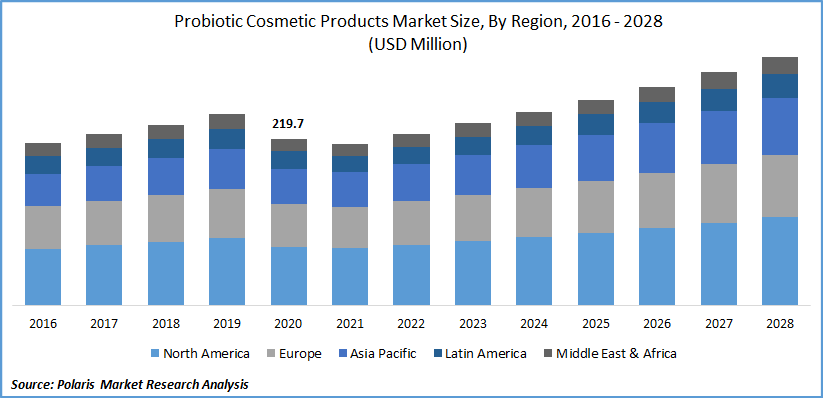

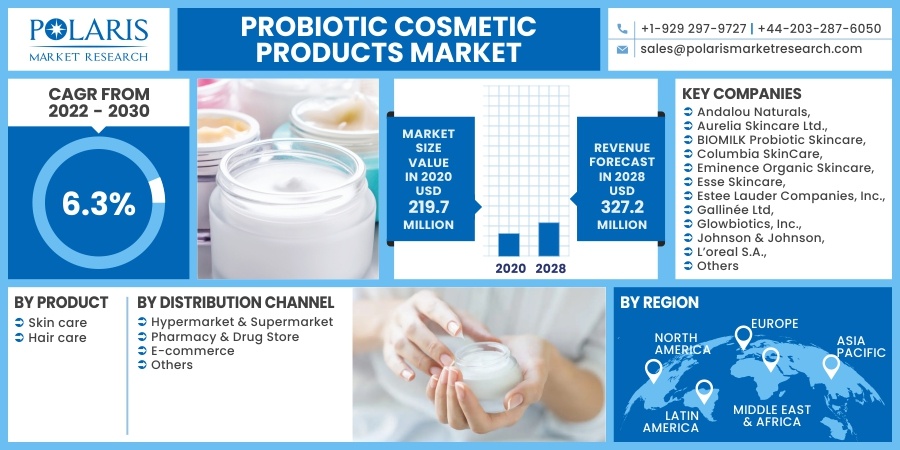

The global probiotic cosmetic products market was valued at USD 219.7 million in 2020 and is expected to grow at a CAGR of 6.3% during forecast period. The numerous benefits of probiotic cosmetic products, such as preventing acne, dryness, and inflammation, eczema, etc., are coupled with the rising disposable income, creating a vigorous demand for these cosmetics products market. In addition, growing responsiveness regarding the hazardous consequence of chemicals of using synthetic and chemical cosmetic products is accelerating industry demand for probiotic cosmetic products. As well, accessibility to a diverse line of cosmetics products with an increasing population fuels the international market growth in the upcoming years.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The probiotic cosmetic product refers to the beauty products that assist in enhancing the quality of the skin. It helps in feeding the healthy bacteria present in the skin for balancing skin pH and protecting it from damages. Several cosmetic products are in demand as they help in controlling natural imbues response of the skin and facilitate improved skin elasticity and protection. Such factors favor cosmetics product uptake.

Industry Dynamics

Growth Drivers

The industry has perceived a noteworthy development in some past years, reinforced by the fact that manufacturers are presenting numerous varieties of probiotic cosmetic products with innovations that gain a strong fan base among end-users. For instance, The Simple Skin first probiotic-based skincare products by AIME skincare supplement and wellness was introduced into the market in January 2020. The company’s first probiotic skincare range includes The Simple Cream, The Simple Cleanser, and The Simple Serum for maintaining a skincare routine for every kind of skin.

As well as existing players are opting for strategic policies framework or acquisitions for increasing sales and creating goodwill in the global cosmetics industry. For instance, L’Oreal declared in January 2017 the company’s acquisition with three corporations- AcneFree, CeraVe, and Ambi, which is from Valeant Pharmaceuticals International. This achievement brought the accompanying division of the skincare line of L’Oréal, which creates gradually created a lucrative growth of the company.

Similarly, In October 2017, Ganaden was acquired by the Kerry Group- a food and nutrition giant to extend the company’s product portfolio. The aim of the acquisition is to cater to an exponent consumer base by satisfying their needs and wants. Thus, these strategic acquisitions and product introduction boost the industry for probiotic cosmetics in the foreseen years.

The research report offers a quantitative and qualitative analysis of the Probiotic Cosmetic Products Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Know more about this report: request for sample pages

Report Segment

The market is primarily segmented on the basis of product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based on the product segment of probiotic cosmetic products market, skincare accounted for the largest share in terms of revenue in 2020. Probiotics are referred as a relief component as it guards against irritation or inflammation and averting skin problems such as redness, severe ache, dry patches, etc., leading to segment growth. As well as, the effectiveness of the probiotic cosmetics facilitates the rising responsiveness of clinically proven products suggested by the professionals due to the least chances of any side-effects drives the industry demand for probiotic cosmetic products.

Haircare segment is likely to generate a lucrative growth rate over the assessment period. In the modernized world, the problems regarding hair, such as the rough scalp, hair fall, and degradation of hair quality, kept rising. Therefore, it needs a proper hair care routine and products. Accordingly, consumers are opting for goods like hair shampoos, conditioners, serums, etc., which embrace probiotic hair care products for treating the problems. Thus, it may accelerate segment growth of these cosmetic products across the globe.

Furthermore, product launches act as a significant factor contributing to the industry demand. For instance, Tela Beauty Organics by Philip Pelusi unveiled its new probiotic scalp scrub in June 2019. This product is another supplement in the company’s life force probiotic haircare collection. This new product presents as a treatment of pre-shampoo and offers a probiotic blending system.

By Distribution Channel

In the distribution channel segment, the hypermarket & supermarket segment accounted for the largest revenue share. Factors such as rapid urbanization, increasing spending on self-care goods & services, and the growing trend of adopting organic and premium microbial cosmetic products offered by the supermarkets/hypermarkets will stimulate the segment growth.

Growing number of supermarkets and hypermarkets in urban areas offering more shelf space to the probiotic cosmetic product will further lead the segment growth. In addition, several chief retailers, like Ultra Beauty and Sephora, have been involved in maximizing the customer experience for accessing offline services.

E-commerce is projected to generate the highest CAGR in the coming years. The growing penetration of smart gadgets along with online platforms is directly associated with industry development. In addition, low-operational cost, numerous varieties of cosmetic products, widespread business scale offers eliminate the limitation of foreign trading are the prime factors that attribute to the segment expansion. Accordingly, some prominent online retailers for probiotic cosmetic products market are Nykaa, Sephora.com, skinstore.com, and Amazon.com, which leads the segment growth in the future.

Geographic Overview

Geographically, North America is the spotted with the leading position in 2020. The increasing occurrence of numerous skin-related problems and diseases leads the market growth across the region for these cosmetics products. Prospective market players involved in product innovations for securing a foothold through maximum consumer satisfaction also favoring the region’s growth. For instance, Futurist Hydra Rescue Moisturizing Makeup SPF45 was launched by Estee Lauder in April 2020. The product is imbued with Ion Charged Water, along with chia-seed extract and probiotic technology, which facilitates natural glow and skin hydration.

Furthermore, Asia Pacific is witnessing to record the fastest CAGR in all over the world over the foreseen period. The region's market growth is driven by the fact that intensifying population across the APAC is more tending towards the healthy and better lifestyle reinforced by the increasing trend of adopting eco-friendly products.

Competitive Landscape

Some of the major players operating the global probiotic cosmetic products market include Andalou Naturals, Aurelia Skincare Ltd., BIOMILK Probiotic Skincare, Columbia SkinCare, Eminence Organic Skincare, Esse Skincare, Estee Lauder Companies, Inc., Gallinée Ltd, Glowbiotics, Inc., Johnson & Johnson, L’oreal S.A., LaFlore Probiotic Skincare, Marie, Veronique., The Procter & Gamble Co., Tula Life, Inc., Unilever.

Probiotic Cosmetic Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 219.7 million |

|

Revenue forecast in 2028 |

USD 327.2 million |

|

CAGR |

6.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Andalou Naturals, Aurelia Skincare Ltd., BIOMILK Probiotic Skincare, Columbia SkinCare, Eminence Organic Skincare, Esse Skincare, Estee Lauder Companies, Inc., Gallinée Ltd, Glowbiotics, Inc., Johnson & Johnson, L’oreal S.A., LaFlore Probiotic Skincare, Marie, Veronique., The Procter & Gamble Co., Tula Life, Inc., Unilever |

Uncover the dynamics of the Probiotic Cosmetic Products Market sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.