Probiotics Ingredients Market Share, Size, Trends, Industry Analysis Report

By Ingredients (Bacteria, Yeast, Spore Formers); By Application (Probiotic Food & Beverages, Probiotic Dietary Supplements, Animal Feed Probiotics, Others); By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM1592

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The probiotics ingredients market was valued at USD 2,892.93 million in 2022 and is expected to grow at a CAGR of 7.9% during the forecast period.Probiotics benefit the human body by promoting gut health, reducing intestinal inflammation, and improving digestion when consumed in sufficient quantities. They play a significant role in preventive healthcare by bolstering the body's immune system and preventing disease. Consequently, the increasing awareness of preventive healthcare is expected to impact the probiotics ingredients market in the foreseeable future positively.

To Understand More About this Research: Request a Free Sample Report

The success of the probiotics ingredients market heavily relies on research and development efforts. Companies are investing substantial resources in R&D to develop highly efficient probiotic strains that are more effective in preventing diseases. This ongoing trend is anticipated to drive the demand for probiotics ingredients, including spore formers, in the coming years.

Significant advancements have been made in the delivery systems for probiotics, enhancing their effectiveness in reaching targeted areas of the body, particularly the intestines. This progress includes the development of efficient strains of spore former ingredients that work compatibly with these delivery systems. As a result, more probiotics can effectively reach their intended destinations, further amplifying their impact.

Different countries have different regulations pertaining to probiotics cultures and functional foods. This scenario creates a confusing situation for industry participants. Frequent changes in regulations affect the market, and companies have to adjust according to these changes.

Industry Dynamics

Growth Drivers

Increasing awareness of consumers toward preventive healthcare

The global preventive healthcare awareness is on the rise due to various factors such as increasing disposable income, rising standards of living, aging population, and changing attitude toward healthcare. Also, easy availability of information pertaining to preventive healthcare on the internet is contributing favorably to the rising levels.

Probiotics improve the gut health by acting against the bad bacteria in the body. This probiotic activity results in improved immunity of the body. Probiotics are beneficial for the body and prevent a wide range of problems related to gut health. This results in prevention of occurrence of diseases related to gut health.

Probiotics can also be used to prevent diseases related to oral health, bacterial vaginosis, and urinary tract. They can also be used to prevent diseases such as respiratory infections, necrotizing enterocolitis, and bowel diseases. The risk of occurrence of these diseases is high, particularly among the geriatric population. Probiotics prove an easily available and safe alternative to the geriatric population, to prevent the occurrence of these diseases. This trend has benefitted the spore former market in the recent past and is expected to continue to do so over the forecast period.

There has been a change in attitude toward preventive healthcare due to factors such as rising disposable income, available information sources, and increasing standard of living. Probiotics are available in a wide variety of products, which can be used to prevent the occurrence of a broad range of diseases. They are available in food & beverages and dietary supplements and can be used to prevent specific as well as broad spectrum diseases. The changing attitude toward preventive healthcare coupled with probiotics product portfolio is expected to benefit the overall probiotics ingredients market growth over the forecast period.

There has been a recent increase in the per capita expenditure on probiotics, as you can see in the chart above. Campaigning strategies adopted by major market participants, easy availability of products, and inherent benefits offered by probiotics have resulted in increased per capita expenditure on probiotics across the globe.

Report Segmentation

The market is primarily segmented based on ingredients, application, end use and region.

|

By Ingredients |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

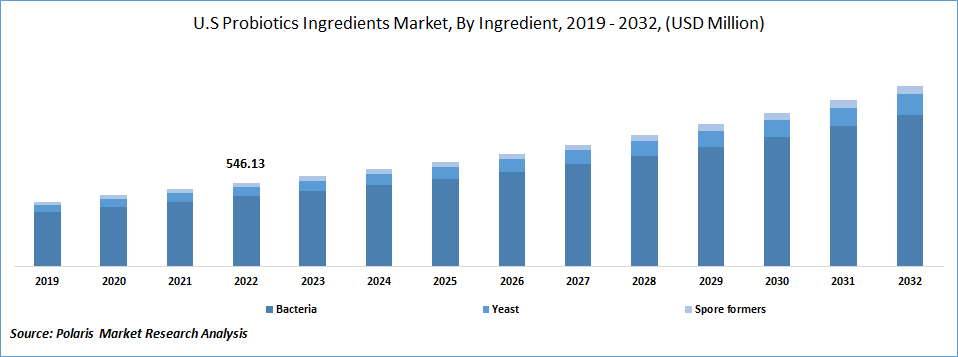

The bacteria ingredient segment dominated the market share in 2022

The bacteria ingredient segment is led the industry and continue its dominance over the forecast period. The strains of Lactococcus, Lactobacillus, Bifidobacterium and Streptococcus are important components of bacteria-based probiotic ingredients. Among these, Lactobacillus is mostly used in various end-use industries, which is expected to boost its growth.

The probiotic food & beverage application segment is expected to dominate the market over the forecast period

Increasing gut health concerns, rising geriatric population and efficacy of probiotics products in providing health benefits is expected to benefit the food & beverages segment market demand over the forecast period. Inclination towards preventive healthcare, availability of probiotic dietary supplements aimed at treating specific health conditions and strategies adopted by major market participants is expected to benefit the market worth for probiotic ingredients used for dietary supplement applications.

Asia Pacific witnessed a highest CAGR in the market in 2022

Asia Pacific region is expected to witness the highest growth rate over the forecast period. The main reasons for growth are rising living standards, increased disposable income, and increased awareness of the benefits of probiotics. Around here, buyers are becoming more health-conscious and inclined towards products that offer both convenience and nutritional value. The region's market is expected to benefit from strong demand from nations like China and Japan.

Competitive Insight

Some of the major players operating in the global market include Probiotical S.p.A., Sabinsa Corporation, Biocodex Inc., Chr. Hansen Holding A/S, Danisco A/S, Danone Inc., Lallemand Inc., Probi AB, Lactosan GmbH & Co., ProbioFerm, Kerry Inc., and Kibow Biotech.

Recent Developments

- In November 2020, Kerry Group acquired Bio-K+ International Inc. With this acquisition, Kerry expanded its probiotic portfolio in the market.

- In April 2020, Chr. Hansen acquired HSO Health Care to grow probiotics offering for women’s health. The acquisition will strengthen and expand Chr. Hansen’s global microbial platform.

Probiotics Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3109.32 million |

|

Revenue forecast in 2032 |

USD 6153.56 million |

|

CAGR |

7.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2032 |

|

Segments Covered |

By Ingredients, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Biocodex Inc. Danone Inc., Chr. Hansen Holding A/S, Lallemand Inc, and Danisco A/S., Probi AB, Lactosan GmbH & Co., ProbioFerm, Kerry Inc., and Kibow Biotech. |

Navigate through the intricacies of the 2024 Probiotics Ingredients Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Carboprost Tromethamine Market Size, Share 2024 Research Report

Cytomegalovirus Treatment Market Size, Share 2024 Research Report

Soybean Market Size, Share 2024 Research Report

Property And Casualty Insurance Market Size, Share 2024 Research Report

Medical Polyetheretherketone Market Size, Share 2024 Research Report

FAQ's

key companies in Probiotics Ingredients Market are Probiotical S.p.A., Sabinsa Corporation, Biocodex Inc., Chr. Hansen Holding A/S, Danisco A/S, Danone Inc.

The probiotics ingredients market expected to grow at a CAGR of 7.9% during the forecast period.

The Probiotics Ingredients Market report covering key are ingredients, application, end use and region.

key driving factors in Probiotics Ingredients Market are Increasing demand for immunity-enhancing products from consumers.

The global probiotics ingredients market size is expected to reach USD 6153.56 million by 2032