Project Portfolio Management (PPM) Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Service); By Deployment; By Enterprise Size, By Application, By Vertical, By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2821

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

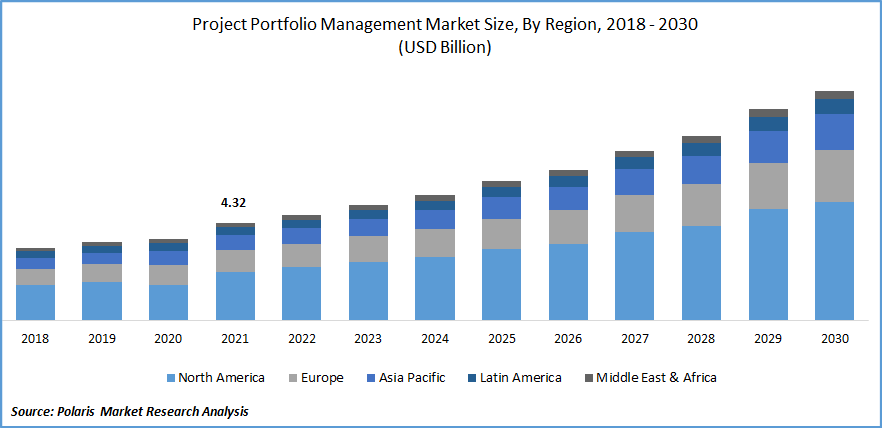

The global project portfolio management (PPM) market was valued at USD 4.32 billion in 2021 and is expected to grow at a CAGR of 10.54% during the forecast period. PPM services are in great demand because of the growing requirement to have a 360-degree view of the whole project lifecycle. The usage of cloud-based services for wireless connectivity of current projects is likely to fuel market growth.

PPM is software that centrally handles several projects in an organization under one roof. The program aids in the management and coordination of all areas of a project. The system provides critical data via interactive dashboards to ensure that the number of projects selected and completed meets organizational objectives. Consequently, as it supports organizations in attaining their strategic business goals, this software is gaining appeal across all industries.

Know more about this report: Request for sample pages

Data is commonly recognized as an organization's most precious asset; therefore, it must be protected against cyber-attacks. Organizations that use new advanced digital technologies put their company data in danger. These attacks will always be an issue, no matter how well-prepared a company is to cope with cybercrime. Every technology that promises to improve business operations opens the door for hackers and cybercriminals to get access to IT systems. Low-cost public cloud services are easily accessible to small and medium-sized organizations. These services, however, are more exposed to cyberattacks and security issues, whilst small enterprises, owing to price constraints, cannot afford a private cloud.

Small vendors employ these technologies to make faster and better decisions in a dynamic and hypercompetitive business climate. To provide extra functionality in a single solution, SaaS PPM may be linked with current business process management systems. As a result, the solutions significantly contribute to its acceptance. Furthermore, the combination of software coordination and lifecycle management for application systems is projected to fuel market growth.

Tata Consultancy Services (TCS), for example, has declared that 75% of its workers will work from home permanently. Such initiatives make it hard for businesses & project managers to track their current projects and to also introduce new projects & resources using traditional project management approaches. As a result, many firms chose such systems, which are provided them with specialized tools for project planning & execution.

Market.webp)

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Companies began to rethink their entire project management processes as project complexity rose. Traditional waterfall projects do not necessarily give the greatest response to cost and resource management in today's fast-paced world. As a result, businesses adapt their operations by converting their organizational procedures into an agile business model. The agile revenue model has evolved into one of the foremost widely used approaches to systems due to its extremely cross-functional and collaborative project management.

The Scaled Agile Framework (SAFe) idea is gaining traction in the industry. The framework includes a collection of workflow templates meant to help firms grow their agile and lean business processes. This strategy assists firms of all sizes in maintaining their skills in uncertain business conditions. As a result, many firms are reconsidering their strategy for agile development and asset allocation models. Agile processes may be tightly tailored to the dynamic digital market's ever-changing company demands. As a result, growing agile techniques are propelling market expansion.

Furthermore, using an agile strategy helps businesses to identify the value of a certain project and its ROI. The project manager may monitor the project's progress in real-time and make modifications as needed. According to a survey undertaken by leading industry participants, implementing a contemporary result based on a lean manifesto reduces project preparation time by 37% on average. Therefore, the global market should expand over the forecast period.

Report Segmentation

The market is primarily segmented based on component, deployment, enterprise size, vertical, application, and region.

|

By Component |

By Deployment |

By Enterprise Size |

By Vertical |

By Application |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Software as a component is the dominant segment in 2021

Among components, the software category may have the biggest market share due to the high acceptance of this software by IT vendors. This software is in high demand across all sectors due to increased functionality and customizable price packages, and the appetite for cloud-based technology remains strong.

Services are further classified as deployment and integration teaching and consultation, and support and maintenance. The increasing desire for portfolio programming personalization is a primary driving force behind integration and delivery services. The need for delivery services rises because of program mobilization, & recovery. Training & consulting services have the potential for expansion, as people learn how to use such advanced systems. Support and maintenance services are also significant components of these services and solutions.

Cloud-based deployment is projected to be the fastest-growing segment

As of the growing popularity of the Software as a Service (SaaS) PPM system, the cloud-based category is expected to grow at the fastest rate over the projection period. Cloud-based infrastructure is expected to grow in popularity due to its adjustable pricing structures, quick upgradability, maintenance packages, and ease of access. Cloud-based solutions are also in great demand due to their easy adaptability, portability, and cheap cost. SaaS is straightforward and quick to set up with a managed deployment method.

The hosted subscription model is gaining popularity owing to advantages such as higher uptime, dependability, technical assistance, and cost savings. As a result, throughout the forecast period, the hosted sector is predicted to grow considerably. In-house apps may easily be linked to on-premises software. Furthermore, the safe and extensive data control features of the on-premises implementation are expected to drive adoption during the projection period.

The demand in North America is expected to witness significant growth

North America is expected to have the largest proportion of the market. High penetration of modern technologies such as cloud, artificial intelligence (AI), and others are driving software growth in North America. Cloud-based solutions provide robust processing and simple access to project portfolio management for enterprises, consequently boosting the industry.

During the projection period, Asia Pacific is expected to develop at the fastest CAGR due to the growing number of competitors whose primary goal is to extend their geographical presence. Acceptance of technology and increasing digitalization are two key factors that will most likely promote industry progress in APAC. The use of cloud-based solutions is likely to fuel SaaS PPM demand throughout the area. As a consequence, the Asia Pacific market is predicted to grow considerably during the forecast period by providing customized services to clients in emerging countries throughout the world.

Competitive Insight

The worldwide market comprises of thriving start-up ecosystem. There can be more than 100 start-ups in the industry developing and innovating PPM products and services for customers. Such a fragmented market is expected to generate severe competition by compelling current enterprises to constantly improve and incorporate innovations in offers.

Some of the major players operating in the global market include Adobe (Workfront), Hewlett Packard Enterprise Development, Broadcom, ServiceNow, Oracle Corporation, Microsoft Corporation, SAP, HEXAGON, ATLASSIAN, Planview, and others.

Recent Developments

- In 2022, Oracle introduced workflow manager, a new technology that will help field service teams to provide efficient and fair assistance.

- In 2021, SAP collaborated with Siemens to develop Teamcenter software as the key foundation for product management. Siemens expected to provide its “SAP Intelligent Asset Management” services, and other applications, to boost customer business value from across products and the service lifecycle.

Project Portfolio Management (PPM) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.69 billion |

|

Revenue forecast in 2030 |

USD 10.5 billion |

|

CAGR |

10.54% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment, By Enterprise Size, By Vertical, By Application, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Adobe (Workfront) (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Broadcom Inc. (U.S.), ServiceNow (U.S.), Oracle Corporation (U.S.) |