Reclaimed Rubber Market Size, Share, Trends, Industry Analysis Report

: By Product, Application (Tire and Non-Tire), End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1579

- Base Year: 2024

- Historical Data: 2020-2023

Reclaimed Rubber Market Overview

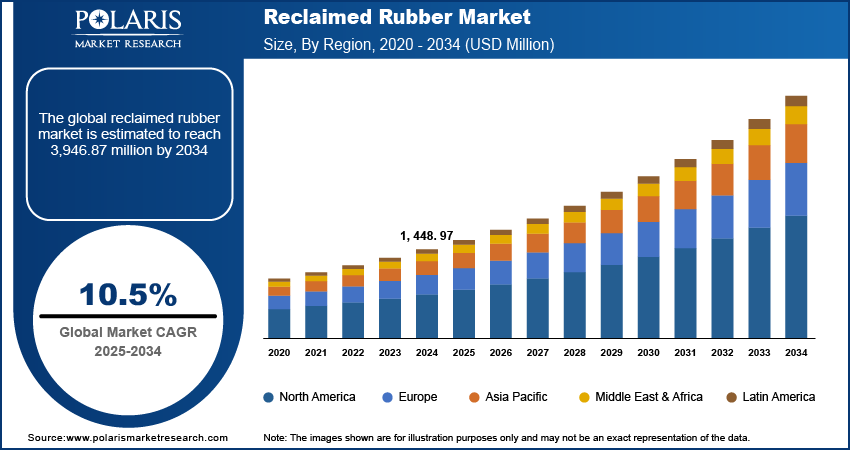

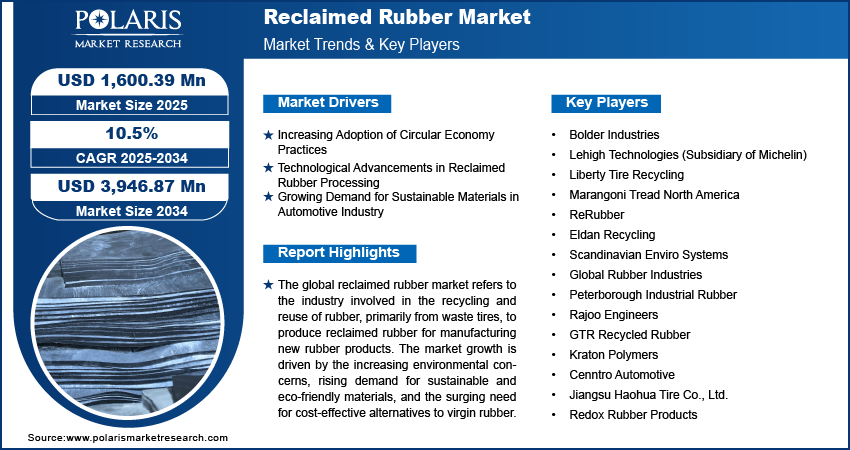

The global reclaimed rubber market size was valued at USD 1,448.97 million in 2024. The market is projected to grow from USD 1,600.39 million in 2025 to USD 3,946.87 million by 2034, exhibiting a CAGR of 10.5% during 2025–2034.

The global reclaimed rubber market focuses on the recycling and reuse of rubber, primarily from waste tires, to produce reclaimed rubber for manufacturing new rubber products. The market is driven by increasing environmental concerns, the rising demand for sustainable and eco-friendly materials, and the need for cost-effective alternatives to virgin rubber. Key drivers include the growing adoption of circular economy practices, regulatory pressure on waste management, and the rising need to reduce carbon footprints in industrial processes. Trends such as technological advancements in recycling methods and the use of reclaimed rubber in industries such as automotive, footwear, and construction are expected to propel the reclaimed rubber market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Reclaimed Rubber Market Drivers and Trends

Increasing Adoption of Circular Economy Practices

The increasing adoption of circular economy practices emphasizes recycling and reusing materials to minimize waste. In the rubber industry, this practice involves reclaiming used rubber, primarily from discarded tires, and reprocessing it for use in manufacturing new products. As governments and industries prioritize sustainability, businesses are increasingly looking for ways to reduce reliance on virgin materials, particularly in the automotive and manufacturing sectors. For instance, the European Union's tire recycling regulations and similar initiatives in the US have fostered greater adoption of reclaimed rubber in tire manufacturing. The drive for a circular economy is further supported by consumer demand for sustainable products, encouraging companies to adopt recycling practices to improve their environmental footprint. Thus, the rising adoption of circular economy practices would emerge as a key reclaimed rubber market trend in the coming years.

Technological Advancements in Reclaimed Rubber Processing

Advancements in technology play a significant role in enhancing the quality and efficiency of reclaimed rubber production. Traditional methods of reclaiming rubber were often inefficient and resulted in subpar material quality. However, newer techniques such as devulcanization, a chemical process that breaks the sulfur bonds in vulcanized rubber, have significantly improved the quality of reclaimed rubber. This innovation has made reclaimed rubber more viable for high-performance applications, particularly in the automotive and construction sectors. In addition, emerging technologies are optimizing the sorting and processing of used tires, increasing yield and reducing costs. According to a study by the American Chemical Society, improvements in devulcanization technology have made it possible to reclaim up to 85% of the original rubber's properties, enabling manufacturers to use reclaimed rubber in a wider range of products. As technological advancements are rising in reclaimed rubber processing, the reclaimed rubber market witnesses robust growth.

Growing Demand for Sustainable Materials in Automotive Industry

The automotive industry remains one of the largest consumers of reclaimed rubber, driven by the industry's growing focus on sustainability. As automakers work to reduce their environmental impact, many are turning to reclaimed rubber as a cost-effective and environmentally friendly alternative to virgin rubber in the production of tires, seals, and other rubber components. Automakers are also increasingly under pressure from regulatory bodies to meet stricter environmental standards, particularly regarding emissions and waste management. The tire industry in the US has seen a rise in the use of reclaimed rubber, with some manufacturers incorporating up to 20% reclaimed rubber in tire production. As a result, tire manufacturers are investing in improved processes for reclaiming rubber to meet these sustainability goals. This shift is helping boost the global reclaimed rubber market expansion, particularly as consumer demand for eco-friendly products continues to rise.

Reclaimed Rubber Market Segment Insights

Reclaimed Rubber Market Outlook – by Product-Based Insights

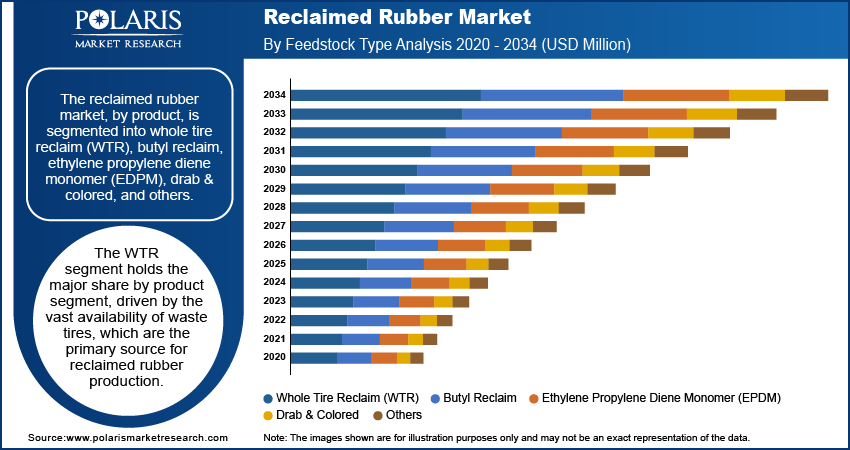

The reclaimed rubber market, by product, is segmented into whole tire reclaim (WTR), butyl reclaim, ethylene propylene diene monomer (EDPM), drab & colored, and others. The whole tire reclaim (WTR) segment holds the largest market share, driven by the vast availability of waste tires, which are the primary source for reclaimed rubber production. WTR is extensively used in the manufacturing of new tires, rubber mats, and automotive components due to its cost-effectiveness and sustainability advantages. Additionally, the growing adoption of tire recycling practices and the regulatory push for tire waste management boost the demand for WTR. The segment is also witnessing robust growth, particularly in regions with high rates of vehicle production and tire waste, such as North America and Europe.

The butyl reclaim and EPDM segments are experiencing increasing demand, driven by their use in specific applications such as inner tire linings and high-performance seals. These segments are showing notable growth, especially in industries requiring specialized rubber properties. However, WTR remains the dominant segment, while butyl and EPDM reclaim are also registering steady growth as industries seek alternatives to virgin rubber for cost reduction and sustainability. The drab & colored and other niche segments, while holding the smallest share, are expanding as manufacturers target specialized products with unique color or appearance requirements. As the market continues to evolve, WTR's position is expected to strengthen due to continued innovation in recycling technologies and growing environmental awareness.

Reclaimed Rubber Market Outlook – by Application-Based Insights

The reclaimed rubber market, based on application, is bifurcated into tire and non-tire. The tire segment holds a larger market share, as tires remain the primary source of reclaimed rubber, with waste tires being extensively recycled to produce new tires. The automotive industry’s ongoing shift toward sustainability, coupled with regulations promoting tire recycling, has contributed to the significant demand for reclaimed rubber in tire manufacturing. This segment is also witnessing the highest growth, driven by the increasing focus on reducing the environmental impact of tire production and improving waste tire management systems globally. As a result, reclaimed rubber is increasingly being incorporated into the production of new tires, making the tire segment the dominant force in the market.

The non-tire segment, which includes sectors such as footwear, construction, and automotive components, is experiencing growth, albeit at a slower pace. The demand for reclaimed rubber in non-tire applications is rising due to the growing preference for sustainable materials in manufacturing, along with the economic benefits of using recycled rubber. This segment includes uses in products such as mats, seals, and gaskets, where reclaimed rubber offers cost savings while maintaining functional properties. The non-tire segment is growing as more industries adopt reclaimed rubber as part of their sustainability strategies.

Reclaimed Rubber Market Outlook – by End Users-Based Insights

The reclaimed rubber market, by end users, is segmented into automotive & aircraft, cycle c, retreading, belts & hoses, footwear, molded rubber goods, and others. The automotive & aircraft segment holds the largest market share, as reclaimed rubber is extensively used in the production of automotive tires, seals, gaskets, and other components. The automotive industry’s focus on reducing environmental impact and meeting regulatory requirements for waste management has driven substantial demand for reclaimed rubber, making it the dominant end-user segment. This segment is also registering significant growth, supported by innovations in tire recycling technologies and the increasing adoption of reclaimed rubber in both original equipment manufacturing (OEM) and aftermarket products.

The retreading segment is experiencing notable growth, particularly due to the cost-effectiveness of using reclaimed rubber for retreaded tires, which is an increasingly popular solution in the commercial and fleet vehicle sectors. Retreading reduces the environmental impact of waste tires and offers substantial cost savings. Other segments such as footwear and molded rubber goods are growing steadily, as manufacturers in these sectors seek sustainable material alternatives to virgin rubber. The molded rubber goods segment, which includes products such as mats and seals, benefits from rising consumer demand for eco-friendly and affordable rubber products.

Reclaimed Rubber Market Regional Insights

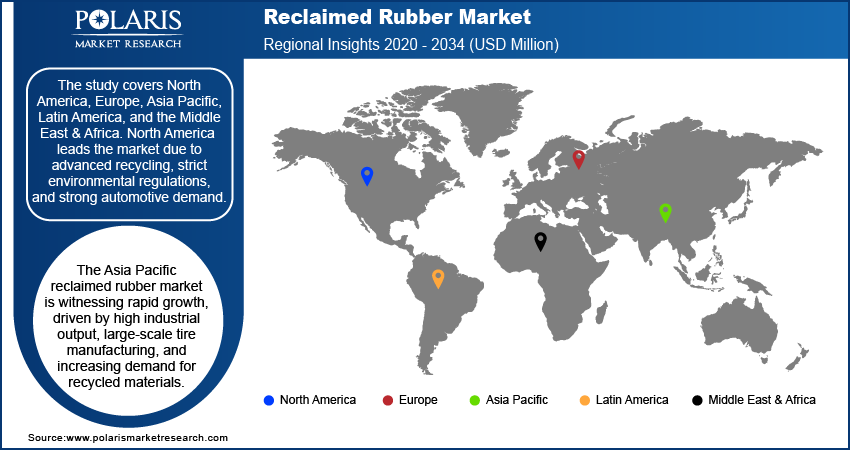

By region, the study provides reclaimed rubber market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to the region’s advanced recycling infrastructure, stringent environmental regulations, and strong demand from the automotive industry, particularly in tire manufacturing and retreading. The US, in particular, has made significant strides in waste tire management, with the development of efficient recycling technologies and government initiatives promoting sustainability. Additionally, North America's growing focus on circular economy practices and eco-friendly products in various industrial sectors, such as automotive and construction, continues to drive the adoption of reclaimed rubber, solidifying the region’s leading position in the global market.

Europe holds a significant share of the global reclaimed rubber market, driven by strong regulatory frameworks and sustainability initiatives. The European Union’s stringent environmental policies, such as the End-of-Life Vehicle (ELV) Directive and the Waste Tire Recycling Program, have accelerated the adoption of recycled rubber, particularly in the automotive sector. The region’s focus on adopting circular economy practices and reducing carbon emissions has increased demand for eco-friendly materials, further boosting the reclaimed rubber market expansion. Major players in the tire industry, such as Michelin and Continental, have embraced the use of reclaimed rubber in tire manufacturing. Additionally, the rising focus on sustainable construction materials and growing automotive production in Eastern Europe also support market expansion.

The Asia Pacific reclaimed rubber market is witnessing rapid growth, driven by high industrial output, large-scale tire manufacturing, and increasing demand for recycled materials. Countries such as China and India, with their massive automotive and tire industries, play a pivotal role in the growth of the market. China, being the largest producer and consumer of tires, has implemented policies to promote tire recycling and waste management, leading to a higher uptake of reclaimed rubber in tire manufacturing. India’s growing automotive market, coupled with rising awareness about sustainability, further fuels the demand for recycled rubber in tire production and non-tire applications. The expanding construction, footwear, and industrial sectors across the region also contribute to the overall reclaimed rubber market growth in Asia Pacific.

Reclaimed Rubber Market – Key Players and Competitive Insights

Bolder Industries; Lehigh Technologies (a subsidiary of Michelin); Liberty Tire Recycling; Marangoni Tread North America; ReRubber; Eldan Recycling; Scandinavian Enviro Systems; Global Rubber Industries; Peterborough Industrial Rubber; Rajoo Engineers; GTR Recycled Rubber; Kraton Polymers; Cenntro Automotive; Jiangsu Haohua Tire Co., Ltd.; and Redox Rubber Products are among the key players in the reclaimed rubber market. These companies are involved in the production, recycling, and distribution of reclaimed rubber for applications in various sectors, including automotive, industrial, and construction sectors. Their operations range from tire recycling to producing value-added products, and many of them are based in regions with strong regulatory frameworks, such as North America and Europe. Additionally, Lehigh Technologies, now a part of Michelin, is a major player focused on providing high-quality reclaimed rubber through advanced technologies. These companies are heavily involved in research and development to enhance the properties of reclaimed rubber and expand its applications.

In terms of competitive positioning, companies in the reclaimed rubber market are focused on expanding their production capacities and adopting innovative recycling technologies. Bolder Industries, for instance, has developed proprietary technology for the production of high-performance reclaimed rubber, positioning itself as a supplier for the automotive industry. Liberty Tire Recycling is another significant player, primarily serving the North American market, with a robust network for tire recycling and supplying reclaimed rubber to various industries. Additionally, companies such as Scandinavian Enviro Systems and Lehigh Technologies are leveraging their technological expertise to improve the efficiency of the devulcanization process, which significantly impacts the quality of reclaimed rubber and broadens its use in more demanding applications, such as in high-performance tires.

Despite the competitive nature of the market, there is still room for new entrants, especially those focusing on innovation and sustainability in rubber recycling processes. As environmental concerns continue to rise, companies in the reclaimed rubber market are likely to face increased pressure to adopt sustainable practices, reduce waste, and offer more cost-effective solutions. As a result, companies that can capitalize on advances in recycling technologies, particularly those improving the quality of reclaimed rubber for use in premium products, will be well-positioned to meet the growing demand from industries such as automotive, construction, and footwear. This dynamic environment suggests that competition will intensify, with companies focusing on expanding product offerings and geographical presence, particularly in regions with emerging markets such as Asia Pacific and Latin America.

Bolder Industries is a key player in the reclaimed rubber market, known for its advanced technology used in recycling scrap tires into valuable reclaimed rubber. The company operates a sustainable business model that focuses on reducing waste and promoting eco-friendly practices. Bolder Industries has a strong presence in the automotive and industrial sectors, where its reclaimed rubber is used in products such as tires, gaskets, and mats.

Liberty Tire Recycling, a leading company in tire recycling, provides reclaimed rubber for a wide range of applications, including tires, playground surfaces, and construction materials. The company operates extensive tire collection and recycling operations across North America, ensuring a steady supply of reclaimed rubber.

Key Companies in Reclaimed Rubber Market

- Bolder Industries

- Lehigh Technologies (Subsidiary of Michelin)

- Liberty Tire Recycling

- Marangoni Tread North America

- ReRubber

- Eldan Recycling

- Scandinavian Enviro Systems

- Global Rubber Industries

- Peterborough Industrial Rubber

- Rajoo Engineers

- GTR Recycled Rubber

- Kraton Polymers

- Cenntro Automotive

- Jiangsu Haohua Tire Co., Ltd.

- Redox Rubber Products

Reclaimed Rubber Industry Developments

- In November 2024, Bolder Industries announced a new partnership with Antea Group, Cyclops, and OSQB to expand the use of its recycled rubber in tire production, aiming to meet growing demands for sustainable materials in the automotive industry.

- In June 2023, Liberty Tire Recycling launched a new facility in Ohio to improve its processing capacity and enhance the quality of the reclaimed rubber produced. This move is a part of the company's strategy to expand its recycling capabilities and meet the increasing demand for eco-friendly products in multiple industries.

Reclaimed Rubber Market Segmentation

By Product Outlook

- Whole Tire Reclaim (WTR)

- Butyl Reclaim

- Ethylene Propylene Diene Monomer (EPDM)

- Drab & Colored

- Others

By Application Outlook

- Tire

- Non-Tire

By End Users Outlook

- Automotive & Aircraft

- Cycle Tire

- Retreading

- Belts & Hoses

- Footwear

- Molded Rubber Goods

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Reclaimed Rubber Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,448.97 million |

|

Market Size Value in 2025 |

USD 1,600.39 million |

|

Revenue Forecast by 2034 |

USD 3,946.87 million |

|

CAGR |

10.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global reclaimed rubber market value reached USD 1,448.97 billion in 2024 and is projected to grow to USD 3,946.87 billion by 2034.

The global market is projected to register a CAGR of 10.5% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the reclaimed rubber market are Bolder Industries; Lehigh Technologies (a subsidiary of Michelin); Liberty Tire Recycling; Marangoni Tread North America; ReRubber; Eldan Recycling; Scandinavian Enviro Systems; Global Rubber Industries; Peterborough Industrial Rubber; Rajoo Engineers; GTR Recycled Rubber; Kraton Polymers; Cenntro Automotive; Jiangsu Haohua Tire Co., Ltd.; and Redox Rubber Products.

The whole tire reclaim (WTR) segment accounted for the largest share of the global market in 2024.

The tire segment accounted for a larger share of the global market in 2024.

Reclaimed rubber is a type of recycled rubber that is derived from waste rubber products, such as used tires, rubber scraps, or defective rubber products. It is processed through various methods, including mechanical grinding and chemical treatments, to restore its properties and make it reusable in manufacturing new rubber products. The reclamation process typically involves breaking down the rubber's structure, removing impurities, and treating it to improve its elasticity, strength, and durability.

A few key trends in the reclaimed rubber market are described below: Rising Demand for Sustainable Products: Increased focus on environmental sustainability and circular economy practices is driving the adoption of reclaimed rubber as a green alternative to virgin rubber. Technological Advancements: Innovations in rubber recycling technologies, including devulcanization processes, are improving the quality and performance of reclaimed rubber. Growth of Tire Retreading: The use of reclaimed rubber in tire retreading, especially in commercial and fleet vehicles, is gaining traction due to cost savings and environmental benefits. Regulatory Support: Government regulations encouraging tire recycling and waste management are boosting the demand for reclaimed rubber, particularly in regions such as North America and Europe.

A new company entering the reclaimed rubber market must focus on leveraging advanced recycling technologies to improve the efficiency and quality of reclaimed rubber. By investing in innovation, such as developing superior devulcanization processes, the company can offer a product that meets higher performance standards. Additionally, focusing on the growing demand for sustainable solutions in the automotive and construction industries can provide a strong market foothold. Collaborating with key players in tire recycling, automotive manufacturers, and government agencies to ensure compliance with regulations and sustainability goals will also be crucial.

Companies producing reclaimed rubber and related products and other consulting firms must buy the report.