Recombinant Proteins Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Product and Production Services), By Application, By End Use, and By Region -Market Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2565

- Base Year: 2024

- Historical Data: 2020-2023

Overview

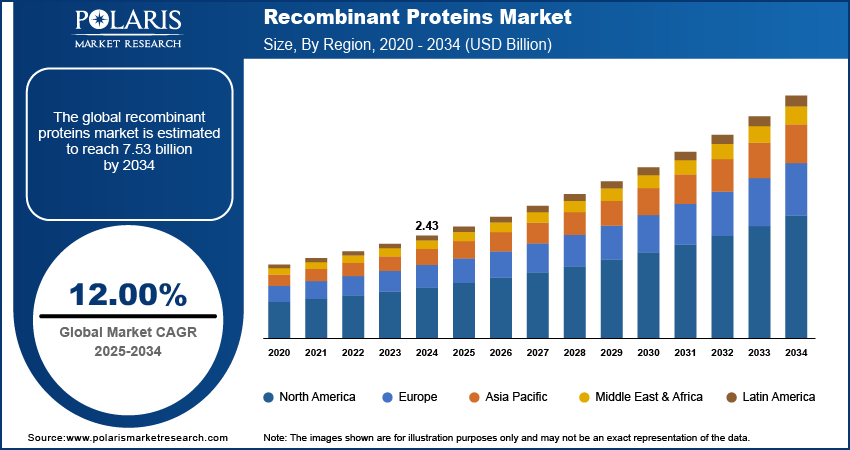

The global recombinant proteins market size was valued at USD 2.43 billion in 2024. The market is projected to grow at a CAGR of 12.00% during 2025 to 2034. Key factors driving demand for recombinant proteins include the increasing global burden of chronic and genetic diseases and significant investments in biopharmaceutical research and development.

Key Insights

- Among all the products, the enzymes segment accounted for the largest revenue share in 2024, owing to its usage in several research domains.

- The pharmaceutical & biotech companies segment is expected to dominate the industry over the forecast period, owing to the rise in demand for recombinant proteins in predicting, prognosis, and diagnosing drug research.

- North America dominated the global recombinant proteins market in 2024, due to increasing cases of infectious and chronic diseases.

- The market in the Asia Pacific is growing, owing to increasing chronic illness in particular countries, such as India.

Industry Dynamics

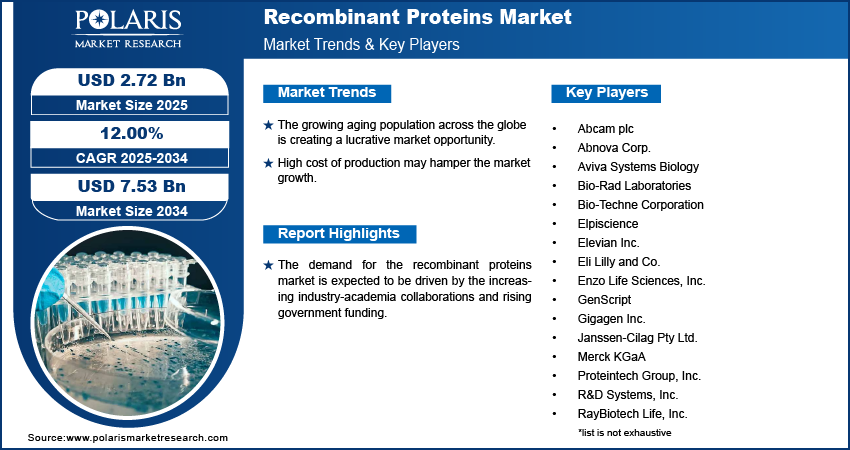

- The recombinant proteins market is expected to grow in the coming years, owing to rising cases of chronic diseases and growing R&D programs.

- The launch of new products and innovative biotechnology activities is also leading to market growth.

- The growing aging population across the globe is creating a lucrative market opportunity.

- High cost of production may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 2.43 Billion

- 2034 Projected Market Size: USD 7.53 Billion

- CAGR (2025-2034): 12.00%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Recombinant Proteins Market

- AI helps in the design and testing of recombinant proteins.

- AI models predict protein folding and stability.

- AI improves production yields.

- AI tailors recombinant protein therapies to patient-specific genetic.

The demand for the recombinant proteins market is expected to be driven by the increasing industry-academia collaborations and rising government funding. The production procedure of recombinant protein requires a technology called recombinant DNA (rDNA) technology which then produces a large number of proteins and other commercial products. Increasing levels of chronic diseases and markets focusing more on protein curatives can also be considered to drive market growth. Furthermore, the rise in demand for biological products, production of recombinant DNA from various sources, and alternatives of basic proteins is likely to complement market growth.

The COVID-19 pandemic had a positive impact on the market growth for the proteins. With the rise in COVID infection, it was suggested that recombinant protein vaccines might come up with a combination of subunits of various adjuvants and antigens, which will be more effective on SARS-CoV-2 infections and will be easily available in the center.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The recombinant proteins market is expected to grow with more chronic disease incidences, more R&D programs, and favorable funding from the government. The market is also driven, due to new products and innovative biotechnology activities. Growing R&D programs and development of new healthcare technologies is further contributing to the market growth. According to a recent report, the market for proteins is expected to witness a huge influx of R&D expenditure and favorable funding, with India and China facing several untreated diseases, will have the advantage of expanding and coming up with new solutions of recombinant protein.

Report Segmentation

The market is primarily segmented based on product & services, application, end use, and region.

|

By Product & Services |

By Application |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

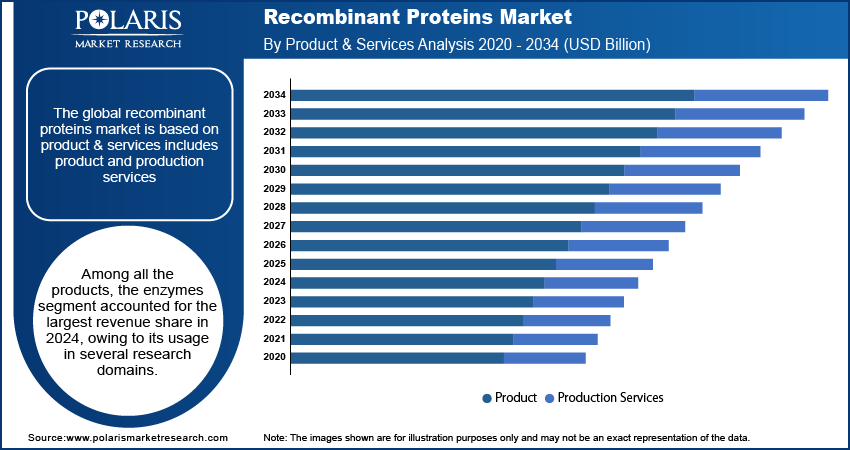

The Enzymes Segment Accounted for the Largest Share in 2024

Among all the products, the enzymes segment accounted for the largest revenue share in 2024, owing to its usage in several research domains. It is also expected to witness fastest growth over the forecast period. Several research initiatives, such as wound repair, transplantation, oncology, and even COVID-19, are the primary disease that will require attention, and enzymes have the advantage of growing in this sector. Enzymes have been aslo used in the treatment of chronic conditions such as diabetes. Similarly, in cancer, enzymes can be helpful and improve chemotherapy.

The Pharmaceutical & Biotech Companies Segment is Expected to Account for the Largest Share in 2034

The pharmaceutical & biotech companies segment is expected to dominate the industry over the forecast period owing to the rise in demand for recombinant proteins in predicting, prognosis, and diagnosing drug research which acquires a major portion of the market. Furthermore, the rising competition in the market, accurate measurements in drugs in research & development, and multiple collaborations have resulted in proliferating the growth of recombinant protein.

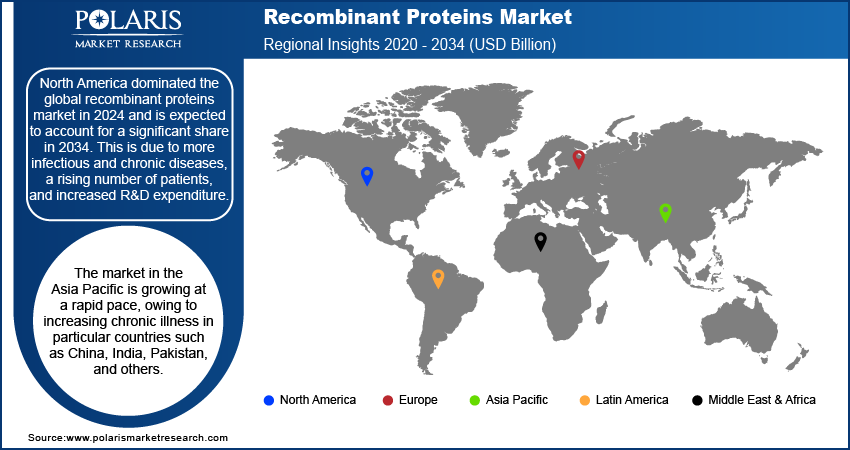

North America Accounted for the Largest Revenue Share in 2024

North America dominated the global recombinant proteins market in 2024 and is expected to account for a significant share in 2034. This is due to more infectious and chronic diseases, a rising number of patients, and increased R&D expenditure. The growing healthcare spending in the region, particualry in the U.S. also propelled the market growth. Moreover, government in the region are covering medical charges for certain chronic diseases, which contributed to the regional dominance.

The market in the Asia Pacific is growing at a rapid pace, owing to increasing chronic illness in particular countries such as China, India, Pakistan, and others. The presence of high geriatric population in countries such as Japan and China is also leading to the market growth. Moreover, governments in the region are investing in the development of hospitals, clinics, and other medical contact centers to overcome chronic illness conditions. This is increasing the demand for recombinant proteins.

Competitive Insight

Companies in the market are competing to capture the major revenue share. These companies are also expanding their operation and investing in product development to cater the growing demand. Some of the major players operating in the global market include Abcam plc, Abnova Corp, Aviva systems biology, Bio-Techne corporation, Bio-Rad laboratories, Elpiscience, Elevian inc, Eli lilly and co, Enzo life sciences, Inc, Gigagen inc, Genscript, Janssen-Cilag pty ltd, Merck KGaA, Proteinrech Group, Inc, R&D System, Inc, Raybiotech Life Inc, Stemcell Technologies Inc, Sino Biological Inc, Thermo Fisher Scientific, U Protein Express.

Recent Developments

- In January 2022, Alamar Biosciences announced a strategic partnership with Abcam plc to understand the fundamental biology of human health and diseases, which enables innovation in therapeutics and research. In August 2022, Thermo Fisher Scientific will expand its cells and gene therapy capabilities with viral vector manufacturing, which are important in gene therapies.

Recombinant Proteins Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.43 billion |

| Market size value in 2025 | USD 2.72 billion |

|

Revenue forecast in 2034 |

USD 7.53 billion |

|

CAGR |

12.00% |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Abcam plc, Abnova Corp, Aviva systems biology, Bio-Techne corporation, Bio-Rad laboratories, Elpiscience, Elevian inc, Eli lilly and co, Enzo life sciences,Inc, Gigagen inc, Genscript, Janssen-Cilag pty ltd, Merck KGaA, Proteinrech Group, Inc, R&D System, Inc, Raybiotech Life Inc, Stemcell Technologies Inc, Sino Biological Inc, Thermo Fisher Scientific, U Protein Express |

FAQ's

• The global market size was valued at USD 2.43 billion in 2024 and is projected to grow to USD 7.53 billion by 2034.

• The global market is projected to register a CAGR of 12.00% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are Abcam plc, Abnova Corp, Aviva systems biology, Bio-Techne corporation, Bio-Rad laboratories, Elpiscience, Elevian inc, Eli lilly and co, Enzo life sciences,Inc, Gigagen inc, Genscript, Janssen-Cilag pty ltd, Merck KGaA, Proteinrech Group, Inc, R&D System, Inc, Raybiotech Life Inc, Stemcell Technologies Inc, Sino Biological Inc, Thermo Fisher Scientific, and U Protein Express.

• The product segment dominated the market revenue share in 2024.