Recycled Carbon Fiber Market Size, Share, Trend, & Industry Analysis Report

: By Source (Aerospace Scrap, Automotive Scrap, and Other), By Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5721

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

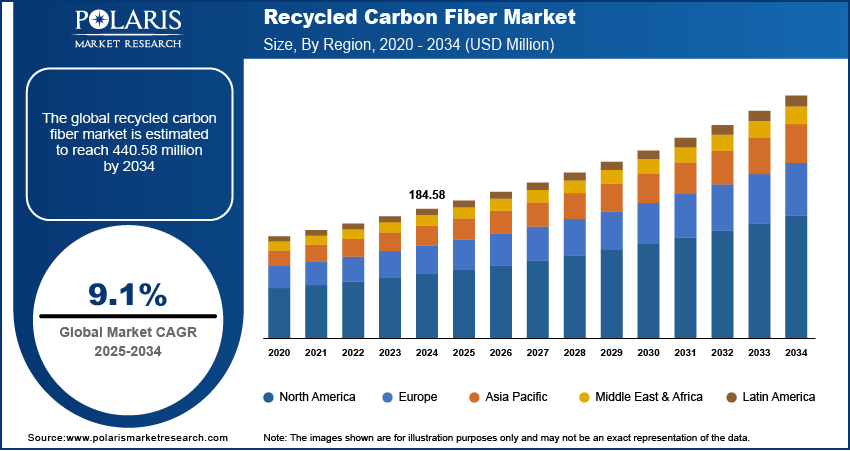

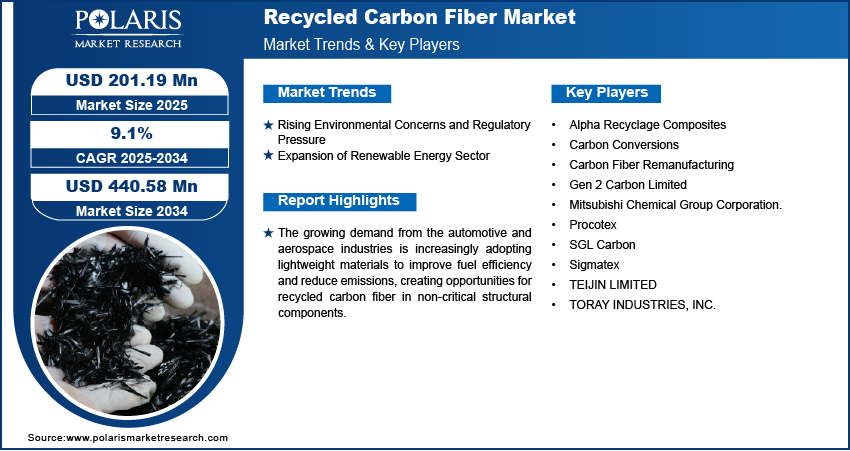

The global recycled carbon fiber market size was valued at USD 184.58 million in 2024 and is projected to register a CAGR of 9.1% during 2025–2034. The growing automotive and aerospace industries are increasingly adopting lightweight materials to improve fuel efficiency and reduce emissions, creating opportunities for recycled carbon fiber in non-critical structural components. For instance, in January 2025, the China Passenger Car Association (CPCA) reported that China produced around 2.11 million passenger vehicles, up 3.6% year on year. Exports totaled 380,000 units, reflecting a 3% increase from the previous year.

The recycled carbon fiber market refers to the industry involved in the collection, processing, and reuse of carbon fiber waste generated from manufacturing processes or end-of-life products. Carbon fiber is a lightweight material, high-strength material widely used in aerospace, automotive, wind energy, and sporting goods industries. However, its production is energy-intensive and costly, leading to a growing focus on recycling to reduce environmental impact and material costs. Recycling carbon fiber involves recovering fibers from pre-consumer scrap (production waste) or post-consumer waste (discarded products) using methods such as pyrolysis, solvolysis, and mechanical recycling. The resulting recycled carbon fiber retains much of its original strength and is used in various applications, especially where cost efficiency and sustainability are priorities. The expensive and energy-intensive production process of virgin carbon fiber is pushing manufacturers to adopt recycled alternatives that offer comparable performance at a lower cost.

To Understand More About this Research: Request a Free Sample Report

Innovations in recycling techniques such a microwave-assisted pyrolysis and chemical solvolysis have improved fiber quality and recovery rates, making recycling more economically viable. Additionally, companies across industries are integrating sustainable materials into their supply chains to meet environmental, social, and governance (ESG) targets, boosting the adoption of recycled carbon fiber.

Market Dynamics

Rising Environmental Concerns and Regulatory Pressure

Growing awareness of environmental degradation has led governments to impose stringent regulations on industrial waste and carbon emissions. For instance, in March 2024, the EPA finalized the Multi-Pollutant Emissions Standards for light-duty and medium-duty vehicles, effective for model years 2027 and onward. This rule sets stricter emissions limits to reduce harmful air pollutants and enhance air quality protections. Many countries are pushing for circular economy models that emphasize recycling and reuse. These policies make it more expensive and difficult for industries to dispose of carbon fiber waste in landfills. As a result, companies are turning to recycled carbon fiber as a sustainable alternative. Regulatory support in the form of subsidies, tax incentives, and green certifications further encourages adoption. This shift helps businesses comply with environmental laws and also enhances their sustainability image, aligning with global climate goals and consumer expectations.

Expansion of Renewable Energy Sector

The renewable energy sector, particularly wind power, is expanding rapidly to meet clean energy targets. For instance, the Biden-Harris administration has approved the Maryland Offshore Wind Project, the tenth commercial-scale offshore wind initiative under President Biden. This approval adds to over 15 gigawatts of offshore wind capacity authorized, nearing the administration's goal of 30 gigawatts by 2030. The projects approved so far are expected to supply renewable energy to about 5.25 million homes. Wind turbine blades, often made from composite materials containing carbon fiber, have long lifespans but eventually reach end-of-life. Disposal of these massive blades poses significant environmental challenges. In response, recycling initiatives are gaining momentum to recover valuable carbon fiber. The growing volume of decommissioned blades presents a major opportunity for the recycled carbon fiber industry. Companies are investing in technologies to extract and repurpose fibers, supporting both resource efficiency and sustainability in the energy transition.

Segment Insights

Market Assessment by Source

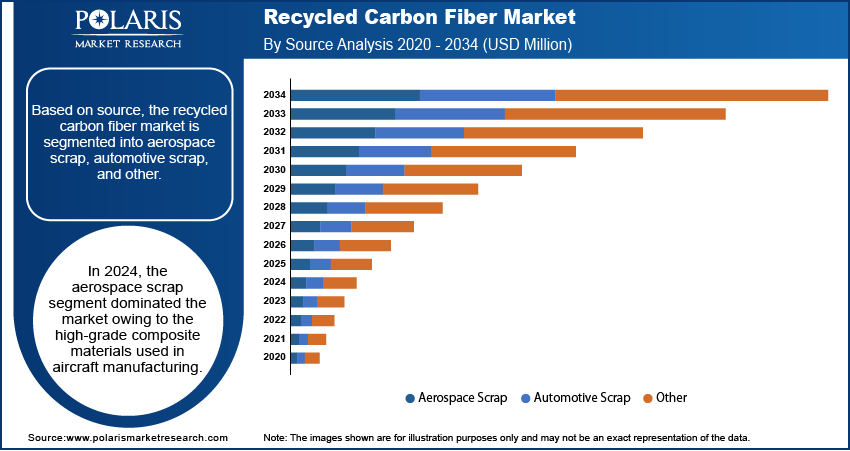

Based on source, the segmentation includes aerospace scrap, automotive scrap, and others. In 2024, the aerospace scrap segment dominated the market owing to the high-grade composite materials used in aircraft manufacturing. Retired aircraft and production off-cuts generate substantial volumes of carbon fiber scrap, which retains excellent mechanical properties even after recovery. The consistency and strength of aerospace-grade carbon fiber make it particularly suitable for reuse in demanding structural applications, thus driving its appeal among recyclers and manufacturers seeking performance-driven, cost-efficient alternatives to virgin carbon fiber.

The automotive scrap segment is projected to register the highest CAGR during the forecast period, due to rising initiatives within the automotive industry to improve sustainability and reduce production costs. Increased use of carbon fiber-reinforced composites in EVs and lightweight vehicle platforms is leading to greater scrap generation. Recovery and reuse of this material enable manufacturers to meet regulatory targets for emissions and material recycling, creating a strong incentive for integrating recycled carbon fiber into new automotive components.

Market Assessment by Type

Based on type, the segmentation includes chopped fiber and milled fiber. In 2024, the chopped fiber segment held a larger share, due to its wide applicability in thermoplastic compounding and compression molding processes. Its compatibility with automated manufacturing systems and superior reinforcement capabilities make it the preferred format in high-volume industries such as automotive and electronics. Chopped fibers deliver a strong balance of mechanical performance and processing efficiency, especially in parts that require strength, stiffness, and dimensional stability.

The milled fiber segment is projected to grow at a faster pace during the forecast period due to its rising use in coatings, adhesives, and 3D printing filaments. Milled recycled carbon fiber offers excellent surface area and dispersibility, improving electrical conductivity, wear resistance, and thermal stability in formulated products. Its ability to enhance functional properties without significantly altering viscosity or density makes it ideal for emerging applications in smart materials and conductive polymers.

Market Evaluation by End Use

Based on end use includes automotive & transportation, consumer goods, sporting goods, industrial, aerospace & defense, marine, and others. In 2024, In 2024, the automotive & transportation segment emerged as the largest end-use category due to escalating demand for lightweight, high-performance materials in electric vehicles and structural components. Recycled carbon fiber meets the industry's need for cost-effective, sustainable alternatives to virgin composites. Major OEMs are integrating recycled carbon fiber into under-the-hood applications, interior parts, and body panels to align with circular economy goals and reduce vehicle mass for improved efficiency.

The marine segment is projected to grow significantly over the forecast period due to the increasing adoption of recycled carbon fiber in hulls, decks, and interior structures of leisure boats, yachts, and unmanned marine vessels. Moreover, the material's inherent corrosion resistance, high strength-to-weight ratio, and fatigue durability are critical performance characteristics in harsh, saltwater environments, which is propelling the demand. Manufacturers in the marine industry are exploring sustainable alternatives to traditional composites, and recycled carbon fiber presents a cost-efficient solution without compromising structural integrity. Design flexibility and improved fuel efficiency through weight reduction further support its integration into advanced marine applications, particularly in custom and performance-driven vessel segments.

Regional Analysis

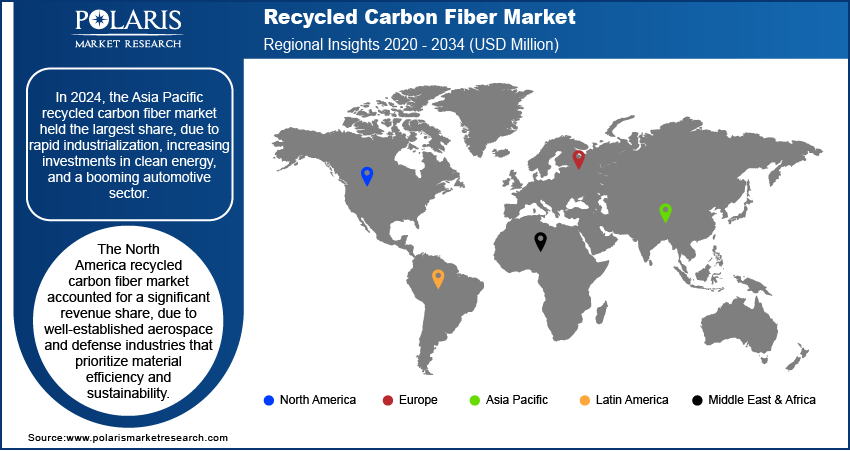

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific recycled carbon fiber market held the largest share due to rapid industrialization, increasing investments in clean energy, and a booming automotive sector. According to the Zero Carbon Analytics, since 2020, ASEAN has experienced a robust annual growth rate of ∼15% in international investment projects related to renewable energy, surpassing the global average of 11%. By 2022, total investments in this sector within the region surged to USD 43 billion, reflecting a significant trend toward sustainable energy development. Countries such as Japan, South Korea, and India played a key role by adopting advanced recycling technologies and promoting circular economy practices. The region's expanding aerospace manufacturing base also contributed to demand. In addition, growing awareness about sustainable materials among manufacturers led to higher adoption of recycled carbon fiber in applications ranging from electronics to infrastructure.

The China recycled carbon fiber market held the dominant share in the region in 2024, due to strong government support for green manufacturing and electric vehicles (EVs). According to the International Energy Agency, in 2024, China dominated the electric vehicle (EV) market, with electric cars including nearly 50% of total automotive sales. The country recorded over 11 million units sold, reflecting a significant escalation in EV adoption and market penetration compared to previous years. Policies mandating waste reduction and resource reuse spurred investment in recycling infrastructure. Chinese automakers increasingly used lightweight composites to meet fuel efficiency targets, boosting domestic demand. Local companies expanded their capabilities in processing carbon fiber waste from wind turbines and aircraft parts. Also, China’s aggressive push toward renewable energy created a large volume of decommissioned turbine blades, further driving the need for effective recycling solutions.

The North America recycled carbon fiber market accounted for a significant revenue share in 2024, due to well-established aerospace and defense industries that prioritize material efficiency and sustainability. The US Department of Energy and other agencies funded research into composite recycling, supporting innovation in recovery methods. Automotive manufacturers adopted recycled carbon fiber for light weighting in high-performance and electric vehicles. A strong regulatory framework on waste management and emissions encouraged companies to integrate recycled materials. Additionally, partnerships between material suppliers and end-use industries helped scale up commercial applications across multiple sectors.

The US recycled carbon fiber market held the dominant share in North America in 2024. owing to its mature composites industry and early adoption of recycling technologies. Major players in the aerospace and automotive sectors actively integrated recycled carbon fiber into production lines to cut costs and meet environmental goals. Federal incentives for green manufacturing and landfill diversion pushed companies toward sustainable alternatives. Research institutions and private firms collaborated on improving fiber recovery techniques. Also, the country generated high volumes of carbon fiber waste from military equipment, aircraft, and wind farms, creating a consistent feedstock supply for recyclers.

The Europe recycled carbon fiber market is expected to grow significantly during the forecast period, due to strict EU directives on waste reduction and product lifecycle sustainability. Countries such as Germany, France, and the UK led efforts to incorporate recycled materials in the automotive, aviation, and construction sectors. European automakers embraced lightweight composites to comply with CO₂ emission norms, while wind energy expansion increased the need to recycle old turbine components. Government-backed R&D programs supported the development of chemical and thermal recycling methods. Consumer demand for eco-friendly products also influenced brand owners to source recycled carbon fiber, strengthening market growth across the region.

Key Players and Competitive Analysis Report

The competitive landscape of the recycled carbon fiber industry is highly dynamic, shaped by continuous technology advancements, evolving market expansion strategies, and increasing emphasis on sustainable material solutions. Industry players are focusing on strategic alliances, joint ventures, and mergers and acquisitions to strengthen their foothold and enhance recycling capabilities. Many firms are leveraging product launches that highlight improved fiber recovery rates and superior material performance to differentiate themselves in a crowded marketplace. Post-merger integration is playing a crucial role in consolidating expertise and scaling up production capacities across key regions. Companies are also aligning with end-use industries such as automotive, aerospace, and renewable energy to tailor recycled fiber applications. Industry analysis reveals a growing trend toward vertical integration, where manufacturers are partnering with waste suppliers to secure raw material streams. As environmental regulations tighten, competitive advantage is being driven by innovation in pyrolysis, solvolysis, and mechanical recycling methods. The market continues to evolve through collaborative efforts aimed at achieving circularity and cost efficiency.

Toray Industries, Inc., is a global company known for its diverse portfolio of products and cutting-edge innovations. Specializing in fibers and textiles, performance chemicals, carbon fiber composite materials, environmental engineering, and life sciences, Toray is operating in various industries. The company is engaged in manufacturing, processing, and sales of various products, including fibers and textiles such as nylon, polyester, and acrylic fabrics; performance chemicals such as resins, molded products, and films; carbon fiber composite materials and related products; environmental engineering solutions; life science products including pharmaceuticals and medical devices; and offering services such as analysis, physical evaluation, and research.

Mitsubishi Chemical Corporation (MCC) is a global chemical and materials company that operates under the Mitsubishi Chemical Holdings Corporation, one of the chemical companies in Japan. MCC offers products in various industries, including automotive, electronics, healthcare, and agriculture. MCC's product portfolio is vast and diverse, encompassing a wide range of chemical and materials solutions, including advanced materials such as high-performance resins, films, and composites. These materials have applications in automotive components, electronic devices, and aerospace technologies, ensuring lightweight, durable, and energy-efficient solutions for various industries.

List of Key Companies

- Alpha Recyclage Composites

- Carbon Conversions

- Carbon Fiber Remanufacturing

- Gen 2 Carbon Limited

- Mitsubishi Chemical Group Corporation.

- Procotex

- SGL Carbon

- Sigmatex

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

Recycled Carbon Fiber Industry Developments

In March 2025, Syensqo and Vartega partnered to repurpose industrial carbon fiber waste into high-performance materials. Under the collaboration, Vartega applied its proprietary technology to convert Syensqo’s dry carbon fiber and prepreg waste into EasyFeed Bundles. These recycled fibers were then incorporated into Syensqo’s ECHO line of carbon fiber-reinforced polymers, widely used in automotive applications.

In December 2023, Toray Industries, Inc. developed recycled carbon fiber from waste generated during Boeing 787 component production, using its TORAYCA carbon fiber. This initiative provided a high-quality recycled material source, demonstrating its suitability for use in performance-critical industries and supporting broader adoption in aerospace and other sectors.

Recycled Carbon Fiber Market Segmentation

By Source Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Aerospace Scrap

- Automotive Scrap

- Other

By Type Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Chopped Fiber

- Milled Fiber

By End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Automotive & Transportation

- Consumer Goods

- Sporting Goods

- Industrial

- Aerospace & Defense

- Marine

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Recycled Carbon Fiber Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 184.58 million |

|

Market Size Value in 2025 |

USD 201.19 million |

|

Revenue Forecast by 2034 |

USD 440.58 million |

|

CAGR |

9.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 184.58 million in 2024 and is projected to grow to USD 440.58 million by 2034.

The global market is projected to register a CAGR of 9.1% during the forecast period.

In 2024, the Asia Pacific recycled carbon fiber market held the largest share due to rapid industrialization, increasing investments in clean energy, and a booming automotive sector.

A few of the key players are Alpha Recyclage Composites; Carbon Conversions; Carbon Fiber Remanufacturing; Gen 2 Carbon Limited; Mitsubishi Chemical Group Corporation; Procotex; SGL Carbon; Sigmatex; TEIJIN LIMITED; and TORAY INDUSTRIES, Inc.

In 2024, the aerospace scrap segment dominated the recycled carbon fiber market, owing to the high-grade composite materials used in aircraft manufacturing.

In 2024, the chopped fiber segment held the largest share due to its wide applicability in thermoplastic compounding and compression molding processes.