Recycled Styrenics Market Size, Share, & Industry Analysis Report

By Application [Packaging, Automotive, Electronics & Electrical (E&E), Construction, and Other Applications], By Type, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5791

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

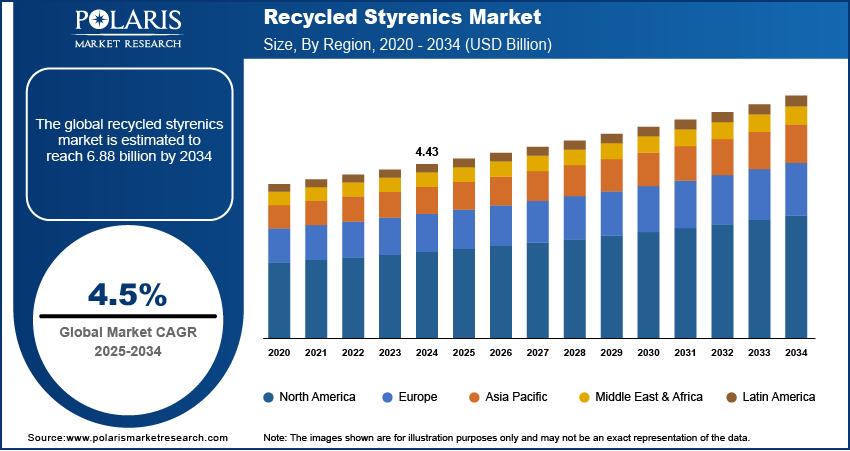

The global recycled styrenics market size was valued at USD 4.43 billion in 2024, growing at a CAGR of 4.5% during 2025–2034. The growth is driven by the increasing focus on fire resistance and thermal management.

Recycled styrenics refer to polystyrene and other styrene-based plastics that are reprocessed from post-consumer or post-industrial waste into reusable materials, supporting sustainability in plastic applications. Their demand is being driven by strict environmental regulations and policies promoting a circular economy. For instance, a 2023 European Commission report highlighted the 2020 Circular Economy Action Plan (CEAP), which promotes sustainable resource use and climate goals. In 2023, new tracking metrics were introduced alongside initiatives to control micro plastics recycling, such as REACH restrictions and pellet loss prevention measures. Governments and international bodies are increasingly implementing regulatory frameworks that restrict single-use plastics and mandate recycling targets, convincing manufacturers to adopt recycled alternatives. These policy shifts are boosting industrial demand for recycled styrenics as companies aim to align with compliance standards and reduce their environmental footprint. In addition, extended producer responsibility (EPR) regulations are further motivating brands to invest in recycled content, thereby bolstering the market landscape for recycled styrenics.

The market growth is attributed to consumer awareness and preference for green premium products as environmental concerns continue to escalate. Consumers are becoming more conscious of the impact of plastic waste on ecosystems and are actively choosing products made with recycled materials. This growing demand is impacting brand strategies, encouraging companies across the packaging, automotive, and consumer goods sectors to integrate recycled styrene into their product lines. For instance, in March 2025, Green Lab, a subsidiary of Frasers & Neave Group, expanded into the US market, offering FSC-certified recycled paper bags and cost-competitive green packaging. The shift toward sustainable consumption is shaping purchasing behavior and also encouraging manufacturers to improve their recycling capabilities and innovate in circular product design. This consumer-driven trend reinforces the long-term growth.

Industry Dynamics

Growing Demand for Sustainable Packaging Solutions Across Industries

Businesses increasingly prioritize environmentally responsible alternatives to meet both regulatory requirements and shifting consumer preferences. In September 2024, the US EDA granted USD 500,000 to the University of Wisconsin-Stevens Point to advance sustainability in Wisconsin’s packaging, supporting research and development efforts in the sector. Industries such as food and beverage, electronics, and personal care are actively seeking recyclable and low-impact materials to reduce their carbon footprint. The adoption of recycled content in packaging improves brand sustainability credentials and also aligns with global initiatives aimed at minimizing plastic waste. Thus, the growing demand for sustainable packaging solutions across industries is boosting growth opportunities.

Advancements in Recycling Technologies for Styrenic Polymers

Advancements in recycling technologies for styrenic polymers are improving the quality, efficiency, and scalability of recycling processes, thereby fueling market growth. Innovations such as chemical recycling, de-polymerization, and closed-loop systems are allowing the recovery of high-purity styrenics with properties comparable to virgin materials. These technological improvements are addressing historical limitations related to contamination, degradation, and cost-effectiveness, making them more feasible for a wider range of applications. Manufacturers are increasingly integrating recycled content into their production cycles as recycling processes become more refined and economically feasible. In July 2024, Versalis (Eni) and Forever Plast launched REFENCE, a new line of food-contact recycled polymers, such as polystyrene for yogurt pots and meat trays. The products enable safe food packaging with recycled materials. This progress in recycling technology supports circular economy goals and strengthens the supply chain for sustainable styrenic materials.

Segmental Insights

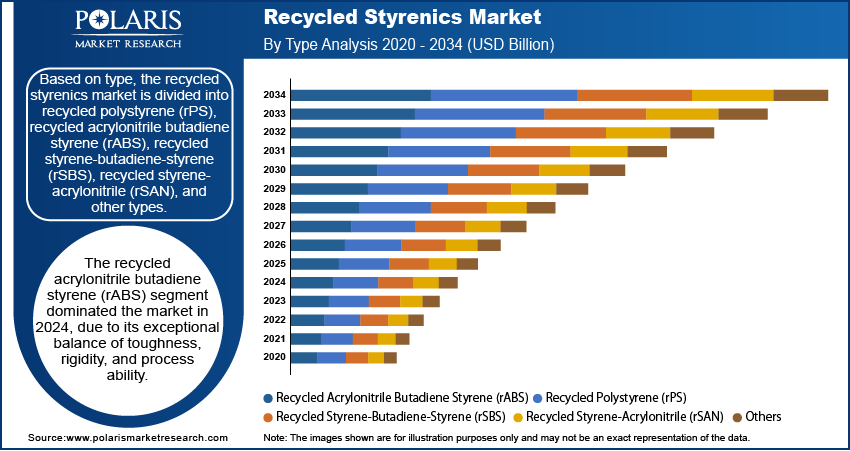

By Type Analysis

The segmentation, based on type, includes recycled polystyrene (rPS), recycled acrylonitrile butadiene styrene (rABS), recycled styrene-butadiene-styrene (rSBS), recycled styrene-acrylonitrile (rSAN), other types. The recycled acrylonitrile butadiene styrene (rABS) segment dominated the market in 2024 due to its exceptional balance of toughness, rigidity, and processability. rABS is valued for its ability to maintain mechanical properties even after recycling, as it is widely used across automotive, electronics, and consumer goods industries. Its excellent resistance to heat and impact makes it ideal for high-performance applications where durability is critical. The demand for rABS has increased as industries shift toward integrating more sustainable materials without compromising product quality. Moreover, its compatibility with advanced recycling techniques has strengthened its position.

By Application Analysis

The segmentation, based on application, includes packaging, automotive, electronics & electrical (E&E), construction, and other applications. The automotive segment is expected to witness fastest growth during the forecast period driven by the increasing adoption of recycled materials in-vehicle components to support sustainability targets and reduce production costs. Automakers are integrating recycled styrenics such as rABS and rPS in interior panels, trims, and under-the-hood applications due to their lightweight nature and robust performance. The shift toward electric vehicles and environmentally conscious manufacturing has boosted the demand for recyclable materials in this sector. The automotive industry is accelerating its transition to circular materials as regulatory pressures on vehicle emissions and end-of-life recycling mandates increase, thereby boosting the uptake of recycled styrenics.

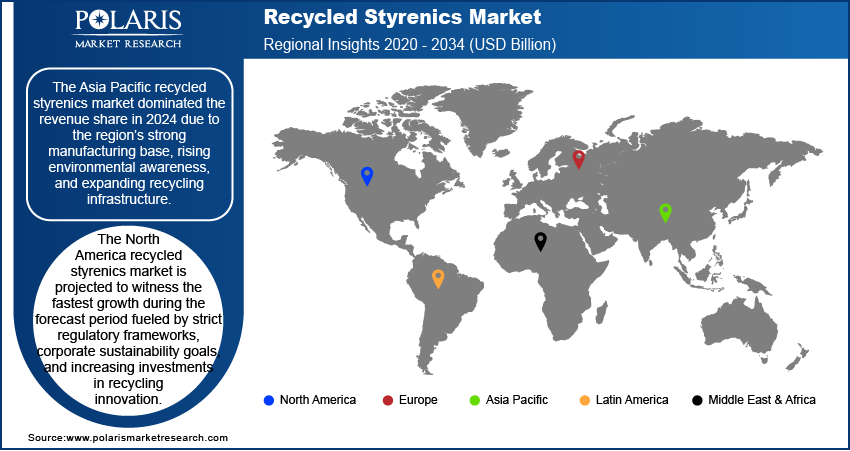

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific recycled styrenics market dominated the revenue share in 2024 due to the region’s strong manufacturing base, rising environmental awareness, and expanding recycling infrastructure. Government initiatives promoting plastic recycling and circular economy models are further driving demand for recycled styrenics. An April 2025 report from the Ministry of Chemicals and Fertilizers stated that India's Department of Chemicals and Petrochemicals launched the Plastic Parks Scheme, offering 50% grant funding of USD 4.8 million per project to develop advanced infrastructure for plastic processing. The initiative aims to boost sectoral growth while promoting circular economy practices such as recycling and biodegradable alternatives. Additionally, the presence of large-scale plastic processors and cost-effective labor has positioned Asia Pacific as a major hub for both production and consumption of recycled styrenic materials.

The China recycled styrenics market is at the forefront of adopting sustainable practices across the packaging, automotive, and electronics industries due to its strong policy push toward circular economy models and aggressive plastic waste reduction targets. The country's investments in large-scale recycling infrastructure and support for industrial green transformation accelerate the integration of recycled materials, such as styrenics, across major manufacturing sectors.

The North America recycled styrenics market is projected to witness the fastest growth during the forecast period fueled by strict regulatory frameworks, corporate sustainability goals, and increasing investments in recycling innovation. Companies across sectors are actively incorporating recycled polymers into their products to meet ESG targets and align with consumer demand for environmentally responsible solutions. Advancements in material recovery and chemical recycling are also expanding the usability of recycled styrenics in high-performance applications. A 2025 University of Bath report outlined a polystyrene recycling method developed by US researchers. The energy-efficient process will make polystyrene reuse viable for the first time, addressing current recycling rates below 5%. The method may replace 60% of polystyrene with chemically recycled styrene. Moreover, growing collaborations between government and industry players are accelerating the development of circular supply chains, further propelling market growth in the region.

The US recycled styrenics market growth is driven by increasing corporate sustainability commitments and advancements in recycling technologies that support high-quality material recovery. The presence of organized collection systems, coupled with consumer demand for eco-friendly products, is encouraging manufacturers to integrate it into a wider range of applications.

The Europe recycled styrenics market is projected to witness substantial growth during the forecast period, supported by strict EU regulations on plastic waste management and circular economy mandates. European countries are implementing strong strategies to reduce plastic pollution, which includes the widespread promotion of recycled materials across various industries. The region’s strong focus on sustainable packaging, automotive emission reductions, and green procurement policies is driving the demand for high-quality styrenics. Furthermore, the presence of leading recycling technology providers and supportive funding for innovation is enabling a favorable environment for expansion.

The UK recycled styrenics market growth is fueled by strict environmental regulations, plastic packaging taxes, and government-led initiatives promoting waste reduction and material reuse. The country’s focus on achieving net-zero goals and transitioning to a circular economy is encouraging businesses to adopt recycled alternatives, particularly in high-impact sectors such as retail, automotive, and electronics.

Key Players & Competitive Analysis Report

The recycled styrenics sector is witnessing growth, driven by sustainable value chains and strategic investments in advanced recycling technologies. Industry trends highlight the increasing adoption of chemical recycling methods, which addresses the latent demand for cost-effective solutions. Developed markets lead in revenue opportunities, supported by strict regulations and circular economy policies. Meanwhile, emerging markets gain traction through expansion opportunities in packaging and automotive applications. Competitive intelligence reveals major players such as INEOS Styrolution and Trinseo are leveraging disruptive technologies to improve material efficiency and meet ESG goals. Vendors focus on partnerships, such as Versalis and Forever Plast’s food-grade rPS to unlock growth projections in high-value segments. Economic and geopolitical shifts, such as EU microplastics regulations and India’s Plastic Parks Scheme, are reshaping regional footprints. A few key players are Agilyx, Americas Styrenics LLC, BASF, INEOS Styrolution Group GmbH, LG Chem, MBA Polymers Inc., Nexus Circular, Poly Source LLC., Styropek, and Trinseo.

Key Players

- Agilyx

- Americas Styrenics LLC

- BASF

- INEOS Styrolution Group GmbH

- LG Chem

- MBA Polymers Inc.

- Nexus Circular

- Poly Source LLC.

- Styropek

- Trinseo

Industry Developments

April 2025: Simoldes Plastics partnered with ELIX Polymers to integrate recycled materials into premium vehicle interiors. The collaboration supports Simoldes' goal to increase renewable material usage by 40%, utilizing ELIX's E-LOOP PC/ABS with 30% post-consumer recyclate from water bottles.

February 2025: Trinseo launched Europe's first transparent dissolution-recycled polystyrene (rPS) for direct food contact, complying with EU Regulation 2022/1616. The product marks a milestone in sustainable food-grade packaging solutions.

December 2024: INEOS Styrolution produced mechanically recycled polystyrene for yogurt cups, collaborating with value-chain partners. The process involved advanced sorting, washing, and its EU-certified "super clean" technology compliant with Regulation 2022/1616.

Recycled Styrenics Market Segmentation

By Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Recycled Polystyrene (rPS)

- Recycled Acrylonitrile Butadiene Styrene (rABS)

- Recycled Styrene-Butadiene-Styrene (rSBS)

- Recycled Styrene-Acrylonitrile (rSAN)

- Other types

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Packaging

- Automotive

- Electronics & Electrical (E&E)

- Construction

- Other applications

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Recycled Styrenics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.43 billion |

|

Market Size in 2025 |

USD 4.63 billion |

|

Revenue Forecast by 2034 |

USD 6.88 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.43 billion in 2024 and is projected to grow to USD 6.88 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Agilyx, Americas Styrenics LLC, BASF, INEOS Styrolution Group GmbH, LG Chem, MBA Polymers Inc., Nexus Circular, Poly Source LLC., Styropek, and Trinseo.

The recycled acrylonitrile butadiene styrene (rABS) segment dominated the market in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.