Remote Patient Monitoring System Market Size, Share, Trends, Industry Analysis Report

By Product (Vital Sign Monitors, Special Monitors), By End Use, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6206

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

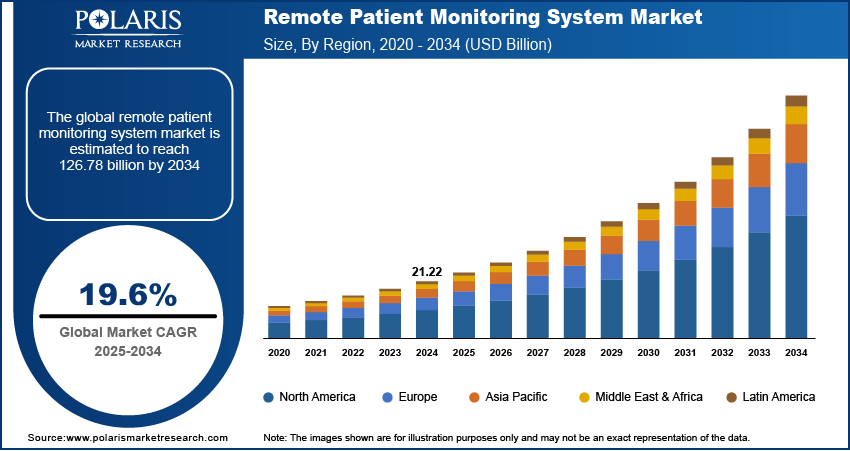

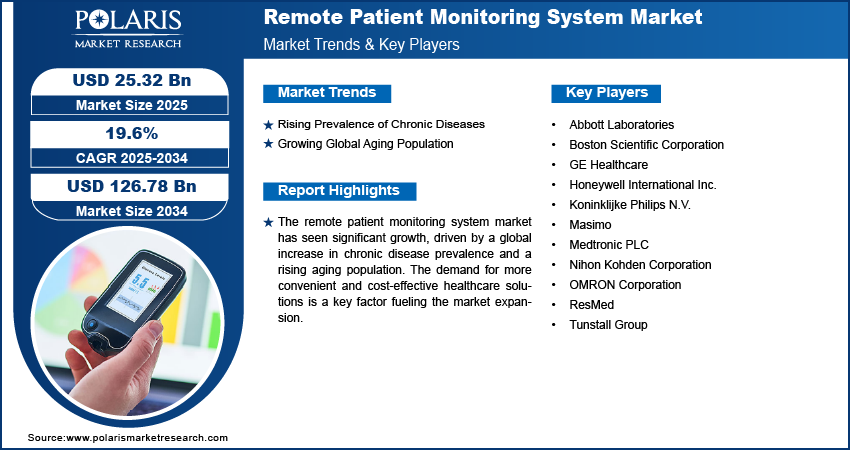

The global remote patient monitoring (RPM) system market size was valued at USD 21.22 billion in 2024 and is anticipated to register a CAGR of 19.6% from 2025 to 2034. The increasing number of people affected by chronic diseases and the world's aging population are major growth factors. These dynamics are driving the demand for home-based care solutions. The rising use of digital health technologies such as digital patient monitoring and government support for telehealth services, also boosts the market.

Key Insights

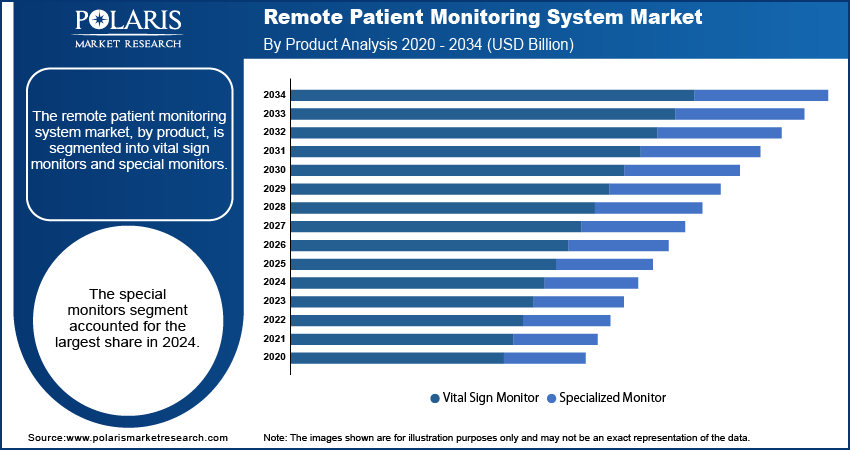

- By product, the special monitors segment held the largest share in 2024, as these devices provide specific and critical data for patients suffering from complex conditions such as heart failure and diabetes. Their use is crucial for specialized healthcare management, which contributes to their market dominance.

- Based on end use, the hospitals based patients segment held the largest share in 2024. This is driven by their use in post-discharge care and for managing complex conditions within the hospital's infrastructure, which helps improve patient outcomes and increase efficiency.

- In terms of application, the cardiovascular diseases segment held the largest share in 2024, due to the high prevalence of heart-related conditions and the critical need for constant monitoring to prevent major health events.

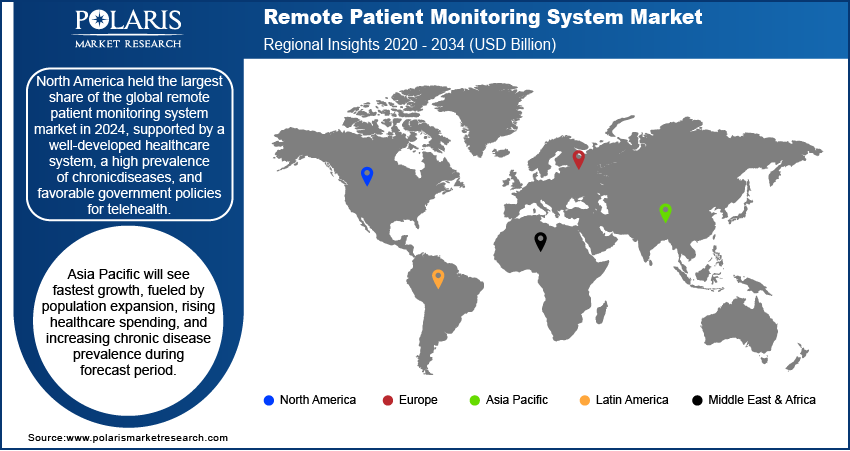

- By region, North America holds the largest regional share of the market, supported by a well-developed healthcare system, a high prevalence of chronic diseases, and favorable government policies for telehealth.

Industry Dynamics

- There is an increasing prevalence of chronic diseases such as diabetes and heart failure, which require constant monitoring. This growing need for continuous patient observation from home is a key growth factor.

- The aging population is expanding globally, leading to a higher demand for convenient and accessible healthcare solutions. This demographic shift is driving the adoption of remote monitoring technologies for elderly care.

- Technological advancements in digital health, such as wearable sensors and mobile apps, are making these systems more effective and easier to use. This development is boosting the demand for solutions that can provide real-time patient data to healthcare providers.

Market Statistics

- 2024 Market Size: USD 21.22 billion

- 2034 Projected Market Size: USD 126.78 billion

- CAGR (2025–2034): 19.6%

- North America: Largest market in 2024

AI Impact on Remote Patient Monitoring System Market

- AI integration enables healthcare providers to monitor numerous patients simultaneously with minimal manual effort.

- AI-powered remote patient monitoring devices and apps provide personalized feedback and health recommendations, which boost user adherence and satisfaction.

- AI provides better chronic disease management by offering continuous monitoring and insights on conditions such as diabetes, hypertension, and heart disease.

- AI algorithms reduce errors in data interpretation, which ensures more reliable monitoring.

- Market players use AI tools to collect insights from user data, refining product features and performance.

A remote patient monitoring (RPM) system is a technology that allows healthcare providers to monitor a patient's health data from a distance, outside of traditional clinical settings. These systems use digital devices to collect various health data, such as blood pressure or heart rate, and then securely send this information to a patient's care team. This allows for continuous oversight and can lead to faster intervention if a patient's condition changes.

One driver for the landscape is the growing need to provide care in rural and underserved areas. Many people live in places with limited access to healthcare facilities and specialists. Remote monitoring systems help bridge this gap by providing quality care to remote patients without requiring them to travel. This is a significant factor in promoting health equity and expanding access for vulnerable populations.

Another growth factor is the rising demand for personalized healthcare. Patients are increasingly interested in having a more active role in managing their own health. Remote monitoring devices, often in the form of easy-to-use wearables and mobile apps, give patients real-time insights into their health metrics. For example, a patient with diabetes can track their glucose levels with a continuous glucose monitor that sends the data to their phone and doctor. The National Library of Medicine (NLM) has shown that this type of self-management can improve patient engagement and health outcomes.

Drivers and Trends

Rising Prevalence of Chronic Diseases: Chronic conditions such as diabetes, hypertension, and heart failure require constant management and monitoring of vital signs. Remote monitoring systems allow for this continuous oversight from the comfort of a patient's home, which can help prevent complications and reduce hospital readmissions.

Remote patient monitoring systems offer a way for doctors to get real-time health data, which enables them to adjust treatment plans quickly. This is especially helpful for patients who need regular check-ups but have trouble traveling to a clinic. As chronic diseases become more common, the demand for effective and convenient monitoring tools grows, which is why remote patient monitoring systems are becoming a necessary part of modern healthcare.

According to a November 2024 article from the Centers for Disease Control and Prevention (CDC) in "Preventing Chronic Disease," over half of the U.S. adults with prediabetes or diabetes used telemedicine in the previous 12 months. This highlights the widespread use of remote technology for managing these specific conditions. The article, titled "Telemedicine Use Among Adults With and Without Diagnosed Prediabetes or Diabetes, National Health Interview Survey, United States, 2021 and 2022," demonstrates how the need for chronic disease management is directly fueling the demand for remote healthcare solutions. Therefore, the rising prevalence of chronic diseases boosts the remote patient monitoring system market growth.

Growing Global Aging Population: As people live longer, there is a greater need for long-term care solutions that support independent living and manage age-related health conditions. Remote patient monitoring systems allow older adults to “age in place” by providing continuous health surveillance without the need for constant in-person visits or moving to a care facility.

Remote monitoring systems give caregivers and family members peace of mind by alerting them to potential health issues in real time. They also help reduce the financial burden on healthcare systems by lowering hospital stays and clinic visits. The need to provide high-quality, long-term care for an expanding elderly population is a key reason for the rising adoption of these technologies.

A World Health Organization (WHO) fact sheet from October 2024, titled "Ageing and health," states that the number of people aged 60 years and above is expected to more than double between 2020 and 2050. It also notes that common conditions in older age include chronic obstructive pulmonary disease (COPD), diabetes, and heart disease. This demographic shift and the associated health challenges are creating a substantial demand for technologies that can manage these conditions remotely. Hence, the global increase in the elderly population drives the market growth.

Segmental Insights

Product Analysis

Based on product, the segmentation includes vital sign monitors and special monitors. The special monitors segment held the largest share in 2024, due to their ability to provide highly specific and critical data for patients affected by complex and specialized health conditions. Special monitors include devices for cardiac rhythm, blood glucose, and respiratory monitoring, which are crucial for managing diseases such as heart failure, diabetes, and sleep apnea. The growing global prevalence of chronic illnesses, along with the increasing adoption of personalized and condition-specific care plans, is accounting for this segment's leading position. These devices often offer more advanced features and deeper insights into a patient's specific health needs, making them essential tools for specialized healthcare management. Their widespread use in hospital settings and home care for targeted conditions has driven their dominance.

The vital sign monitors segment is anticipated to register the highest growth rate during the forecast period. This category includes devices for monitoring basic but essential metrics such as blood pressure, heart rate, and body temperature. The rapid growth is being fueled by several factors, including the increasing focus on preventive care and general wellness monitoring. As more people become proactive about their health, they are turning to easy-to-use, often wearable, vital sign monitors to keep track of their basic health data. The affordability and user-friendly nature of many of these devices are also making them widely accessible to a broader consumer base. Furthermore, the foundational nature of vital sign monitoring means these devices are used across a wide range of patients, from those with chronic conditions to those recovering from surgery. The demand for these devices is expected to grow significantly as they become a standard part of home healthcare and telehealth services.

End Use Analysis

Based on end use, the segmentation includes hospitals based patients, ambulatory patients, and home healthcare. The hospitals based patients segment held the largest share in 2024. Hospitals serve a large number of patients, both in-house and as outpatients, and have the infrastructure to implement these complex systems. In hospital settings, remote monitoring systems are often used for post-discharge care, where patients are monitored at home to prevent readmissions or manage complex chronic conditions. Hospitals also have dedicated technical staff to manage the systems and analyze data collected from patients. The demand for these systems within hospitals is high as they are seen as a tool to improve patient outcomes, reduce costs, and increase efficiency in the delivery of care. The high volume of patients and the clear need for advanced monitoring solutions in this environment have made this a dominant segment.

The home healthcare segment is anticipated to register the highest growth rate during the forecast period, due to a strong preference from both patients and providers for receiving and giving care in a home setting. The growth is fueled by an aging population that wants to maintain independence, as well as a rise in chronic diseases that can be managed effectively from home. Home healthcare services use these monitoring systems to provide continuous care and track a patient's progress without requiring them to visit a clinic. The advancement of easy-to-use, often wearable, devices has made this type of care more accessible and practical. As healthcare systems seek ways to lower costs and improve patient satisfaction, the home healthcare model, supported by remote monitoring technology, is gaining significant traction and is expected to expand rapidly during the forecast period.

Application Analysis

Based on application, the segmentation includes cancer, cardiovascular diseases, diabetes, sleep disorder, weight management & fitness monitoring, bronchitis, infections, virus, dehydration, and hypertension. The cardiovascular diseases segment held the largest share in 2024, owing to the widespread occurrence of heart-related conditions and the critical need for constant monitoring to prevent severe events such as heart attacks and strokes. Remote monitoring devices, such as ECG monitors and blood pressure cuffs, are essential for managing conditions such as hypertension and heart failure from home. These systems provide healthcare providers with real-time data, allowing for prompt interventions and better management of a patient's condition. The aging population, which is more prone to cardiovascular issues, further boosts the demand for these monitoring solutions.

The cardiovascular diseases segment is anticipated to register the highest growth rate during the forecast period. This is driven by several factors, including the increasing prevalence of cardiovascular diseases globally and the continuous development of more advanced and user-friendly remote monitoring devices. Technological improvements in sensors, data analytics, and connectivity have made these devices more effective at detecting and predicting potential cardiac events. The shift toward preventive and value-based care models also encourages the adoption of these systems to improve patient outcomes and reduce healthcare costs. As more healthcare providers and patients recognize the benefits of remote cardiac monitoring, this application area is expected to expand rapidly.

Regional Analysis

The North America remote patient monitoring system market held the largest global revenue share in 2024, due to a well-developed healthcare system that quickly adopts new technology, a high prevalence of chronic diseases, and a large aging population. Supportive government policies and favorable reimbursement structures for telehealth services also help drive the sector. The region has many key industry players and a strong focus on innovation, which leads to the continuous development of advanced monitoring solutions. The integration of remote monitoring into standard care pathways is well-established here, contributing to its dominance.

U.S. Remote Patient Monitoring System Market Insights

The U.S. is the largest contributor to the North America market. The country's strong healthcare infrastructure, combined with a significant and growing elderly population, creates a high demand for remote care solutions. The rising prevalence of chronic diseases such as diabetes and heart failure, along with a focus on reducing healthcare costs and hospital readmissions, drives the adoption of remote patient monitoring systems. Additionally, favorable government initiatives and insurance policies that support the use of telehealth services have made it easier for both providers and patients to use these systems.

Europe Remote Patient Monitoring System Market Trends

Europe is a key regional market for remote patient monitoring system. The region is witnessing an increase in the cases of chronic diseases and a large aging population, which is creating a need for more efficient healthcare delivery. Many European countries have well-established public healthcare systems that are increasingly seeking ways to manage patient care more effectively and reduce costs. This is also benefiting from a growing awareness of the benefits of remote monitoring for both patients and healthcare providers, such as improved patient outcomes and greater convenience. Regulatory support for digital health solutions helps promote growth in the region.

The Germany remote patient monitoring system market is a major country in Europe for this sector. The country has a very advanced healthcare system and is a leader in medical technology. With a large aging population and a high rate of chronic diseases, there is a significant need for innovative healthcare solutions. The German government has also been proactive in supporting digital health through initiatives that promote the use of remote monitoring in standard care. These factors, combined with a strong economy and a focus on patient-centered care, have made Germany a key player in the European market.

Asia Pacific Remote Patient Monitoring System Market Overview

The Asia Pacific market for remote patient monitoring system is expected to report the highest growth rate during the forecast period. This growth is being driven by factors such as a large and expanding population, increasing healthcare spending, and a growing number of people suffering from chronic diseases. Many countries in this region are also seeing rapid improvements in their healthcare infrastructure and a push to use digital technologies to improve access to care, especially in rural areas. The increasing awareness of personal health and wellness is also leading to a greater demand for home-based monitoring devices.

China Remote Patient Monitoring System Market Outlook

In Asia Pacific, China is a major contributor to the market landscape. The country has a massive population and is experiencing a rapid increase in chronic disease cases and an aging demographic. The Chinese government supports digital health and telemedicine initiatives to address the healthcare needs of its large population. There is a strong focus on improving healthcare access and efficiency, particularly in remote regions, which makes remote patient monitoring systems a crucial tool for healthcare reform.

Key Players and Competitive Insights

The competitive landscape for the remote patient monitoring system market is dynamic and includes many established medical device companies as well as new, innovative startups. The landscape is defined by strong competition, with companies focusing on product innovation, strategic partnerships, and mergers to gain a larger share. Key players are constantly adding advanced features such as artificial intelligence and machine learning to improve their product offerings and provide more accurate and predictive health insights. This drive for technological advancement is shaping the competitive dynamics. Many companies are also expanding their product portfolios to cover a wider range of health conditions, from chronic disease management to general wellness. This competitive environment encourages constant innovation to meet the growing demand for effective, user-friendly remote monitoring solutions.

A few prominent companies in the industry include Medtronic PLC, Koninklijke Philips N.V., GE Healthcare, Masimo, ResMed, Tunstall Group, Nihon Kohden Corporation, OMRON Corporation, Honeywell International Inc., Boston Scientific Corporation, and Abbott Laboratories.

Key Players

- Abbott Laboratories

- Boston Scientific Corporation

- GE Healthcare

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Masimo

- Medtronic PLC

- Nihon Kohden Corporation

- OMRON Corporation

- ResMed

- Tunstall Group

Remote Patient Monitoring System Industry Developments

April 2025: Abbott Laboratories announced the integration of its Freestyle Libre continuous glucose monitoring (CGM) data with Epic's electronic health record system.

May 2023: Medtronic PLC announced its plan to acquire EOFlow Co. Ltd., a company known for its EOPatch, a wearable and tubeless insulin patch.

Remote Patient Monitoring System Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Vital Sign Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special Monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals Based Patients

- Ambulatory Patients

- Home Healthcare

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management & Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Hypertension

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Remote Patient Monitoring System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.22 billion |

|

Market Size in 2025 |

USD 25.32 billion |

|

Revenue Forecast by 2034 |

USD 126.78 billion |

|

CAGR |

19.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.22 billion in 2024 and is projected to grow to USD 126.78 billion by 2034.

The global market is projected to register a CAGR of 19.6% during the forecast period.

North America dominated the share in 2024.

A few key players include Medtronic PLC, Koninklijke Philips N.V., GE Healthcare, Masimo, ResMed, Tunstall Group, Nihon Kohden Corporation, OMRON Corporation, Honeywell International Inc., Boston Scientific Corporation, and Abbott Laboratories.

The special monitors segment accounted for the largest share of the market in 2024.

The home healthcare segment is expected to witness the fastest growth during the forecast period.