Retail Automation Market Share, Size, Trends, Industry Analysis Report

By Product (Camera, PoS, RFID & Barcode, Others), By Implementation (In-store, Warehouse), By End-use (Fuel Stations, Supermarkets, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: pdf

- Report ID: PM4382

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

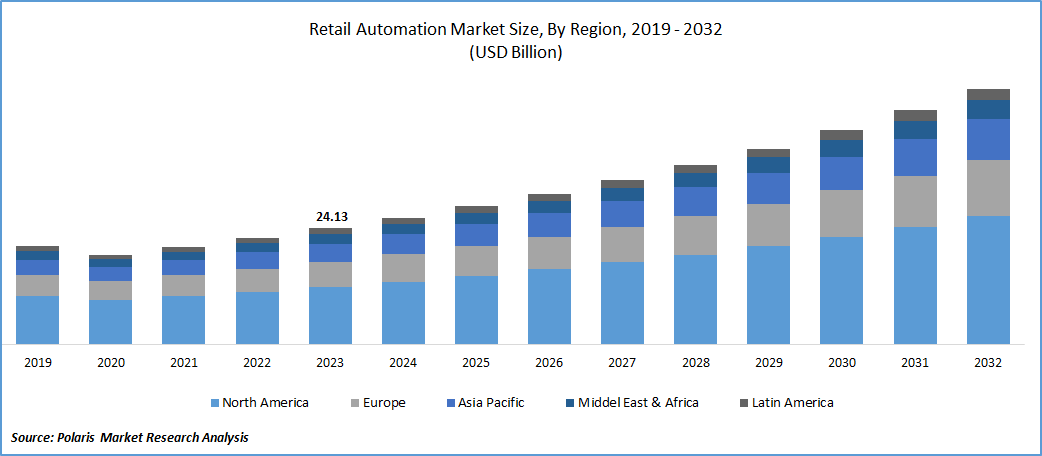

The global retail automation market was valued at USD 24.13 billion in 2023 and is expected to grow at a CAGR of 9.2% during the forecast period.

Market growth in the retail automation sector is being fueled by the need to optimize operational workflows in the retail industry, leading to improved business processes, enhanced transparency, and increased efficiency for organizations in the long term. Additionally, the adoption of retail automation software offers comprehensive visibility, eliminates redundancies, and incorporates advanced technologies like the Internet of Things (IoT) and Machine Learning (ML), further contributing to the expansion of the market. Retail operators are actively upgrading their point-of-sale (POS) systems to elevate the convenience and transparency of their stores.

To Understand More About this Research:Request a Free Sample Report

The growing inclination of consumers towards online retail transactions is anticipated to incentivize retail software providers to develop innovative retail solutions, fostering market growth. The proliferation of diverse products has heightened the need for effective warehouse and inventory management systems. Notable players in the e-commerce industry, including Amazon and Walmart, are already implementing robots to address labor shortages and meet escalating demand. Consequently, the market is poised to attract new entrants, including startups. Moreover, with a shift towards prioritizing convenience and personalized shopping experiences, technologies like automated inventory management and self-checkout systems are experiencing heightened demand.

Growing utilization of robotics automation in the retail sector is anticipated to propel market expansion. The application of automation technologies can minimize the reliance on human involvement for repetitive tasks, such as managing merchandise within the store. Automation serves as a swift and precise method for executing operations and repeating processes, enabling businesses to operate seamlessly, efficiently, and consistently. Retail automation expedites transactions and enables customers to browse merchandise through a touchscreen interface. It allows customers to choose their preferred products and make payments using credit or debit cards.

Industry Dynamics

Growth Drivers

Increasing Adoption of Integrated Cloud-Based POS Systems

Small retail establishments are increasingly adopting POS systems owing to their cost-effectiveness. These POS systems provide secure functionality within an integrated and user-friendly platform, assisting users in efficiently managing various aspects of their business through advanced technology and enhanced hardware. For instance, in January 2023, Markt POS, a provider of retail solutions, introduced a unified cloud-based POS software tailored for small and medium-sized enterprises, groceries, & supermarkets.

Hence, the market is anticipated to experience growth due to the increasing adoption of integrated cloud-based POS systems. The incorporation of advanced technology platforms like robotics process automation (RPA), artificial intelligence (AI), and machine learning (ML) is expected to result in cost reduction by automating processes throughout the retail sector. An illustrative example is the expanded partnership between Brain Corporation, a provider of robotics AI software, & Dane Technologies, aiming to develop inventory-scanning systems for retailers based on Brain Corporation's robotics platform, in November 2023.

Report Segmentation

The market is primarily segmented based on implementation, product, end use, and region.

|

By Implementation |

By Product |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Implementation Analysis

In Store Segment Accounted For the Largest Market Share in 2023

In-store segment accounted for the largest share. This is primarily due to increasing focus on omnichannel retailing, advancements in robotics and AI, and a rising demand for contactless and self-service technologies. Additionally, operators benefit from reduced maintenance costs through the automation of retail locations and the adoption of cloud-based solutions. Real-time notifications delivered via cloud platforms enable prompt issue resolution.

Warehouse segment will grow rapidly. The growing adoption of autonomous guided vehicles (AGV) & autonomous mobile robotics (AMR) in the retail sector has led to increased automation. This trend is anticipated to fuel the demand for retail automation in the coming years. Furthermore, organizations within the industry stand to gain from the implementation of cognitive technology and adjustments to their warehouse storage practices.

By Product Analysis

POS Segment Held the Significant Market Share in 2023

POS segment held the significant retail automation market share. The growth of this segment is propelled by factors such as a heightened demand for merchandise optimization, an uptick in the adoption of technologies like the Internet of Things (IoT), application programming interface (API), & robotics process automation. Additionally, the segment is influenced by the emergence of logistic warehousing, the increasing prevalence of e-commerce and m-commerce retail, advancements in real-time data analytics, and the evolution of virtual marketing.

Camera segment is expected to gain substantial growth rate. Retail establishments, including stores and malls, face elevated security risks such as theft and inventory loss. Investing in cameras as a retail solution offers long-term advantages, including enhanced store profits, reduced retail losses, decreased theft incidents, monitoring employee activities, and understanding customer purchasing patterns. Consequently, end-users are adopting camera products to streamline retail automation processes, fostering the growth of this segment.

By End Use Analysis

Supermarkets Segment Held the Significant Market Share in 2023

Supermarkets segment held the significant market share. Supermarkets are adopting retail automation to improve customer satisfaction, reduce shopping durations, minimize waste, and achieve cost savings, resulting in enhanced customer experiences and increased customer loyalty. Furthermore, there is significant growth potential for the market in emerging economies. With the business landscape evolving rapidly, supermarkets are adapting by prioritizing the streamlining of processes and swiftly embracing retail automation software and solutions to stay competitive.

Hypermarket segment is expected to gain substantial growth rate. The extensive product range in hypermarkets can benefit from streamlined store operations, leading to reduced bookkeeping costs and safeguarding profit margins. Automation of processes like shelf stocking, inventory management, and checkout operations contributes to increased efficiency. By automating routine tasks, employees can redirect their focus to more intricate and customer-centric activities, ultimately boosting productivity. Additionally, automated stores experience substantial cost savings, contributing to the growing demand for retail automation in this segment.

Regional Insights

North America Region Dominated the Global Market in 2023

The North America region dominated the global market. Region’s growth is due to widespread adoption of automation technology by major businesses, a thriving e-commerce market, and the escalating costs associated with labor. Additionally, numerous manufacturers have chosen to establish their presence in the region, attracted by the substantial customer base and the potential for achieving economies of scale. In response to this trend, local retailers in the region are implementing strategies such as loyalty programs to incentivize digital payments, contributing to the increased demand for retail automation platforms.

The Asia Pacific will grow with substantial pace. The region has witnessed a notable increase in the number of SMEs, and these businesses are actively embracing automation technology. Emerging technologies are offering various avenues for enhancing operational efficiency, ranging from the loading dock to the checkout line. Notably, the prevalence of mobile checkout devices in developing countries has expanded the possibilities for selling goods in diverse settings, including events, pop-up stores, kiosks, and other public areas. As a result, the adoption of new automation technologies is expected to exert a substantial impact on the retail industry in the region.

Key Market Players & Competitive Insights

Major players in the industry sustain a comprehensive product portfolio, securing a competitive advantage. This encompasses their range of products, the market segments they cater to, the technological sophistication incorporated into their offerings, their strategies for product differentiation, and the overall impact they have on the industry.

Some of the major players operating in the global market include:

- 6 River Systems LLC

- Amazon Web Services, Inc.

- Casio Computer Co. Ltd.

- Datalogic S.p.A.

- Diebold Nixdorf, Incorporated.

- E&K Automation GmbH

- ECR Software Corporation

- Honeywell Scanning and Mobility

- Kiosk & Display LLC

- Kuka AG

- NCR Corporation

- Pricer AB

- Toshiba Global Commerce Solutions Inc.

- Wincor Nixdorf AG

- Zebra Technologies Corporation

Recent Developments

- In November 2023, Datalogic S.p.A., introduced intralogistics solutions that combine safety technology and barcode reading. This integration is designed to enhance support for supply chain applications and intralogistics for end-users.

Retail Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.30 billion |

|

Revenue forecast in 2032 |

USD 53.01 billion |

|

CAGR |

9.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Implementation, By Product, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Retail Automation Market are 6 River Systems, Amazon Web Services, Casio Computer.

The global retail automation market is expected to grow at a CAGR of 9.2% during the forecast period.

Retail Automation Market report covering key segments are implementation, product, end use, and region

The key driving factors in Retail Automation Market are increasing adoption of integrated cloud-based POS systems.

Retail Automation Market Size Worth $ 53.01 Billion By 2032.