Warehouse Robotics Market Share, Size, Trends, Industry Analysis Report

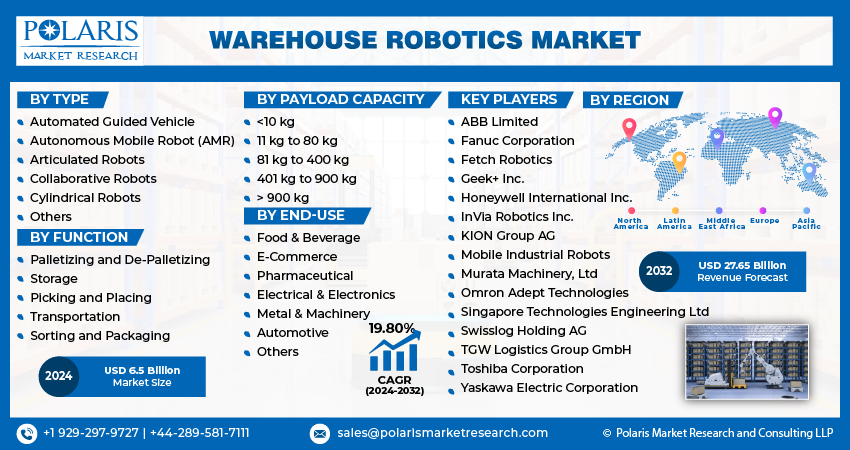

By Type (Automated Guided Vehicle, Autonomous Mobile Robots, Articulated Robots, Collaborative Robots, Cylindrical Robots, Others); By Function; By Payload Capacity, By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3959

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

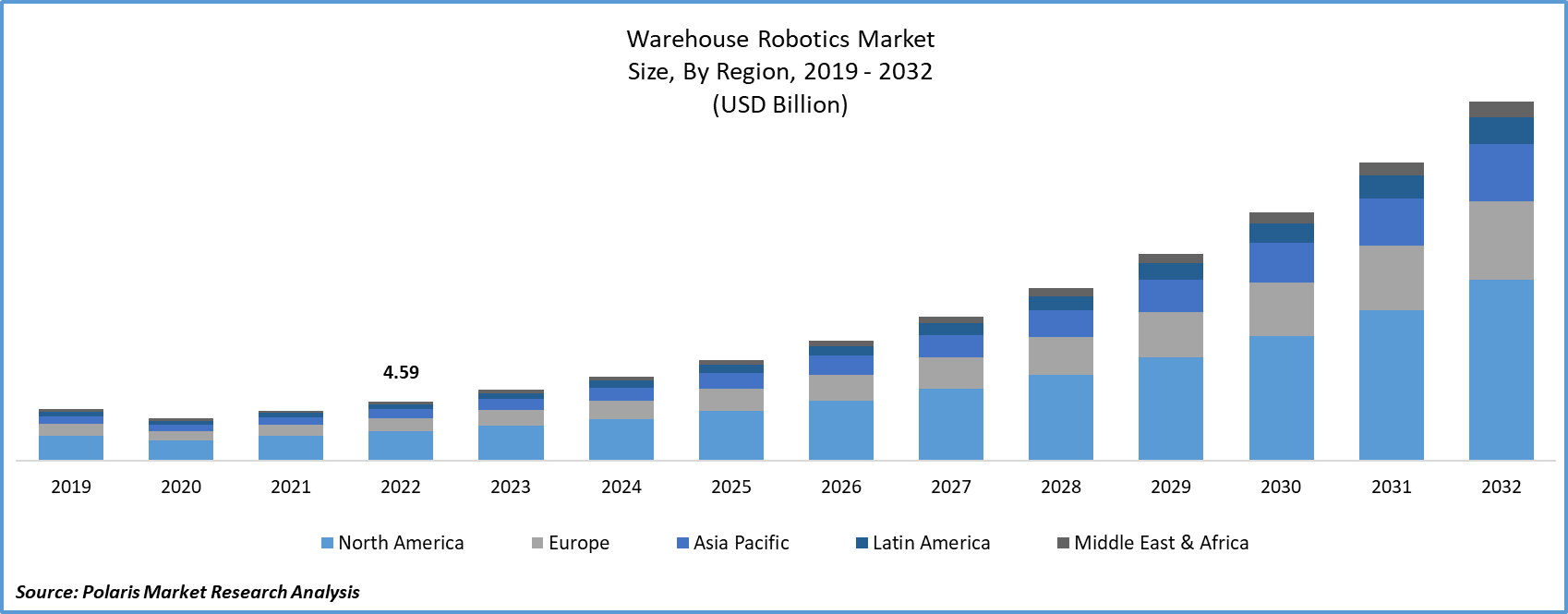

The global warehouse robotics market was valued at USD 5.46 billion in 2023 and is expected to grow at a CAGR of 19.80% during the forecast period.

Warehouse robotics represents a computer-driven approach employed to efficiently manage material transport while optimizing and automating various warehouse operations. This innovative system relies on dedicated machinery and software solutions for tasks such as item retrieval and placement, packing, material transportation, packaging, and palletization, all executed with remarkable precision. Warehouse robotics encompasses a range of technologies, including industrial robots, sorting mechanisms, conveyors, autonomous mobile robots (AMR), and automated storage and retrieval systems (AS/RS).

To Understand More About this Research: Request a Free Sample Report

Warehouse operations have been revolutionized by the use of robotic systems. These systems use computer systems, onboard sensors, magnetic strips, infrared cameras, and maps to navigate, avoid obstacles, and transport inventory. By taking over repetitive tasks, these robots reduce workload on human workers and remain resilient against fatigue and wear and tear. Warehouse robotics are now indispensable in sectors such as food and beverage, automotive, pharmaceutical, and retail.

The research report offers a quantitative and qualitative analysis of the warehouse robotics market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

- For instance, Walmart and Symbiotic have collaborated to introduce cutting-edge automation into their supply chain. The robotic systems deployed in their warehouses excel at sorting, retrieving, storing, and packing goods with remarkable precision. This enhances the efficiency of the intake process, leading to faster operations, and improves the accuracy of inventory storage for subsequent orders.

Warehouses serve as essential hubs for storage and distribution in various industries. Many prominent corporations operate vast warehouse facilities that encompass both vertical and horizontal storage capacities. Given their intricate nature, automation is instrumental in enhancing operational efficiency, resulting in significant time and cost savings. Warehouse robots, renowned for their precision and efficiency surpassing human labor, are increasingly deployed based on their specific utility.

The COVID-19 pandemic has significantly impacted the warehouse robotics market in several ways. With the outbreak of the virus, there was a sudden surge in demand for essential goods, e-commerce, and online retail. Warehouses and distribution centers faced unprecedented challenges in meeting this increased demand while adhering to social distancing and safety measures. In response, the adoption of warehouse robotics accelerated as companies sought to automate their operations and reduce human contact in their facilities. This surge in demand for robotics solutions has led to increased investments in research and development, resulting in more advanced and efficient robotics technology.

Moreover, the pandemic has highlighted the importance of supply chain resilience, prompting many businesses to reevaluate their logistics strategies and invest in robotics to enhance their operational flexibility. As a result, the warehouse robotics market has witnessed robust growth during and after the pandemic, with a promising outlook for the future.

The global warehouse robotics market is experiencing a boost due to the rising use of IIoT technology in robotics. Industrial robots are now fitted with IIoT devices, such as smart sensors, which gather data and improve productivity. IIoT systems, which consist of smart devices, data infrastructure, and cloud-based analytics, provide valuable insights for informed decision-making. The data collected from IoT systems and sensors in production, including warehouse robotics, aids in analyzing manufacturing efficiency, enhancing asset reliability, and improving cost efficiency.

Industry Dynamics

Growth Drivers

- Amplification of e-commerce industry will boost Market Growth

The e-commerce industry has seen remarkable growth in recent years, primarily due to factors such as mobile adaptability, omnichannel retailing, improved convenience for both buyers and sellers and a broader range of product offerings from various brands. The increasing preference of customers for online shopping has led to a surge in inventory stored in company warehouses. To meet this rising consumer demand, companies need to expand their product range, all while ensuring the safe storage and packaging of these items.

However, as the volumes of goods increase, managing storage and packaging operations becomes increasingly challenging. Companies have been actively investing in tools that offer quick returns on investment and higher efficiency to streamline their warehouse operations and reduce delivery times. This has led to the widespread adoption of warehouse robotics solutions in company warehouses. These warehouse robotics solutions are gaining popularity as comprehensive answers to efficiently handle order management and fulfillment processes in the e-commerce sector. Additionally, they enhance human safety, facilitate flexible material movement, and provide traceability.

Report Segmentation

The market is primarily segmented based on type, function, payload capacity, end-use, and region.

|

By Type |

By Function |

By Payload Capacity |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Automated Guided Vehicle segment held the largest revenue share over the forecast period

The Automated Guided Vehicle (AGV) segment held the largest revenue share. The primary use of warehouse roots lies in the transportation of items within warehouses and storage facilities through mobile automated guided vehicles (AGVs). These robots are responsible for moving goods along predetermined routes, facilitating their storage and shipment. AGVs play a pivotal role in reducing logistical expenses and optimizing supply chain operations. Moreover, AGVs are employed in the processes of item selection and replenishment, both during inbound and outbound handling. What distinguishes autonomous mobile robots from AGVs is the extent of autonomy they possess.

By Function Analysis

- The Storage segment accounted for the largest market share over the forecast period

The storage segment accounted for the largest market share over the forecast period. Effective storage solutions are an indispensable component of contemporary warehouse automation. Employing automated storage systems, prevalent in modern warehouses, enhances organizational efficiency by providing users with improved inventory management, control, and tracking capabilities. Furthermore, these solutions contribute to heightened workplace safety, simultaneously reducing labor costs and the requisite workforce. Anticipated to surge in tandem with increasing manufacturing activity, the ascent of technologies like Industry 4.0 in manufacturing facilities, and the expansive growth of the global transportation and logistics market, the utilization of warehouse robots is on the rise.

Regional Insights

- Asia-Pacific dominated the largest market over the forecast period

Asia-Pacific dominated the largest market over the forecast period, with increasing investments in the sector, the manufacturing industry is poised to secure a substantial market share and become a significant player in the region. Chinese businesses that had previously deployed these robots in their warehouses experienced positive outcomes during times of crisis. JD.com, a major Chinese e-commerce company headquartered in Wuhan, operates automated warehouses equipped with a fleet of robotic trucks. These robots facilitate the delivery of essential goods to urban customers who prefer online shopping and may be confined to their homes.

North America is anticipated to grow fastest over the forecast period. The proliferation of e-commerce, coupled with advancements in technology enhancing the capabilities of robots, cost reduction, and labor shortages in specific industries, are the key factors driving the rising utilization of robots within North American warehouses and distribution centers. Many businesses across North America are collaborating with tech firms to jointly develop robots for potential deployment in retail outlets, aimed at assisting customers in finding desired products and accessing additional information, like interactive product displays and research resources.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ABB Limited

- Fanuc Corporation

- Fetch Robotics

- Geek+ Inc.

- Honeywell International Inc.

- InVia Robotics Inc.

- KION Group AG

- Mobile Industrial Robots

- Murata Machinery, Ltd

- Omron Adept Technologies

- Singapore Technologies Engineering Ltd

- Swisslog Holding AG

- TGW Logistics Group GmbH

- Toshiba Corporation

- Yaskawa Electric Corporation

Recent Developments

- In December 2022, ABB unveiled the "ABB SWIFT CRB 1300" collaborative robot designed to automate diverse warehouse tasks, including palletizing and pick-and-place operations. This introduction empowers ABB's clientele to enhance process flexibility, efficiency, and resilience through robotic automation. By deploying this technology, ABB customers can address labor shortages by allowing their workforce to focus on essential business activities.

- In September 2022, Honeywell introduced its latest robotic innovation, the "Smart Flexible Depalletizer," aimed at enhancing warehouse productivity through the reduction of manual labor.

- In August 2022, Yaskawa introduced a collaborative robot with machine vision capabilities known as the MOTOMAN-HC30PL. This robot is designed for palletizing applications and can handle payloads of up to 30 kilograms.

Warehouse Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.5 billion |

|

Revenue forecast in 2032 |

USD 27.65 billion |

|

CAGR |

19.80% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Function, By Payload Capacity, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

Want to check out the warehouse robotics market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.