Retail Cloud Market Size, Share, Trends, Industry Analysis Report

: By Component (Solution, Service), Service Model Type, Deployment, Organization Size, and Region– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM5661

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

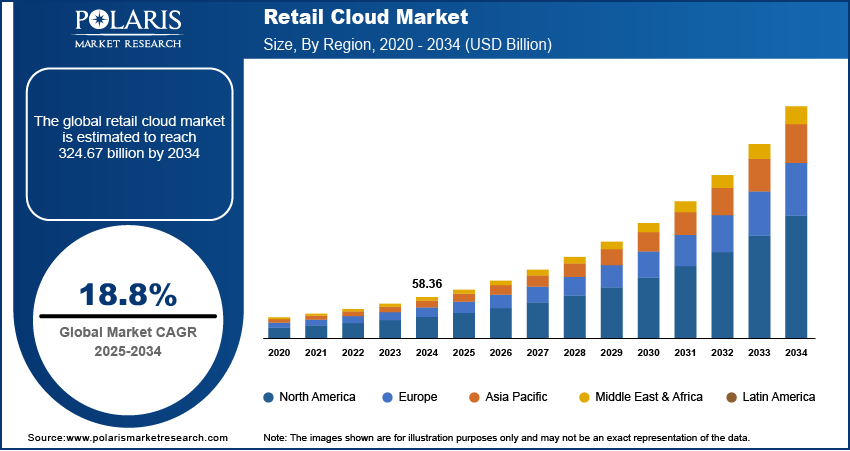

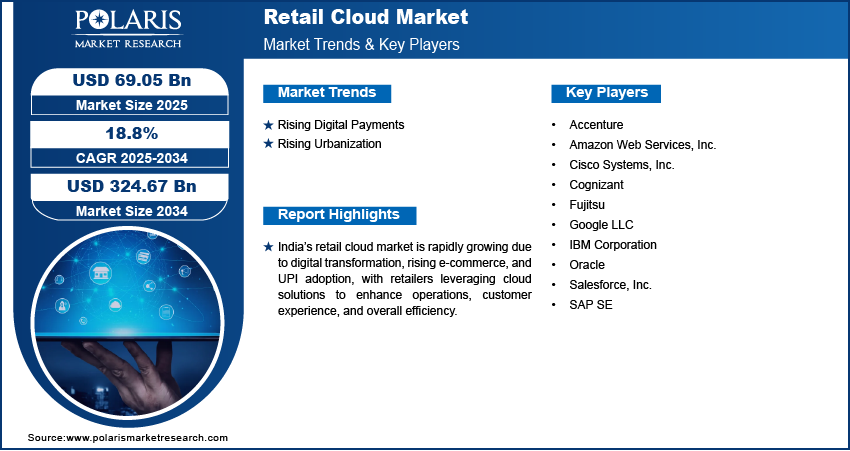

Retail cloud market size was valued at USD 58.36 billion in 2024, exhibiting a CAGR of 18.8% during the forecast period. The market is driven by retailers’ growing need for scalable, cost-effective, and agile digital infrastructure to support omnichannel operations, enhance customer experiences, and respond quickly to fluctuating demand, rising digital payments, and urbanization trends.

Key Insights

- SaaS segment is growing fastest due to easy deployment, low cost, and quick access to retail management tools.

- Solution segment led the market in 2024 as retailers prioritized cloud tools for POS, inventory, CRM, and analytics functions.

- North America dominated the market in 2024 due to advanced retail systems, early cloud adoption, and strong digital infrastructure.

- Asia Pacific shows strong growth with rising internet access, mobile commerce, and cloud-driven e-commerce innovation.

Industry Dynamics

- Scalability of cloud platforms during peak retail seasons allows seamless handling of high traffic without extra hardware costs.

- Cloud solutions reduce capital expenses by eliminating the need for costly on-premises infrastructure and lowering IT maintenance fees.

- Increasing mobile payments require secure, flexible cloud systems that support digital wallets and real-time fraud detection.

- Growing urban populations demand smarter inventory, faster deliveries, and personalized experiences enabled by centralized cloud management.

- Expansion into emerging markets with rising smartphone penetration and e-commerce growth enhances cloud adoption for retail operations.

- Data security concerns and potential cyber threats limit cloud adoption due to fear of breaches and loss of customer trust.

Market Statistics

2024 Market Size: USD 58.36 billion

2034 Projected Market Size: USD 324.67 billion

CAGR (2025–2034): 18.8%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Retail cloud is a cloud-based platform designed to help retailers manage and unify their operations across digital and physical channels. It offers tools such as point-of-sale, inventory, customer data, and AI-driven insights to enhance the shopping experience and streamline business processes.

Retail is a fast-moving industry, especially during peak seasons such as holidays or big sales events. Cloud-based solutions allow retailers to scale up or down based on demand. During a flash sale, a retailer easily handles increased website traffic or transactions without needing extra hardware. This flexibility enables retailers to save money and avoid service interruptions. Traditional systems often can't adapt quickly, but cloud platforms can expand services instantly. This makes it easier for retailers to respond to changing business needs, launch new products, or enter new markets without worrying about IT limitations, which in turn is driving the adoption of cloud services in retail, thereby driving the retail cloud market growth.

Setting up and maintaining traditional IT systems can be very expensive. According to Veritis Group Inc., establishing an on-premises infrastructure typically requires a capital investment ranging from USD 100,000 to several million dollars. Retailers don’t need to buy costly servers or pay large maintenance fees with cloud solutions. Instead, they pay only for the services they use, making budgeting easier. Cloud platforms also reduce downtime and IT labor costs since updates and troubleshooting are handled automatically by the provider. The high cost of traditional IT systems has raised awareness about cloud services among retailers, thereby driving the growth of the market.

Market Dynamics

Rising Digital Paymentsdrives the market growth

More people are turning to their smartphones as a convenient tool for shopping and making payments, whether online or in physical stores. Digital wallets, such as Apple Pay and Google Pay, as well as mobile banking apps, are becoming increasingly common. For instance, according to the National Payments Corporation of India, in January 2025, USD 951.91 million worth of transactions were made in India through Google Pay. Retailers require cloud-based systems that securely and efficiently support these payment methods. Cloud platforms allow payment systems to be updated and integrated quickly with various devices and channels. They also help with fraud detection and real-time payment tracking. Retailers that adopt flexible, cloud-powered payment systems can offer customers better convenience and stay competitive in the mobile-first world, as mobile commerce continues to grows, thereby driving the retail cloud market expansion.

Rising Urbanization boost the market revenue

Urban areas are growing rapidly, with more people living in cities than ever before. This leads to higher demand for retail stores, faster deliveries, and smarter inventory management. For instance, according to the World Bank Group, in 2023, 63% of the total population in Asia Pacific lived in urban areas, highlighting the trend of urbanization. Urban customers expect fast service, easy returns, and personalized experiences. Cloud solutions enable retailers to manage complex logistics, store operations, and customer data across multiple locations. Businesses centralize control while still serving local needs with cloud systems. Retailers need the agility and intelligence that cloud technologies offer to serve large cities and become more connected, thereby driving the growth of the retail cloud market opportunity.

Segment Analysis

Assessment by Service Model Type

The market segmentation, based on service model type, includes SaaS, PaaS, and IaaS. The SaaS segment is expected to witness the fastest growth during the forecast period as SaaS solutions are easy to deploy, cost-effective, and don’t require complex IT setups. Retailers can quickly access tools such as customer management, analytics, and inventory tracking through the cloud, eliminating the need for large upfront investments. SaaS helps businesses stay competitive by offering regular updates, easy scalability, and improved customer experiences, as they aim for flexibility and faster innovation, thereby driving segmental growth in the market.

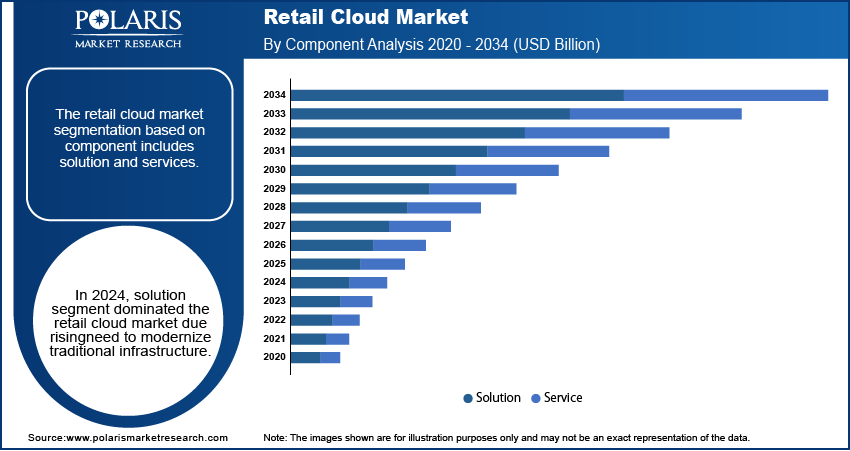

Evaluation by Component

The market segmentation, based on component, includes solution and service. The solution segment dominated the retail cloud market in 2024, driven by retailers’ increasing need to modernize their operations and improve customer experiences. Cloud-based retail solutions include tools for point-of-sale, inventory management, customer relationship management, and analytics. These tools help retailers streamline operations, reduce costs, and respond more quickly to market demands. More businesses are adopting cloud solutions to stay competitive as shopping behavior shifts toward digital and omnichannel experiences. The ease of integration, scalability, and real-time data access make solutions the preferred choice over traditional retail software, thereby driving the segmental growth.

Regional Insights

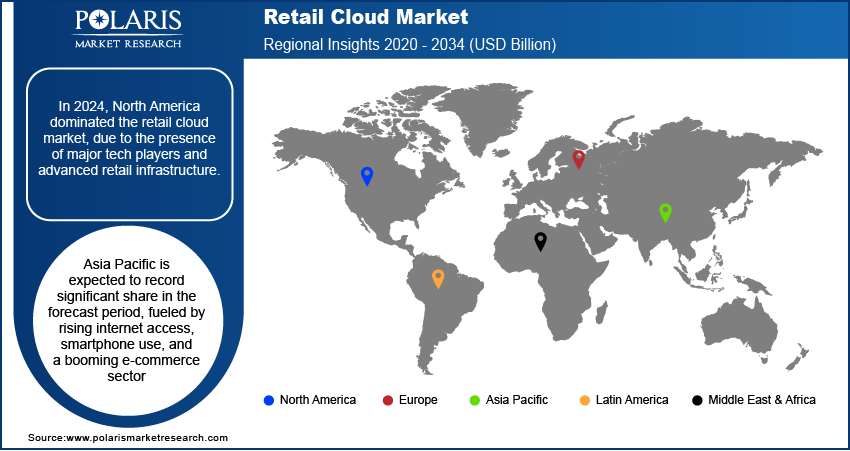

By region, the study provides the retail cloud market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the presence of major tech players and advanced retail infrastructure. Retailers in the US and Canada are early adopters of cloud technology, using it to create personalized shopping experiences and integrate physical and digital operations. High internet penetration, growing use of mobile payments, and strong customer demand for fast, seamless service are key factors driving cloud adoption. Additionally, companies are heavily investing in AI and data analytics to improve decision-making, thereby driving the market expansion in North America.

Asia Pacific is expected to record a significant share during the forecast period, fueled by rising internet access, smartphone use, and a booming e-commerce sector. Countries such as China, Japan, South Korea, and Southeast Asian nations are adopting cloud technologies to modernize their retail operations. Retailers are using the cloud to manage large-scale customer data, enable mobile payments, and support omnichannel experiences. Government support for digital transformation and the presence of tech-savvy consumers are further fueling the market expansion.

The retail cloud market in India is experiencing substantial growth driven by rapid digital transformation and the expansion of organized retail. The rise of e-commerce, mobile shopping, and digital payment systems such as UPI, has created a strong demand for scalable, cloud-based platforms. Retailers in India are turning to cloud technology to improve supply chain management, personalize customer experiences, and streamline operations across physical stores and online channels. More businesses are moving away from legacy systems to embrace cloud-based tools with increasing investments in retail tech and supportive government policies such as “Digital India,” thereby driving the growth of the market.

Key Players and Competitive Insights

The market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the retail cloud market analysis, this competitive environment is amplified by continuous progress in product offerings. Major players in the market include Accenture; Amazon Web Services, Inc.; Cisco Systems, Inc.; Cognizant; Fujitsu; Google LLC; IBM Corporation; Oracle; Salesforce, Inc.; and SAP SE.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. IBM Watson, started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. IBM provides retail solutions that leverage AI and hybrid cloud to optimize operations, improve customer experience, promote sustainability, and drive growth. The solution offers customer behavior forecasting, supply chain optimization, personalized marketing, seamless e-commerce experiences, smart checkout and self-service functionality, and an inventory management solution.

Cognizant Technology Solutions Corporation is an American multinational IT services company based in Teaneck, New Jersey. Founded in 1994 as a technology unit of Dun & Bradstreet, it became an independent entity in 1996. The company provides a range of services, including consulting, digital services, and business process outsourcing (BPO), across various industries. Cognizant's offerings include digital transformation services such as digital engineering, Internet of Things (IoT), data analytics, and cloud solutions. In addition to these, the consulting segment focuses on business strategy and technology consulting aimed at optimizing client operations. The company also provides application services involving the development, integration, testing, and maintenance of software applications. Infrastructure services are another key area, supporting IT infrastructure management and security for clients. Cognizant is organized into several business segments which include financial services, which encompasses banking and insurance; Healthcare, serving healthcare providers and life sciences; Products and Resources, which addresses manufacturing, retail, and logistics; and Communications, Media, and Technology, focusing on digital content and user experience. Cognizant operates globally with a presence in North America, Europe, Asia Pacific, and Latin America. Key markets include the United States, India, Germany, Australia, China, Brazil, France, Spain, and Japan. Cognizant's Stores 360 offering provides comprehensive retail technology solutions, including store strategy, build, and launch services. It aims to reduce store opening times by 10-20% and operating expenses by 30-40%. The service covers predictive store management, control tower operations, and intelligent asset management. Cognizant commits to over 98% uptime for store systems and offers centralized asset management with enhanced data accuracy and demand forecasting.

List of Key Companies

- Accenture

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Fujitsu

- Google LLC

- IBM Corporation

- Oracle

- Salesforce, Inc.

- SAP SE

Retail Cloud Industry Developments

January 2025: Salesforce introduced Retail Cloud and Agentforce skills, featuring a headless POS system from PredictSpring, to modernize retail operations and integrate cloud-based transaction data for enhanced customer experiences.

January 2025: SAP launched S/4HANA Cloud Public Edition for retail and fashion, offering AI-driven ERP capabilities in the public cloud to unify finance, procurement, and merchandising for streamlined retail operations.

Retail Cloud Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Solution

- Customer Management

- Supply Chain Management

- Workforce Management

- Data Security

- Others

- Services

- Professional Services

- Managed Services

By Service Model Type Outlook (Revenue USD Billion, 2020–2034)

- SaaS

- PaaS

- IaaS

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size Outlook (Revenue USD Billion, 2020–2034)

- Large Enterprises

- Small & Medium Size Enterprises

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Retail Cloud Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 58.36 billion |

|

Market Size Value in 2025 |

USD 69.05 billion |

|

Revenue Forecast in 2034 |

USD 324.67 billion |

|

CAGR |

18.8% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 58.36 billion in 2024 and is projected to grow to USD 324.67 billion by 2034.

The global market is projected to grow at a CAGR of 18.8% during the forecast period, 2025-2034.

North America had the largest share in the global market in 2024.

The key players in the market are Accenture; Amazon Web Services, Inc.; Cisco Systems, Inc.; Cognizant; Fujitsu; Google LLC; IBM Corporation; Oracle; Salesforce, Inc.; and SAP SE.

The solution segment dominated in 2024 due rising need to modernize traditional infrastructure.

The SaaS segment is expected to witness fastest growth in the forecast period as SaaS solutions are easy to deploy, cost-effective, and don’t require complex IT setups.