Sales Compensation Software Market Share, Size, Trends, Industry Analysis Report

By Deployment Type (Cloud, On-premise); By End Use; By Enterprise Size; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 119

- Format: PDF

- Report ID: PM3856

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

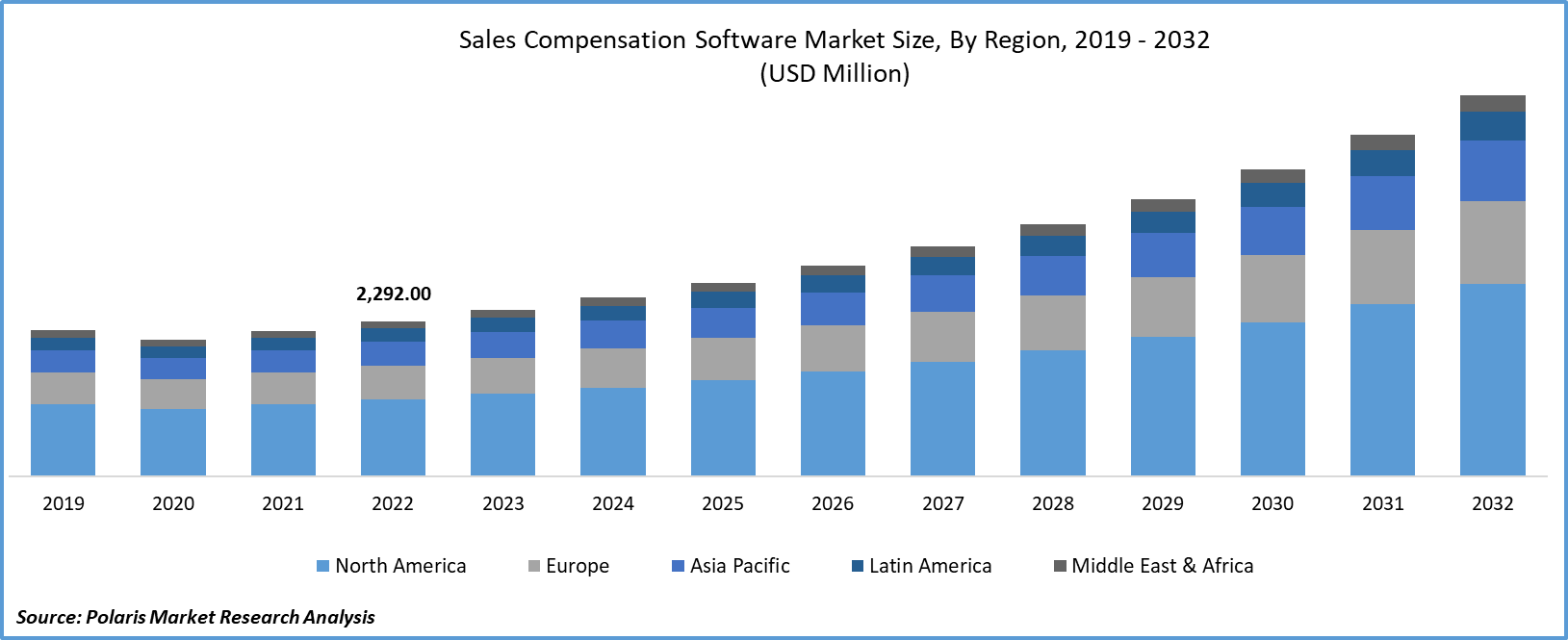

The global sales compensation software market was valued at USD 2,292.00 million in 2022 and is expected to grow at a CAGR of 9.7% during the forecast period.

Employees are expecting a hike in their compensation owing to rising needs, inflation, and other factors. According to the data from the annual global survey of the ADP Research Institute, 83% of people are expected to hike in 2023, with an average rise of 8.3%. Around the world, 10% of employees anticipate wage increases of more than 15% in the upcoming 12 months, while 18% anticipate increases of between 10% and 12%. This creates a hierarchy for the employers in determining compensation for the workers while managing underpayment and overpayment at the same time. Determining sales compensation is a very difficult task, as it is a fully performance-based commission.

To Understand More About this Research: Request a Free Sample Report

Sales compensation software plays a crucial role in reducing stress for employers in the distribution of commissions to the sales team. The potential for increased compensation drives the motivation of sales people. Performance-based incentives motivate average employees to enhance their sales results while simultaneously rewarding top performers. This environment of constructive competition and performance-based incentives increases overall sales productivity. This will further boost demand as enterprises recognize the importance of performance-based incentives in the sales team.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Technological advancements and increasing automation in industries propelling the demand for sales compensation software

For businesses to generate revenue and stay competitive, they rely on sales personnel. Incentivizing and compensating based on the performance of the sales team will fuel the company's sales. This facilitates the need for effective sales compensation software in determining compensation based on the work efficiency of sales personnel. According to SAP sales management, more than 650 customers calculated commissions for over 12 million payees through SAP sales performance management in 2022. The rapid adoption by enterprises to determine reasonable commissions for their employees is driving the growth of the market.

Report Segmentation

The market is primarily segmented based on deployment type, end use, enterprise size and region.

|

Deployment Type |

By End Use |

By Enterprise Size |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Type Analysis

The cloud segment is expected to experience the fastest growth in the forecast timeframe

The cloud segment is projected to witness faster growth in the market. This enables the software to be used anywhere with a good internet connection. It gives the employer access to work remotely in determining compensation based on individual performance with sales compensation software. Additionally, in order to accommodate variations in the size and needs of the sales team, cloud solutions can scale up or down based on the needs of the organization.

This deployment model enables organizations to save money as it does not require hardware setup, reducing installation costs. Furthermore, these solutions can be incorporated easily without taking a huge amount of time, ensuring organizations use software early. In general, cloud solutions require less IT upkeep and support, freeing up resources for other important strategic projects. These factors, taken together, contributed to the demand for sales compensation software during the study period.

By End Use Analysis

Information technology (IT) and telecom segment accounted for the largest market share in 2022

IT & Telecom segment held the largest market share for the market in the study period. These are highly competitive, and most of the companies in this sector depend on sales teams to increase their market presence, driving revenue through their solutions and services. Companies in this domain prefer performance-based incentives to fuel further sales of their services by assigning sales targets to their sales and marketing teams.

The sales process in the IT and telecom sectors can be complex, with several stakeholders and a range of deal sizes. Software for compensation management makes these complexities easier. Furthermore, most enterprises are adopting data-driven strategies for business operations, primarily in the IT and telecom industries. This software aids sales managers in understanding real-time sales insights, enabling efficient marketing strategies to increase sales revenue.

By Enterprise Size Analysis

The large enterprises segment is expected to hold the larger revenue share during the forecast period

Large enterprises segment registered the largest revenue share in the forecast period. This growth is due to the rising utilization of sales compensation software in large enterprises due to the diverse product range and wide range of sales teams. Managing many sales teams makes it difficult for the organization to determine the commission by analyzing each salesperson. This difficulty is driving many organizations to adopt sales compensation software.

In addition, these software solutions increase communication between businesses and employees through the facilitation of open reward systems. One of the benefits of sales compensation software is that it is more effective than manual processes at tracking and calculating employee data and pay grades. This is fueling the demand for sales compensation software by large enterprises in the global market.

By Regional Analysis

APAC dominated the global market with the highest growth rate in the study period

APAC is expected to witness a higher growth rate for the market. Many firms in this region are showing interest in expanding sales teams to increase their revenue. According to LinkedIn, Singapore is expected to have a higher demand for sales development executives in 2023. This trend is expected to continue as companies invest heavily in expanding the sales channel to gain a competitive advantage. This creates demand for sales compensation software.

Software for sales compensation automates the accounting & management of commissions & incentive plans depending on a variety of programmable criteria, such as employee role, & tenure. Furthermore, compensation plans become more complicated as businesses broaden their product lines and marketing tactics. The software ensures that incentives are calculated consistently and accurately for all types of sales roles. Competitive remuneration is essential due to the rising talent competition. Software for sales compensation assists in providing fair and alluring incentive packages. These factors contributed to the growth and demand for sales compensation software during the study period.

North America is projected to have a larger revenue share for the market. This growth is attributable to rising employee retention rates due to lower salary compensation. According to the ADP Research Institute report, 50% of the population in the U.S. believes that they are underpaid. This demonstrates the importance of reliable and transparent compensation practices. Particularly in competitive industries like sales, poorer motivation and increased turnover rates could result if a sizable portion of the workforce feels undervalued.

Organizations may create incentive plans that encourage sales teams and lower turnover with the use of sales compensation software. Furthermore, sales compensation involves variable components based on performance, including commissions and bonuses. Organizations may require software that can precisely handle these dynamic compensation arrangements as expectations for bigger salary increases emerge. Rising employee salary expectations are creating new growth opportunities for the sales compensation software market in this region.

Competitive Insight

The Sales Compensation Software Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- SAP

- Oracle

- Performio

- Iconic Sales Compensation Software

- Optymyze

- Xactly

- NICE Systems

- Apttus

- NetSuite

- Commissionly

- ZS Associates

- IBM

- CellarStone

- Anaplan & Quota Path

Recent Developments

- In June 2023, CaptivateIQ, a leading incentive compensation management provider, unveiled CaptivateIQ Assist, a state-of-the-art commission AI solution that will revolutionize how businesses handle their compensation procedures.

- In April 2023, Spiff introduced a new mobile application, which was developed in collaboration with Ukrainian design and development firm Merge. This software is accessible on Google Play & Apple Software Store.

Sales Compensation Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,456.10 million |

|

Revenue forecast in 2032 |

USD 5,628.73 million |

|

CAGR |

9.7% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Deployment Type, By End Use, By Enterprise Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in sales compensation software market are SAP, Oracle, Performio, Iconic Sales Compensation Software, Optymyze

The global sales compensation software market is expected to grow at a CAGR of 9.7% during the forecast period.

The sales compensation software market report covering key segments are deployment type, end use, enterprise size and region.

key driving factors in industrial sales compensation software market are Technological advancements and increasing automation in industries.

The global sales compensation software market size is expected to reach USD 5,628.73 million by 2032.