U.S. Portable Ultrasound Devices Market Size, Share, Trends, Industry Analysis Report

By Type (Handheld, Compact, Cart/Trolley), By Technology, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6129

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

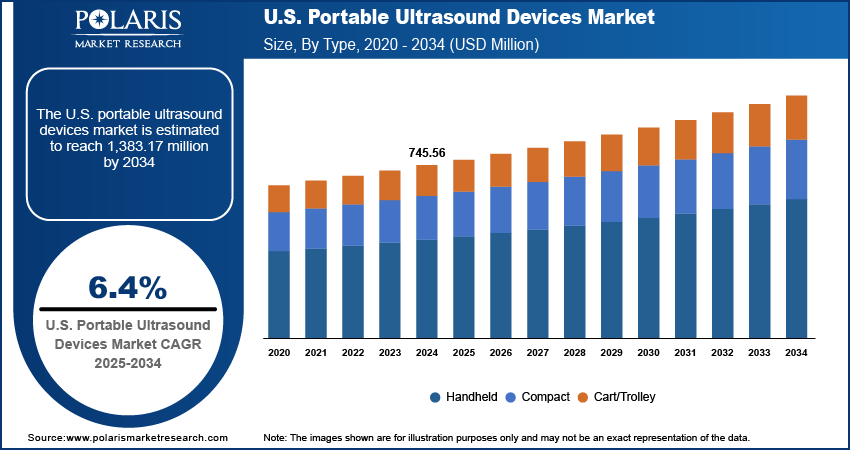

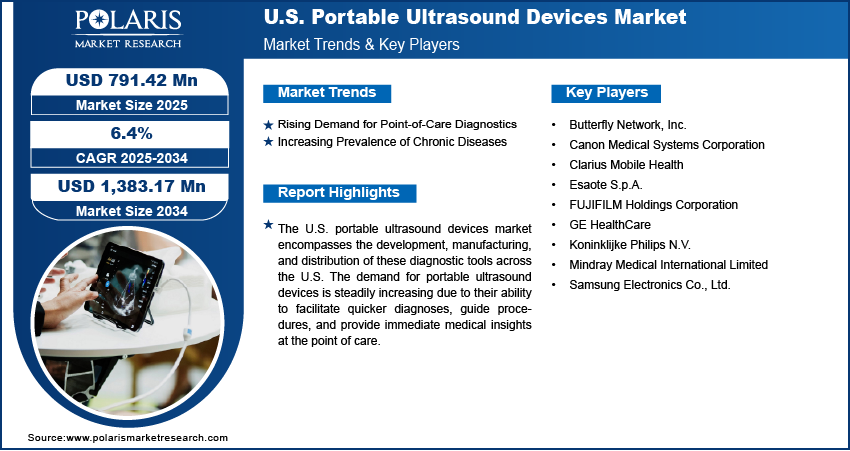

The U.S. portable ultrasound devices market size was valued at USD 745.56 million in 2024 and is anticipated to register a CAGR of 6.4% from 2025 to 2034. The market is primarily driven by rising demand for point-of-care diagnostics, which enables quick assessments at the patient's bedside. Another key driver is the increasing prevalence of chronic diseases such as cardiovascular conditions and cancer, boosting the need for accessible diagnostic tools.

Key Insights

- By type, the cart/trolley-based segment held the largest share in 2024 due to its advanced imaging capabilities and comprehensive features. These systems offer a strong balance of mobility and performance.

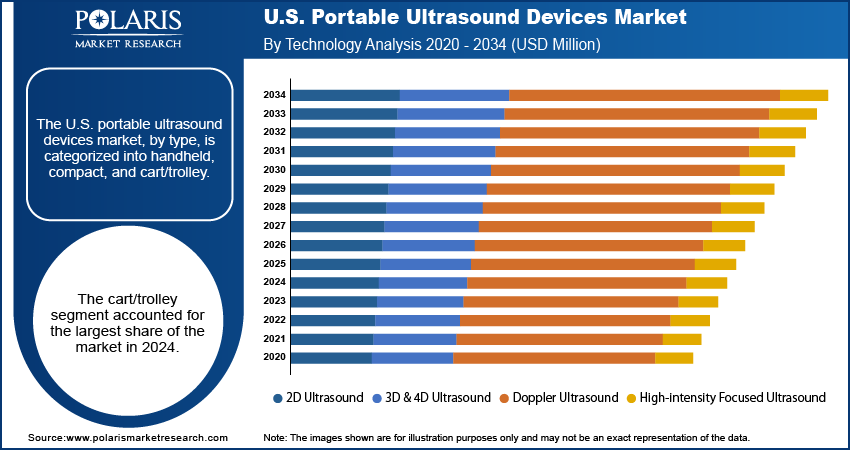

- By technology, the 2D ultrasound technology segment held the largest share in 2024, driven by its widespread adoption, cost-effectiveness, and established clinical utility. This foundational imaging modality provides essential real-time, two-dimensional images crucial for basic diagnostic assessments and routine examinations.

- By application, the obstetrics/gynecology application segment held the largest share in 2024, primarily because of the critical role of ultrasound in comprehensive prenatal care and gynecological examinations.

- By end use, the hospitals & specialty clinics segment held the largest share in 2024 due to their vast patient volume, diverse medical specialties, and robust infrastructure.

Industry Dynamics

- There is a significant and increasing need for immediate diagnostic capabilities directly at the patient's location, such as in emergency rooms, critical care units, or even remote settings.

- The increasing prevalence of chronic health conditions, including cardiovascular disorders, various cancers, and musculoskeletal issues, drives the need for frequent and accessible diagnostic imaging.

- Ongoing developments in imaging technology, such as improved resolution, 3D ultrasound capabilities, and the integration of artificial intelligence, are making these devices more efficient and user-friendly.

Market Statistics

- 2024 Market Size: USD 745.56 million

- 2034 Projected Market Size: USD 1,383.17 million

- CAGR (2025–2034): 6.4%

To Understand More About this Research: Request a Free Sample Report

The U.S. portable ultrasound devices market includes compact, mobile ultrasound systems designed for use in various settings, from patient bedsides to remote locations. These devices offer real-time imaging capabilities, providing healthcare professionals with immediate diagnostic information. They are typically available in handheld, tablet-based, or cart-based formats, enabling flexibility and ease of transport.

The rising integration with telehealth platforms drives the U.S. portable ultrasound devices market growth. As telemedicine services expand, portable ultrasound devices become essential tools for remote consultations and diagnostics. This allows healthcare providers to conduct virtual examinations and receive real-time images from patients in distant areas, improving access to care.

Another notable driver is the increasing use of these devices in emergency medical services (EMS) and pre-hospital care. Their lightweight design and quick setup make them ideal for rapid assessments at accident sites or during patient transport. This helps EMS personnel make faster decisions regarding patient triage and hospital destination, potentially improving outcomes in critical situations.

Drivers and Trends

Rising Demand for Point-of-Care Diagnostics: The increasing need for immediate diagnostic results at the patient's bedside or in non-traditional healthcare settings is a major driver for the U.S. portable ultrasound devices market growth. Point-of-care ultrasound (POCUS) devices enable clinicians to quickly assess conditions, guide procedures, and make timely decisions, which can significantly improve patient outcomes. The shift from fixed imaging departments to portable solutions streamlines workflow and enhances efficiency, particularly in urgent or remote care scenarios.

The utility and growing adoption of POCUS are supported by various studies. For example, an article titled "Utilization of Point-of-Care Ultrasound as an Imaging Modality in the Emergency Department: A Systematic Review and Meta-Analysis," published in PubMed Central in 2024, highlights that POCUS has become a fundamental part of clinical care in emergency departments, aiding in resuscitation, diagnosis, and procedure guidance. Another study, "Evaluation of point-of-care ultrasound training among healthcare providers: a pilot study," published in PubMed Central in February 2024, notes that POCUS is increasingly used across multiple specialties, allowing clinicians to perform ultrasound imaging directly at the bedside for timely diagnoses. This growing integration of POCUS into various clinical settings is a strong indicator of its expanding role, thus propelling the demand for portable ultrasound devices.

Increasing Prevalence of Chronic Diseases: The growing burden of chronic diseases in the U.S. is another significant driver for the U.S. portable ultrasound devices market. Conditions such as heart disease, cancer, and liver disease require frequent monitoring and diagnostic imaging for effective management. Portable ultrasound devices offer a convenient and noninvasive way to track disease progression, assess organ health, and guide interventions, making them indispensable tools in long-term patient care.

The widespread impact of chronic diseases underscores the need for accessible diagnostic technologies, including gastric cancer diagnosis. According to the Centers for Disease Control and Prevention’s (CDC) "About Chronic Diseases" information updated in October 2024, six in 10 Americans have at least one chronic disease, and four in 10 have two or more. Furthermore, the article "The Burden of Chronic Disease," published in PubMed Central in January 2024, states that in 2021, over 934,500 deaths in the U.S. were caused due to cardiovascular disease, and cancer remains the second leading cause of death. This high prevalence of chronic conditions necessitates ongoing diagnostic assessments, which portable ultrasound devices are well-suited to provide due to their ease of use and ability to be deployed in diverse healthcare environments, thus driving market growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes handheld, compact, and cart/trolley. The cart/trolley segment held the largest share in 2024, due to their advanced imaging capabilities, which often include a broader range of features, superior image quality, and support for multiple probe types. These systems offer a balanced combination of mobility and performance, making them highly versatile for use across various hospital departments, specialty clinics, and emergency settings. They provide a stable platform for comprehensive diagnostic examinations, including detailed studies in cardiology, obstetrics, and radiology, where higher resolution and detailed analysis are critical. While larger than handheld devices, their wheeled design allows for easy movement between patient rooms, enabling high-quality imaging without the need to transport patients to a centralized imaging facility, which significantly contributes to their widespread adoption in established healthcare infrastructures.

The handheld segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is largely driven by their extreme portability, affordability, and increasing integration with smartphone and tablet technologies. Handheld devices are exceptionally convenient for point-of-care applications, allowing clinicians to perform quick assessments directly at the bedside, in ambulances, or during home visits. Their compact size makes them ideal for environments where space is limited or rapid deployment is essential, such as in emergency medicine, primary care, and remote healthcare settings. The continuous advancements in miniaturization and improvements in image quality, combined with wireless connectivity and artificial intelligence-powered features, are further enhancing their utility and driving their accelerated adoption across a wider range of medical professionals, including those without specialized ultrasound training.

Technology Analysis

Based on technology, the segmentation includes 2D ultrasound, 3D & 4D ultrasound, doppler ultrasound, and high-intensity focused ultrasound. The 2D ultrasound segment held the largest share in 2024. This traditional imaging modality remains foundational due to its widespread adoption, cost-effectiveness, and established clinical utility across numerous medical disciplines. 2D ultrasound provides real-time, two-dimensional images that are essential for basic diagnostic assessments, guided procedures, and routine examinations. Its simplicity of use, coupled with continuous advancements in image processing and artificial intelligence enhancements, ensures its continued relevance. Many healthcare settings, especially those with limited resources or a high volume of general screenings, rely heavily on 2D portable ultrasound systems for efficient and accurate diagnostic capabilities, contributing to its substantial market presence.

The Doppler ultrasound technology segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing demand for detailed assessment of blood flow, which is crucial for diagnosing and monitoring various cardiovascular conditions, vascular disorders, and for evaluating organ perfusion. Doppler ultrasound, which includes color Doppler, power Doppler, and pulsed-wave Doppler, allows clinicians to visualize and quantify blood flow direction and velocity. As the prevalence of heart disease, strokes, and other circulatory system issues rises, the ability of portable Doppler ultrasound systems to provide noninvasive, real-time hemodynamic information at the point of care becomes increasingly valuable. This specialized capability, combined with the portability of these devices, makes them indispensable for both diagnostic and interventional applications, fueling their rapid expansion.

Application Analysis

Based on application, the segmentation includes obstetrics/gynecology, cardiovascular, urology, gastric, musculoskeletal, and others. The obstetrics/gynecology segment held the largest share in 2024. This robust position is largely attributed to the essential role of ultrasound devices in prenatal care, monitoring fetal development and performing gynecological examinations. Portable ultrasound devices offer the convenience and flexibility needed for routine check-ups in clinics, allowing for frequent and noninvasive assessments of maternal and fetal health throughout pregnancy. The continuous demand for safe and effective monitoring during gestation, coupled with the increasing number of gynecological procedures that benefit from real-time imaging guidance, firmly establishes this application as a dominant force in the segment. Its widespread adoption stems from its critical utility in ensuring positive outcomes for both mother and child, making it an indispensable tool for healthcare providers in this specialty.

The cardiovascular application segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily fueled by the increasing prevalence of cardiovascular diseases, such as heart failure, coronary artery disease, and stroke, which necessitate frequent and precise diagnostic imaging. Portable ultrasound devices allow cardiologists and other medical professionals to conduct immediate cardiac assessments, evaluate blood flow, and identify structural abnormalities at the patient's bedside or in emergency situations. The ability to perform rapid, noninvasive cardiac imaging outside of traditional imaging departments significantly improves the speed of diagnosis and initiation of treatment for time-sensitive conditions. As the focus shifts toward early detection and continuous monitoring of heart health, the demand for portable ultrasound solutions in cardiovascular care is rapidly expanding, driving notable growth in this application area.

End Use Analysis

Based on end use, the segmentation includes hospitals & specialty clinics, ambulatory surgical centers, and others. The hospitals & specialty clinics segment held the largest share in 2024. This dominance stems from the vast patient volume, diverse range of medical specialties, and the established infrastructure present within these facilities. Hospitals and larger specialty clinics require a comprehensive suite of diagnostic tools to address various patient needs, from emergency care to routine check-ups and complex surgical procedures. Portable ultrasound systems offer invaluable flexibility, allowing for rapid diagnostics at the bedside, in operating rooms, or in various departmental settings without the need to transport critically ill patients. Their integration into existing workflows, coupled with the presence of trained professionals and a consistent demand for high-quality imaging, solidifies this segment's leading position.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to register the highest growth rate during the forecast period. This accelerated expansion is largely influenced by the ongoing shift in healthcare delivery toward outpatient settings, driven by factors such as cost-effectiveness, patient convenience, and a focus on specialized procedures. ASCs perform a wide array of surgeries and diagnostic procedures that increasingly benefit from the real-time guidance and immediate diagnostic capabilities offered by portable ultrasound. As more procedures transition from inpatient hospitals to these efficient outpatient centers, the demand for versatile and easily transportable medical imaging equipment to support precise interventions and assessments in a streamlined environment is rapidly increasing, thereby fueling significant growth in this end-use segment.

Key Players and Competitive Insights

Competition in the U.S. portable ultrasound devices market is primarily driven by continuous technological advancements, especially in areas such as miniaturization, artificial intelligence integration, and enhanced image quality. Companies are focused on research and development to introduce innovative products that meet the evolving needs of healthcare providers for point-of-care diagnostics and versatile applications across various clinical settings. The competitive intensity is further amplified by strategic initiatives such as mergers and acquisitions, collaborations, and product launches aimed at expanding market reach and bolstering product portfolios.

A few key players in the market include GE HealthCare, Koninklijke Philips N.V., Siemens Healthineers, FUJIFILM Holdings Corporation, Samsung Electronics Co., Ltd., Canon Medical Systems Corporation, and Mindray Medical International Limited.

Key Players

- Butterfly Network, Inc.

- Canon Medical Systems Corporation

- Clarius Mobile Health

- Esaote S.p.A.

- FUJIFILM Holdings Corporation

- GE HealthCare

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Samsung Electronics Co., Ltd.

U.S. Portable Ultrasound Devices Industry Developments

February 2025: Philips announced the global launch of its Flash Ultrasound System 5100 POC. The system is engineered for the fast-moving needs of anesthesia, critical care, and emergency medicine.

September 2024: GE HealthCare launched an enhanced Venue ultrasound system, which includes a new point-of-care ultrasound (POCUS) solution called Venue Sprint. The portable device combines advanced Venue software with AI-powered tools, excellent image quality, and wireless probe functionality, designed for versatile use in clinical settings.

U.S. Portable Ultrasound Devices Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Handheld

- Compact

- Cart/Trolley

By Technology Outlook (Revenue – USD Million, 2020–2034)

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- High-intensity Focused Ultrasound

By Application Outlook (Revenue – USD Million, 2020–2034)

- Obstetrics/Gynecology

- Cardiovascular

- Urology

- Gastric

- Musculoskeletal

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals & Specialty Clinics

- Ambulatory Surgical Centers

- Others

U.S. Portable Ultrasound Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 745.56 million |

|

Market Size in 2025 |

USD 791.42 million |

|

Revenue Forecast by 2034 |

USD 1,383.17 million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 745.56 million in 2024 and is projected to grow to USD 1,383.17 million by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period.

A few key players in the market include GE HealthCare, Koninklijke Philips N.V., Siemens Healthineers, FUJIFILM Holdings Corporation, Samsung Electronics Co., Ltd., Canon Medical Systems Corporation, and Mindray Medical International Limited.

The cart/trolley segment accounted for the largest share of the market in 2024.

The doppler ultrasound segment is expected to witness the fastest growth during the forecast period.