Gastric Cancer Diagnostics Market Size, Share, Trends, Industry Analysis Report

By Product (Reagents & Consumables, Instruments), By Disease Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM5915

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

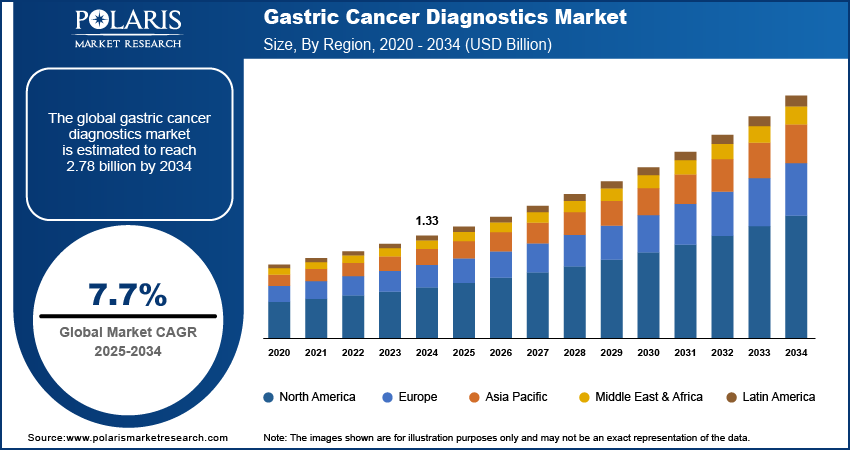

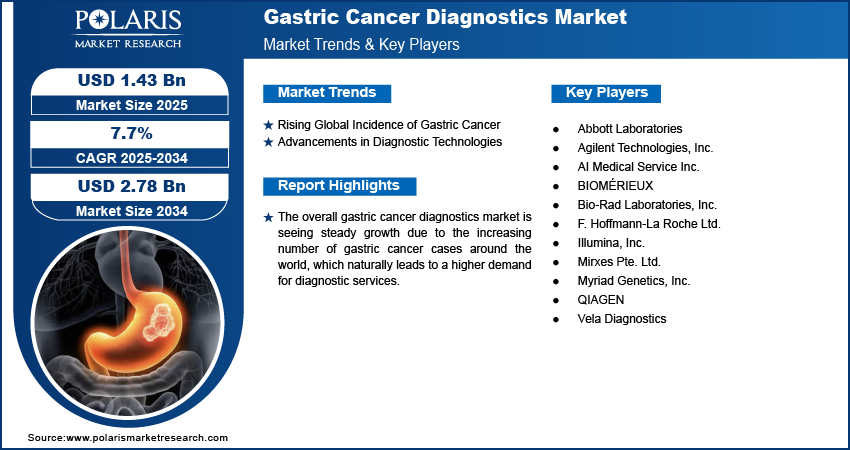

The global gastric cancer diagnostics market size was valued at USD 1.33 billion in 2024 and is anticipated to register a CAGR of 7.7% from 2025 to 2034. The market is largely driven by the increasing prevalence of gastric cancer worldwide and a greater focus on early disease detection through screening programs.

The gastric cancer diagnostics focuses on identifying and confirming the presence of stomach cancer, also known as gastric cancer. This includes a variety of medical procedures, tests, and evaluations used by healthcare professionals to detect the disease early, assess its severity, and guide treatment plans.

To Understand More About this Research: Request a Free Sample Report

The increasing shift toward personalized medicine is a significant driver of the gastric cancer diagnostics industry growth. Personalized medicine aims to tailor medical treatment to the individual characteristics of each patient, which relies heavily on advanced diagnostic testing to identify specific cancer biomarkers, genetic mutations, and molecular profiles of a patient's tumor. This allows clinicians to select therapies that are most likely to be effective for a particular patient, moving away from a "one-size-fits-all" approach.

The global increase in the geriatric population is a substantial driver for the market. Gastric cancer incidence rises significantly with age, making older individuals a high-risk group that requires more frequent screening and diagnostic attention. As the proportion of older adults in the global population continues to grow, so does the pool of individuals susceptible to gastric cancer, leading to a higher demand for diagnostic services.

Industry Dynamics

Rising Global Incidence of Gastric Cancer

The increasing number of gastric cancer cases worldwide fuels the demand for diagnostic solutions. Despite advancements in prevention and treatment, gastric cancer remains a significant global health challenge, especially in certain regions. The sheer volume of new diagnoses necessitates a robust and accessible diagnostic infrastructure. This includes everything from initial screening tools to advanced confirmatory tests.

For instance, according to the World Cancer Research Fund (WCRF) and the Global Cancer Observatory (GCO) by the International Agency for Research on Cancer (IARC), there were 968,784 new cases of stomach cancer globally in 2022. Countries in Asia, particularly China and Japan, accounted for a substantial portion of these cases. This continuous high incidence globally ensures a steady and growing patient pool requiring effective diagnostic procedures, thus driving the market.

Advancements in Diagnostic Technologies

Ongoing innovations in diagnostic technologies are significantly shaping and expanding the gastric cancer diagnostics market. These advancements focus on improving detection accuracy, reducing the invasiveness of procedures, and enabling earlier diagnosis—all of which are critical for improving patient outcomes. New techniques, ranging from advanced imaging to molecular diagnostics, are providing healthcare professionals with more effective tools to detect and assess gastric cancer.

For example, a review published in PubMed titled "Advancements in Non-Invasive Diagnosis of Gastric Cancer" by Zhang et al., in February 2025, highlights that "with the emergence of innovative technologies such as advanced imaging, liquid biopsy, and breath tests, the landscape of gastric cancer diagnosis is poised for radical transformation—becoming more accessible, less invasive, and more efficient." These technological advancements, including improved endoscopic techniques and the discovery of novel biomarkers, are offering more accurate and less burdensome diagnostic options, thereby driving market growth.

Segmental Insights

Product Analysis

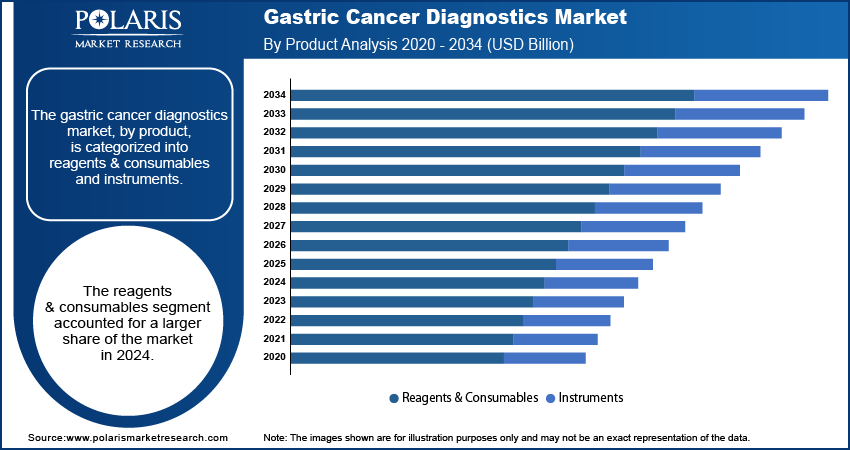

The reagents and consumables segment held the largest share in 2024, primarily due to their consistent and high-volume usage across almost every diagnostic procedure. From basic blood tests to complex molecular analyses, reagents such as antibodies, stains, and various assay kits are indispensable. Every cancer biopsy and immunohistochemistry test identify specific cancer markers, and molecular test for genetic mutations requires a fresh set of these disposables. The ongoing need for precise reagents to detect biomarkers such as HER2 or PD-L1 in gastric cancer tissue ensures a constant demand, particularly in personalized treatment approaches.

The instruments segment is anticipated to register the highest growth rate during the forecast period. This growth is propelled by continuous technological advancements and the increasing adoption of innovative diagnostic platforms. Modern instruments such as advanced endoscopes with enhanced imaging capabilities, including narrowband imaging (NBI) or even AI-powered analysis, are significantly improving the ability to detect subtle lesions early. Furthermore, the rise of sophisticated molecular diagnostic instruments for liquid biopsies and next-generation sequencing (NGS) allows for less invasive and more comprehensive genetic profiling of tumors.

Disease Type Analysis

The adenocarcinoma segment held the largest share in 2024. This is because gastric adenocarcinoma is by far the most prevalent form of stomach cancer, accounting for the vast majority of all diagnosed cases. Its widespread occurrence drives a consistent and significant demand for diagnostic procedures, from initial screening to detailed staging. For instance, a review on "Epidemiology of stomach cancer", updated in 2022, states that the majority of all stomach cancers (~90%) are adenocarcinomas. This high incidence ensures that diagnostic tools and services primarily cater to the detection and characterization of this specific type, solidifying its dominant position in the market.

The gastric lymphoma segment is anticipated to register the highest growth rate during the forecast period. Although gastric lymphoma is a less common form of stomach cancer compared to adenocarcinoma, advancements in diagnostic accuracy and increased awareness are contributing to its growth. Diagnosis often involves a combination of endoscopy with biopsy and specialized immunohistochemical staining to differentiate it from other gastric lesions. Moreover, the primary gastric lymphoma is rare, but its incidence has been increasing over the last two decades. This increasing recognition and better diagnostic capabilities for gastric lymphoma, particularly mucosa-associated lymphoid tissue (MALT) lymphoma, which is often linked to H. pylori infection, are driving the demand for specific diagnostic pathways and tests, leading to its higher growth trajectory.

End Use Analysis

The hospitals segment held the largest share in 2024. Hospitals serve as primary points of care for most patients, offering a comprehensive suite of diagnostic services from initial symptoms to advanced staging. They consist of the necessary infrastructure, including endoscopy suites, imaging departments, and pathology labs, making them central to the diagnostic pathway. Patients typically first present to a hospital for an upper endoscopy and biopsy if gastric cancer is suspected, making these institutions crucial. For instance, the National Cancer Institute (NCI) notes that procedures such as upper endoscopy with biopsy are key in diagnosing stomach cancer, and these are predominantly performed within hospital settings, where immediate follow-up care and multi-disciplinary consultations are readily available.

The diagnostic laboratories segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing complexity of diagnostic testing, particularly the rise of molecular diagnostics and specialized biomarker analysis. While hospitals perform initial screenings, definitive diagnosis and detailed characterization of tumors often rely on specialized laboratory tests. These labs conduct in-depth analyses of biopsy samples for genetic mutations, protein expression, and other biomarkers crucial for personalized treatment plans. The growing adoption of liquid biopsies and next-generation sequencing (NGS) for gastric cancer, which are typically processed in advanced diagnostic laboratories, is contributing significantly to this segment's expansion. As research continues to uncover new biomarkers and diagnostic techniques, the demand for specialized laboratory services is set to increase rapidly.

Regional Analysis

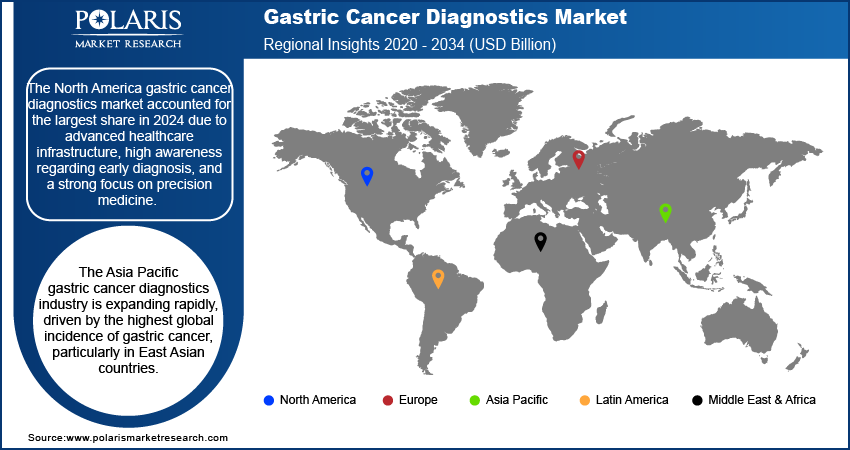

The North America gastric cancer diagnostics market accounted for the largest share across the world in 2024. This is due to advanced healthcare infrastructure, high awareness regarding early diagnosis, and a strong focus on precision medicine. The region benefits from substantial investments in research and development, leading to the adoption of advanced diagnostic technologies. While the overall incidence of gastric cancer may be lower compared to some Asian countries, factors such as an aging population and increasing emphasis on early detection programs contribute to the steady demand for diagnostic solutions. The presence of key players and favorable reimbursement policies further support the growth and innovation within this regional sector.

U.S. Gastric Cancer Diagnostics Market Insight

In North America, the U.S. is a major gastric cancer diagnostics market. The country's robust healthcare system and leading-edge technological advancements contribute to its prominent position. There is a continuous demand for better screening and early detection methods, which is supported by research initiatives. For example, the National Institutes of Health (NIH) awarded a significant grant in April 2025 to evaluate the feasibility of gastric cancer screening in the U.S., highlighting the commitment to improving early detection strategies. The emphasis on personalized medicine, including biomarker-based tests and genomic profiling, also fuels the demand for advanced diagnostic tools in the U.S., enabling tailored treatment approaches.

Europe Gastric Cancer Diagnostics Market Trends

The gastric cancer diagnostics market in Europe is witnessing substantial growth, driven by a growing awareness of the disease, an aging population, and continuous advancements in medical technology. While incidence rates vary across European countries, there is a collective effort to improve diagnostic capabilities to enhance patient outcomes. The region benefits from strong healthcare systems and a focus on integrating innovative diagnostic methods. Efforts are also being made to implement organized population-based screening programs, especially in areas with higher incidence rates, which further boosts the demand for effective diagnostic tools and services across the region.

Germany Gastric Cancer Diagnostics Market Insights

Germany stands out as a key country in Europe. The country boasts a highly developed healthcare system with advanced diagnostic facilities and a strong emphasis on research. While incidence rates of gastric cancer have been declining in Germany, there is still a significant patient population requiring diagnosis and monitoring, particularly among older age groups. The country's commitment to adopting new technologies, including advanced imaging and molecular diagnostics, contributes to the activity. Diagnostic approaches in Germany often integrate comprehensive pathological analysis and biomarker testing to guide patient management.

Asia Pacific Gastric Cancer Diagnostics Market Overview

The Asia Pacific gastric cancer diagnostics industry is expanding rapidly, driven by the highest global incidence of gastric cancer, particularly in East Asian countries. The sheer volume of cases, coupled with increasing healthcare expenditure and improving access to medical facilities, significantly propels the demand for diagnostic solutions across the region. Governments and health organizations in several Asia Pacific nations have implemented widespread screening programs, recognizing the critical role of early detection in improving survival rates. This proactive approach, combined with a growing aging population, creates a dynamic environment for diagnostic growth.

Japan Gastric Cancer Diagnostics Market Outlook

Japan is a leading country in Asia Pacific, renowned for its highly advanced diagnostic practices and widespread screening programs. Gastric cancer has historically been prevalent in Japan, leading to the development of sophisticated early detection strategies, including routine endoscopic examinations. This proactive screening culture has significantly contributed to higher rates of early gastric cancer diagnosis and improved patient survival compared to many other parts of the world. The continuous innovation in endoscopic technology and the strong emphasis on comprehensive diagnostic pathways continue to cement Japan's position at the forefront of gastric cancer diagnostics.

Key Players and Competitive Insights

The competitive landscape of the gastric cancer diagnostics industry is marked by a blend of established healthcare companies and innovative biotechnology firms. These players are actively engaged in developing and commercializing a wide range of diagnostic tools, from traditional biopsy and imaging solutions to advanced molecular and AI-powered platforms. Competition often revolves around technological innovation, the accuracy of diagnosis, the speed of results, and the ability to offer comprehensive solutions that integrate seamlessly into existing clinical workflows.

A few prominent companies in the industry include F. Hoffmann-La Roche Ltd.; Abbott Laboratories; QIAGEN; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Illumina, Inc.; Myriad Genetics, Inc.; Mirxes Pte. Ltd.; Vela Diagnostics; BIOMÉRIEUX; and AI Medical Service Inc.

Key Players

- Abbott Laboratories

- Agilent Technologies, Inc.

- AI Medical Service Inc.

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd. (Roche)

- Illumina, Inc.

- Mirxes Pte. Ltd.

- Myriad Genetics, Inc.

- QIAGEN

- Vela Diagnostics

Industry Developments

May 2025: SSI Diagnostica Group announced that it is acquiring Gulf Coast Scientific to enhance its gastrointestinal disease testing offerings and reinforce its presence in the market.

October 2024, Roche introduced the VENTANA CLDN18 (43-14A) RxDx Assay as the first immunohistochemistry-based companion diagnostic test to receive CE Mark approval for identifying CLDN18 protein expression in tumors of patients with gastric or gastroesophageal junction adenocarcinoma

Gastric Cancer Diagnostics Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Reagents & Consumables

- Instruments

By Disease Type Outlook (Revenue – USD Billion, 2020–2034)

- Adenocarcinoma

- Gastric lymphoma

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Diagnostic Laboratories

- Diagnostic Imaging

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Gastric Cancer Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.33 billion |

|

Market Size in 2025 |

USD 1.43 billion |

|

Revenue Forecast by 2034 |

USD 2.78 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.33 billion in 2024 and is projected to grow to USD 2.78 billion by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include F. Hoffmann-La Roche Ltd.; Abbott Laboratories; QIAGEN; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Illumina, Inc.; Myriad Genetics, Inc.; Mirxes Pte. Ltd.; Vela Diagnostics; BIOMÉRIEUX; and AI Medical Service Inc.

The reagents & consumables segment accounted for a larger share of the market in 2024.

The gastric lymphoma segment is expected to witness the fastest growth during the forecast period.