Defense Cybersecurity Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By Deployment Mode, By Solution, By Security Type, End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6124

- Base Year: 2024

- Historical Data: 2020-2023

Overview

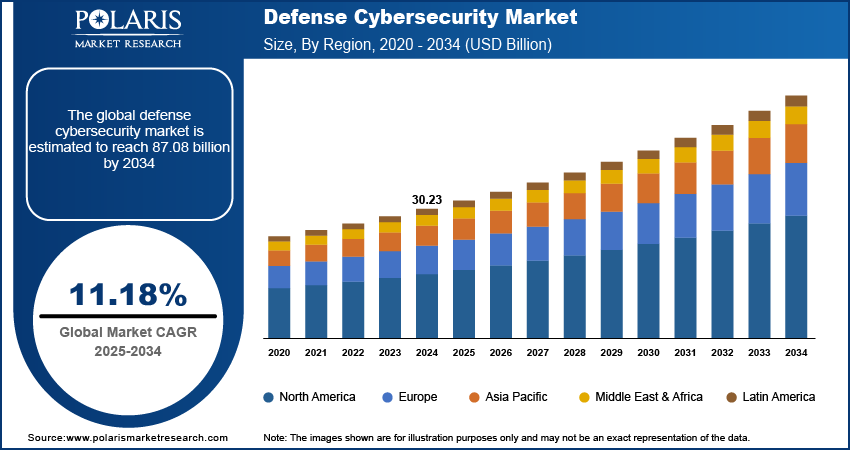

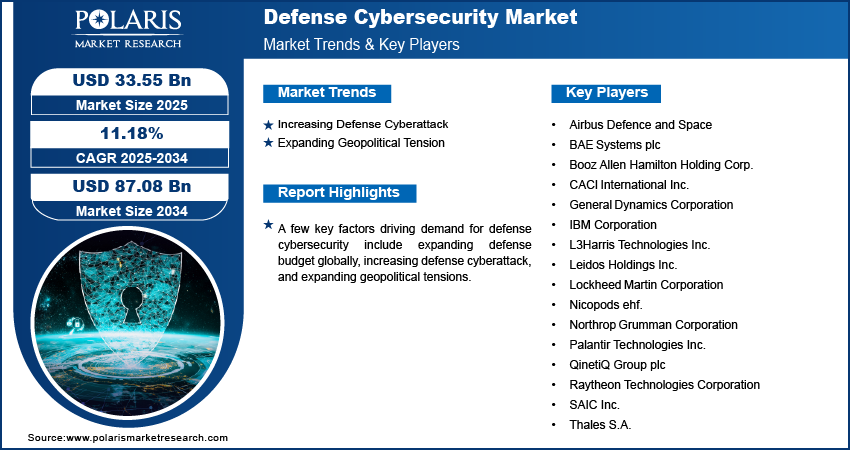

The global defense cybersecurity market size was valued at USD 30.23 billion in 2024, growing at a CAGR of 11.18% from 2025 to 2034. Key factors driving demand for defense cybersecurity include expanding defense budget globally, increasing cyberattacks in the defense industry, and expanding geopolitical tension.

Key Insights

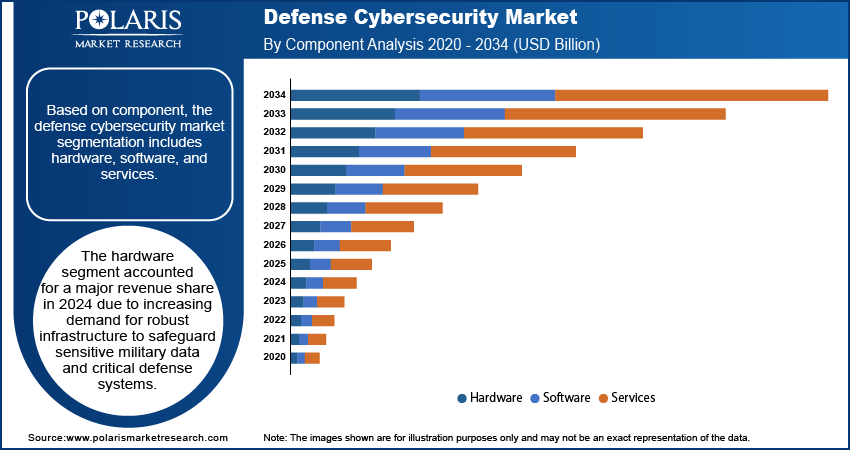

- The hardware segment captured a major revenue share in 2024, driven by growing demand for durable, high-performance infrastructure essential to protect sensitive military data and critical defense assets against evolving cyber threats and sophisticated attacks.

- The on-premises segment held 72.45% revenue share in 2024, favored for offering organizations direct control, enhanced security, and compliance over sensitive data and critical defense infrastructure, which is crucial for mitigating risks in highly secure military environments.

- The threat evaluation and vulnerability management segment dominated revenue in 2024, reflecting the prioritization of defense organizations on proactive risk identification and mitigation strategies to safeguard critical systems from increasingly complex and persistent cyber threats.

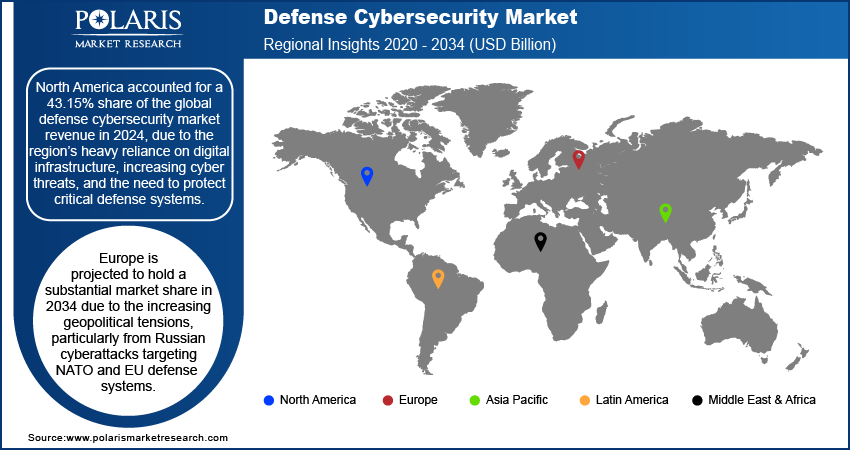

- North America accounted for 43.15% of the global defense cybersecurity revenue in 2024, driven by the region’s reliance on advanced digital infrastructure, the increasing frequency of cyberattacks, and stringent government regulations aimed at securing vital defense and national security systems.

- The industry in Asia Pacific is projected to grow at a fastest pace in the coming years owing to the cyber conflicts involving China and North Korea, and rising tensions between India and Pakistan.

- Countries such as China, Japan, South Korea, and Australia are increasing defense cyber budgets to counter espionage and sabotage threats.

Industry Dynamics

- Increasing number of defense cyberattacks is propelling the market growth by driving governments to invest in stronger cyber defense solutions as these attacks expose vulnerabilities in critical infrastructure.

- The expanding geopolitical tensions are fueling the demand for defense cybersecurity solutions by prompting nations to strengthen their defense cybersecurity capabilities to safeguard military secrets.

- High costs associated with cybersecurity solutions and implementation hinder market growth.

- Advancements in cloud computing and artificial intelligence are projected to create lucrative opportunities in the industry during the forecast period.

Market Statistics

- 2024 Market Size: USD 30.23 Billion

- 2034 Projected Market Size: USD 87.08 Billion

- CAGR (2025–2034): 11.18%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Defense cybersecurity refers to the specialized field within cybersecurity focused on protecting the digital infrastructure, systems, networks, and data assets of defense organizations, including military, government defense agencies, and contractors from cyber threats and attacks. It encompasses a wide range of proactive and reactive strategies, technologies, and practices designed to detect, prevent, respond to, and recover from cyber intrusions that target defense-related digital assets. A defense cyber program integrates threat intelligence, continuous monitoring, incident response, and recovery mechanisms to actively defend against nation-state actors, cybercriminal groups, hacktivists, and insider threats who may seek to disrupt defense systems, steal classified information, or undermine national security.

The usage of defense cybersecurity includes employing a variety of tools such as firewalls, intrusion detection and prevention systems, antivirus software, encryption, and access control measures, alongside advanced threat intelligence platforms that leverage artificial intelligence and machine learning to identify and counter evolving threats in real-time. Furthermore, active cyber defense plays a critical role by incorporating offensive tactics such as cyber deception and threat hunting to mislead adversaries, detect intrusion attempts early in the attack lifecycle, and neutralize threats before they can cause harm.

The global defense cybersecurity demand is driven by the expanding defense budget globally. Stockholm International Peace Research Institute in its report stated that world military expenditure reached $2718 billion in 2024, an increase of 9.4% from 2023. This increase in defense budget is encouraging military organizations worldwide to invest heavily in advanced cybersecurity solutions to protect defense networks, communication systems, and weapon systems from hacking, espionage, and cyberattacks. Moreover, rising defense budgets are increasing integration of digital technologies, such as AI and IoT into operations, which is increasing the need for robust cybersecurity solutions to prevent vulnerabilities.

Drivers and Opportunities

Increasing Defense Cyberattack: Various countries across the world are reporting a rising number of cyberattacks across their defense sector. According to the Indian Ministry of Electronics and IT, cyberattacks on Indian government entities increased by 138% between 2019 and 2023, rising from 85,797 incidents in 2019 to 204,844 in 2023. This is driving governments to invest in stronger cyber defense solutions as these attacks expose vulnerabilities in critical infrastructure. Moreover, rising cyberattacks prompt militaries to prioritize real-time cyber monitoring and AI-powered defense tools to counter evolving threats, thereby driving contracts with cybersecurity firms, which is leading to market growth.

Expanding Geopolitical Tension: Expanding geopolitical tensions are prompting nations to strengthen their defense cybersecurity capabilities to safeguard military secrets, critical infrastructure, and command systems. Rival nations such as China and India are increasingly deploying cyber espionage, sabotage, and disinformation campaigns, compelling governments to invest in advanced threat intelligence, secure communication networks, and resilient cyber defenses. The growing mistrust between global powers is also increasing defense spending on cybersecurity, fostering innovation in military-grade protection and expanding partnerships with private-sector cyber firms.

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware, software, and services. The hardware segment accounted for a major revenue share in 2024, due to increasing demand for robust infrastructure to safeguard sensitive military data and critical defense systems. Governments and defense agencies heavily invested in advanced hardware solutions, such as encrypted communication devices, secure servers, and intrusion detection systems, to counter the rising cyber threats. The proliferation of sophisticated cyberattacks targeting defense networks and the need for real-time threat monitoring drove the adoption of high-performance hardware. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into hardware components enhanced their capability to detect and mitigate zero-day vulnerabilities, further contributing to their market dominance.

The services segment is projected to grow at a robust pace in the coming years, owing to the growing complexity of cyber threats and the need for specialized expertise. Managed security services, including threat intelligence, incident response, and penetration testing, are projected to witness high demand as defense organizations prioritize proactive cybersecurity strategies. The shortage of skilled in-house personnel and the rising cost of maintaining dedicated cybersecurity teams are further pushing agencies toward outsourcing these critical functions. Furthermore, the increasing adoption of cloud-based defense systems and the expansion of IoT analytics in military applications are necessitating the need for continuous monitoring and maintenance, fueling the growth of cybersecurity services.

Deployment Mode Analysis

In terms of deployment mode, the segmentation includes on-premises and cloud. The on premises segment held 72.45% of revenue share in 2024 due to its ability to offer direct control over sensitive data and critical infrastructure. Military agencies and government entities favor on-premises solutions owing to stringent regulatory requirements, data sovereignty concerns, and the need for air-gapped systems in highly classified operations. The rising frequency of cyberattacks further reinforced the demand for localized, physically secured systems that minimize exposure to external threats. Additionally, legacy defense networks, designed for isolated operations, were slow to transition to cloud-based models, ensuring sustained dominance for on-premises deployments.

Solution Analysis

In terms of solutions, the segmentation includes threat evaluation and vulnerability management, identity and access management (IAM), content/data security, managed security solutions, risk and compliance management, and cyber threat protection. The threat evaluation and vulnerability management segment dominated the revenue share in 2024. The surge in sophisticated cyberattacks, including ransomware and advanced persistent threats (APTs) targeting critical defense infrastructure, drove demand for real-time monitoring and automated vulnerability assessment tools. Defense agencies increasingly rely on AI-powered analytics to identify zero-day exploits and patch weaknesses before adversaries can exploit them. Strict compliance mandates, such as the U.S. DoD’s Cybersecurity Maturity Model Certification (CMMC), further accelerated investments in vulnerability management to ensure hardened networks against breaches.

Security Type Analysis

In terms of security type, the segmentation includes network security, endpoint security, application security, cloud security, and infrastructure security. The network security accounted for 43.34% of revenue share in 2024. The increasing frequency of attacks on defense networks, including Distributed Denial-of-Service (DDoS) assaults and advanced espionage campaigns, compelled governments to invest heavily in next-generation firewalls, intrusion detection systems (IDS), and encrypted communication protocols. The shift toward interconnected battlefield technologies, such as tactical data links and satellite communications, further amplified the need for network security to ensure operational integrity. Additionally, the adoption of software-defined networking (SDN) and 5G-enabled military infrastructure needed enhanced network protection, reinforcing the segment’s dominance.

The cloud security segment is estimated to grow at a rapid pace in the coming years, owing to the rising migration to cloud-based platforms for data storage, analytics, and mission-critical operations. The U.S. Department of Defense’s Joint Warfighting Cloud Capability (JWCC) and similar global initiatives are highlighting the strategic shift toward scalable, secure cloud environments. However, the expansion of hybrid and multi-cloud architectures introduces vulnerabilities, such as misconfigurations and unauthorized access, necessitating advanced cloud-native security tools such as cloud access security brokers (CASBs) and workload protection platforms.

Regional Analysis

The North America defense cybersecurity market accounted for 43.15% of the global revenue share in 2024. This dominance is attributed to region’s heavy reliance on digital infrastructure, increasing cyber threats, and the need to protect critical defense systems. The U.S. and Canada invested heavily in cybersecurity to safeguard military networks, intelligence data, and defense supply chains. The growing adoption of advanced technologies such as AI, IoT, and cloud computing in defense operations has also increased vulnerabilities, which necessitated robust cybersecurity solutions. Additionally, stringent government regulations and partnerships with private cybersecurity firms fueled market growth.

U.S. Defense Cybersecurity Market Insights

The U.S. held the largest revenue share in the North America defense cybersecurity landscape in 2024 due to rising cyber warfare threats from China, Russia, and North Korea. The Department of Defense (DoD) has prioritized cybersecurity through initiatives such as the Zero Trust Architecture (ZTA) mandate and the Cybersecurity Maturity Model Certification (CMMC) program. Increased defense budgets, rising ransomware attacks on military contractors, and the need to secure next-gen warfare technologies drove the market growth in the U.S. According to Stockholm International Peace Research Institute, military spending by the USA rose by 5.7% to reach $997 billion in 2024. Additionally, collaborations between defense agencies and Silicon Valley tech firms fostered innovation in cyber defense solutions.

Europe Defense Cybersecurity Market Trends

The market in Europe is projected to hold a substantial market share in 2034 due to the increasing geopolitical tensions, particularly from Russian cyberattacks targeting NATO and EU defense systems. The rise in hybrid warfare tactics, including disinformation campaigns and infrastructure hacking are accelerating investments in military-grade cybersecurity. Furthermore, the growing digitization of defense logistics and the need for cross-border cyber defense cooperation are driving industry growth.

France Defense Cybersecurity Market Overview

France is emerging as a key country in European defense cybersecurity, driven by its strong military-industrial base and proactive government policies. The French Ministry of Armed Forces has launched multiple cyber defense initiatives, including the creation of a Cyber Defense Command (COMCYBER), driving market growth. Increased cyber espionage threats, particularly from Russia and China, are leading to higher investments in encryption, threat intelligence, and secure communications for defense networks. France’s focus on strategic autonomy in defense technology is further fueling demand for homegrown cybersecurity solutions.

Asia Pacific Defense Cybersecurity Market Analysis

The industry in Asia Pacific is projected to grow at a fastest pace in the coming years owing to the cyber conflicts involving China and North Korea, and tensions between India and Pakistan. Countries such as China, Japan, South Korea, and Australia are increasing defense cyber budgets to counter espionage and sabotage threats. China’s military-civil fusion strategy emphasizes cyber warfare capabilities, while Japan and Australia are strengthening alliances with the U.S. for cyber defense collaboration. The rise in cyberattacks on critical infrastructure in the region are pushing governments to adopt advanced cybersecurity frameworks.

Key Players and Competitive Analysis

The defense cybersecurity market is highly competitive, with a mix of established defense contractors, specialized cybersecurity firms, and technology giants competing for dominance. Major players such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies leverage their deep expertise in defense systems to provide integrated cyber solutions, including threat detection, secure communications, and resilient infrastructure. These companies benefit from long-standing government contracts and advanced research in areas such as artificial intelligence (AI) and quantum-resistant encryption. Meanwhile, BAE Systems, Thales, and Airbus Defence and Space bring a strong international presence, offering tailored cybersecurity solutions for NATO and allied nations, often focusing on secure military networks and electronic warfare.

A few major companies operating in the defense cybersecurity industry include Airbus Defence and Space, BAE Systems plc, Booz Allen Hamilton Holding Corp., CACI International Inc., General Dynamics Corporation, IBM Corporation, L3Harris Technologies Inc., Leidos Holdings Inc., Lockheed Martin Corporation, Nicopods ehf., Northrop Grumman Corporation, Palantir Technologies Inc., QinetiQ Group plc, Raytheon Technologies Corporation, SAIC Inc., and Thales S.A.

Key Players

- Airbus Defence and Space

- BAE Systems plc

- Booz Allen Hamilton Holding Corp.

- CACI International Inc.

- General Dynamics Corporation

- IBM Corporation

- L3Harris Technologies Inc.

- Leidos Holdings Inc.

- Lockheed Martin Corporation

- Nicopods ehf.

- Northrop Grumman Corporation

- Palantir Technologies Inc.

- QinetiQ Group plc

- Raytheon Technologies Corporation

- SAIC Inc.

- Thales S.A.

Defense Cybersecurity Industry Developments

May 2025, Leidos announced that it had acquired Kudu Dynamics to scale artificial intelligence (AI)-enabled cyber capabilities for defense, intelligence, and homeland security customers.

April 2025, Leidos announced a new contract to provide signals intelligence (SIGINT) capabilities, engineering, analysis, and reporting tools to the National Security Agency (NSA) for USD $390 million.

January 2025, Leidos announced that it had received a contract to provide Key Management Architecture & Engineering and Cyber Security Engineering Support Services to the Department of Defense, Intelligence Community and civilian agencies.

Defense Cybersecurity Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Solutions Outlook (Revenue, USD Billion, 2020–2034)

- Threat Evaluation and Vulnerability Management

- Identity and Access Management (IAM)

- Content/Data Security

- Managed Security Solutions

- Risk and Compliance Management

- Cyber Threat Protection

By Security Type Mode Outlook (Revenue, USD Billion, 2020–2034)

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Infrastructure Security

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Land Forces

- Naval Forces

- Air Forces

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Defense Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 30.23 Billion |

|

Market Size in 2025 |

USD 33.55 Billion |

|

Revenue Forecast by 2034 |

USD 87.08 Billion |

|

CAGR |

11.18% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 30.23 billion in 2024 and is projected to grow to USD 87.08 billion by 2034.

The global market is projected to register a CAGR of 11.18% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Airbus Defence and Space, BAE Systems plc, Booz Allen Hamilton Holding Corp., CACI International Inc., General Dynamics Corporation, IBM Corporation, L3Harris Technologies Inc., Leidos Holdings Inc., Lockheed Martin Corporation, Nicopods ehf., Northrop Grumman Corporation, Palantir Technologies Inc., QinetiQ Group plc, Raytheon Technologies Corporation, SAIC Inc., and Thales S.A.

The hardware segment dominated the market revenue share in 2024.

The cloud security segment is projected to witness the fastest growth during the forecast period.