U.S. Personalized Vitamins Market Size, Share, Trends, Industry Analysis Report

By Dosage Form (Tablets, Capsules, Powders, Gummies/Chewable, Liquids, Softgels), By Age Group, By Distribution Channel, By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6133

- Base Year: 2024

- Historical Data: 2020-2023

Overview

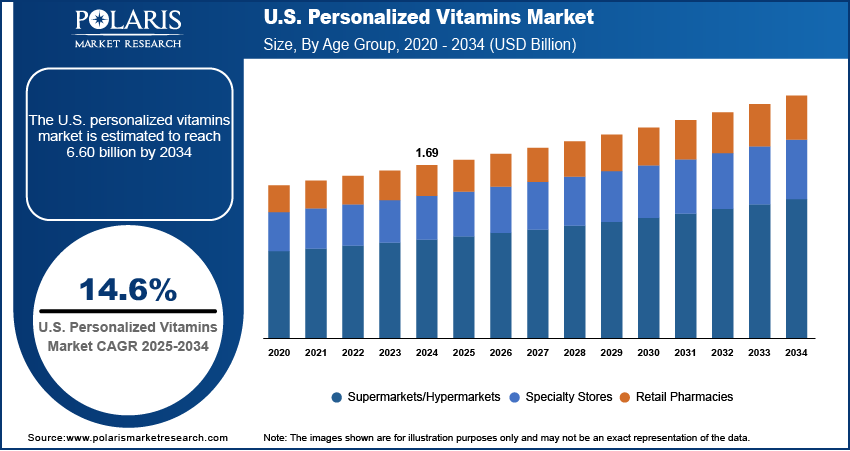

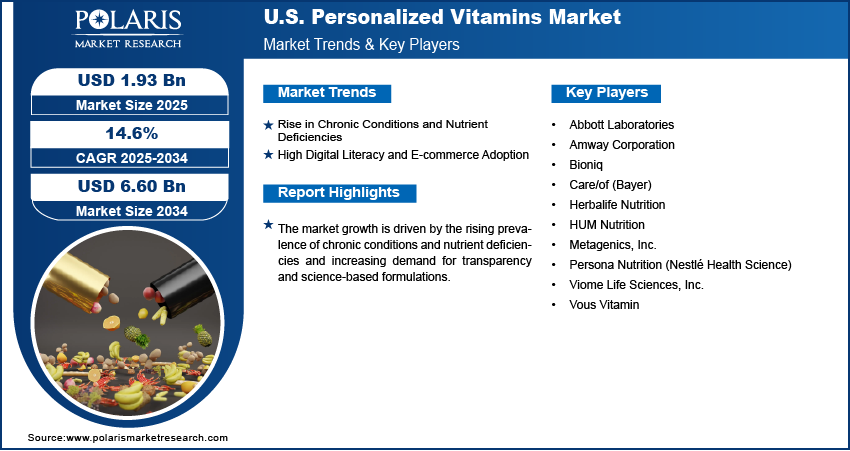

The U.S. personalized vitamins market size was valued at USD 1.69 billion in 2024, growing at a CAGR of 14.6% from 2025 to 2034. The market growth is driven by the rising prevalence of chronic conditions and nutrient deficiencies and increasing demand for transparency and science-based formulations.

Key Insights

- In 2024, the tablets segment dominated with the largest share due to their practicality, cost-effectiveness, and consumer familiarity.

- The geriatric segment is expected to experience significant growth during the forecast period as older adults require targeted supplementation due to age-related changes such as reduced nutrient absorption, chronic health issues, and medication interactions.

- The online pharmacies & e-commerce site segment is expected to experience significant growth during the forecast period as American consumers increasingly rely on digital platforms for healthcare purchases.

- The disease-based supplements segment dominated with the largest share in 2024, as these products are tailored to help manage or prevent chronic health conditions such as diabetes, heart disease, and bone health issues, which are highly prevalent in the U.S.

Industry Dynamics

- Rise in the prevalence of chronic conditions and nutrient deficiencies drives the demand for personalized vitamins.

- High digital literacy and e-commerce adoption are fueling the U.S. personalized vitamins market growth.

- Rising focus on wellness is driving the demand for personalized vitamins.

- High product costs and limited consumer awareness restrain the market growth.

Market Statistics

- 2024 Market Size: USD 1.69 billion

- 2034 Projected Market Size: USD 6.60 billion

- CAGR (2025–2034): 14.6%

To Understand More About this Research: Request a Free Sample Report

Personalized vitamins are custom-formulated supplements tailored to an individual’s unique health needs, lifestyle, genetics, and diet. Personalized vitamins often use data from quizzes, DNA tests, or blood biomarker analysis to determine optimal nutrient combinations. This approach aims to improve effectiveness and avoid under- or over-supplementation.

The U.S. has one of the most advanced healthcare and biotechnology sectors in the world. This environment supports rapid innovation in personalized nutrition, including DNA testing, biomarker analysis, and digital health tools. American companies are leading the way in using artificial intelligence (AI), machine learning (ML), and telehealth services to deliver customized vitamin recommendations. Consumers have access to at-home testing kits and mobile apps that track health data, making it easier to use personalized supplements. These technological advancements give U.S. companies a competitive edge and accelerate consumer adoption across the country.

Wellness is deeply embedded in U.S. culture, influencing everything from food and fitness to sleep and mental health. Personalized vitamins fit into this lifestyle, offering a way for individuals to feel in control of their health routines. Social media influencers, celebrities, and fitness experts regularly promote personalized supplements, which helps boost awareness and trust. Additionally, U.S. consumers further value individuality and customization, making personalized nutrition an appealing option, thereby driving the growth.

Drivers and Opportunities

Rise in Chronic Conditions and Nutrient Deficiencies: Chronic conditions such as diabetes, heart disease, and obesity are widespread in the U.S., often linked to poor nutrition and lifestyle habits. According to the Center for Disease Control and Prevention, in 2023, 40.3% of U.S. adults had obesity. At the same time, many Americans suffer from vitamin deficiencies, such as low levels of Vitamin D or Iron. Personalized vitamins offer a solution by providing supplements tailored to individual health risks and nutritional gaps. Healthcare professionals and wellness coaches are increasingly recommending personalized options as part of a broader prevention strategy. This growing health burden is making customized supplementation more relevant, driving strong demand in the U.S.

High Digital Literacy and E-commerce Adoption: The U.S. citizens have adopted digital platforms for shopping, healthcare, and wellness. Personalized vitamin brands in the U.S. leverage this trend by offering online quizzes, subscription services, and easy-to-navigate digital platforms. Many consumers prefer the convenience of having tailored supplements delivered directly to their homes through e-commerce channels. The COVID-19 pandemic further accelerated the adoption of online health service. This digital-savvy population supports the growth of personalized supplement services that operate almost entirely online, helping brands scale quickly and efficiently in the U.S. market.

Segmental Insights

Dosage Form Analysis

The U.S. personalized vitamins market segmentation, based on dosage form, includes tablets, capsules, powders, gummies/chewable, liquids, and softgels. In 2024, the tablets segment dominated with the largest share due to their practicality, cost-effectiveness, and consumer familiarity. Many American consumers prefer tablets as they are easy to consume, store, and transport. They further allow for precise dosage and the inclusion of multiple nutrients in a single pill, which supports user convenience. U.S.-based personalized vitamin brands often choose tablets as their primary form, especially for subscription models, thereby driving the segment growth.

Age Group Analysis

The segmentation, based on age group, includes pediatric, adults, and geriatric. The geriatric segment is expected to experience significant growth during the forecast period as older adults require targeted supplementation due to age-related changes such as reduced nutrient absorption, chronic health issues, and medication interactions. There is a rising interest in tailored supplements that address specific health needs with the U.S. population aging rapidly and many seniors prioritizing wellness and independence. Personalized vitamin services that include health screenings and biomarker testing are especially appealing to this group. As a result, the geriatric segment is growing in the U.S.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes supermarkets/hypermarkets, specialty stores, retail pharmacies, online pharmacies & e-commerce site. The online pharmacies & e-commerce site segment is expected to experience significant growth during the forecast period as American consumers increasingly rely on digital platforms for healthcare purchases due to their convenience, access to personalized assessments, and home delivery options. Brands such as Care/of and Persona Nutrition have built direct-to-consumer models that include subscriptions, refill reminders, and customized product dashboards. The rise of mobile health apps and telehealth has further fueled online sales, thereby fueling the growth.

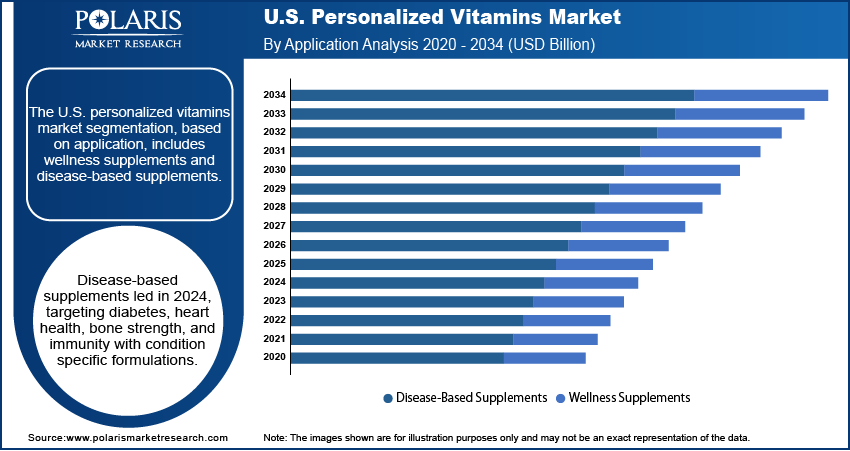

Application Analysis

The U.S. personalized vitamins market, based on application, is segmented into wellness supplements and disease-based supplements. The disease-based supplements segment dominated with the largest share in 2024, as these products are tailored to help manage or prevent chronic health conditions such as diabetes, heart disease, and bone health issues, which are highly prevalent in the U.S. population. Personalized supplements that include targeted nutrients based on blood tests or genetic data are gaining popularity among individuals suffering from specific health concerns. The increasing burden of chronic illness, along with greater acceptance of nutrition as part of a long-term care plan further fuels the segment growth.

Key Players and Competitive Analysis

The U.S. personalized vitamins market is highly competitive, with a mix of established healthcare giants and innovative startups. Companies such as Abbott Laboratories and Bayer’s Care/of leverage strong research capabilities and brand recognition to deliver science-backed personalized solutions. Nestlé’s Persona Nutrition and Viome Life Sciences utilize AI and microbiome data to offer deeply tailored products, gaining popularity among tech-savvy consumers. Herbalife Nutrition and Amway bring global scale and wellness-focused networks, while Metagenics and HUM Nutrition emphasize clean-label, premium-grade ingredients. Bioniq and Vous Vitamin focus on medical-grade testing and personalized formulations, appealing to health-conscious and aging populations. Competition is centered around data-driven personalization, digital engagement, and subscription-based convenience. Companies are investing in digital health platforms, biomarker analysis, and user experience to differentiate their offerings as consumer demand for preventive care and customized health grows. The market continues to evolve rapidly, driven by innovation, health trends, and increasing consumer expectations for tailored wellness solutions.

Key Players

- Abbott Laboratories

- Amway Corporation

- Bioniq

- Care/of (Bayer)

- Herbalife Nutrition

- HUM Nutrition

- Metagenics, Inc.

- Persona Nutrition (Nestlé Health Science)

- Viome Life Sciences, Inc.

- Vous Vitamin

U.S. Personalized Vitamins Industry Development

In January 2025, Bioniq launched a custom supplement product tailored for individuals with special health needs, targeting the 15% of the population seeking personalized vitamins. The company expanded its offerings as part of its strategy to reshape the growing global supplements market.

U.S. Personalized Vitamins Market Segmentation

By Dosage Form Outlook (Revenue, USD Billion, 2020–2034)

- Tablets

- Capsules

- Powders

- Gummies/Chewable

- Liquids

- Softgels

By Age Group Outlook (Revenue, USD Billion, 2020–2034)

- Pediatric

- Adults

- Geriatric

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets/Hypermarkets

- Specialty Stores

- Retail Pharmacies

- Online pharmacies & E-commerce site

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Wellness Supplements

- Disease-Based Supplements

U.S. Personalized Vitamins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.69 Billion |

|

Market Size in 2025 |

USD 1.93 Billion |

|

Revenue Forecast by 2034 |

USD 6.60 Billion |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.69 billion in 2024 and is projected to grow to USD 6.60 billion by 2034.

The market is projected to register a CAGR of 14.6% during the forecast period.

A few of the key players in the market are Abbott Laboratories; Amway Corporation; Bioniq; Care/of (Bayer); Herbalife Nutrition; HUM Nutrition; Metagenics, Inc.; Persona Nutrition (Nestlé Health Science); Viome Life Sciences, Inc.; and Vous Vitamin.

The tablet segment dominated the market share in 2024.

The geriatric segment is expected to witness the significant growth during the forecast period.