Security Inks Market Share, Size, Trends, Industry Analysis Report

By Product Type (Intaglio, Silkscreen, Letterpress, Offset, and Others); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3343

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

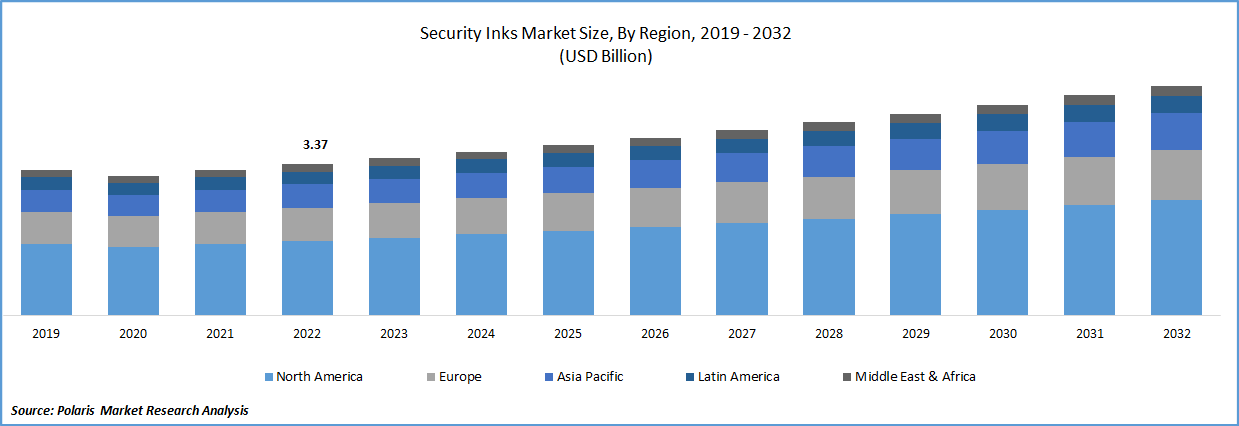

The global security inks market was valued at USD 3.37 billion in 2022 and is expected to grow at a CAGR of 4.3% during the forecast period. The security ink market is evolving rapidly, with new technologies and innovations being developed to meet the growing demand for secure and sustainable solutions. Increased adoption of digital technologies, sustainability, customization, multifunctional ink, and nanotechnologies are some of the latest trends generating potential in the market. Several businesses are utilizing these trends to improve their revenue. For instance, in May 2021, HP Inc. unveiled HP Indigo Secure, a collection of ground-breaking security. Security printers and print service providers can better safeguard their clients from counterfeiters.

To Understand More About this Research: Request a Free Sample Report

Security ink plays a crucial role in protecting businesses, consumers, and sensitive information. One of the primary reasons for adopting security ink is to deter counterfeiting. By using ink that is difficult to replicate or tamper with, manufacturers can make it much harder for criminals to produce fake products. Security ink can help protect a brand's reputation by ensuring that customers are receiving genuine products that meet the company's quality standards. In some industries, such as the financial sector, the use of security ink is required by law or regulation. For example, banknotes and official documents must be printed using specific types of ink to prevent counterfeiting.

The COVID-19 pandemic had a mixed impact on the security ink market. The security ink market is a niche industry that manufactures inks used for printing on products such as banknotes, passports, and other documents that require high levels of security. However, the demand for secure documents such as passports and visas declined due to travel restrictions and the closure of borders in many countries, which led to a decrease in demand for the security inks used in their production.

Apart from this, the pandemic created new opportunities for the security ink market as the demand for secure packaging increased. With the rise of e-commerce and the delivery of goods, there was a greater need for secure packaging to protect the products from theft or damage during transport. This led to an increase in demand for security inks used for printing on packaging materials. Furthermore, the pandemic highlighted the importance of secure documents, such as health certificates, vaccination records, and other medical documents. This increased the demand for the security inks used in their production.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Growing use of security ink in packaging and labelling is one of the prominent factors driving the growth of the global security inks market. To prevent tampering and ensure the authenticity of products, security inks are widely used. For example, in December 2022, Nanografix has established a new product line of lenticular security labels. It is utilised for automatic labelling and laminating for packaging and is produced with incredibly thin substrates. Microtrace also launched new security inks for tags on packaging.

As a result, many businesses are leveraging the benefits of the market by focusing on packaging and labelling. With the growth of e-commerce and increasing concerns around product safety and security, the demand for security inks in packaging and labelling is likely to rise. All these factors are boosting the market’s development.

Growing counterfeiting across many countries is likely to improve the demand for security inks. Counterfeiting is a growing problem in many industries, including pharmaceuticals, electronics, and luxury goods. For example, research by the non-profit Authentication Solutions Providers' Association (ASPA), which works with anti-counterfeit awareness, revealed that cases of substandard and falsified medical items climbed by about 47% from 2020 to 2021, driven by the COVID-19 pandemic. This has enhanced the need for security inks worldwide. As it helps companies fight counterfeiting by making it difficult for counterfeiters to produce fake products that look like the real thing. Subsequently, this factor is rocketing the market’s growth worldwide.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Intaglio segment held largest market share in the 2022

In fiscal year 2022, the intaglio segment dominates the market share. This is due to a combination of precision, uniqueness, and resistance to tampering. Intaglio printing produces an image that is difficult to counterfeit or reproduce using digital or other printing methods. This is because the printing plate itself is difficult to create and requires specialized equipment and expertise, and the resulting prints have a unique texture and feel that are difficult to replicate.

Private businesses as well as the government are adopting intaglio security ink to resist counterfeiting. For example, in January 2023, the Nigerian Security Printing and Minting (NSPM) revealed that the new currency notes’ to leave traces. As a result, it is considered an ideal choice for printing high-security documents such as banknotes and passports.

Security labels segment is dominating the global market

In 2022, the security labels segment held the largest global share in terms of volume and value. This is due to the fact that they offer a highly effective and flexible solution for protecting products and packaging against counterfeiting, tampering, and theft. Security labels can also incorporate various security features, such as serial numbers, barcodes, and RFID tags, which provide additional layers of protection and help track and trace the product throughout the supply chain. Moreover, security labels are easily applied to products or packaging, which means that manufacturers can easily integrate them into their existing packaging processes without significant changes to their production lines.

Asia Pacific is expected to be the largest share over the forecast period

This is primarily due to the rising incidences of forgery and counterfeiting, government support, and many other factors. Growth of e-commerce is one of the primary factors increasing counterfeiting cases in the region. E-commerce made it easier for counterfeiters to sell their goods online, often through social media platforms. However, with the rise of e-commerce, the need for security ink has also increased to combat counterfeiting and fraud. As a result, this factor is likely to spur the growth of the global market in this region.

North America is a significant player in the security ink market, accounting for a significant share of the global market. This is attributed to ongoing technological advancements, various innovations among industry participants, and many other factors. North America is a region with high disposable income levels. For instance, as per the U.S. Bureau of Economic Analysis, disposable personal income in the United States augmented to nearly 19594.76 USD billion in January from 19207.40 USD billion in December 2022. Enhancing disposable income has led to a greater demand for luxury goods and high-end products. This has created a huge need for security ink to protect these products from being counterfeited.

Competitive Insight

The global security inks market involves Chroma Inks, Chromatic Technologies, Ink Tec Inc., Gans Ink, Kao Collins Corporation, Microtrace, Naigai Ink Mfg., SICPA HOLDING, Sun Chemical, and Cronite Company

Recent Developments

- In November 2022, International Paper established the newest technology OHMEGA Conductive Ink + Touchcode that adds a new level of trademark protection to the packaging sector.

Security Inks Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.50 billion |

|

Revenue forecast in 2032 |

USD 5.11 billion |

|

CAGR |

4.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Chroma Inks, Chromatic Technologies Inc., Ink Tec Inc., Gans Ink and Supply, Kao Collins Corporation, Microtrace, Naigai Ink Mfg. Co. Ltd., SICPA HOLDING SA, Sun Chemical, and Cronite Company |

FAQ's

The global security inks market size is expected to reach USD 5.11 billion by 2032.

Key players in the security inks market are Chroma Inks, Chromatic Technologies, Ink Tec Inc., Gans Ink, Kao Collins Corporation, Microtrace, Naigai Ink Mfg.

Asia Pacific contribute notably towards the global security inks market.

The global security inks market expected to grow at a CAGR of 4.3% during the forecast period.

The security inks market report covering key segments are product type, application, and region.