Security Orchestration Automation and Response (SOAR) Market Share, Size, Trends, Industry Analysis Report

By Offering (Solutions, and Services); By Application; By Deployment Mode; By Organization Size; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2820

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

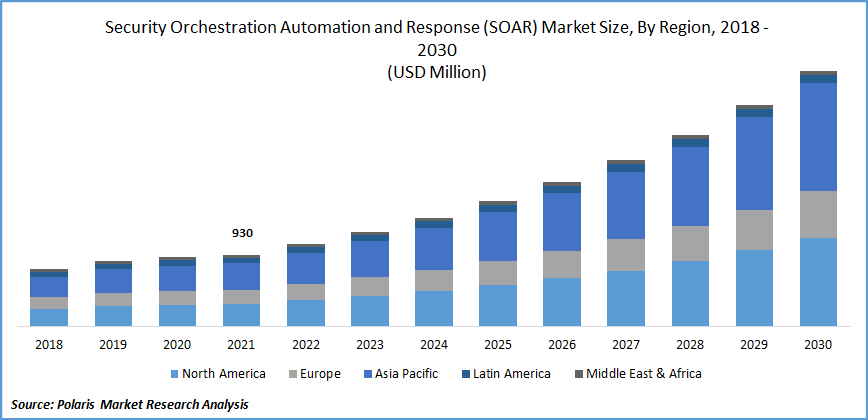

The global security orchestration automation and response (SOAR) market was valued at USD 930 million in 2021 and is expected to grow at a CAGR of 15.2% during the forecast period. During the aforementioned forecast period, increased research and development efforts in the industry and the convergence of security analytics and orchestration will further open up new prospects for the market.

A collection of different software tools known as security orchestration, automation, and response (SOAR) enables enterprises to deal with minor risks by automating procedures. With the use of this solution stack, businesses are better equipped to identify and eliminate low-level security issues without the assistance of human beings.

Know more about this report: Request for sample pages

Security threats and incidents are escalating in both volume and speed. Lowering the mean time to detect (MTTD) and mean time to respond (MTTR) can be achieved with SOAR's improved data context in combination with automation. Threats can be decreased in scope via quicker detection and reaction. With solving bandwidth and latency issues as well as business maturation, the deployment of increasingly intelligent devices supports the expansion industry.

However, the market is significantly constrained by a lack of awareness of SOAR. Nevertheless, it is anticipated that the market would be supported over the assessment year by rising cloud usage, business IoT professionals, and the most reliable IoT network and security orchestration automation and response.

The market was positively impacted by COVID-19 due to the advancement in IT and telecom industries and economies undergoing digital transformation. The pandemic's global effects have increased industrial sector modernization and digitization. To transfer data files in real time with high reliability, automation increased the need for better Internet access, cloud-based apps, connected devices, and IoT services. Over the past few months, the use of security orchestration automation and response has been rising significantly, and solution providers are spending a lot of money on R&D to create and enhance SoCs.

Market.webp)

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising adoption of SOAR across various verticals is the major factor driving the market growth over the forecast period. Retailers with fixed Point-of-Sale (PoS) locations operate from physical stores and online retailers both falling within the retail and eCommerce category. The vertical is at the top of the heap in terms of decreasing costs, boosting revenue margins, and using cutting-edge technology. Due to the possible payouts and the significant volume of financial transactions processed through VISA, MasterCard, and other payment processing networks, it is one of the most frequently targeted verticals by cyber attackers. As a result, comprehensive security solutions are adopted because data risk exists at all levels, from different transactions to the confidentiality of customer and staff personal information.

Retailers are currently implementing cutting-edge technology like internal work localization from one level to another and location-based marketing to draw in customers and fully exploit the risky online business potential. Retailers are using network security software solutions to protect sensitive and private information due to the rise in cyberattacks and data theft activities.

Report Segmentation

The market is primarily segmented based on offering, application, deployment mode, organization size, vertical, and region.

|

By Offering |

By Application |

By Deployment Mode |

By Organisation Size |

By Vertical |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

The service segment is expected to witness the fastest growth

Services are assistance provided by security suppliers to help their clients effectively use and maintain security solutions. Organizations are implementing security services to handle risks associated with cyber threats as well as prevent them in response to the sophistication of cyberattacks. These services help businesses improve their security portal and protect their systems from hacking, exploitation, and data loss. Customers want ongoing advice from SOAR implementation professionals as a result of growing digitization and shifting regulatory standards. Customers can create bespoke solutions for their business processes with the assistance of the expertise collected from managed services.

The Cloud management segment industry accounted for the highest market share

As the entire ecosystem transitions from on-premises traditional ways to cloud-based solutions, organizations are embracing cloud security solutions like security orchestration automation and response to see threats in a centralized manner and make collaborative efforts to remediate assaults. There is a shortage of personnel security in many organizations. Organizations are adapting to the rapid digital revolution by adopting cloud-based technologies and modifying their operating paradigms.

Scalability and agility, reduced physical infrastructure, lower maintenance costs, and 24/7 data accessibility from anywhere are just a few advantages that cloud-based deployment offers to businesses. To stop and safeguard large amounts of data from threats, organizations are implementing SOAR solutions that are both affordable and effective. Cloud computing platforms automate every procedure in a company that lacks the manpower to oversee security operations.

The demand in North America is expected to witness significant growth

Among all the other geographies, the SOAR market in North America is one of the most established markets due to significant investments made by businesses and nations to protect themselves from cyberattacks, as well as the presence of market participants throughout the region.

Europe is anticipated to be the second-largest market over the study period due to the growing demand among businesses from all industry verticals and managed intelligence service providers complying with government laws.

During the projected period, the SOAR market in Asia-Pacific is expected to develop at the fastest rate. The primary factors driving the market's expansion in Asia-Pacific include the surge in SOAR use for security incident and response, security orchestration and automation, and threat intelligence. The cyber threat environment in these nations is evolving daily, and the threats faced by enterprises are rising fast.

Asia Pacific was the most frequently attacked region by cyberattacks, with one in every four attacks launched globally. Threats to nations are also evolving and becoming more sophisticated every day. A proactive leader in the creation and uptake of numerous new technologies, including smart cities, is Asia Pacific. The region also becomes more susceptible to more advanced threats when more complicated projects or technologies are used in it. Many businesses are expanding into Asia Pacific to address the growing vulnerabilities that drive the SOAR market.

Competitive Insight

Some of the major players operating in the global market include Anomali ThreatStream Inc., Cisco Systems, DFLabs Inc, Man SOAR, EclecticIQ, FireEye, Fortinet FortiSOAR, Honeycomb SOCAutomation, IBM Corporation, LogicHub SOAR+, Micro Focus ArcSight SOAR, Rapid7 InsightConnect, ServiceNow Security, Siemplify SOAR Platform Inc., Splunk Phantom Inc., Swimlane SOAR LLC, ThreatConnect SOAR Platform, and ThreatQuotient ThreatQ Corp.

Recent Developments

In May 2022, Cohesity and Palo Alto Networks announced a collaboration for reducing customers' ransomware risk. Palo Alto Network will connect its SOAR technology with Cohesity's Al data management platform.

In March 2022, Splunk and Ridge Security joined together to shorten reaction times. The efficiency of security personnel RidgeBot's API will be integrated into Splunk SOAR, enhancing its ability to defend against strong attacks.

Security Orchestration Automation and Response (SOAR) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,067.4 million |

|

Revenue forecast in 2030 |

USD 3,307.5 million |

|

CAGR |

15.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Offering, By Application, By Deployment Mode, By Organisation Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Anomali ThreatStream Inc., Cisco Systems, Inc., Cyware Virtual Cyber Fusion Center Corp., D3 Security D3 SOAR, DFLabs IncMan SOAR, EclecticIQ Platform, FireEye Helix Inc., Fortinet FortiSOAR, Honeycomb SOCAutomation, IBM Corporation, LogicHub SOAR+, Micro Focus ArcSight SOAR, Rapid7 InsightConnect, ServiceNow Security Operations, Siemplify SOAR Platform Inc., Splunk Phantom Inc., Swimlane SOAR LLC, ThreatConnect SOAR Platform, and ThreatQuotient ThreatQ Corp. |