Self-Compacting Concrete Market Size, Share, Trends, & Industry Analysis Report

By Type (Powder, Viscosity, and Combination), By Raw Material, By Application, By End-Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6080

- Base Year: 2024

- Historical Data: 2020-2023

Overview

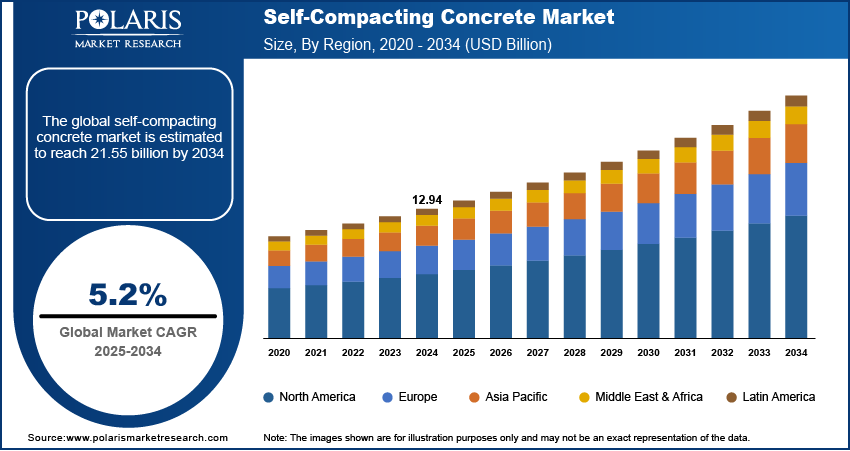

The global self compacting concrete market size was valued at USD 12.94 billion in 2024, growing at a CAGR of 5.2% from 2025–2034. Global urbanization and infrastructure development coupled with sustainability and green building initiatives are driving the growth of the market.

Key Insights

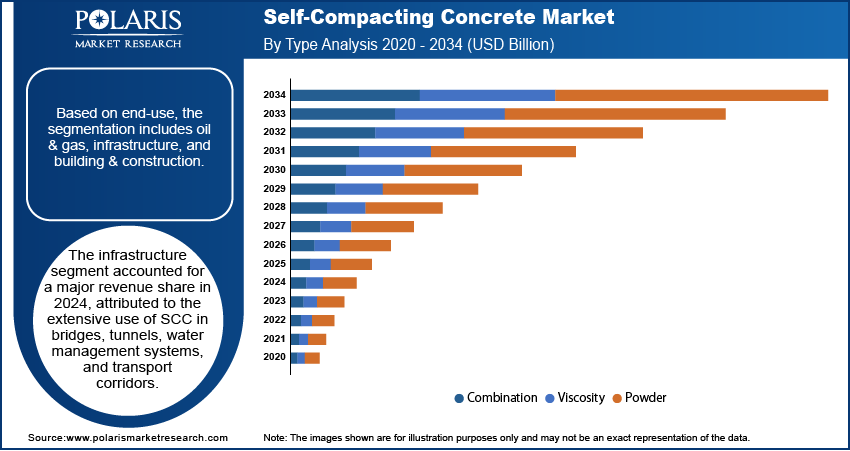

- The combination segment accounted for largest market share in 2024.

- The building & construction segment is projected to grow at the fastest rate over the forecast period, due to the material’s aesthetic and functional advantages.

- The Asia Pacific self-compacting concrete market accounted for 45,8% of the global market share in 2024.

- China self-compacting concrete market held largest regional of the Asia Pacific market share in 2024, driven by the expanding smart city and infrastructure development programs.

- The market in North America is projected to grow at a significant CAGR from 2025-2034. This growth is owing to the rising use of precast and modular construction methods across residential and commercial developments.

- The market in the US is expanding due the regulatory emphasis on construction safety, material durability, and sustainability standards.

Industry Dynamics

- Global urbanization and infrastructure development are driving demand for SCC in high-density cities and megaprojects to meet tight project timelines.

- Sustainability and green building initiatives are accelerating the shift toward SCC as builders aim to meet energy efficiency, carbon reduction, and LEED/BREEAM certification targets through reduced vibration, lower noise, and eco-friendly mix designs.

- Integration of supplementary cementitious materials (SCMs) such as fly ash, GGBS, and silica fume is creating new opportunities to enhance the performance and sustainability of SCC while reducing overall material costs and environmental impact.

- High material cost compared to conventional concrete remains a key restraint, in cost-sensitive markets.

Market Statistics

- 2024 Market Size: USD 12.94 billion

- 2034 Projected Market Size: USD 13.61 billion

- CAGR (2025-2034): 5.2%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Self-compacting concrete (SCC) is a highly flowable, non-segregating concrete that spreads into place under its own weight, filling formwork and encapsulating reinforcement without the need for mechanical vibration. This enables faster placement, improved surface finish, and consistent quality, making SCC a preferred choice in complex construction environments such as high-rise buildings, bridges, and precast components. The shift from traditional concrete to SCC is accelerating due to its ability to reduce labor dependency, enhance construction speed, and meet high-performance requirements in modern infrastructure.

Rising labor shortages coupled with surges in construction costs are driving the adoption of self-compacting concrete (SCC) across regions such as North America, Europe, and parts of Asia Pacific. Traditional concrete placement requires manual vibration and continuous oversight, which increases dependency on experienced labor. SCC minimizes these requirements due to its self-leveling nature, enabling faster placement and reducing labor costs. Contractors and developers are increasingly adopting SCC as a cost-effective solution to maintain productivity while addressing labor shortages and project delays. These advantages are beneficial for speed and precision in urban construction and precast manufacturing environments.

Additionally, large-scale government investments in public infrastructure are contributing to the growth of the SCC market. Projects involving roads, bridges, tunnels, rail systems, and water treatment facilities require durable, flowable concrete that perform well under structural and environmental stress. SCC provides high mechanical strength, improved bond with reinforcements, and enhanced durability, making it suitable for such demanding applications. According to the Ministry of Information & Broadcasting, India’s total infrastructure spending witnessed substantial growth, driven by combined public and private sector investments. Budget allocations reached approximately USD 120 billion in 2023–24, marking a significant rise in infrastructure development efforts. Governments prioritizing long-term infrastructure development for economic growth and urban resilience are driving increased adoption of self-compacting concrete across public and private sector projects.

Drivers & Opportunities/Trends

Global Urbanization and Infrastructure Development: Rapid urbanization growth and the continued expansion of metropolitan regions are increasing the demand for construction materials that offer long-term structural stability and reduced labor dependency. As per United Nations estimation, an additional 2.5 billion people are expected to live in urban areas by 2050, reflecting the ongoing global trend of population movement from rural to urban regions. SCC are increasingly used in infrastructure projects such as bridges, tunnels, and high-rise buildings due to its ability to ensure uniform placement and improve durability. Its application reduces construction time, supports automation, and minimizes rework benefits that are relevant in fast-developing urban centers.

Sustainability and Green Building Initiatives: Regulatory frameworks aimed at promoting sustainable construction are further propelling the growth of the market. For instance, in 2024, the World Green Building Council launched a new global programme aimed at making all buildings net zero by 2050. The initiative focused on helping the construction and real estate industries cut carbon emissions and adopt sustainable building practices worldwide. The material’s self-consolidating nature allows for low-noise application, making it suitable for urban infill projects and nighttime operations. It also enables the partial replacement of traditional cement with recycled or industrial by-products, supporting environmental performance goals. Also, growing influence of green certifications such as leadership in energy and environmental design (LEED) and building research establishment environmental assessment method (BREEAM) is driving demand for self-compacting concrete in projects focused on reducing embodied carbon and improving energy efficiency.

Segmental Insights

Type Analysis

Based on type, the segmentation includes powder, viscosity, and combination. The combination segment accounted for largest revenue share in 2024, driven by its balanced mix of powder and viscosity-modifying admixtures, enabling optimal flow and segregation resistance in varied placement conditions. Contractors and ready-mix suppliers prefer this type for its adaptability across reinforced structures, complex formworks, and vertical pours. It provides consistent performance in both precast and cast-in-place applications, supporting construction quality in large-scale infrastructure and building projects.

The viscosity segment is projected to register the fastest growth during the forecast period, owing to the rising demand in tunnel linings, deep foundations, and column structures. Viscosity-modifying admixtures offer enhanced control over concrete behavior, under variable weather and site conditions. Growing demand for precise material performance in tight construction environments is boosting the adoption of this type among engineers and architects focused on reliable solutions for architectural and infrastructure components.

Raw Material Analysis

Based on raw material, the segmentation includes fine & coarse aggregates, water, cement, admixture, fibers, and others. The admixture accounted for largest revenue share in 2024, driven by the essential role of chemical additives in achieving SCC’s flowability and stability. These include superplasticizers and viscosity-modifying agents that improve workability without increasing water content. Admixtures enable SCC to maintain high strength and resistance to segregation, in congested reinforcement layouts. The precise control over rheological behavior makes it indispensable across structural and architectural concreting applications.

The fibers segment is expected to grow at the highest CAGR over the forecast period. Fiber-reinforced SCC offers improved crack resistance, ductility, and durability, making it suitable for structural applications such as slabs, pavements, and precast units. Increasing focus on reducing shrinkage, improving impact resistance, and enhancing lifecycle performance is driving demand for various fiber types, including polypropylene, glass, and steel fibers.

Application Analysis

Based on application, the segmentation includes concrete frames, metal decking, columns, drilled shafts, and others. The columns accounted for largest revenue share in 2024, driven by its widespread use in residential towers, commercial buildings, and transportation structures. SCC is well-suited for casting vertical elements with dense reinforcements, eliminating voids and improving surface finish. The material’s ability to flow without vibration makes it ideal for ensuring full compaction in confined spaces, enhancing the structural reliability of load-bearing elements such as columns and piers.

The drilled shafts segment is projected to grow at the fastest pace during the forecast period. SCC is increasingly used in foundation systems for bridges, wind turbines, and tall buildings, where deep shafts must be filled efficiently without segregation. The reduced need for vibration and the ease of placement in deep, narrow spaces are propelling adoption in geotechnical and infrastructure applications. Growing infrastructure investment and the rising number of large-scale transportation projects are supporting the expansion of this segment.

End-Use Analysis

By end-use, the market is segmented into oil & gas, infrastructure, and building & construction. The infrastructure segment held the largest share in 2024, attributed to the extensive use of SCC in bridges, tunnels, water management systems, and transport corridors. SCC improves constructability and structural longevity in complex civil engineering projects, allowing for faster turnaround and reduced rework. Government-funded infrastructure expansion across emerging and developed economies continues to generate strong demand for reliable concrete technologies that ensure safety and performance over time.

The building & construction segment is anticipated to grow at the fastest rate during the forecast period. The material’s aesthetic and functional advantages are leveraged in architectural components, high-rise construction, and urban redevelopment projects. SCC enables intricate formwork filling and high-quality finishes, reducing the need for patching and refinishing. Its growing acceptance in precast components, foundations, and commercial developments is strengthening its application in the broader construction sector.

Regional Analysis

Asia Pacific self compacting concrete market accounted for 45.8% of global market share in 2024. This dominance is due to rapid urbanization coupled with rising infrastructure investment across countries such as China, India, and Southeast Asia. The rising demand for construction materials that improve project speed and reduce manual labor is driving adoption of SCC in residential, commercial, and transport sectors. Developers are using SCC to streamline on-site activities and meet tight construction schedules in congested urban environments. Additionally, national efforts to promote sustainable construction practices are accelerating the use of low-noise, low-waste concrete solutions such as SCC in green-certified projects.

China Self Compacting Concrete Market Insight

China held largest regional share in Asia Pacific self-compacting concrete landscape in 2024, driven by the expanding smart city and infrastructure development programs. According to the Green Finance & Development Center, BRI engagement reached a record high in 2024, totaling approximately USD 70.7 billion in construction contracts and USD 51 billion in investments. Projects involving urban rail, highways, airports, and underground utilities are incorporating SCC to manage complex geometries, reduce construction time, and ensure high-performance concrete placement. The material is increasingly adopted among domestic contractors and engineering firms focused on building structures that require high strength, durability, and efficient constructability.

North America Self Compacting Concrete Market

The market in North America is projected to grow at a significant CAGR from 2025-2034. This growth is owing to the rising use of precast and modular construction methods across residential and commercial developments. The material’s ability to flow easily into formworks without vibration is enhancing construction efficiency, reducing rework, and improving surface finishes in a wide range of structural components. Investments aimed at modernizing bridges, tunnels, and public buildings are further contributing to increased adoption. In addition, growing infrastructure renewal across the region is driving the use of self-compacting concrete to improve structural strength and extend the lifecycle of existing assets.

The US Self Compacting Concrete Market Overview

The market in the US is expanding due the regulatory emphasis on construction safety, material durability, and sustainability standards. For instance, OSHA regulations strengthen construction safety by mandating hazard identification, worker training, safety protocols, and use of personal protective equipment (PPE) to reduce accidents and injuries. Public and private sector projects are adopting SCC to meet performance benchmarks and reduce jobsite noise in populated urban zones. The material’s compatibility with advanced formwork systems and its suitability for both cast-in-place and precast applications are boosting its role in fast-track construction. Developers and engineering firms are adopting SCC to meet demands for high-quality finishes and improved worksite productivity.

Europe Self Compacting Concrete Market

The self-compacting concrete landscape in Europe is projected to hold a substantial share in 2034, due to the growing focus on sustainable construction and energy-efficient urban renewal across the region. Strict enforcement of environmental regulations, including on carbon reduction and construction noise, is contributing to the shift toward low-impact materials such as SCC. Furthermore, the region is addressing aging infrastructure in transport and utilities, where SCC is used to retrofit structures without compromising quality or timeline. Public infrastructure projects increasingly specify SCC for its ability to reduce site disruption while delivering structural consistency and long-term durability.

Key Players & Competitive Analysis Report

The self compacting concrete (SCC) market is moderately competitive, with leading companies emphasizing product innovation, material optimization, and strategic partnerships to expand their regional and global presence. Manufacturers are investing in advanced mix design technologies to develop SCC with superior flowability, durability, and minimal segregation, tailored for use in complex construction applications such as high-rise buildings, precast elements, and infrastructure megaprojects. Key players are focusing on expanding production capacity, adopting sustainable manufacturing practices, and incorporating supplementary cementitious materials such as fly ash and slag to reduce environmental impact and meet green building standards. R&D efforts are directed toward improving rheological behavior, early strength development, and surface finish to meet evolving performance requirements across residential, commercial, and transport sectors. Additionally, the focus on urbanization, smart city development, and modernization of aging infrastructure is boosting the adoption of SCC as a cost-effective and quality-enhancing alternative to traditional concrete.

Major companies operating in the self compacting concrete market include, ACC Limited, Ambuja Cements Ltd., BASF SE, Buzzi Unicem S.p.A., CEMEX S.A.B. de C.V., HeidelbergCement AG, Kilsaran International Ltd., LafargeHolcim Ltd., Roadstone Ltd., Sika AG, Tarmac Holdings Limited, Ultratech Cement Limited, Unibeton Ready Mix, Breedon Group plc, and Firth Concrete Limited.

Key Players

- ACC Limited

- Ambuja Cements Ltd.

- BASF SE

- Buzzi Unicem S.p.A.

- CEMEX S.A.B. de C.V.

- HEIDELBERGCEMENT AG

- Kilsaran International Ltd.

- LafargeHolcim Ltd.

- Roadstone Ltd.

- Sika AG

- Tarmac Holdings Limited

- Ultratech Cement Limited

- Unibeton Ready Mix

- Breedon Group plc

- Firth Concrete Limited

Industry Developments

- August 2024: Kilsaran received approval from Ireland’s Competition and Consumer Protection Commission (CCPC) to acquire Kilmurray Precast Concrete Limited. The acquisition includes key assets such as a sand and gravel pit, chip-processing plant, vehicles, supply contracts, goodwill, and two freehold properties in Derryarkin, Co. Offaly.

- January 2024: ACC Limited acquired the remaining 55% equity stake in Asian Concretes and Cements Pvt Ltd (ACCPL). This acquisition added 2.8 million tons per annum to ACC's production capacity, bringing it to 38.6 million TPA. Combined with Ambuja Cements, the Adani Group’s total cement capacity now stands at 76.1 million TPA.

Self-Compacting Concrete Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Powder

- Viscosity

- Combination

By Raw Material Outlook (Revenue, USD Billion, 2020–2034)

- Fine & coarse aggregates

- Water

- Cement

- Admixture

- Fibers

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Concrete frames

- Metal decking

- Columns

- Drilled shafts

- Others

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil & gas

- Infrastructure

- Building & Construction

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Self Compacting Concrete Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.94 Billion |

|

Market Size in 2025 |

USD 13.61 Billion |

|

Revenue Forecast by 2034 |

USD 21.55 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.94 billion in 2024 and is projected to grow to USD 21.55 billion by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

Asia Pacific dominated the market in 2024, holding 45.8% share.

A few of the key players in the market are ACC Limited, Ambuja Cements Ltd., BASF SE, Buzzi Unicem S.p.A., CEMEX S.A.B. de C.V., HeidelbergCement AG, Kilsaran International Ltd., LafargeHolcim Ltd., Roadstone Ltd., Sika AG, Tarmac Holdings Limited, Ultratech Cement Limited, Unibeton Ready Mix, Breedon Group plc, and Firth Concrete Limited.

The contactor segment dominated the market in 2024, holding largest share. This dominance is driven by its balanced mix of powder and viscosity-modifying admixtures, enabling optimal flow and segregation resistance in varied placement conditions.

The fibers segment is expected to witness the fastest growth during the forecast period, due to the increasing focus on reducing shrinkage, improving impact resistance, and enhancing lifecycle performance