Sensor Bearings Market Share, Size, Trends, Industry Analysis Report

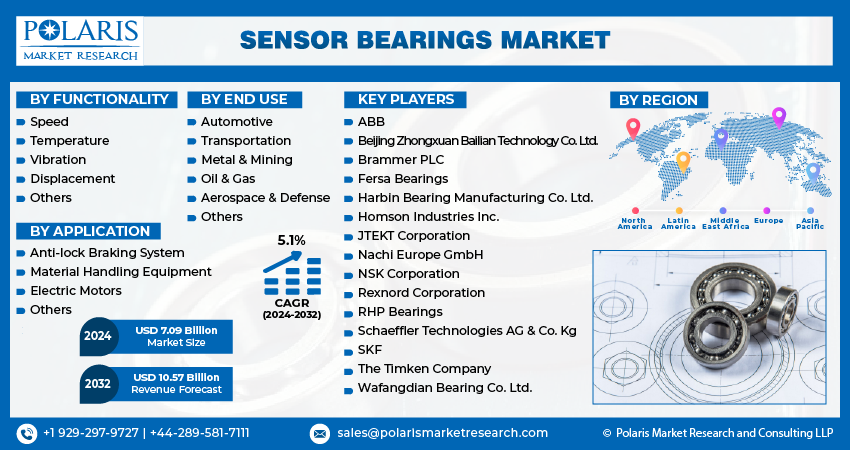

By Functionality (Speed, Temperature, Vibration, Displacement, and Others); By Application; By End-Use; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4105

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

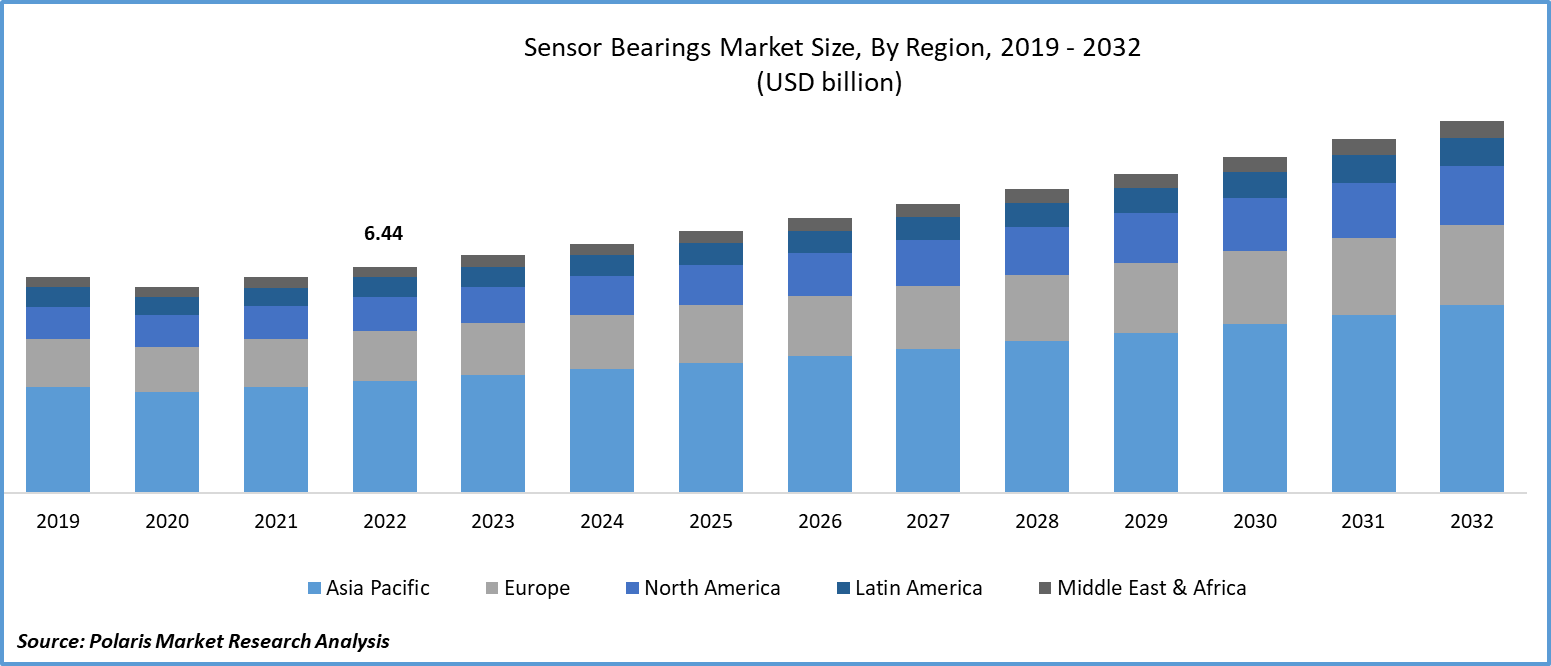

The global sensor bearings market was valued at USD 6.76 billion in 2023 and is expected to grow at a CAGR of 5.1% during the forecast period.

The substantial increase in the demand and adoption of various types of off-road equipment and material handling equipment and growing proliferation for efficient, modern, and low-maintenance bearings across the globe, are the primary factors influencing the market growth. In addition, the growing need and proliferation for high-performance and innovated bearings has encouraged manufacturers to develop new bearings that assimilating advanced sensor units, which helps in assisting digital monitoring of axial movement, deceleration, rotation speed, and acceleration, among others, which in turn, has been propelling the market growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in May 2022, SKF announced about the launch of SKF Axios that is powered by AWS and provides anomaly detection solution for a wide range of applications. The newly developed solution is a fully automated technology that comprised of sensors, gateways, and a machine learning service.

In the recent years, some sensor bearings are increasingly being integrated into IoTs, as they allow for real-time monitoring and data collection, that could be widely used for predictive maintenance and performance optimization. Along with this, sensor bearings worldwide are also being incorporated with advanced data analytics and artificial intelligence algorithms, enabling detection of anomalies or early signs of wear.

However, the incorporation of sensors into bearing could lead to increased manufacturing costs which can be a barrier for its adoption for some industries along with the lack of universal standard bearings for product that complicate their integration and development, are among the factors could restrain the growth of the market.

Industry Dynamics

Growth Drivers

- Rising adoption of IoT and Industry 4.0 and growing technological advancements are likely to spur market growth

There has been a significant increase in the integration of sensor bearings into the wider context of Internet of Things and Industry 4.0, as sensor bearings are playing a very crucial role in gathering real-time data and remote monitoring that could lead to improved and prognostic maintenance approaches and higher operational efficiency. Beside this, the surging use of sensor bearings for predictive maintenance applications, status monitoring, modularization, and smart manufacturing and automation, among others, are further anticipated to boost global sensor bearings market growth over the years.

- For instance, as per a report published by IoT Analytics, there is a significant increase of approx. 319% in annual funding of start-ups that are active in Industry 4.0. Only in 2021, a total of USD 2.2 billion of funding was seen in companies that develop technology related to Industry 4.0.

Report Segmentation

The market is primarily segmented based on functionality, application, end use, and region.

|

By Functionality |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Functionality Analysis

- Speed segment accounted for the largest market share in 2022

The speed segment accounted for the largest market share. The growth of the segment market can be largely attributed to widespread utilization across various industrial applications from aerospace & defense, electric vehicles, energy generation medical equipment, and Industry 4.0, where precise speed monitoring is crucial and critical for safety and performance.

As, there is an increased number of industries who are increasingly adopting predictive maintenance strategies in order to reduce downtime and their overall maintenance costs. The need and demand for sensor bearings as an instrumental approach due to their ability to provide real-time and accurate data on bearing condition, while allowing for timely maintenance and replacement.

By Application Analysis

- Anti-lock braking system segment held the significant market share in 2022

The anti-block braking system segment held the majority market share in 2022, which is majorly driven by continuous growth and expansion of automotive industry that creates huge demand for sensor bearings to be used in ABS and growing technological advancements in ABS technology that led to the development of sophisticated ABS systems requiring high-quality and more accurate sensor bearings. Apart from this, the rising production of vehicles including electric and hybrid vehicles that are equipped with ABS systems and increasing consumer disposable income that allows them to spend higher of vehicles with advanced safety features including ABS.

- For instance, according to a report by ACEA, the total production of motor vehicles in 2022 stood at around 85.4 million units, with a significant increase of 5.7% as compared to previous year.

By End Use Analysis

- Automotive segment is expected to witness highest growth

The automotive segment is expected to grow at highest growth rate during the projected period, mainly due to growing emphasis on vehicle safety all over the world and increasing integration of advanced or innovated sensor bearings into vehicles to enhance their safety features coupled with the ability of these bearings to enhance the performance of various vehicle systems such as transmission, drivetrain, and engine management.

Furthermore, the drastic shift towards electric and hybrid vehicles worldwide is positively fostering the demand for sensor bearings, as electric & hybrid vehicles often require more sensors for various performing various functions such as battery management systems, regenerative braking, and electric power steering seamlessly. Thus, with the upsurge in the sales of such vehicles worldwide, the adoption and demand for sensor bearings are likely to grow as well.

- For instance, as per a report by World Economic Forum, the electric vehicle car sales have increased by over 60% in 2022, surpassing 10 million units for the first time. In 2022, one in every seven passenger cars bought worldwide was an electric vehicle, which only one in every seventy cars in 2017.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with considerable share. The regional market growth is highly attributable to increasing adoption of automation in manufacturing processes and continuous expansion of various industries such as energy and power generation, automotive, electronics and semiconductor, and aerospace & defense, among others, requiring sensor bearings to monitor and control various crucial parameters.

The North America region held the second largest market and is likely to register highest growth over the stud period, owing to region’s growing investment towards research & development activities mainly focused on MEMS sensors and Industry 4.0 and surging need for real-time monitoring and predictive maintenance in industrial applications. In addition, there has been an increasing focus and emphasis on renewable energy sources such as wind turbines and solar panels across the region, which has boosted the demand for sensor bearings, as they are highly essential for monitoring and optimizing the performance of renewable energy systems and helps in improving operational efficiency.

Key Market Players & Competitive Insights

The sensor bearings segment is moderately competitive in nature with the presence of various global and local market players. Several leading companies operating in the market are significantly focusing on different growth strategies including new product endorsements, collaborations, partnerships, and product development and launches.

Some of the major players operating in the global market include:

- ABB

- Beijing Zhongxuan Bailian Technology Co. Ltd.

- Brammer PLC

- Fersa Bearings

- Harbin Bearing Manufacturing Co. Ltd.

- Homson Industries Inc.

- JTEKT Corporation

- Nachi Europe GmbH

- NSK Corporation

- Rexnord Corporation

- RHP Bearings

- Schaeffler Technologies AG & Co. Kg

- SKF

- The Timken Company

- Wafangdian Bearing Co. Ltd.

Recent Developments

- In March 2022, Schaeffler, introduced new gears, sensors, & bearings for the industrial robots at Automate 2023. These new needle roller bearings deliver 30% more tilting rigidity and almost 20% less friction than crossed roller bearings.

- In January 2023, NSXe Co. introduced new Wi-Fi vibration sensor named “Conanair” in the United States. It enables users to easily detect the damage to bearing at very much lower costs.

Sensor Bearings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.09 billion |

|

Revenue forecast in 2032 |

USD 10.57 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Functionality, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |