Sesame Oil Market Share, Size, Trends, Industry Analysis Report

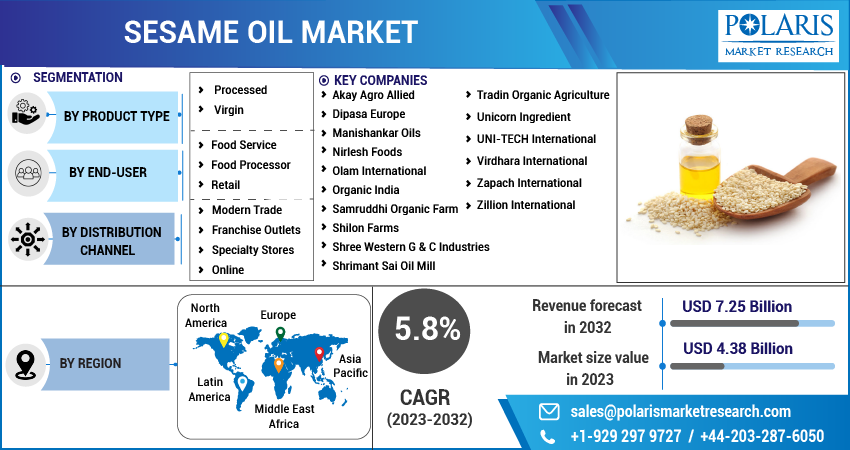

By Product Type (Processed and Virgin); By End User (Food Service, Food Processor, Retail); By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Aug-2023

- Pages: 118

- Format: PDF

- Report ID: PM3729

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

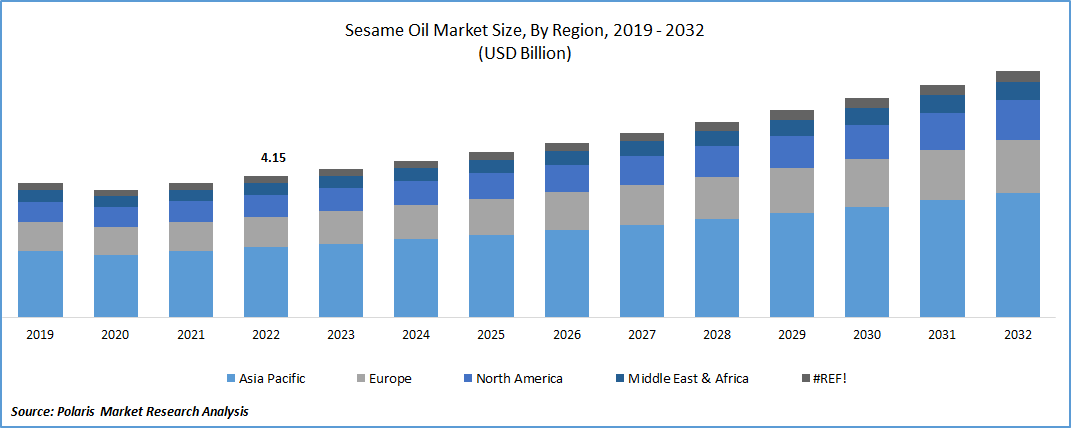

The global sesame oil market was valued at USD 4.15 billion in 2022 and is expected to grow at a CAGR of 5.8% during the forecast period.

The rising awareness among consumers about the range of benefits associated with the consumption of pure sesame oil, growing focus of companies towards finding product applications in apart from food industry like in cosmetics and personal care products and also in nutraceutical applications, are among the key factors fostering the market growth at exponential pace. In addition, surging proliferation for supportive government initiatives helping sesame seed farmers in terms of subsidies and tax rebate and emergence of consumer inclination towards organic and natural products as a major key trend, are likely to positively influence the market.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2023, SEIAW KASEI, introduced its new range of 100% plant ingredient raw material that is made up by upcycling sesame, which is like to increase the collagen production and keep skin moisturized. The newly developed ingredient is COSMOS-approved, NATRUE, completely plant-derived, preservative-free, and biodegradable.

Moreover, the rapidly growing innovations in packaging technologies across the globe that have led to improved preservation and extended shelf life of sesame oil and rising incorporation of light and oxygen-resistant packaging materials such as opaque bottles or cans, which helps to protect the oil from degradation caused by light and air exposure as well as being widely employed to maintain the freshness and flavor of sesame oil, which positively contributes to the sesame oil market growth at rapid pace.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the sesame oil market. The rapid spread of the deadly coronavirus led to significant disruptions in global supply chains and reduced production, as many countries have imposed lockdown and other restrictions. However, the pandemic has placed a greater emphasis on health and wellness with people becoming more conscious of their immune system and overall well-being, thereby increased the demand for product during the pandemic period.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Rising Culinary Exploration

The rising trend of globalization of food culture and the increasing popularity of ethnic cuisines across the world have expanded the demand for sesame oil worldwide. As increased number of people exploring different cuisines and flavors, the use of sesame oil in non-traditional recipes and fusion dishes has huge gained momentum and traction in the last few years, which are the major factors propelling the global market growth.

Furthermore, major sesame oil manufacturers are exploring opportunities for product differentiation and premiumization to cater to different niche markets and higher-end consumers, which includes offering organic or cold-pressed sesame oil, creating unique flavor variants, or introducing value-added products such as infused or blended sesame oils, that helps them to establish a competitive edge and capture higher profit margins and creating lucrative growth opportunities for the market.

Report Segmentation

The market is primarily segmented based on product type, end user, distribution channel, and region.

|

By Product Type |

By End User |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Processed segment accounted for the largest market share in 2022

The processed segment accounted for highest market share in 2022, and is likely to retain its market position throughout the anticipated period, mainly driven by growing awareness among consumers about the potential health benefits of sesame oil, as it is rich in antioxidants, vitamins, and minerals along with the increasing number of health-conscious consumer, actively seeking out healthier cooking oil options like processed sesame oil. The surging popularity of various Asian cuisines like Chinese, Japanese, Indian, and Korean worldwide, that has led to an increased demand for processed sesame oil that is widely utilized in these cuisines.

The virgin segment is projected to gain substantial growth rate over the next coming years, that is largely accelerated to its growing adoption as a healthier alternative diet among consumers due to its anti-inflammatory and heart-healthy properties. The rising penetration regarding the use of virgin sesame oil in natural skincare products due to its potential moisturizing and nourishing properties, is also likely to impact the segment market positively.

By End User Analysis

Food service segment held the significant market share in 2022

Food service segment held the maximum market share in terms of revenue in 2022, mainly due to increasing number of food service establishments including restaurants, hotels, and catering services along with the growing prevalence for sesame oil as a healthier alternative to many other cooking oils due to its high content of monounsaturated and polyunsaturated fats. Additionally, the exponential growth of food delivery services such as Uber Eats, DoorDash, & Grubhub, which led to higher prevalence among restaurants and food outlets for using sesame oil to enhance the flavor of their dishes.

The retail segment is anticipated to grow at fastest growth rate over the anticipated period, which is largely attributable to rapidly surging preference for organic and natural products and growing accessibility to consumers to easily explore different brands, types, and variants of sesame oil through different retail stores coupled with the increasing efforts towards making consumer aware about the potential benefits of the oil and influencing their purchasing decisions.

By Distribution Channel Analysis

Online segment is projected to witness highest growth

The online segment is expected to grow at highest growth rate during the course of study period, which is significantly driven by widespread internet availability and continuous increase in the number of internet users, leading to higher convenience and ease of purchasing such oils through online channels and growing popularity of these channels due to their numerous beneficial characteristics including competitive pricing & discounts, wider product availability, convenient payment methods, and free home delivery among others.

For instance, according to our findings, the number of active internet users globally was stood around 4.9 billion people in 2022, accounting for approx. 69% of total world’s population. It is estimated that number of internet users globally increases around 196 million every year with a growth rate of 4%.

Regional Insights

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with considerable growth rate in 2022, and is anticipated to maintain its market dominance throughout the forecast period, that is highly attributable to presence of major exporting countries of sesame oil including India, Indonesia, and China, which almost accounts for 46% of world’s total exports along with the rising consumption of product in various types of cuisines, massage oils, and Ayurveda.

Moreover, the region is home to a large and rapidly growing population and urbanization especially in countries like China, India, and Indonesia among others, along with rising people incomes and changing lifestyles, which has led to an increased demand for convenience foods that utilizes sesame oil, which in turn, positively contributing towards the segment market.

North America region is projected to be the fastest emerging region with significant CAGR during the forecast period, owing to increasing number of product applications in the food & beverage industry, growing popularity of several international cuisines including Chinese, Thai, Indian, and Korean, and presence of favorable initiatives and support programs helping sesame seed farmers across the region.

Key Market Players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Akay Agro Allied

- Dipasa Europe

- Manishankar Oils

- Nirlesh Foods

- Olam International

- Organic India

- Samruddhi Organic Farm

- Shilon Farms

- Shree Western G & C Industries

- Shrimant Sai Oil Mill

- Tradin Organic Agriculture

- Unicorn Ingredient

- UNI-TECH International

- Virdhara International

- Zapach International

- Zillion International

Recent Developments

- In January 2022, Suntory, announced the expansion of its portfolio for heart and brain health with the launch of new products including DHA & EPA + Sesamin and Sesamin EX, through its direct-to-consumer channel in Singapore. The both newly developed products contain sesame, which is an antioxidant of sesame seeds but is present in comparatively less amount.

- In May 2021, Momofuku, announced the launch of its new own toasted sesame oil, which is a type of cold-pressed oil and is being produced into a dinky bottle. The newly developed oil will mainly serve as the natural upgrade to most home cooks.

Sesame Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.38 billion |

|

Revenue forecast in 2032 |

USD 7.25 billion |

|

CAGR |

5.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By End User, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

FAQ's

The global sesame oil market size is expected to reach USD 7.25 billion by 2032.

Key players in the sesame oil market are • Akay Agro Allied, Dipasa Europe, Manishankar Oils, Nirlesh Foods, Olam International.

Asia Pacific contribute notably towards the global sesame oil market.

The global sesame oil market is expected to grow at a CAGR of 5.8% during the forecast period.

The sesame oil market report covering key segments are product type, end user, distribution channel, and region.