Shared Services Center Market Share, Size, Trends, Industry Analysis Report

By End-use (Pharmaceutical & Clinical, Legal, BFSI, Manufacturing, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4263

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

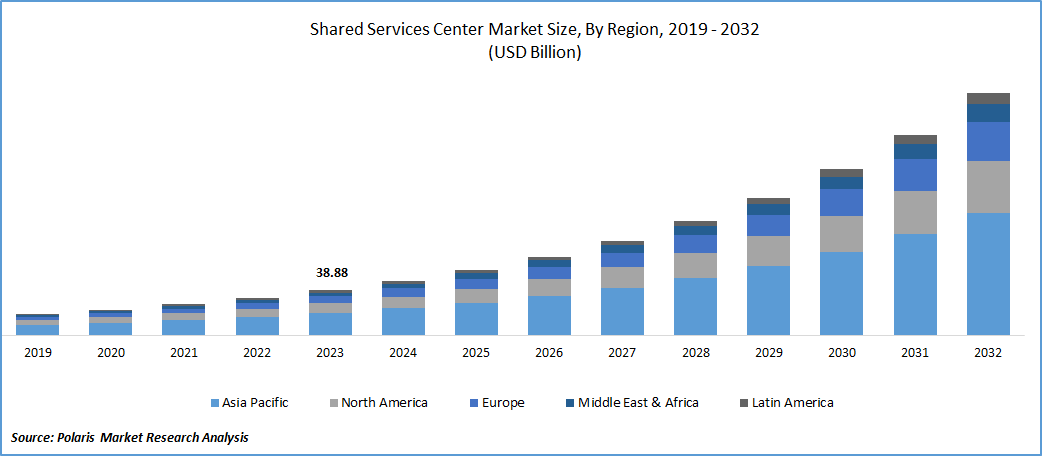

The global shared services center (SSC) market was valued at USD 38.88 billion in 2023 and is expected to grow at a CAGR of 20.6% during the forecast period.

The establishment of SSC is driven by the availability of qualified and cost-effective labor in major developing countries like India, China, Lithuania, & the Philippines. Organizations worldwide are actively seeking innovative approaches for continuous improvement in day-to-day operations, coupled with performance management programs, to maximize the potential outcomes from SSC units. The efficient implementation of SSC has the potential to yield operational cost savings, with key outcomes including reduced operational complexity and enhanced efficiency in task implementation. This underscores the significance of SSC as a strategic approach for organizations aiming to optimize their operations and achieve cost-effective solutions by leveraging qualified labor in developing regions.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for greater strategic flexibility has resulted in a significant increase in the establishment of the SSC. These centers are structured according to organizational frameworks and process flows, aiming to provide a fully optimized impact that enhances operational excellence. Moreover, they assist management in concentrating on strategic decision-making. The implementation of a shared services center entails a comprehensive re-engineering of primary business functions, ultimately aimed at improving operational efficiency and function optimization.

Anticipated tax benefits & the presence of low-cost labor in regions like Eastern Europe, South America, & Asia-Pacific are poised to drive a significant shift in the location dynamics of SSC entities toward these geographies. Currently, Latin American, & Asia Pacific regions are attractive due to their combination of affordable labor and substantial tax relaxation. However, as these regions achieve stable economic development and improve living standards for their populations, it is presumed that the initial tax incentives and labor cost advantages may gradually diminish over the forecast period.

As the economic conditions and living standards improve in these regions, the cost advantages that initially attracted SSC entities may reduce. This shift highlights the dynamic nature of the global business landscape, where organizations may reassess and adapt their SSC strategies based on changing economic conditions and cost dynamics in different regions.

Industry Dynamics

Growth Drivers

Operational Excellence

SSCs enable operational excellence by centralizing non-core functions such as finance, human resources, and IT. This allows organizations to focus on their core competencies while benefiting from standardized, efficient processes.

The ready availability of affordable, qualified labor and a well-educated workforce is expected to be a key driver for the establishment of SSC in regions like Latin America & Asia Pacific. Tax incentives, including tax-free zones and Special Economic Zones (SEZs), as introduced by domestic legislation in certain territories, have had a positive impact on the establishment of SSCs. However, the inherent complexity associated with setting up and implementing the SSC framework is anticipated to pose challenges to market growth. The assigned tasks are dynamically distributed across various business units within SSC functional entities, with routine and repetitive procedures being managed by leveraging best practices from multiple task sets.

Report Segmentation

The market is primarily segmented based on end use, and region.

|

By End Use |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

By End Use Analysis

Others segment accounted for the largest market share in 2023

Others segment accounted for the largest share. In the context of human resources, shared services center market play a crucial role in handling a spectrum of HR activities, including payroll processing, recruitment, managing employee relations, and overseeing training and development initiatives. By centralizing these HR functions within a shared services framework, organizations can streamline their processes without the need to establish separate, dedicated departments for each of these functions.

This consolidation of HR activities in a shared services center allows companies to achieve operational efficiency, as specialized HR teams within the center can efficiently manage diverse HR tasks. Consequently, this streamlined approach not only enhances process optimization but also results in significant cost savings for the company. The shared services model enables organizations to leverage a centralized resource for these critical HR functions, eliminating the need for redundant efforts and associated costs that would arise from maintaining separate HR departments across various business units.

Pharmaceuticals segment will grow rapidly. This growth is primarily fueled by the escalating demand for cost reduction and enhanced efficiency in expediting the market introduction of new drugs within the pharmaceutical industry. In the highly competitive pharmaceutical sector, where innovation and time-to-market are critical, companies are continually seeking ways to optimize their operations and reduce costs. Shared services centers provide a strategic solution by centralizing various functions such as finance, HR, and IT, allowing pharmaceutical companies to streamline their processes and improve overall efficiency. This operational optimization enables organizations to allocate resources more effectively, ultimately contributing to faster and more cost-effective drug development and market entry.

The shared services center model, with its focus on consolidation and efficiency, aligns with the pharmaceutical industry's need for agility, cost-effectiveness, and rapid decision-making. As a result, companies in this sector are increasingly adopting shared services centers to enhance their competitiveness and navigate the dynamic landscape of drug development and commercialization.

Regional Insights

Asia Pacific dominated the global market in 2023

Region stands out due to lower charges associated with setting up SSCs. This can be attributed to the presence of a substantial pool of young, English-speaking professionals, relatively lower wages, and infrastructure costs compared to other regions. The cultural homogeneity in countries such as India, China, & Singapore further enhance the appeal of the region for establishing SSCs. This cultural alignment facilitates seamless collaboration and communication within SSC teams, contributing to operational efficiency. Additionally, the lower labor and infrastructure costs make the region an attractive destination for companies seeking to optimize their operational expenses by leveraging shared services models.

Europe will grow with substantial pace. This growth can be attributed to several factors that make the region an attractive destination for establishing the SSCs. Key elements contributing to this growth include the availability of a skilled labor force, multilingual capabilities, and the cultural and geographic proximity to Western Europe.

Europe benefits from a well-educated and skilled workforce, with a comprehensive knowledge of multiple languages. This linguistic diversity is crucial for SSCs that often handle operations across various regions with different language requirements. The cultural and geographic proximity to Western Europe adds to the appeal, making it easier for companies to manage shared services functions seamlessly across borders. Furthermore, the region hosts numerous well-known universities, providing access to a qualified talent pool. This educational infrastructure ensures a continuous supply of skilled professionals equipped with the necessary knowledge and expertise required for SSC operations.

In Eastern Europe, there is a competition among cities to attract investments for new or expanding SSCs. This competition is evaluated based on factors such as the availability of skilled personnel, labor rates, and infrastructure. The lower operational costs and a still significant talent pool in these second-tier cities contribute to their growing popularity as preferred locations for shared services centers in the European landscape.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Ahlstrom

- Allen & Overy LLP

- Aspen Holdings

- Barclays

- Ernst & Young Global Limited

- Intermedix

- Invest Lithuania

- KPMG International Limited

- Nasdaq, Inc.

- Novartis AG

- PA Knowledge Limited

- PwC

- Tentacle Technologies

- Western Union Financial Services, Inc.

- WNS (Holdings) Ltd.

Recent Developments

- In August 2023, Teleperformance inaugurated a shared service center in Hyderabad, India. This facility offers essential assistance using advanced AI and data analytics for the efficient management of back-office services. These services encompass finance, human resources, IT administrative support, & workforce management.

- In January 2022, Chasey Partners recommended ISA to extend and establish their shared services center, intending to enhance the company's strategic approach. The objective was to shift emphasis from transactional processes towards providing value-added services.

Shared Services Center Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 46.81 billion |

|

Revenue forecast in 2032 |

USD 209.17 billion |

|

CAGR |

20.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Shared Services Center Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The Shared Services Center Market report covering key segments are end use, and region.

The global shared services center market size is expected to reach USD 209.17 billion by 2032

The global shared services center (SSC) market is expected to grow at a CAGR of 20.6% during the forecast period.

Asia Pacific regions is leading the global market.

Operational Excellence are the key driving factors in Shared Services Center Market.