SiC-On-Insulator and Other Substrates Market Share, Size, Trends, Industry Analysis Report

By Substrate Type (Semi-insulating SiC Substrates, Conductive SiC Substrates); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4459

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

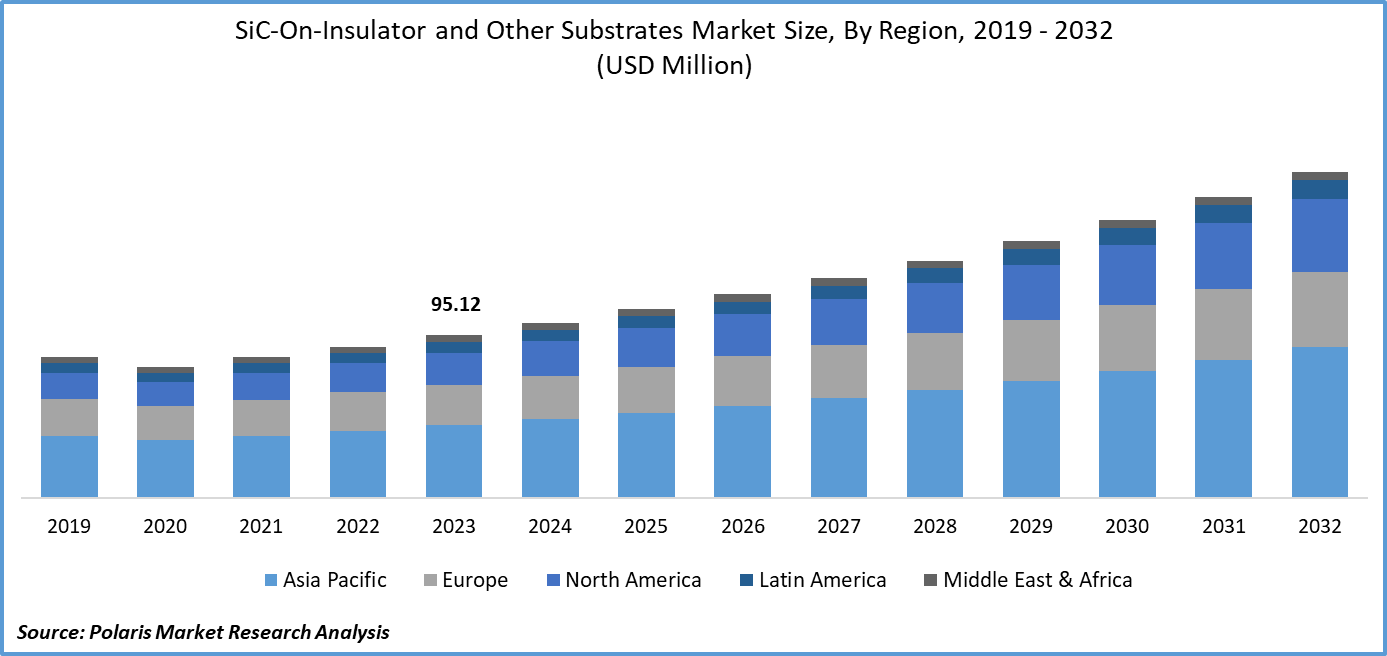

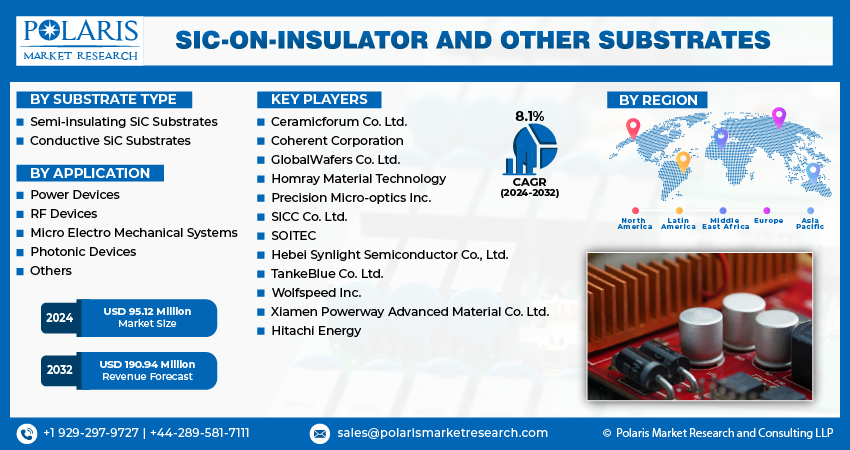

SiC-On-Insulator and Other Substrates Market size was valued at USD 95.12 million in 2023. The market is anticipated to grow from USD 102.44 million in 2024 to USD 190.94 million by 2032, exhibiting a CAGR of 8.1% during the forecast period

Industry Trends

Silicon carbide (SiC) on insulators and other substrates refers to the process of growing or depositing a thin layer of silicon carbide onto an insulating material, such as silicon dioxide sapphire or another suitable substrate material. This technique allows for the creation of high-quality SiC films with excellent electrical and optical properties, which are useful for a wide range of applications.

The global SiC-on-insulator and other substrates market worth are expected to experience significant growth due to the superior properties of silicon carbide, such as high thermal conductivity, chemical inertness, and high-temperature resistance, which make it an ideal material for use in high-power electronic devices, leading to its increased adoption in power electronics and RF power amplifiers. Advancements in CMOS technology have enabled the development of low-cost and efficient SiC-on-insulator materials, further expanding their application scope.

- For instance, in May 2022, Leapers Semiconductor, a developer and manufacturer of power semiconductors, introduced compact SiC MOSFET solutions. These solutions are designed to cater to power electronics applications and include SiC and IGBT modules for improved efficiency and performance of power semiconductors.

The growing demand for energy-efficient technologies also drives SiC-on-insulator and other substrates industry worth, as it helps reduce energy consumption by minimizing power losses in electronic devices. However, the high cost of producing SiC-on-insulator and other substrates is a significant challenge for market growth. The expensive nature of raw materials, coupled with complex manufacturing processes, increases the overall cost of these materials, limiting their widespread adoption. Despite these challenges, government support for the development of advanced technologies and increasing investment in research and development activities are anticipated to create opportunities for the SiC-on-insulator and other substrates market key players during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Key Takeaways

- Asia Pacific dominated the market and contributed over 38% of the SiC-on-insulator and other substrates market share in 2023

- By substrate type category, the conductive SiC substrates segment is expected to grow with a significant CAGR over the SiC-on-insulator and other substrates market forecast to 2032

- By application category, the power devices segment held the dominating SiC-on-insulator and other substrates market share in 2023

What are the market drivers driving the demand for SiC-on-insulator and other substrates market?

- Technological advancements and new product launches drive the SiC-on-insulator and other substrates market growth

The technological advancements and new product launches drive the global SiC-on-insulator and other substrate markets. The market's growth is attributed to the increasing demand for high-performance power electronics devices that operate efficiently at high temperatures and frequencies. SiC-on-insulator and other substrates offer improved thermal conductivity, reduced thermal dissipation, and higher breakdown voltage, making them ideal for use in high-power electronic devices such as electric vehicles, renewable energy systems, and advanced industrial applications.

Similarly, the development of new products and technologies using SiC-on-insulator and other substrates is propelling the growth of the market. For example, the introduction of gallium nitride (GaN) on SiC substrates has expanded the range of available materials for high-frequency and high-power electronic devices, enabling faster switching speeds and more efficient power transfer. Also, several companies are investing heavily in developing new manufacturing processes and equipment to improve efficiency and lower production costs. This includes the adoption of advanced epitaxial growth techniques, chemical vapor deposition (CVD), and molecular beam epitaxy (MBE). These advancements have enabled the production of high-quality SiC crystals with fewer defects, leading to better device performance and increased yield rates.

Which factor is restraining the demand for SiC-on-insulator and other substrates?

- The high cost and complex manufacturing process limit the market growth.

The high cost of production is a major barrier for many companies, especially small and medium-sized enterprises, which may need more resources to invest in the expensive equipment and processes required to produce high-quality SiC crystals. The manufacturing process for SiC-on-insulator and other substrates is highly complex and requires specialized expertise involving steps such as epitaxial growth, doping, and device fabrication. This complexity leads to higher production costs, making it difficult for companies to achieve economies of scale and reduce prices. Moreover, the need for more standardization in the manufacturing process and the dependence on a limited number of suppliers for high-quality SiC crystals further contribute to the high cost of production.

Report Segmentation

The market is primarily segmented based on substrate type, application, and region.

|

By Substrate Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

- By Substrate Type Insights

Based on substrate type analysis, the market is segmented on the basis of semi-insulating SiC substrates and conductive SiC substrates. The Conductive SiC Substrates segment is expected to grow with a significant CAGR over the forecast period due to the increasing demand for high-power electronic devices, which require high-performance power devices that can handle high currents and voltages. Conductive SiC substrates are well-suited to meet this demand due to their excellent electrical properties.

Also, the increasing emphasis on energy efficiency and sustainability has driven the adoption of conductive SiC substrates in renewable energy applications such as solar inverters, wind turbines, and electric vehicles, as they offer lower power losses and higher efficiency compared to traditional silicon devices.

By Application Insights

Based on application analysis, the market has been segmented on the basis of power devices, RF devices, and others. The power devices segment held the dominant market share in 2023 in the market. This dominance is due to the increasing demand for high-power electronic devices, such as electric vehicles, renewable energy systems, and industrial motor drives. This has led to a growing requirement for high-performance power devices that can handle high currents and voltages. SiC power devices are well-suited to meet this demand due to their excellent electrical properties, such as high breakdown voltage and high thermal conductivity. These properties enable SiC power devices to operate efficiently and reliably in high-power applications, making them a popular choice for power electronics designers.

Also, the development of advanced manufacturing techniques has improved the quality of SiC crystals, leading to a reduction in production costs to an extent and an increase in the availability of high-quality SiC wafers. This has enabled the production of more affordable SiC power devices, which has helped to drive up demand in the market.

Regional Insights

Asia Pacific

The Asia Pacific has emerged as the dominant region in terms of market share in the global SiC-on-insulator and other substrates industry. One of the primary reasons for this dominance is the presence of leading semiconductor manufacturers in countries such as Taiwan, South Korea, Japan, and China. These companies have invested heavily in research and development, which has enabled them to develop advanced technologies and production processes that can meet the growing demand for high-performance SiC devices.

In parallel, governments in these countries provide various initiatives to encourage the growth of the semiconductor industry, which further supports the expansion of the SiC market. Also, the availability of low-cost labor and raw materials in some Asian countries helps reduce production costs, making it more competitive for companies operating in the region. The increasing adoption of electric vehicles and renewable energy sources in the region creates a significant demand for power electronics devices that use SiC technology, further contributing to the dominance of the market.

North America

The North American region is expected to experience significant growth in the global markets due to the increasing demand for high-power electronics, such as advanced-power electronic devices. These applications require high-performance materials that handle higher temperatures and voltage levels than regular insulators. In addition, the presence of prominent players in the region is also contributing to the growth of the SiC-on-insulator market.

Competitive Landscape

The market's key players are focused on developing and producing high-quality, reliable, and efficient products that meet the growing demand for power electronics and RF applications. They invest heavily in research and development to improve the properties of SiC materials, such as reducing defects, improving purity, and increasing crystal size, which can enhance device performance and longevity. These key players also work closely with customers to understand their specific requirements and develop customized solutions tailored to their needs.

Some of the major players operating in the global market include:

- Ceramicforum Co. Ltd.

- Coherent Corporation

- GlobalWafers Co. Ltd.

- Homray Material Technology

- Precision Micro-optics Inc.

- SICC Co. Ltd.

- SOITEC

- Hebei Synlight Semiconductor Co., Ltd.

- TankeBlue Co. Ltd.

- Wolfspeed Inc.

- Xiamen Powerway Advanced Material Co. Ltd.

- Hitachi Energy

Recent Developments

- In October 2023, Globalwafers, the manufacturer of silicon wafers, plans to start mass-producing an advanced type of chip substrate by 2025 to address the auto industry's surging demand for power semiconductors.

- In May 2023, Hitachi Energy inaugurated a new SiC e-Mobility production line in Lenzburg, Switzerland. This is an example of smart manufacturing, and the fully automated production line includes fully integrated data systems, as well as a new clean room and server infrastructure.

- In December 2020, Infineon Technologies launched the CIPOS Maxi IPM IM828 series. It is a 1200 V transfer molded silicon carbide (SiC) integrated power module (IPM). The series provides a compact inverter solution with thermal conduction and a wide range of switching speeds for 3-phase AC motors.

Report Coverage

The SiC-On-Insulator and Other Substrates market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, substrate type, application, and futuristic growth opportunities.

SiC-On-Insulator and Other Substrates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 95.12 million |

|

Revenue Forecast in 2032 |

USD 190.94 million |

|

CAGR |

8.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Substrate Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global SiC-on-insulator and other substrates market size is expected to reach USD 190.94 Billion by 2032

Key players in the market are Ceramicforum Co. Ltd., Coherent Corporation, GlobalWafers Co. Ltd., Homray Material Technology, Precision Micro-optics Inc., SICC Co. Ltd

North American contribute notably towards the global SiC-On-Insulator and Other Substrates Market

SiC-On-Insulator and Other Substrates Market exhibiting a CAGR of 8.1% during the forecast period

The SiC-On-Insulator and Other Substrates Market report covering key segments are substrate type, application, and region.