Sickle Cell Disease Treatment Market Share, Size, Trends, Industry Analysis Report

By Treatment (Blood Transfusion, Pharmacotherapy, Bone Marrow Transplant); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 122

- Format: PDF

- Report ID: PM1396

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

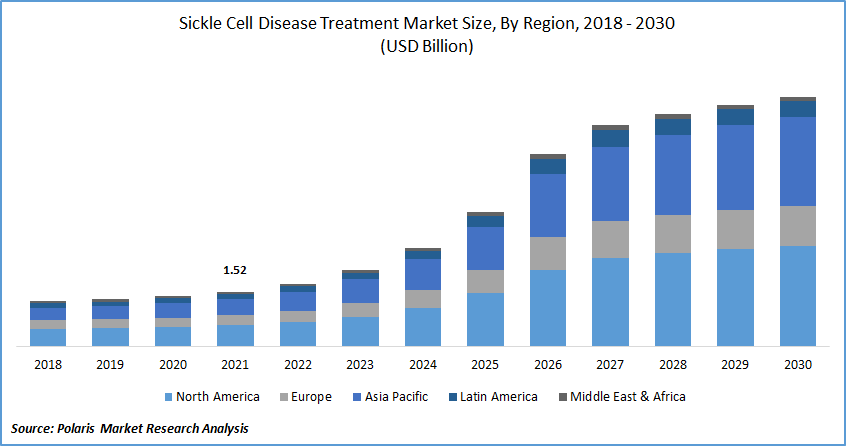

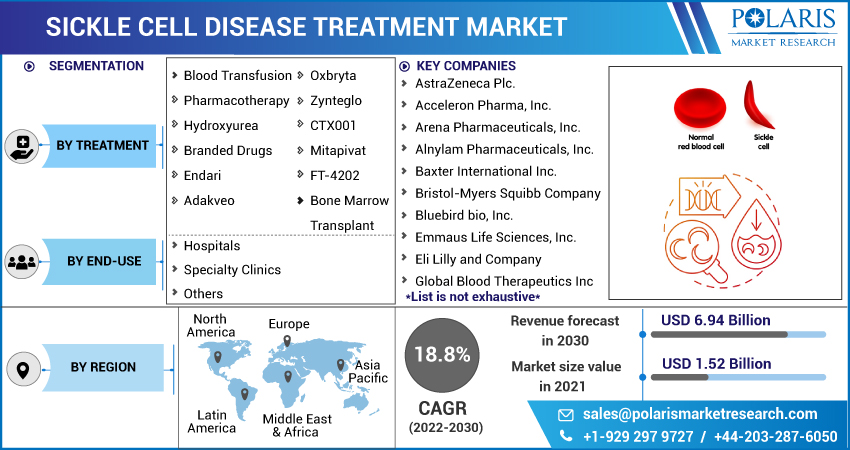

The global sickle cell disease treatment market was valued at USD 1.52 billion in 2021 and is expected to grow at a CAGR of 18.8% during the forecast period. The high prevalence of sickle cell disease in both developing and developed countries is the key driver of the market in both regions. The government and other regulatory bodies are boosting their capital spending assistance for more development and research.

Know more about this report: Request for sample pages

The key constraints hindering the development of the market are the lack of general adoption of the sickle cell disease treatment market and the expensive market demand for medicine. Sickle cell disease (SCD) treatment is a hereditary illness that affects hemoglobin, a molecule that transports oxygen across the body.

It causes a variety of consequences, including for patients who are experiencing syndrome, anemia, and vaso-occlusive crises (VOC). Doctors currently recommend blood and bone marrow transplants for the treatment of SCD. It entails replacing the diseased bone marrow with a healthy substitute obtained from a donor.

Other successful therapies, including medicines and blood transfusions, are also used because they can lessen certain symptoms and extend patients' lives. Even though transplanted bone marrow is the only successful treatment available, it is only recommended for a small percentage of patients. On the market, there are just two FDA-approved medications: hydroxyurea and Endari.

Furthermore, with the world's aging population becoming more vulnerable to chronic diseases, governments are boosting their investments in the healthcare industry to lower mortality risks. As a consequence, the sickle cell disease treatment market is in high market demand for early diagnosis.

For example, in June 2021, The Kidney Cancer Association (KCA) and the Sickle Cell Disease Association of America, Inc. (SCDAA) worked together to create a program called KNOW & TELL to increase awareness of this disease treatment and its probable link to renal phasic carcinoma, a rare kind of kidney cancer (RMC). These activities are projected to boost market growth throughout the forecast period.

The COVID-19 pandemic has far-reaching repercussions in the healthcare business. With the rapid growth in the number of patients, the stress on healthcare institutions and professionals is also increasing. The pandemic had an uneven influence on the market. The number of BMT and blood transfusion treatments decreased when surgeries were postponed.

The pandemic has reduced blood supply demand and donor base. Lockdowns and travel restrictions reduced the number of donors and forced the cancellation of multiple blood drives around the world. For example, blood facilities in the United States saw a 30% drop in blood drives scheduled for the rest of the year, resulting in around 250,000 missed donations.

Furthermore, due to the pandemic, more than 50,000 blood drives have been canceled or relocated, according to the American Red Cross Blood Services. As a result, several hospitals and government agencies chose to reschedule or cancel procedures and consultations to devote resources to COVID-19 patients.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The huge growth in the number of people suffering from SCD is one of the major reasons impacting the market demand for novel drugs that can effectively address disease treatment. According to the World Health Organization (WHO), around 5% of the global population possesses trait genetics for hemoglobin opathies, primarily sickle cell disease and beta-thalassemia.

Hemoglobin problems are hereditary blood diseases caused by the transmission of defective hemoglobin genes from both parents, who are normally healthy. Every year, almost 300,000 newborns are born with serious hemoglobin abnormalities.

As a result, many countries' health government regulators are focusing on expediting the licensing of innovative therapeutic procedures. For example, in November 2019, Oxbryta (voxelotor) was granted fast clearance by the US Food and Drug Administration for the management of sickle cell disease (SCD) in adults and children aged 12 years old and older.

Oxbryta was also designated as an Orphan Drug, which creates opportunities to aid and stimulate the development of treatments for uncommon disease treatment. Global Blood Therapeutics received FDA approval for Oxbryta. Thus, the rising prevalence, along with the FDA approvals for the treatment, is boosting the market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on treatment, end-use, and region.

|

By Treatment |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

The blood Transfusion segment is expected to witness fastest growth

Over the projected period, the blood transfusion segment is expected to develop at a healthy rate. The increased demand for blood transfusions in sickle cell treatment, as well as the rising prevalence of SCD, are driving the expansion of the market. A blood transfusion reduces the body's supply of hemoglobin S red blood cells.

When sickled hemoglobin S cells are at lower concentrations in the bloodstream, they are less prone to accumulate and obstruct blood arteries. Blood transfusion also raises the number of healthy red blood cells in the body, which enhances the body's oxygen supply. A person obtains healthy blood from another person through a blood transfusion. Before being utilized, donated blood is thoroughly checked for pathogens.

Before receiving a blood transfusion, the patient's blood is closely examined to ensure that the donor's blood matches the recipient's. Transfusions allow for the supply of normal red blood cells, which can boost hemoglobin levels and increase oxygen delivery in the body, lowering sickle cell obstruction in blood vessels and the drive to produce more sickle cells.

Many SCD problems are managed with red cell transfusions, both acutely and chronically. Furthermore, plasma transfusion provides chances for players in this arena. As a result, the blood transfusion market is predicted to expand rapidly throughout the forecast period.

Hospital segment accounted for the highest market share in 2021

Throughout the projected period, the hospital sector is expected to dominate the market. VOC is the biggest cause of hospitalization, accounting for roughly 200,000 ER visits in the United States each year. This is projected to benefit hospital segment expansion in the coming years. The growing number of clinics is moving the specialized clinic sector forward.

Furthermore, SCD is linked with a variety of symptoms which has increased the patient's hospital visits. This is another aspect contributing to the segment's growth. As the number of people who use drugs grows, so does the demand for care in home care settings. This will most likely boost the expansion of the other group.

The demand in North America is expected to witness significant growth

Sickle cell disease is a major problem in the healthcare business attributed to its high incidence in North America. The disease treatment is inherited and originated in Africa. According to the CDC, SCD impacts roughly 100,000 people in the United States. SCD impacts around 1 in every 365 Black or African-American babies.

One in every thirteen American babies developed the sickle cell trait. People who have the characteristic of sickle cells are thought to be less likely to contract extreme symptoms of malaria. As a result, the market is likely to benefit from increased awareness about the sickle cell disease treatment market and improved healthcare facilities across Africa.

Furthermore, as the number of SCD babies born in the United States rises, so will the requirement for sickle cell treatment. According to the National Institute of Health, sickle cell disease is a condition and the most common hereditary disease in the US, impacting one in every 500 African Americans.

In addition, every year, around one in every twelve African Americans have the recessive mutation, and around 300,000 newborns with sickle cell anemia. As a result, the aforementioned factors are likely to contribute to the expansion of the studied market in the region.

Competitive Insight

Some of the major players operating in the global market include AstraZeneca Plc., Acceleron Pharma, Inc., Arena Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Baxter International Inc., Bristol-Myers Squibb Company, Bluebird bio, Inc., Emmaus Life Sciences, Inc., Eli Lilly and Company, Global Blood Therapeutics Inc., Novartis AG, Pfizer Inc., and Sangamo Therapeutics, Inc.

Recent Developments

In August 2022, Pfizer Inc. and Global Blood Therapeutics, Inc. (GBT) declared a memorandum of understanding within which Pfizer will obtain GBT for an estimated $5.4 billion. GBT is a pharmaceutical and biotechnology organization devoted to the discovery, advancement, and distribution of life-changing treatment options that offer hope to underprivileged patient populations, beginning with sickle cell disease (SCD).

In February 2022, Global Blood Therapeutics, Inc. reported that the European Commission (EC) has approved Oxbryta (voxelotor) for the management of sickle cell anemia in adults in combination with hydroxycarbamide (hydroxyurea). In Europe, Oxbryta, a drug that effectively inhibits sickle hemoglobin (HbS) polymerization, the fundamental basis of sickling and red blood cell degradation in SCD, has been approved.

Sickle Cell Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.52 billion |

|

Revenue forecast in 2030 |

USD 6.94 billion |

|

CAGR |

18.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Treatment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

AstraZeneca Plc., Acceleron Pharma, Inc., Arena Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Baxter International Inc., Bristol-Myers Squibb Company, Bluebird bio, Inc., Emmaus Life Sciences, Inc., Eli Lilly and Company, Global Blood Therapeutics Inc., Novartis AG, Pfizer Inc., and Sangamo Therapeutics, Inc. |