Single-Use Assemblies Market Size, Share, Trends, Industry Analysis Report

: By Product (Bag Assemblies, Filtration Assemblies, Bottle Assemblies, Tubing Assemblies, and Others), Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 112

- Format: PDF

- Report ID: PM3434

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

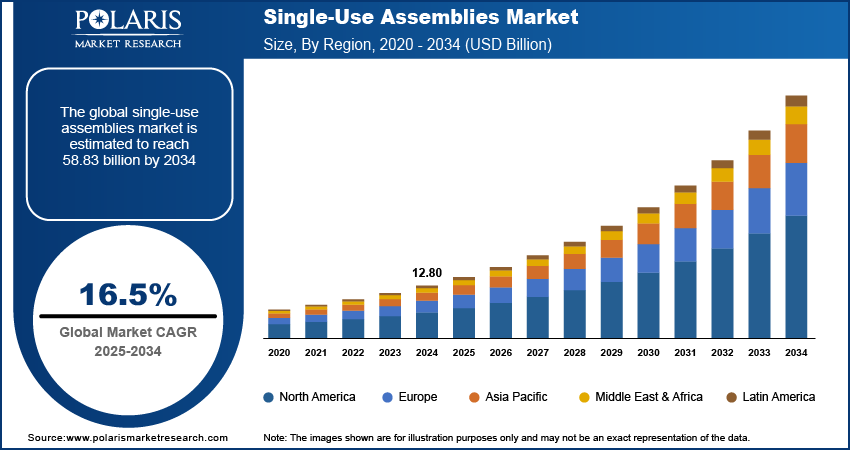

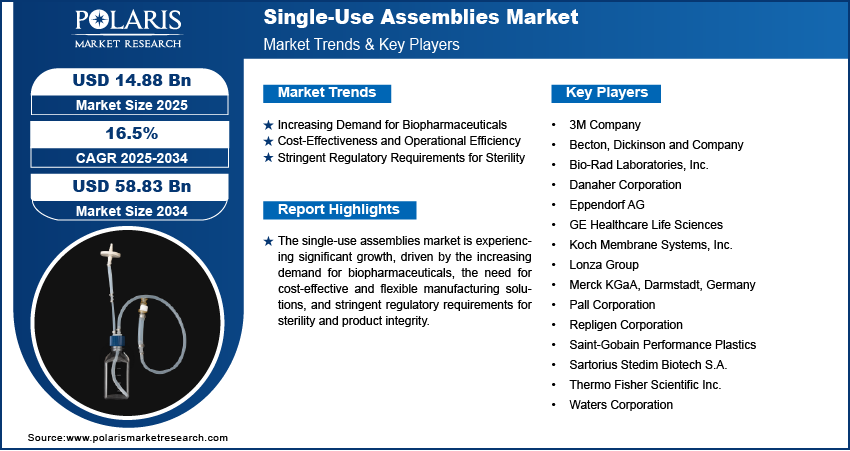

The global single-use assemblies market size was valued at USD 12.80 billion in 2024, growing at a CAGR of 16.5% during 2025–2034. The market growth is primarily fueled by the introduction of stringent regulatory requirements and rising demand for pharmaceuticals.

Key Insights

- The bag assemblies segment accounts for the largest market share, owing to its widespread usage in biopharmaceutical manufacturing to store, mix, and transport critical fluids.

- The cell culture & mixing segment is projected to witness the fastest growth, primarily due to the growing adoption of single-use bioreactors and mixers in the production of biopharmaceuticals.

- The biopharmaceutical & pharmaceutical companies segment dominates the market, owing to major investments in biopharmaceutical production.

- Europe accounts for a major market share. The presence of well-established biopharmaceutical and pharmaceutical industries fuels the region’s leading market position.

- Asia Pacific is witnessing the fastest growth. The regional market growth is driven by rising biopharmaceutical manufacturing and a rising focus on healthcare infrastructure.

Industry Dynamics

- The need for highly controlled and sterile environments for biopharmaceutical production drives market expansion.

- The ability of single-use systems to eliminate the need for extensive cleaning and validation is fueling the adoption of these systems.

- Continuous advancements in material science and engineering, which are enabling the development of robust and versatile single-use assemblies, are expected to provide several market opportunities.

- High initial cost associated with single-use assemblies may hinder market growth.

Market Statistics

2024 Market Size: USD 12.80 billion

2034 Projected Market Size: USD 58.83 billion

CAGR (2025-2034): 16.5%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The single-use assemblies market involves the production and utilization of pre-assembled, sterilized, and disposable components used in biopharmaceutical and pharmaceutical manufacturing processes. These assemblies are designed to minimize contamination risks, reduce cleaning and validation requirements, and increase operational efficiency.

The growing demand for biopharmaceuticals, the need for cost-effective and flexible manufacturing solutions, and stringent regulatory requirements for sterility and process integrity are a few of the key factors driving the single-use assemblies market growth. Emerging trends in the market include advancements in automation, the integration of single-use technologies with digital monitoring systems, and increased adoption of sustainable and environmentally friendly materials.

Market Dynamics

Increasing Demand for Biopharmaceuticals

Biopharmaceuticals, which include vaccines, monoclonal antibodies, and recombinant proteins, require highly controlled and sterile production environments. Single-use assemblies provide an effective solution to meet these stringent requirements by minimizing contamination risks and ensuring product integrity. According to the Biotechnology Innovation Organization, the biopharmaceutical sector has grown rapidly, with biologics representing 46% of the total US prescription drug market by sales in 2021. This increasing reliance on biologics underscores the need for scalable and flexible manufacturing solutions, driving the adoption of single-use technologies. Thus, the rising demand for biopharmaceuticals is boosting the single-use assemblies market revenue.

Cost-Effectiveness and Operational Efficiency

Traditional stainless-steel systems require extensive cleaning, sterilization, and validation, leading to higher operational costs and downtime. Single-use systems eliminate these requirements, significantly reducing cleaning and maintenance costs. For instance, a 2023 study by the International Society for Pharmaceutical Engineering (ISPE) highlights can lower environmental impact compared to traditional systems, which require high-purity water and heat for cleaning and sterilization. Additionally, the reduction in time required for cleaning and validation allows for quicker turnaround between production cycles, enhancing productivity and enabling faster response to market demands. As a result, the cost-effectiveness and operational efficiency of single-use assemblies are propelling the single-use assemblies market development.

Stringent Regulatory Requirements for Sterility

The pharmaceutical industry is subject to stringent regulatory standards to ensure product safety and efficacy. Regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) emphasize the importance of sterility in manufacturing processes. Single-use assemblies offer a pre-sterilized and ready-to-use solution, helping manufacturers comply with these stringent requirements. The adoption of single-use systems reduces the risk of cross-contamination and ensures consistent product quality, aligning with regulatory expectations. As regulatory scrutiny continues to intensify, the demand for reliable and compliant single-use technologies is expected to grow.

Segment Insights

Assessment by Product Insights

The single-use assemblies market, by product, is segmented into bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and others. The bag assemblies segment holds the largest market share, driven by their widespread application in biopharmaceutical manufacturing for storage, mixing, and transportation of critical fluids. Their ability to reduce contamination risk and offer flexibility in manufacturing processes makes them a preferred choice for many biopharmaceutical companies. The ease of scalability and compatibility with various production methods further enhances their adoption.

The filtration assemblies segment is registering the highest growth rate within the market due to its critical role in ensuring sterility and product integrity in biopharmaceutical processes. The increasing demand for high-purity filtration in the production of vaccines, monoclonal antibodies, and other biologics is a significant driver. These assemblies help meet stringent regulatory requirements for sterility and contribute to operational efficiency by simplifying the filtration process. The bottle assemblies and tubing assemblies segments also contribute to market growth, with applications in storage, transfer, and process fluid management. However, their growth is more niche compared to the dominant segments of bag assemblies and filtration assemblies.

Evaluation by Application Insights

The single-use assemblies market, by application, is segmented into filtration, cell culture & mixing, storage, sampling, fill-finish applications, and others. The filtration segment holds the largest market share, driven by its critical role in ensuring the sterility and purity of biopharmaceutical products. The growing demand for biopharmaceuticals, particularly vaccines and monoclonal antibodies, has amplified the need for robust filtration solutions to prevent contamination and maintain product integrity. Filtration assemblies offer efficiency, scalability, and compliance with stringent regulatory standards, making them indispensable in biopharmaceutical manufacturing.

The cell culture & mixing segment is registering the fastest growth in the single-use assemblies market, fueled by the increasing adoption of single-use bioreactors and mixers in biopharmaceutical production. These assemblies support the cultivation of cells and the homogenization of culture media, which is crucial for the production of biologics. The rising demand for flexible and scalable manufacturing solutions, along with advancements in cell therapy and personalized medicine, further drives the growth of this segment. Additionally, the convenience of single-use systems in reducing turnaround times and improving process efficiency contributes to their growing adoption in cell culture and mixing processes.

Outlook by End Users Insights

The single-use assemblies market, by end users, is segmented into biopharmaceutical & pharmaceutical companies, CROs & CMOs, and academic & research institutes. The biopharmaceutical & pharmaceutical companies segment holds the largest market share, driven by their significant investments in biopharmaceutical production and the widespread adoption of single-use technologies to enhance manufacturing efficiency and product quality. These companies rely on single-use systems to streamline production processes, reduce contamination risks, and meet stringent regulatory requirements, making them the primary end-users of single-use assemblies.

CROs & CMOs are experiencing the fastest growth, supported by the growing trend of outsourcing in the pharmaceutical industry. The need for flexible and scalable manufacturing solutions to accommodate various projects and clients drives the adoption of single-use technologies within this segment. CROs and CMOs benefit from the reduced setup and cleaning times associated with single-use systems, allowing for faster project turnaround and cost savings. The growing demand for biopharmaceutical outsourcing services further accelerates the adoption of single-use assemblies in this segment, contributing to its rapid growth.

Regional Analysis

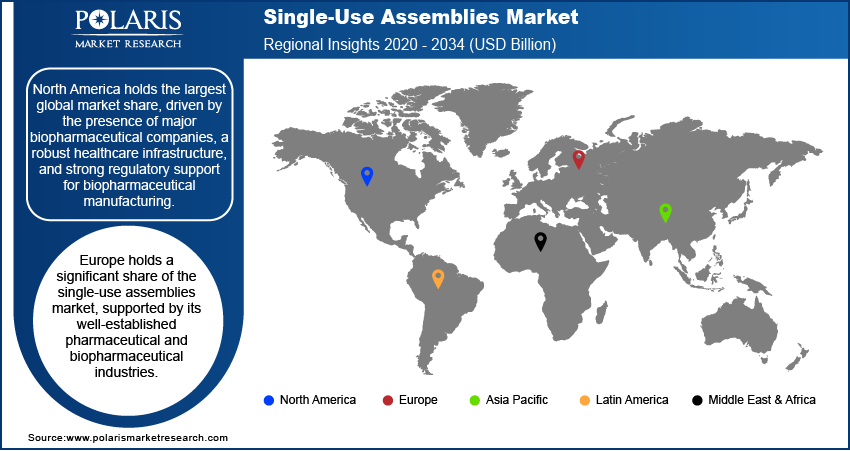

By region, the study provides the single-use assemblies market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share in the global market, driven by the presence of major biopharmaceutical companies, a robust healthcare infrastructure, and strong regulatory support for biopharmaceutical manufacturing. The region’s dominance is also attributed to the increasing demand for biologics, the adoption of advanced manufacturing technologies, and the growing trend of outsourcing by contract research organizations (CROs) and contract manufacturing organizations (CMOs). The US leads in terms of innovation, research, and development in biopharmaceuticals, further fueling the demand for single-use technologies. Europe also contributes significantly to the market, with its strong pharmaceutical industry and regulatory environment. Asia Pacific is witnessing the fastest growth, primarily driven by expanding biopharmaceutical manufacturing capabilities in countries like China and India.

Europe holds a significant share of the single-use assemblies market, supported by its well-established pharmaceutical and biopharmaceutical industries. The region benefits from stringent regulatory frameworks, such as the European Medicines Agency (EMA) guidelines, which drive the demand for reliable and sterile manufacturing processes. Countries like Germany, the UK, and Switzerland are key players in the pharmaceutical sector, with a growing adoption of single-use technologies to ensure compliance with manufacturing standards. Additionally, the increasing trend of contract manufacturing and the rise in biologics production contribute to the growing applications of single-use assemblies in Europe.

Asia Pacific is registering the fastest growth in the single-use assemblies market, driven by the rapid expansion of biopharmaceutical manufacturing in countries like China and India. These nations are increasingly becoming hubs for both local and global pharmaceutical companies due to lower manufacturing costs and large-scale production capabilities. The growing focus on healthcare infrastructure, regulatory improvements, and the rise of biopharmaceutical outsourcing further enhance the adoption of single-use systems. Moreover, the increasing demand for affordable and scalable solutions in biologics manufacturing accelerates the use of single-use assemblies, making Asia Pacific a key growth region in the global market.

Key Players and Competitive Insights

Key players in the single-use assemblies industry include Thermo Fisher Scientific Inc.; Sartorius Stedim Biotech S.A.; GE Healthcare Life Sciences; Merck KGaA Darmstadt, Germany; Danaher Corporation; Pall Corporation; Eppendorf AG; Saint-Gobain Performance Plastics; Bio-Rad Laboratories, Inc.; Lonza Group; Repligen Corporation; Waters Corporation; 3M Company; Becton, Dickinson and Company; and Koch Membrane Systems, Inc. These companies offer a range of single-use products, such as filtration assemblies, bag assemblies, tubing, and connectors for biopharmaceutical and pharmaceutical manufacturing processes. They are actively contributing to the advancement of flexible and efficient manufacturing systems, focusing on improving product safety, reducing contamination risks, and meeting the growing demand for biopharmaceutical production.

In terms of competition, companies like Thermo Fisher Scientific Inc.; Sartorius Stedim Biotech S.A.; and Merck KGaA, Darmstadt, Germany are working to expand their product portfolios and improve technological integration, which enhances their single-use assemblies market presence. Their focus is on developing more efficient and customizable single-use solutions to meet the specific needs of pharmaceutical and biotechnology companies. Moreover, partnerships and collaborations are key strategies for market penetration, with some players working alongside contract manufacturers to expand their offerings.

The single-use assemblies market is also seeing increased attention from companies such as Lonza Group and Pall Corporation, which are leveraging their expertise in cell culture and filtration technologies. These players are enhancing the scalability and flexibility of their single-use assemblies, ensuring their adaptability to a wider range of biopharmaceutical production processes. Additionally, advancements in digital technologies, such as real-time monitoring and data analytics, are becoming integrated into single-use systems, providing further competitive advantages for companies investing in these innovations.

Thermo Fisher Scientific Inc. offers a comprehensive range of single-use assemblies designed to enhance efficiency and flexibility in bioprocessing applications. Their product portfolio includes Fluid Transfer Assemblies, 2D and 3D BioProcess Containers (BPCs), and Bioprocess Drums Liners and Accessories, all tailored to meet the diverse needs of the biopharmaceutical industry. These single-use solutions minimize the risk of cross-contamination, reduce cleaning requirements, and accelerate implementation timelines. By integrating advanced technologies and user-friendly designs, Thermo Fisher Scientific supports scalable and sustainable biomanufacturing processes, reinforcing its leadership in the single-use assemblies market.

Sartorius Stedim Biotech S.A. is a supplier to the biopharmaceutical industry, offering a range of single-use assemblies designed to enhance efficiency and safety in bioprocessing. Notably, the company has developed the Sartocon Self-contained Filter Loop Assembly and the Sartocon Slice Self-contained Bag Loop Assembly, both integrating polyethersulfone (PESU) membranes. These sterile, gamma-sterilized assemblies are pre-wetted and flushed, reducing setup time and eliminating the need for extensive membrane preparation. Their fully enclosed design ensures safe purification of biologics, such as vaccines and recombinant proteins, making them suitable for cGMP environments, including process development, clinical trials, and small-scale production. The PESU membranes offer robustness across broad pH and temperature ranges, with molecular weight cut-offs from 10 to 300 KDa, facilitating linear scalability and efficient process transfer.

List of Key Companies

- 3M Company

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eppendorf AG

- GE Healthcare Life Sciences

- Koch Membrane Systems, Inc.

- Lonza Group

- Merck KGaA, Darmstadt, Germany

- Pall Corporation

- Repligen Corporation

- Saint-Gobain Performance Plastics

- Sartorius Stedim Biotech S.A.

- Thermo Fisher Scientific Inc.

- Waters Corporation

Single-Use Assemblies Industry Developments

- October 2024: Saint-Gobain Life Sciences introduced the Sani-Tech STHT-80 Silicone Tubing. The company stated that the silicone tubing is designed for high burst and vacuum applications.

- In September 2024, MilliporeSigma launches single-use reactor to accelerate antibody drug conjugate manufacturing

- In July 2023, Sartorius Stedim Biotech completed the acquisition of Polyplus, a company that provides technologies for cell and gene therapies. This acquisition aims to expand Sartorius Stedim Biotech's offerings in the field of gene therapies and gene-modified cell therapies.

Single-Use Assemblies Market Segmentation

By Product Outlook

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

By Application Outlook

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish Applications

- Others

By End Users Outlook

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.80 billion |

|

Market Size Value in 2025 |

USD 14.88 billion |

|

Revenue Forecast by 2034 |

USD 58.83 billion |

|

CAGR |

16.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The single-use assemblies market has been segmented into detailed segments of product, application, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth strategy in the single-use assemblies market focuses on expanding product portfolios, enhancing technological integration, and increasing geographic reach. Companies are investing in research and development to introduce innovative, customizable solutions that meet the evolving needs of biopharmaceutical manufacturing. Strategic partnerships and collaborations with contract manufacturers, research institutions, and other key players are also essential for market penetration. Additionally, players are focusing on sustainability by developing environmentally friendly single-use products, which is becoming a key differentiator. Marketing efforts are increasingly emphasizing the benefits of flexibility, scalability, and cost-effectiveness offered by single-use technologies.

FAQ's

The single-use assemblies market size was valued at USD 12.80 billion in 2024 and is projected to grow to USD 58.83 billion by 2034.

The market is projected to register a CAGR of 16.5% from 2025 to 2034.

North America held the largest share of the global market in 2024.

Key players in the single-use assemblies market include Thermo Fisher Scientific Inc.; Sartorius Stedim Biotech S.A.; GE Healthcare Life Sciences; Merck KGaA Darmstadt, Germany; Danaher Corporation; Pall Corporation; Eppendorf AG; Saint-Gobain Performance Plastics; Bio-Rad Laboratories, Inc.; Lonza Group; Repligen Corporation; Waters Corporation; 3M Company; Becton, Dickinson and Company; and Koch Membrane Systems, Inc.

The bag assemblies segment accounted for the larger share of the market in 2024.

The Filtration segment accounted for the larger share of the market in 2024.

Single-use assemblies refer to pre-sterilized, disposable components used in various stages of biopharmaceutical and pharmaceutical manufacturing processes. These assemblies are typically composed of items like bags, filters, tubes, and connectors that are designed for one-time use to minimize contamination risks and eliminate the need for cleaning, sterilization, and validation associated with traditional multi-use equipment. Single-use assemblies are commonly used in applications such as cell culture, filtration, mixing, storage, and fluid transfer. They provide a more flexible, cost-effective, and efficient solution for large-scale production while maintaining compliance with regulatory standards for sterility and product safety.

A few key trends in the market are described below: Sustainability Focus: Increasing demand for environmentally friendly, recyclable, and biodegradable single-use products to reduce waste and environmental impact. Integration of Digital Technologies: Adoption of real-time monitoring, automation, and data analytics in single-use systems to improve operational efficiency and product quality. Customization and Flexibility: Growing need for customizable and flexible solutions to cater to specific biopharmaceutical production requirements. Modular and Scalable Solutions: Shift towards modular, scalable manufacturing systems to meet the demand for flexible and adaptable production processes.

A new company entering the single-use assemblies market could focus on innovative product design and technological advancements to differentiate itself. Specializing in environmentally sustainable materials for single-use products could be a key area, as there is growing demand for eco-friendly solutions. Additionally, investing in digital integration, such as real-time monitoring and data analytics, to enhance the functionality and efficiency of single-use assemblies could provide a competitive edge. Building strong partnerships with contract manufacturers and pharmaceutical companies will also help establish market presence and credibility. Offering customizable, flexible solutions to cater to niche applications could further strengthen the company's position in the market.

Companies manufacturing, distributing, or purchasing single-use assemblies and related products, and other consulting firms must buy the report.