Small Satellite Market Share, Size, Trends, Industry Analysis Report

By Satellite Type; By Application; By NGEO Orbit; By End-Use (Commercial, Government & Defense, Civil); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM2015

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

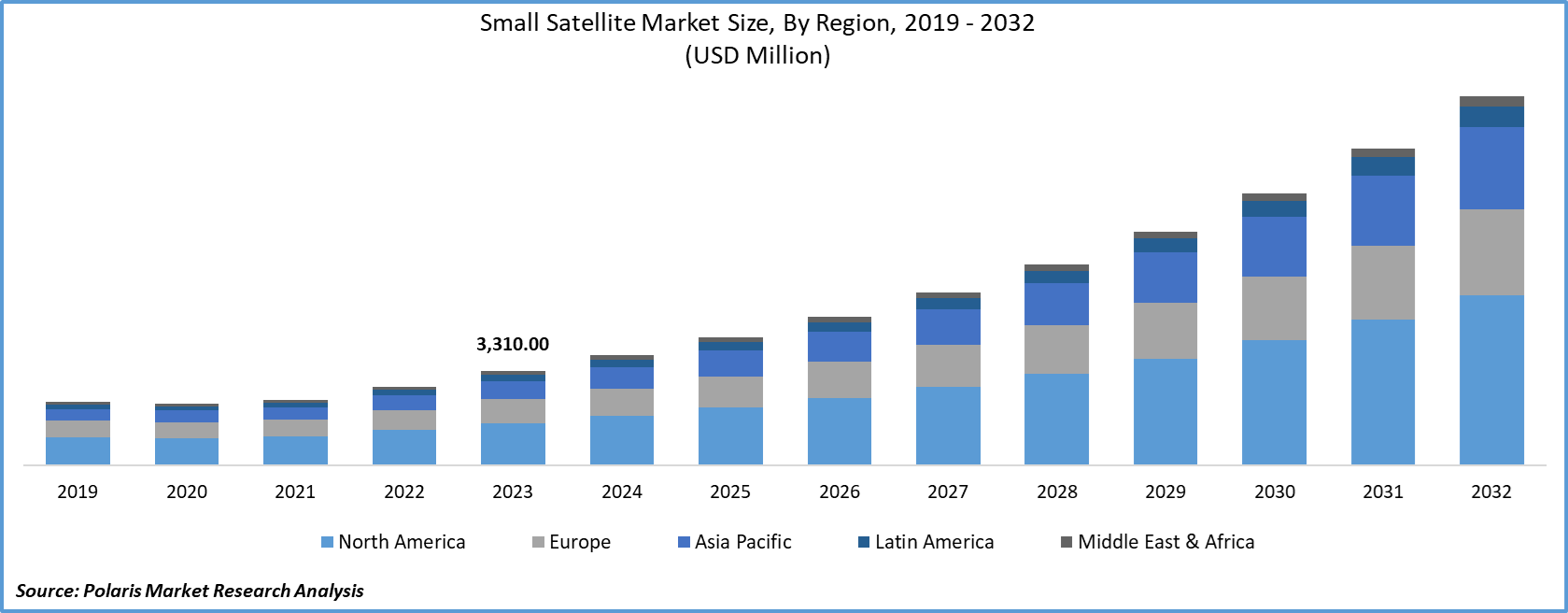

The global small satellite market size was valued at USD 3310.00 million in 2023. The market is anticipated to grow from USD 3848.87 million in 2024 to USD 12,943.78 million by 2032, exhibiting the CAGR of 16.4% during the forecast period.

The number of these space equipment launched in recent years has increased significantly due to their low cost, easy launch vehicle integration, and technical advancements. The market players of the industry also emphasize building CubeSats with off-the-shelf components, which is much easier, quicker, and cheaper.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Additionally, an increase in launch services provided by the market players, such as ride-share mission by SpaceX, which offers easy access to space for the operators at an affordable price, is also anticipated to contribute to the small satellite market growth substantially. COVID-19 outbreak had a moderate impact on the small satellites market due to postponement of launches, stoppage of production lines, and reduced funding sources. The rapid spread of COVID-19 across geographies has led to a significant drop in demand for the small product, a limited workforce, and limited availability of equipment.

Industry Dynamics

Growth Drivers

The growth of the small satellite market is primarily driven by surging market demand for LEO-based services in a communication application. The small product in the communication constellation mainly uses radio or laser communications to communicate with the ground and has attitude control and propulsion systems onboard.

There is a proliferating market demand for high-speed, low-cost broadband with increased capacity for enterprise data (banking, retail), the energy sector (gas, oil, mining), and government in well-established countries. Also, the market demand for low-cost broadband among individual customers in less-developed countries and rural areas who may not have access to the internet is increasing. These market expectations are propelling investments in small LEO constellations.

Amid the pandemic, NASA started offering funds to start-up players as soon as it was apparent that many companies were unable to conduct business as usual due to stringent lockdown and social distance norms which will increase the small product industry demand. When investors are retrenching, especially in the US, the government steps us and either increases their investment or provides advances to some of these companies. For instance, in December 2020, NASA signed a contract with Relativity and Astra Space, and Firefly Black to introduce small satellites for the undersigned contract of USD 16.7 million.

Report Segmentation

The market is primarily segmented on the basis of satellite type, application, end-use, NGEO orbit, and region.

|

By Satellite Type |

By Application |

By NGEO Orbit |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Earth observation and remote sensing segment held the largest share in the global market in 2020. This is mainly ascribed to the highly compact nature of small satellites, which helps in effective earth observation. In earth observation, small satellites are used for electro-optical and radar observation of the earth.

In addition, these small products are used for meteorology, both for operational and Earth-science research purposes. Moreover, these products can monitor natural calamities such as storms, floods, cyclones, volcanic activities, fires, landslides, environmental pollution, and industrial and power plant disasters.

Insight by End-Use

The commercial segment is estimated to register the highest CAGR during the forecast period. The commercial segment consists of various applications such as Earth observation, maritime tracking, and surveillance. Small satellites provide high-resolution imagery & mapping capabilities, which find applications in environmental impacts, monitoring land use, agriculture, forestry management, and natural resources.

Geographic Overview

Geographically, North America was the largest revenue contributor in the global market in 2020. The U.S. was the leading contributor to the regional market growth in the region due to the strong presence of key players such as SpaceX, Spire Global, and Planet Labs. A spike in the small satellite launches in the USA is the key factor propelling the market growth in the region. Also, the robust presence of major small OEMs, raw material suppliers, and component fabricators is likely to propel regional growth. In addition, increased NASA budget and funding by the government for small satellite development are further anticipated to bolster the region’s growth.

Europe held the second-largest share in the global market. Strong funding by VCs and government agencies in space exploration and remote sensing capabilities is likely to boost the market demand in the region. The presence of nascent rocket manufacturers in the region, such asIsar Aerospace and Rocket Factory Augsburg, to deploy small satellites into orbit further spurs the region’s growth. The Asia Pacific is likely to register a healthy growth rate during the assessment period. Rising investment in R&D to develop advanced space technologies is expected to spur the small demand in the region.

Competitive Insight

Some of the major players operating in the global market are AAC Clyde Space, Airbus S.A.S., Chang Guang Satellite Technology Co., Ltd., EXOLAUNCH GmbH, G.A.U.S.S. SRL, GeoOptics, Inc., GomSpace, Kepler Communications Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, NANORACKS, Northrop Grumman, ORBCOMM, Planet Labs Inc., PUMPKIN, INC, Satellogic, Sierra Nevada Corporation, SpaceX, Spire Global Surrey Satellite Technology Ltd., Swarm Technologies, Inc., and Thales Group.

Small Satellite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3848.87 million |

|

Revenue forecast in 2032 |

USD 12,943.78 million |

|

CAGR |

16.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 - 2032 |

|

Segments covered |

By Satellite Mass, By Application, By, NGEO orbit, By end-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AAC Clyde Space, Airbus S.A.S., Chang Guang Satellite Technology Co., Ltd., EXOLAUNCH GmbH, G.A.U.S.S. SRL, GeoOptics, Inc., GomSpace, Kepler Communications Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, NANORACKS, Northrop Grumman, ORBCOMM, Planet Labs Inc., PUMPKIN, INC, Satellogic, Sierra Nevada Corporation, SpaceX, Spire Global Surrey Satellite Technology Ltd., Swarm Technologies, Inc., and Thales Group. |