Smart Doorbell Market Share, Size, Trends, Industry Analysis Report

By Type (Wired, Wireless); By Distribution Channel (Online, Offline); By End-Use (Residential, Commercial); By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2806

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

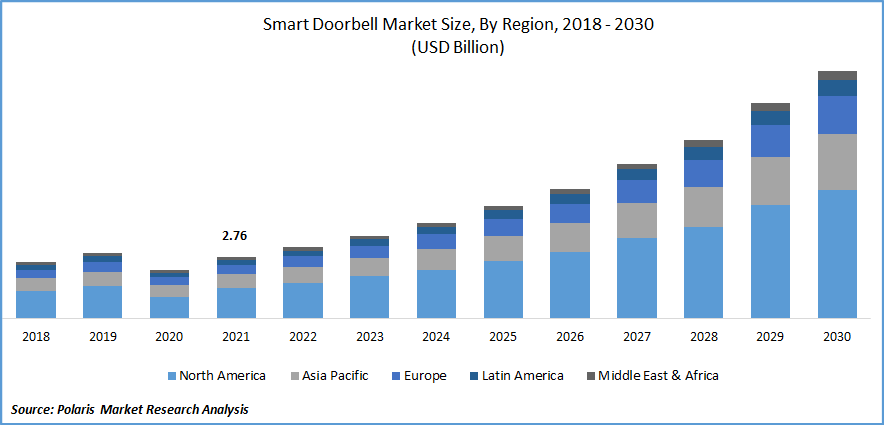

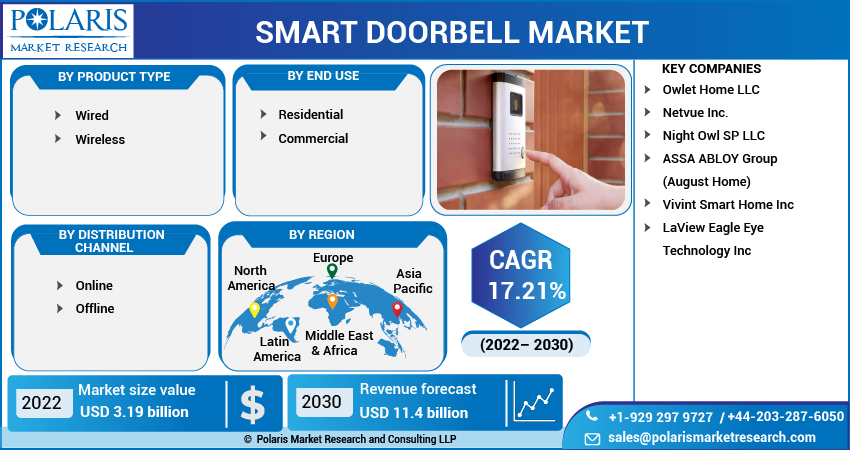

The global smart doorbell market was valued at USD 2.76 billion in 2021 and is projected to grow at a CAGR of 17.21% during the forecast period.

A smart doorbell is a connection and monitoring device that enables users to check guests before permitting them to access the building. In order to give a more sophisticated user experience, these devices are connected to the internet in conjunction with a built-in webcam with a microphone and speaker.

Know more about this report: Request for sample pages

Growing consumer awareness of personal security and burglar alarms has contributed to the widespread deployment of intelligent doorbells all over the world. Moreover, the need for intelligent doorbells in structures is being pushed by expanding urbanization in various nations, which is being paired with increased building automation. However, the expensive nature of smart buzzers in terms of pricing is expected to hinder the market growth.

Consumers are getting more fascinated by security systems due to benefits such as flexibility mixed with good security, easy installation, remote locking & unlocking, and the potential to give homeowners quick notifications in the event of a crime. With the arrival of new companies into the global smart bell business, product innovations are becoming more affordable. Buyer demand for a clever locking & smart doorbell combo is expected to boost product adoption.

Smart doorbells are becoming more popular in corporate settings such as workplaces. However, the impediments in the construction of new buildings on account of the COVID-19 outbreak have hindered market expansion in the recent past.

Also, the ongoing pandemic has created severe interruptions in the equipment distribution chain and fresh supplies, as well as an inflation risk for the commodities. As a result of these disruptions, businesses have been obliged to focus on de-risking while also analyzing their end-to-end distribution network and adopting a telecommuting strategy.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The incorporation of the Internet of Things (IoT) and Machine Intelligence (AI) in doorbell systems is driving the market growth. Growing public concern about safety and security is predicted to increase product demand and advance the industry. Product purchases are likely to rise due to rising internet availability and a rising need to manage most amenities with a single tap. Because of the diversity of features offered by this gadget, consumers may grow more engaged in smart locks in the years ahead.

The expansion of efforts undertaken by governments and authorities is expected to support the growth of the smart doorbell industry. Furthermore, growing concerns regarding protective measures among consumers are further expected to boost market expansion. Additionally, the huge rise in the desire for pleasant building automation and opulent lifestyles is driving the growth.

Police agencies around the world have cooperated with Amazon's smart doorbell program, Ring, to develop a new video surveillance system. Also, motion sensors capture any contact or movement at the customer's front door and provide notifications to mobile devices. These agreements broaden the government's monitoring to ensure accountability and the development of laws.

The increased usage of smart digital security systems in residential neighborhoods is due to an increase in criminal activities, such as unauthorized entry and theft into residential regions. The emergence of intelligent cities and urbanization is one of the key developments in the intelligent doorbell camera market.

Smart cities use data-driven decisions to improve the performance of commercial, critical public, and manufacturing capacity. In smart cities, lighting systems, detectors, smart meters, as well as other linked devices, such as intelligent doorbell cameras, are easy to combine with IoT technology. Thus, the incorporation of the Internet of Things (IoT) and Machine Intelligence (AI) in doorbell systems is projected to drive market growth in the extended run.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, end use, and region.

|

By Product Type |

By Distribution Channel |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Wireless is the fastest and largest segment.

Wireless doorbell dominated the global market and is projected to show a similar trend over the forecast period owing to the rising adoption of wi-fi and the wireless internet of things. Normal doorbells are thought to be an indication of visitors, but in industrialized countries, doorbells have lately arisen as a vital home protection and stability measure. Some wireless doorbells include cameras linked to the board on the outside door, which helps to increase the safety of the owners.

These doorbells also include smart contacting and alert routines in case of an emergency. These doorbells have a loudspeaker and microphone connected, which adds an extra layer of protection and increases the likelihood of owner safety. This provides additional protection for homes because burglars and miscreants cannot enter the residence without the owner's authorization. Rapid urbanization & rising crime rates in towns are driving the industry.

The residential sector is the largest end use category

According to the end-use segment, the market for the residential sector is growing the fastest and is the largest. The residential category, as the biggest customer for door intercom systems, is expected to have the greatest CAGR throughout the projection period. Smart doorbells for intelligent housebuilding are in high demand due to global growth.

Due to increased urbanization, the building sector has recently expanded substantially, as have home automation provisions. With these inventive ways, wireless doorbells have made several developments, such as various types of music, design, and attachment devices. The wireless doorbell has a significant feature in that it does not require wires, making installation simple.

As doorbell technology advances, numerous homeowners are embracing these devices. New functionalities in wireless doorbells are projected to witness in the next years to boost home safety and security measures. Such smart characteristics of these devices are one of the major factors that are driving wireless doorbell sales worldwide.

When doorbells are hooked up to the internet, attackers may get accessibility to the portal using cross-site programming and software injection and use this data to obtain passwords and usernames. When a smart doorbell is connected to a cellular connection, cybercriminals may get control of the device, posing a threat to home security. These security issues are expected to provide a significant impediment to the worldwide market growth.

As the number of intelligent homes developed across the world increases, so does the need for smart doorbells. The residential sector has the most door intercom customers and is predicted to increase with growing product demand throughout the projection period.

The demand in Asia Pacific is expected to witness significant growth.

Asia-Pacific accounted for the largest market share across the globe. The advancement of smart doorbells for usage in the home and commercial settings has been fueled by advances in IoT devices and machine intelligence (AI) technologies. In addition, the increasing real estate sector may drive up demand for intelligent doorbells.

Because of the fast adoption of digital home automation devices and appliances, North America is the leading market for smart doorbells. The use of the most recent sophisticated camera smart doorbell systems is increasing. Significant government expenditures in smart cities will also fuel development in the industry throughout the projected period.

The growth of artificial intelligence (AI) capabilities has prompted manufacturers to create smart doorbells for household and commercial applications. Furthermore, the rise in demand for intelligent doorbells as the real estate business expands is expected to accelerate the expansion of the industry in the region in the coming years.

Competitive Insight

Some of the major players operating in the global market include Ring LLC, Vivint, Inc., Smart wares Group, Intelligent Technology Co. Ltd., Sky Bell Technologies Inc., Aeotec Technology (Shenzhen) Co. Ltd., Arlo Technologies Inc., August Home Inc., Eques Inc., iseeBell Inc., Arlo, Google (Nest), SimpliSafe, Inc.

Recent Developments

- In 2022, Google introduced 2nd generation wired Nest Doorbell. Because it is wired, Google's 2nd-generation Nest Doorbell has an edge over its battery-powered, approximately 30 percent smaller than the prior wired version.

- In 2021, Hero Electronix announced the release of the Qubo Video Doorbell, India's first smart doorbell.

Smart Doorbell Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.19 billion |

|

Revenue forecast in 2030 |

USD 11.4 billion |

|

CAGR |

17.21% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By Distribution Channel, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Ring LLC, Vivint, Inc., Smart wares Group, Intelligent Technology Co. Ltd., Sky Bell Technologies Inc., Aeotec Technology (Shenzhen) Co. Ltd., Arlo Technologies Inc., August Home Inc., Eques Inc., iseeBell Inc., Arlo, Google (Nest), SimpliSafe, Inc. |