Smart Headphones Market Size, Share, Trends, Industry Analysis Report

-By Type, Connectivity (In Ear, On Ear, and Over Ear), Technology, Application, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5585

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

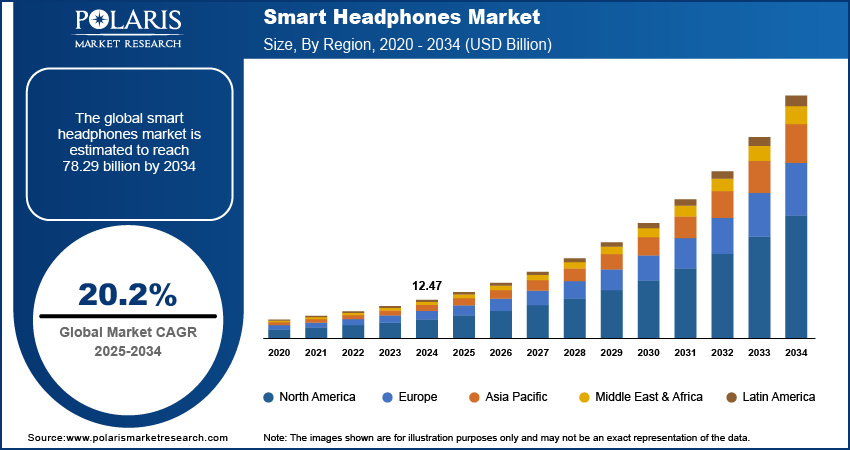

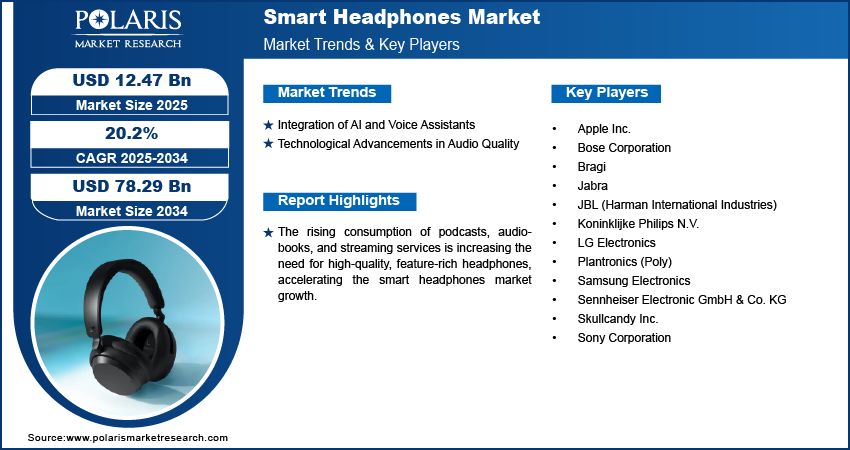

The global smart headphones market size was valued at USD 12.47 billion in 2024, exhibiting a CAGR of 20.2% during 2025–2034. The market is driven by AI-powered voice assistants, biometric health tracking, immersive audio technologies, rising wireless adoption, and increasing demand for multifunctional devices that enhance fitness, entertainment, communication, and smart home integration.

Key Insights

- The in-ear segment leads due to its compact design and true wireless features, which active users prefer.

- The gaming segment experiences the fastest growth, powered by immersive and low-latency audio technology.

- Strong consumer purchasing power, early adoption of advanced technologies, and the rise of remote work are driving increased demand for premium, multifunctional smart headphones in North America.

- Rapid urbanization, growing smartphone penetration, and the availability of affordable, feature-rich models are fueling the fastest growth rate in the global smart headphones market across Asia Pacific.

Market Dynamics

- Integration of AI voice assistants enhances hands-free interaction, personalizing user experiences and increasing engagement.

- Technological advancements in spatial audio, 3D sound, and adaptive EQ drive immersive sound quality and user satisfaction.

- The rising popularity of wireless and true wireless stereo (TWS) headphones is due to portability and convenience.

- Increased use of fitness and health tracking through biometric sensors attracts health-conscious consumers.

- Growth in audio content consumption, such as podcasts and streaming, fuels demand for high-fidelity smart headphones.

Market Statistics

2024 Market Size: USD 12.47 billion

2034 Projected Market Size: USD 78.29 billion

CAGR (2025–2034): 20.2%

North America: Largest market in 2024

AI Impact on Smart Headphones Market

- Enhances hands-free user experience through voice assistants like Siri, Alexa, and Google Assistant for seamless control and real-time interaction.

- Boosts personalization with AI-driven audio optimization, adjusting sound based on user preferences and environmental conditions.

- Increases engagement through natural language processing, enabling more accurate, context-aware responses and smarter device integration.

- Supports smart home automation by allowing users to control connected devices directly via headphones.

- Differentiates products in a competitive market by combining entertainment, communication, and productivity features into a single wearable device.

To Understand More About this Research: Request a Free Sample Report

The smart headphones market refers to the industry encompassing advanced wireless headphones equipped with features such as AI-driven voice assistant application, noise cancellation, health monitoring, gesture controls, and seamless device integration. These devices go beyond audio playback, offering functionalities such as fitness tracking, real-time translation, and smart home automation to tech-savvy consumers and professionals. The shift toward wireless and true wireless stereo (TWS) headphones is reshaping smart headphones market trends, driven by the elimination of tangled wires and improved portability.

The inclusion of biometric sensors for heart rate monitoring, step counting, and other health metrics is appealing to fitness enthusiasts, boosting the smart headphones market demand. Additionally, the rising consumption of podcasts, audiobooks, and streaming services is increasing the need for high-quality, feature-rich smart headphones.

Market Dynamics

Integration of AI and Voice Assistants

The integration of AI-driven voice assistants such as Siri, Google Assistant, and Alexa into smart headphones is significantly contributing to the smart headphones market development by enhancing hands-free interaction and personalized user experiences. For instance, in 2023, Apple’s official announcement highlighted that the integration of Siri into their latest AirPods Pro (2nd generation) resulted in a 40% increase in user engagement with voice commands. This growth was attributed to enhanced natural language processing and contextual awareness, enabling users to seamlessly interact with connected devices and access real-time information. Users manage tasks, control media, receive real-time information, and interact with connected devices using intuitive voice commands. This feature boosts convenience and productivity and also aligns with the growing demand for seamless, multi-functional wearable technology. Continuous improvements in natural language processing and contextual understanding are enabling more accurate and responsive interactions. Voice-enabled capabilities are becoming a key differentiator, particularly among tech-savvy consumers seeking intelligent audio solutions that blend entertainment, communication, and smart home automation.

Technological Advancements in Audio Quality

Ongoing innovations in spatial audio, 3D sound, and adaptive EQ technologies are reshaping the smart headphones market trends, through elevated sound fidelity and immersive user experiences. For instance, Sony launched WH-1000XM5 headphones, featuring adaptive sound control and 360 Reality Audio. These innovations catered to the growing demand for immersive audio experiences, especially among gaming and music enthusiasts. Spatial audio replicates surround sound environments, making content consumption more engaging for gaming, music, and streaming. Adaptive EQ automatically adjusts audio profiles based on real-time environmental cues or user hearing preferences, ensuring optimized sound delivery in diverse settings. These advancements appeal to audiophiles and casual listeners alike, fueling demand and encouraging frequent upgrades.

Segment Insights

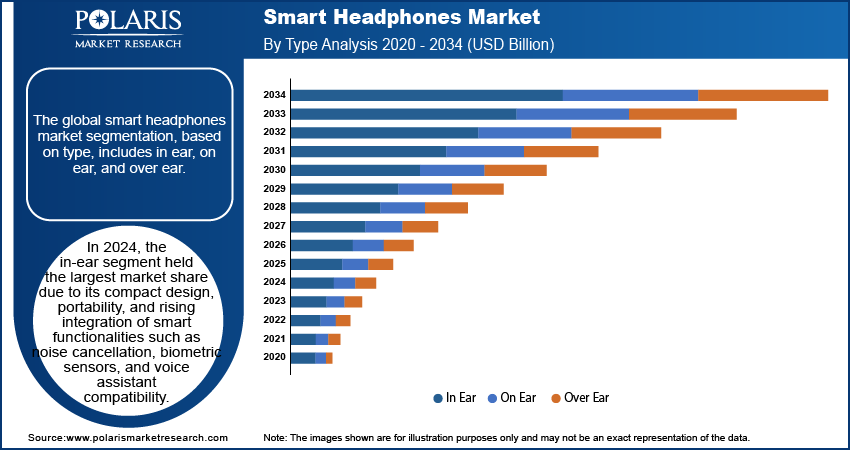

Market Assessment by Type Outlook

The global smart headphones market segmentation, based on type, includes in ear, on ear, and over ear. In 2024, the in-ear segment held the largest share of the smart headphones market revenue due to its compact design, portability, and rising integration of smart functionalities such as noise cancellation, biometric sensors, and voice assistant compatibility. Consumer preference for discreet, lightweight devices suited for on-the-go use has accelerated adoption, particularly among travelers and fitness enthusiasts. Advances in ergonomic design and customizable fit have improved comfort and audio isolation, further enhancing user satisfaction. The increasing availability of feature-rich true wireless earbuds across mid and premium price points continues to drive volume sales, supporting the dominance of the in-ear segment in the smart headphones market landscape.

The over ear segment is expected to witness the highest CAGR over the forecast period due to the rising demand for immersive audio experiences supported by superior soundstage, enhanced battery life, and advanced noise cancellation technologies. Professional users, audiophiles, and content creators are prioritizing over-ear smart headphones for their acoustic accuracy and long-duration comfort. The integration of spatial audio, head-tracking sensors, and AI-driven adaptive sound further differentiates these models. Additionally, brands are expanding their premium product lines targeting hybrid work environments and high-end entertainment consumption, fueling the demand for over-ear smart headphones across consumer and enterprise applications.

Market Evaluation by Application Outlook

The global smart headphones market segmentation, based on application, includes sports and fitness, gaming, music and entertainment, and others. In 2024, the music and entertainment segment dominated the smart headphones market share due to widespread consumption of music streaming services and the demand for high-fidelity sound performance. Consumers increasingly seek personalized, uninterrupted listening experiences, which smart headphones deliver through AI-enhanced equalizers, noise isolation, and real-time audio optimization. Technological innovations such as Dolby Atmos and 3D sound integration have elevated the appeal of smart headphones for immersive music and movie experiences. Continuous growth in music subscriptions, podcast engagement, and digital content creation is sustaining high usage rates, making this application segment the cornerstone of market demand and product innovation.

The gaming segment is expected to register the highest CAGR over the forecast period due to the accelerating adoption of immersive audio technologies that elevate the realism and responsiveness of gaming environments. Features such as low-latency Bluetooth connectivity, head-tracking audio, and spatial sound reproduction are driving the shift toward smart headphones in both casual and competitive gaming. Increased investment in cloud gaming platforms and mobile gaming ecosystems is expanding the user base for high-performance audio gear. Gaming-focused headphones are being tailored with AI-driven communication enhancements and ergonomic designs, contributing to the smart headphones industry expansion in this high-engagement, high-retention vertical.

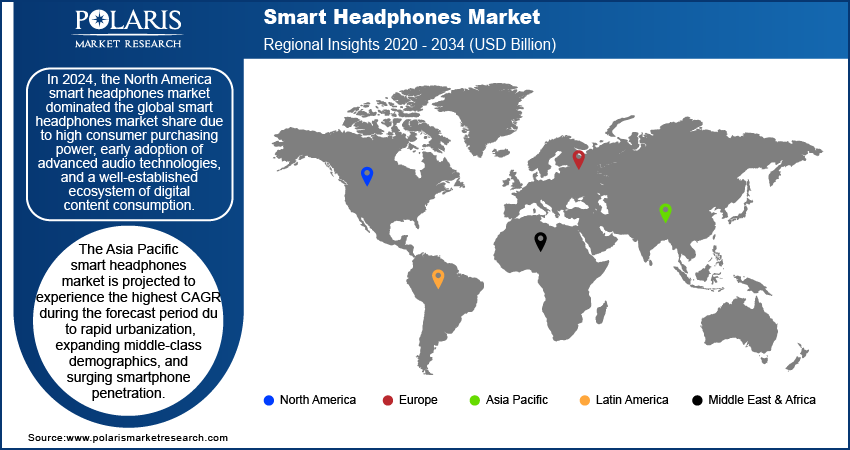

Regional Analysis

By region, the study provides smart headphones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. As per the smart headphones market statistics, in 2024, the North America held the largest market share due to high consumer purchasing power, early adoption of advanced audio technologies, and a well-established ecosystem of digital content consumption. Leading tech companies in the region continue to drive innovation through frequent product launches, integrating features such as adaptive noise cancellation, biometric tracking, and AI-based audio personalization. Demand is further supported by the rising use of smart headphones across remote work, fitness, and entertainment applications. For instance, data from the US Census Bureau indicates that in 2023, 13.8% of the workforce engaged in remote work on a regular basis, a significant increase from the 5.7% reported in 2019. This shift highlights a substantial transformation in work modalities, reflecting broader changes in workforce dynamics and telecommuting practices over the past few years. Strong penetration of streaming platforms and smart assistants is supporting consumer preference for multifunctional audio wearables, solidifying North America’s position in the global market landscape.

The Asia Pacific smart headphones market is projected to experience the highest CAGR during the forecast period due to rapid urbanization, expanding middle-class demographics, and surging smartphone penetration. Local and international manufacturers are aggressively targeting price-sensitive consumers with feature-rich, cost-effective models, accelerating market adoption. The region’s growing gaming and digital entertainment sectors are also fueling demand for advanced audio solutions. Consumer preference for compact, wireless designs is aligning with regional lifestyle shifts, while increasing investments in 5G infrastructure are enabling seamless audio streaming and connectivity. The convergence of affordability, technological access, and lifestyle transformation is driving sustained market expansion across Asia Pacific.

Smart Headphones Key Market Players & Competitive Analysis Report

The competitive landscape of the smart headphones industry is characterized by aggressive innovation, strategic alliances, and constant portfolio enhancement. Industry analysis reveals that key players are heavily focused on market expansion strategies that involve mergers and acquisitions to gain technological advantages and diversify product offerings. Post-merger integration efforts are geared toward streamlining R&D, improving manufacturing efficiency, and leveraging combined distribution networks. Strategic alliances between audio technology firms and mobile device manufacturers are driving synergy in ecosystem compatibility, reinforcing customer loyalty and market penetration. Joint ventures with AI and sensor technology providers are enabling the integration of advanced features such as biometric tracking, adaptive noise cancellation, and voice assistant capabilities. Technology advancements remain central to differentiation, with players investing in spatial audio, low-latency transmission, and head-tracking functionalities. The shift toward premium, multifunctional audio wearables has led to heightened competition in both hardware and software innovation. Product lifecycle strategies are increasingly incorporating user feedback loops and OTA software updates to enhance functionality post-purchase. Continuous investments in miniaturization, energy-efficient chipsets, and seamless connectivity are contributing to dynamic market positioning. The smart headphones market is evolving into a multi-application domain, where players are competing on acoustic performance and on smart integration, user experience, and long-term platform value.

Bose Corporation, founded in 1964, is engaged in designing, manufacturing, and marketing high-performance audio equipment. Headquartered in Framingham, Massachusetts, the company specializes in delivering innovative sound solutions across various industries. The company's product portfolio includes headphones, computer speakers, outdoor and marine speakers, amplifiers, stereo speakers, headsets, wave systems, home theater systems, automotive sound systems for luxury cars, outdoor and marine speakers, advanced automotive suspension systems, and SoundDock systems for iPods. Bose markets its products under several brands, such as SoundLink, SoundTouch, QuietComfort, and CineMate Lifestyle. The company provides services to arts centers, theaters, houses of worship, stadiums, arenas, restaurants, corporate buildings, retail stores, and hospitality establishments. Bose operates globally across North America, South America, Europe, and Asia Pacific.

Sony Corporation was established in 1946 and is headquartered in Tokyo, Japan. The company is engaged in developing electronics products and solutions across the entertainment and communication sectors. Specializing in audio technologies, Sony offers a diverse portfolio of smart headphones, including noise-canceling models, including the WH-1000XM series and wireless earbuds such as the WF-1000XM series. These products integrate advanced features such as adaptive sound control and AI-based noise isolation to enhance user experience. Sony’s services extend to music streaming compatibility and app-based customization for its audio devices. The company operates globally with a strong presence in regions such as Asia Pacific, Europe, North America, and Latin America.

List of Key Companies

- Apple Inc.

- Bose Corporation

- Bragi

- Jabra

- JBL (Harman International Industries)

- Koninklijke Philips N.V.

- LG Electronics

- Plantronics (Poly)

- Samsung Electronics

- Sennheiser Electronic GmbH & Co. KG

- Skullcandy Inc.

- Sony Corporation

Smart Headphones Industry Developments

In September 2024, Neurable Inc. Launched the first consumer-oriented headphones integrated with an advanced brain-computer interface (BCI). This innovative product leverages advanced neural signal processing technology, allowing users to interact with devices through thought commands, thereby merging auditory experiences with direct neural engagement.

In January 2025, JBL launched the Tour ONE M3, a headphone that incorporates advanced features and high-performance capabilities, showcasing a groundbreaking technology that marks a first for JBL.

Smart Headphones Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- In Ear

- On Ear

- Over Ear

By Connectivity Outlook (Revenue – USD Billion, 2020–2034)

- Wired

- Wireless

By Technology System Outlook (Revenue – USD Billion, 2020–2034)

- Active Noise Cancellation (ANC)

- Smart Assistant Integration

- Biometric Monitoring

- Others

By Application System Outlook (Revenue – USD Billion, 2020–2034)

- Sports and Fitness

- Gaming

- Music and Entertainment

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.47 billion |

|

Market Size Value in 2025 |

USD 14.95 billion |

|

Revenue Forecast in 2034 |

USD 78.29 billion |

|

CAGR |

20.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.47 billion in 2024 and is projected to grow to USD 78.29 billion by 2034.

The global market is projected to register a CAGR of 20.2% during the forecast period.

In 2024, North America held the largest market share due to high consumer purchasing power, early adoption of advanced audio technologies, and a well-established ecosystem of digital content consumption

A few of the key players in the market are Apple Inc., Bose Corporation, Bragi, Jabra, JBL (Harman International Industries), Koninklijke Philips N.V., LG Electronics, Plantronics (Poly), Samsung Electronics, Sennheiser Electronic GmbH & Co. KG, Skullcandy Inc., and Sony Corporation.

In 2024, the in-ear segment held the largest market share due to its compact design, portability, and rising integration of smart functionalities such as noise cancellation, biometric sensors, and voice assistant compatibility.

In 2024, the music and entertainment segment accounted for the largest market share due to widespread consumption of audio streaming services and the demand for high-fidelity sound performance.