Smart Label Market Share, Size, Trends, Industry Analysis Report

By Technology (EAS, RFID, Sensing Labels, Electronic Shelf/Dynamic Display Labels, Near Field Communication (NFC) Tags), By Component, By Application (Retail Inventory, Equipment, Others), By End-use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4262

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

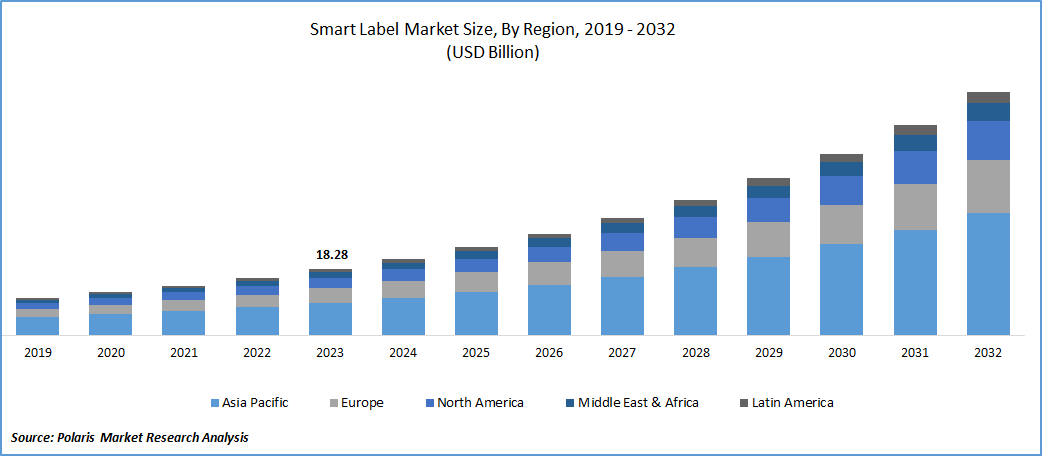

The global smart label market was valued at USD 18.28 billion in 2023 and is expected to grow at a CAGR of 15.6% during the forecast period.

A smart label functions as a responsive electronic device embedded in the body of an object for identification purposes. Configured with chips, antennas, and bonding wires, these labels facilitate real-time tracking of assets and goods. Smart labels incorporate advanced technology, offering advantageous features such as automated reading, rapid identification, re-programmability, high tolerance, and reduced errors. Consequently, they are increasingly favored over conventional barcode systems, particularly in retail, FMCG (Fast-Moving Consumer Goods), and logistics industries. These labels are commonly manufactured from materials like plastics, paper, and fibers.

To Understand More About this Research: Request a Free Sample Report

Crafted to receive, record, and transmit digital information, a smart label contributes to a notable reduction in overall tracking time. Consequently, there is a growing industrial adoption of these labels to minimize human intervention and errors, capitalizing on their accuracy and efficiency. The deployment of smart labels offers effective solutions to address significant challenges encountered by retailers and manufacturers. Notably, it is widely employed to deter theft and shoplifting. Companies are making investments to enhance their anti-theft systems, aiming to mitigate revenue loss and prevent inventory damage caused by incidents of shoplifting and theft. This, in turn, is anticipated to drive increased demand for smart labels throughout the forecast period.

In the healthcare sector, the imperative to improve patient safety drives the adoption of smart labels. These labels offer real-time information regarding medications, encompassing dosage instructions, potential side effects, and expiration dates. This capability empowers healthcare professionals to verify that patients receive the accurate dosage and medication, thereby diminishing the risk of medication errors and adverse drug events. Furthermore, smart labels aid in monitoring medication usage and adherence, enabling healthcare providers to track patient compliance and intervene when necessary.

A significant advantage is the enhancement of operational efficiency. Smart labels empower retailers to automate diverse processes, including inventory management, price updates, and checkout procedures. This automation minimizes human errors, saves time, and reduces operational costs. Moreover, smart labels provide retailers with the capability to track and trace products across the supply chain, thereby improving visibility and expediting recall processes in the event of product quality issues or safety concerns.

However, the expenses linked to the installation of smart label market tracking systems are expected to act as a deterrent to market growth in emerging economies. Additionally, the market is likely to face hindrances due to the lack of uniformity in standardization systems and a low level of susceptibility during the forecast period.

Industry Dynamics

Growth Drivers

Growing Demand for Traceability and Anti-Counterfeiting Measures

Counterfeiting poses a significant challenge across various industries, giving rise to issues such as compromised product performance, damage to brand reputation, and threats to consumer safety. Industries, particularly in sectors like automotive and manufacturing, are becoming increasingly aware of the detrimental impacts of counterfeit products. As this awareness grows, there is an anticipation of a heightened demand for solutions that can effectively combat counterfeiting.

Smart labels, with their ability to provide authentication and traceability features, become crucial tools in addressing this concern. By incorporating smart labels into products, manufacturers can establish a more secure and transparent supply chain, making it more difficult for counterfeit goods to infiltrate the market. This, in turn, contributes to maintaining product quality, safeguarding brand integrity, and ensuring consumer safety, thereby driving the demand for smart labels in industries facing challenges related to counterfeiting.

Report Segmentation

The market is primarily segmented based on technology, component, application, and region.

|

By Technology |

By Component |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

RFID labels segment accounted for the largest market share in 2023

RFID labels segment accounted for the largest share. Key advantages linked to RFID labels include their versatility for application on various substrates, capabilities for automatic data capture, ensuring information accuracy, and facilitating real-time tracking.

Electronic shelf segment will grow rapidly. The increased adoption of dynamic display labels is anticipated, driven by the dynamic presentation of product information and pricing. This trend is expected to facilitate streamlined price management and enhance accuracy.

By Component Analysis

Batteries segment held the significant market share in 2023

Batteries segment held the significant market share. Advancements in miniaturized wireless technologies have facilitated the seamless integration of the batteries into the smart labels. These batteries play a crucial role in powering diverse functionalities of smart labels, including data storage, sensing, & wireless communication. The presence of compact and long-lasting batteries has enabled the development of smart labels capable of prolonged operation without the need for frequent battery replacements.

Memory segment is expected to gain substantial growth rate. The rising adoption of memories in inventory management and asset tracking is expected to fuel the demand for this market segment. Smart labels equipped with memory components facilitate real-time tracking and monitoring of products across the entire supply chain. This capability contributes to the reduction of inventory errors, enhancement of order accuracy, and overall improvement in operational efficiency. As global supply chains become more intricate, businesses are increasingly embracing smart labels to achieve heightened visibility and control over their inventory.

By Application Analysis

Retail inventory segment held the significant market share in 2023

Retail inventory segment held the significant market share. The adoption of smart labels in retail inventory is driven by factors such as the imperative for enhanced inventory management, a heightened demand for real-time data, and the increasing embrace of Internet of Things (IoT) technologies. Smart labels present retailers with a more efficient and accurate approach to inventory management, furnish real-time data for informed decision-making, and facilitate seamless integration with other IoT devices.

Perishable segment is expected to gain substantial growth rate. Smart labels, equipped with sensors, offer real-time data on temperature, humidity, and other environmental conditions. This enables stakeholders to track and monitor the condition of perishable goods from production to consumption. Such visibility aids in identifying potential issues or deviations from optimal conditions, allowing proactive measures to prevent spoilage or contamination.

Regional Insights

Asia Pacific dominated the global market in 2023

The robust growth in the retail, logistics, and Fast-Moving Consumer Goods (FMCG) industries within developing regions can be attributed to rising disposable income and rapid urbanization. As a result, there is a parallel increase in demand for smart labels across these end-user industries. The heightened economic activity in the region, fueled by increasing consumer spending and urban development, is driving the adoption of smart labels.

Key Market Players & Competitive Insights

Major players in the smart label industry are primarily concentrating on expanding their product portfolios and production capacities. Substantial investments in research and innovation are being made by key manufacturers to introduce products tailored for specific applications. These manufacturers are strategically working to enhance their presence in emerging economies. Emphasis is placed on engaging in partnerships, collaborations, and joint ventures to augment market share.

Some of the major players operating in the global market include:

- Alien Technology, LLC.

- AVERY DENNISON CORPORATION

- CCL Industries

- Checkpoint Systems, Inc.

- Zebra Technologies Corp.

Recent Developments

- In January 2023, AVERY DENNISON has entered into an agreement to acquire Thermopatch. Upon completion of the acquisition, Thermopatch will become a part of company's Apparel Solutions segment within the Retail Branding and Information Solutions (RBIS) division.

- In January 2023, Pod Group has entered a strategic collaboration with SODAQ and Lufthansa Industry Solutions to introduce an innovative monitoring tool in the form of a Smart Label. This paper-thin Smart Label is anticipated to bring about a revolution in the logistics sector by enabling the tracking of small and lightweight products. This capability was previously unattainable with existing tracking tools.

Smart Label Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.09 billion |

|

Revenue forecast in 2032 |

USD 67.16 billion |

|

CAGR |

15.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of Smart Label Market in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The Smart Label Market report covering key segments are technology, component, application, and region.

The global smart label market size is expected to reach USD 67.16 billion by 2032

The global smart label market is expected to grow at a CAGR of 15.6% during the forecast period.

Asia Pacific regions is leading the global market.

Rising Adoption of RFID and NFC Technologies are the key driving factors in Smart Label Market.