Smartphone Screen Protector Market Share, Size, Trends, Industry Analysis Report

By Material (Tempered Glass, Polyethylene Terephthalate), By Price Range (Economy, Mid-Range, Premium), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3779

- Base Year: 2023

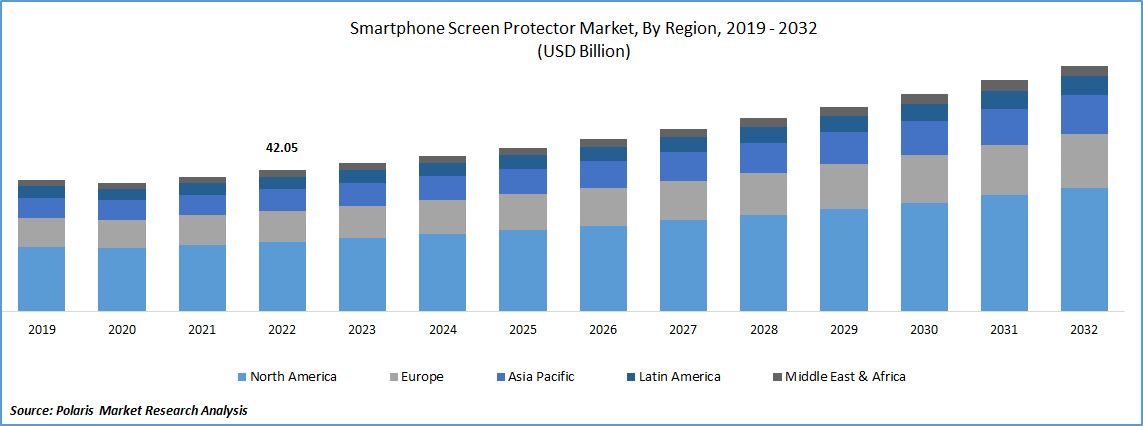

- Historical Data: 2019-2022

Report Outlook

The global smartphone screen protector market was valued at USD 44.02 billion in 2023 and is expected to grow at a CAGR of 5.80% during the forecast period.

The increasing popularity of expensive smartphones has made users more conscious of protecting their devices, especially the delicate screens. Smartphones have become an integral part of daily life, and any damage to the screen can disrupt the device's functionality and affect the user experience. Repairing or replacing a damaged screen can be expensive, prompting users to take preventive measures to safeguard their investments.

To Understand More About this Research: Request a Free Sample Report

As a result, the sales of smartphone screen protectors have witnessed significant growth as users perceive them as an effective way to prevent scratches, cracks, and other damages to their device screens. Screen protectors are thin, transparent films or tempered glass sheets that adhere to the smartphone's screen surface. They act as a protective barrier, absorbing impact and minimizing damage in case of accidental drops or scratches.

Additionally, the rising demand for refurbished and second-hand smartphones has further boosted the sales of smartphone screen protectors. Refurbished and second-hand smartphones offer a more budget-friendly option for users who are looking for the latest technology at a lower cost. As users purchase these pre-owned devices, they are likely to invest in additional protection for their screens to ensure that the device remains in good condition. Moreover, the availability of a wide range of screen protector options, including tempered glass, clear film, matte, and anti-glare variants, caters to different user preferences and requirements. This variety allows users to choose a screen protector that suits their needs, such as anti-fingerprint coatings, privacy filters, or high-definition clarity.

Industry Dynamics

Growth Drivers

Rising disposable income & increasing penetration of smartphones

As per capita income increases, people have more disposable income, which enables them to afford higher-priced items like smartphones. This growing affluence drives the demand for smartphone accessories, such as screen protectors, as consumers seek to protect and enhance the longevity of their expensive devices. Despite the temporary setback, the long-term prospects for the smartphone screen protector market remain positive. As per capita income continues to rise and consumer preferences for premium smartphones and accessories persist, the demand for high-quality screen protectors is expected to remain strong in the future.

Additionally, the growing smartphone market, especially in emerging economies, provides further opportunities for the expansion of the smartphone screen protector industry. As the pandemic situation improved and economies started to reopen, the smartphone screen protector market is expected to recover gradually. The resumption of economic activities, increasing vaccination rates, and pent-up demand from consumers who postponed their purchases during the lockdowns are likely to contribute to the industry's rebound.

Report Segmentation

The market is primarily segmented based on material, price range, and region.

|

By Material |

By Price Range |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Price Range

Premium segment exhibited highest growth rate in 2022

Premium segment witnessed steady growth rate. Premium cell phone covers are becoming increasingly popular among millennials, especially those who invest in premium smartphone models. These high-end protectors offer more than just basic protection; they come with a range of additional features and benefits that appeal to discerning users. One of the main reasons for their growing acceptance is the use of high-quality materials that ensure superior durability and protection for the smartphone's screen. These premium protectors are designed to withstand scratches, impacts, and other potential damages, providing users with peace of mind about their device's safety.

Moreover, these advanced protectors offer various enhanced features to elevate the user experience. For instance, some premium protectors come with anti-glare properties, which reduce glare and reflections on the screen, ensuring comfortable usage even under bright lighting conditions. Additionally, anti-fingerprint coatings help keep the screen smudge-free, maintaining its clarity and aesthetics. As millennials tend to invest in higher-end smartphones and prioritize the protection of their valuable devices, they are increasingly opting for these premium cell phone covers. The combination of advanced features, superior protection, and enhanced user experience makes these protectors a sought-after accessory for discerning smartphone users.

By Material

Tempered glass held substantial market share in 2022

Tempered glass segment is projected to hold significant market share. This segment's growth can be attributed to the numerous advantages it offers over PT (Plastic) & TPU (Thermoplastic Polyurethane) materials used for screen protectors. One of the key advantages of using tempered glass is its superior defense against dings and high-impact damage, providing robust protection for mobile phone screens. This has significantly contributed to its widespread acceptance among consumers as a preferred screen protector choice.

Tempered glass stands out due to its outstanding multi-layered and shock-absorbing properties, ensuring enhanced durability and resilience against accidental drops and impacts. Additionally, the presence of an oleophobic layer on tempered glass prevents fingerprint smudges, giving the phone's screen a pristine look and maintaining a smooth user experience. Furthermore, tempered glass screen protectors are anti-reflective, reducing glare and providing better light transmission compared to other alternatives. This ensures clear visibility and a more comfortable viewing experience for users.

Screen protectors have become a crucial accessory for smartphone users who place a high emphasis on protecting their devices' screens. In response to this growing demand, screen protector brands have started collaborating closely with smartphone manufacturers to develop customized designs that seamlessly align with the aesthetics and branding of the devices.

Thermoplastic polyurethane segment expected to grow at the steady rate. This type of screen protector offers several advantages, including excellent resistance to scratches, oil buildup, and grease. Moreover, the flexibility of thermoplastic polyurethane allows the screen protector to self-heal, which is a valuable feature for long-term usage. Due to its unique physio-chemical properties, thermoplastic polyurethane screen protectors are well-suited for use on curved displays and devices with in-screen fingerprint technology, both of which have become increasingly common in modern smartphones and other gadgets. This adaptability to the latest technological trends contributes to the growing popularity of thermoplastic polyurethane screen protectors in the market.

Regional Insights

North America region dominated the global market in 2022

North America region dominated the global. The region's growth can be attributed to the growing popularity and acceptance of premium, high-priced smartphones with advanced technology features. As consumers in North America increasingly opt for these premium devices, the demand for protective smartphone accessories, including screen protectors, is expected to rise significantly. Furthermore, the region's rising consumer disposable income will play a crucial role in driving the demand for such protective accessories during the forecast period.

APAC registered steady growth rate. This growth can be attributed to the rising sales of smartphones, particularly in developing markets like India & China, which are driving the expansion of the industry. The increased demand for smartphones from prominent Chinese companies like Xiaomi & Oppo Electronics is playing a significant role in propelling the growth of the smartphone screen protector industry. As these companies gain popularity and expand their market share, more consumers will be purchasing their smartphones, leading to a higher demand for reliable screen protectors to safeguard their valuable devices.

Key Market Players & Competitive Insights

The smartphone screen protector market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- AZ Infolink

- Belkin International

- Clarivue, Jiizii Glass

- Corning

- FeYong Digital

- Free S.speed International

- Halloa Enterprise

- IntelliARMOR

- NuShield

- Protek

- Ryan Technology

- Shenzhen Yoobao Technology.

- Xtreme Guard

- ZAGG

Recent Developments

- In February 2023, Belkin International, recently unveiled the 'ScreenForce TrueClear Curve' screen protectors designed specifically for the Samsung Galaxy S23 series. These screen protectors have received official approval from Samsung, making them authorized accessories for the Galaxy S23 devices.

- In February 2023, Gadgetshieldz, a prominent brand known for its mobile skins and screen protectors in India, has launched its latest range of Tempered Glass screen guards under their sub-brand X.Glas. This new addition to their product lineup demonstrates their dedication to offering consumers top-notch and reliable screen protection solutions.

Smartphone Screen Protector Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 44.02 billion |

|

Revenue forecast in 2032 |

USD 72.94 billion |

|

CAGR |

5.80% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Price Range, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

IntelliARMOR, AZ Infolink, Halloa Enterprise, ZAGG, Belkin International, Corning, Ryan Technology, NuShield, Xtreme Guard, Free S.speed International, Clarivue, Jiizii Glass, Protek, FeYong Digital, Shenzhen Yoobao Technology. |

FAQ's

key companies in smartphone screen protector market are IntelliARMOR, AZ Infolink, Halloa Enterprise, ZAGG, Belkin International.

The global smartphone screen protector market is expected to grow at a CAGR of 5.8% during the forecast period.

The smartphone screen protector market report covering key segments are material, price range, and region.

key driving factors in industrial smartphone screen protector market are Increasing penetration of smartphones

The global smartphone screen protector market size is expected to reach USD 72.94 billion by 2032.