Soda Maker Market Share, Size, Trends, Industry Analysis Report

By Type (Electric, Manual), By End Use (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Dec-2023

- Pages: 115

- Format: PDF

- Report ID: PM4137

- Base Year: 2023

- Historical Data: 2020-2022

Report Outlook

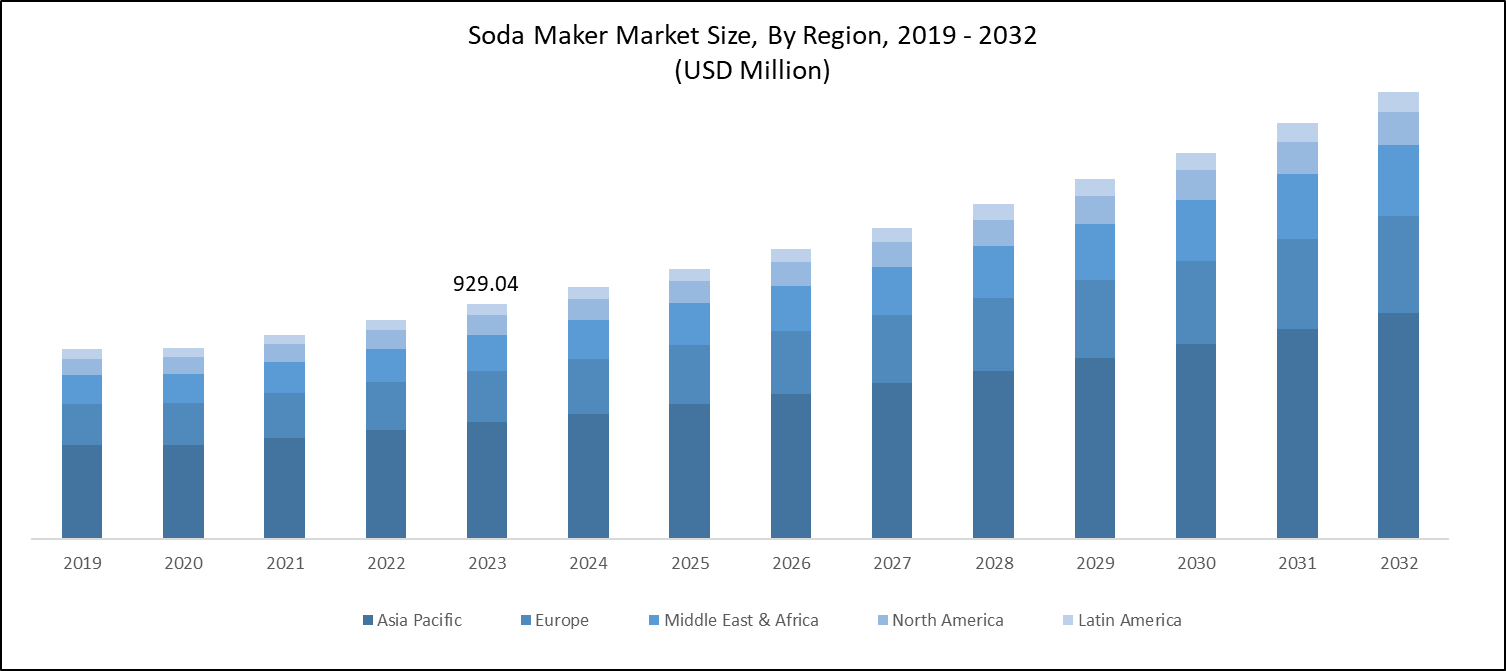

The global soda maker market was valued at USD 929.04 million in 2023 and is expected to grow at a CAGR of 7.4% during the forecast period.

Growing consumer preferences for portable beverages and a variety of flavors are fueling the industry's momentum. The rising desire for low-calorie and low-carb sodas is boosting the soda maker market. Incorporating artificial sweeteners into SodaStream flavors reduces their calorie content. The overall functional beverage market's expansion and heightened consumer health consciousness are driving the surge in low-calorie drink demand. The widespread availability of low-calorie or zero-calorie beverages in retail outlets like Walmart and convenience stores is also bolstering market share.

To Understand More About this Research: Request a Free Sample Report

Soda makers offer a cost-effective and convenient solution for consumers who enjoy soda and carbonated beverages regularly. They enable easy customization of drinks to match individual preferences. Additionally, many soda makers are portable, enhancing their convenience for users. With the ability to create beverages using natural ingredients and without artificial colors, additives, flavors, and sweeteners, these homemade sodas have reduced sugar and calorie content, presenting healthier alternatives to commercially produced soft drinks.

A soda maker, also referred to as a carbonation system, is a device designed for carbonating water and producing fizzy beverages at home. Typically, it comprises a carbonation unit, a bottle to hold water, with different flavoring options. The fundamental process involves filling the bottle with water, placing it in the carbonation unit, and introducing pressurized carbon dioxide (CO2) gas into the water. The CO2 dissolves in the water, creating carbonation or bubbles. Users can adjust the level of carbonation by controlling the duration or number of times the CO2 is released.

Soda makers have gained widespread popularity due to several factors, making them a convenient and eco-friendly choice for consumers. One of the key advantages of soda makers is the convenience they offer. With a soda maker, individuals can carbonate water and create their favorite fizzy beverages at home with just a few simple steps. This eliminates the need to buy pre-carbonated drinks from stores, saving time and effort.

For Specific Research Requirements: Request for Customized Report

The global supply chains, encompassing manufacturing and distribution, experienced disruptions due to the COVID-19 pandemic. These disruptions could have affected the availability of soda makers and their components, potentially caused delays or reduced product options. The pandemic, marked by lockdowns, social distancing measures, and limitations on dining out, led to a surge in homebound activities. People spent more time at home, fostering an increased interest in DIY activities, including the creation of homemade beverages. Consequently, there might have been a heightened demand for soda makers and other home carbonation systems during this period.

Growth Drivers

Customization is another significant factor driving the appeal of soda makers. Users have the freedom to adjust the level of carbonation according to their preference. Whether someone likes lightly sparkling water or intensely fizzy soda, a soda maker allows them to tailor the drink to their taste. Additionally, soda makers often come with flavoring options, enabling users to add different tastes to their beverages. This customization aspect caters to a wide range of consumer preferences.

Moreover, the growing awareness about environmental concerns, particularly plastic waste, has led many consumers to seek sustainable alternatives. Soda makers contribute to reducing plastic waste as they encourage the use of reusable bottles or containers. By creating their own carbonated beverages at home, consumers can significantly decrease their reliance on single-use plastic bottles commonly found in store-bought sodas. This eco-friendly aspect aligns with the increasing environmental consciousness among consumers.

Report Segmentation

The market is primarily segmented based on type, end use, distribution channel, and region.

|

By Type |

By End Use |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Manual Segment Held the Largest Share in 2022

Manual segment dominated the soda maker market. These soda makers are tailored for home usage, designed as compact, countertop devices enabling users to carbonate water and craft small batches of carbonated beverages. Manual soda makers are favored by individuals valuing the hands-on process of making their own drinks. They appreciate the compact, portable nature of these devices, finding them convenient for home use. These machines are user-friendly and provide flexibility, allowing users to adjust carbonation levels based on their preferences.

Electric segment will grow at significant pace. electric soda makers are valued for their simplicity and consistent carbonation. Their automated process allows users to achieve precise carbonation levels with minimal effort. These devices often come with extra features like adjustable carbonation settings, flavor dispensers, and digital displays for monitoring carbonation levels. These advantages are anticipated to drive their demand in the coming years.

By Distribution Channel Analysis

Offline Channels Segment Accounted for the Largest Market Share in 2022

Offline channels segment accounted for the largest market share. Supermarkets and hypermarkets serve as ideal avenues for soda makers due to their extensive reach and convenience. These retail outlets provide a comprehensive shopping experience, enabling customers to effortlessly explore various modes of operation, including different brands and types of bottled water. As consumers increasingly opt for healthier and more sophisticated beverage options, soda makers have gained popularity. These retail establishments offer a diverse array of products, allowing customers to access different global brands conveniently.

Online channels segment will exhibit robust growth rate. Online platforms offer a worldwide presence, allowing manufacturers to engage with a larger audience extending beyond their local boundaries. This extended outreach can enhance brand recognition and potentially boost sales. Additionally, online channels frequently enable direct-to-consumer sales, eliminating intermediaries and lowering distribution expenses. This can lead to competitive pricing and increased profit margins for manufacturers, further stimulating sales.

Regional Insights

North America Region Accounted For the Largest Share of Global Market in 2022

North America emerged as the largest region. The demand for soda makers in the U.S. & Canada is propelled by a rising awareness of health and wellness among consumers. Many Americans are actively searching for healthier beverage options, aiming to decrease their consumption of sugary beverages such as soda. This shift is influenced by several factors, including heightened awareness about the health hazards linked to excessive sugar consumption, apprehensions regarding artificial sweeteners, and an increasing focus on overall well-being.

In response to the demand, beverage companies have introduced a diverse selection of flavored sparkling water products, often enhanced with natural flavors or fruit essences. These offerings offer a variety of taste experiences while maintaining low calorie and sugar content, catering to health-conscious consumers. Furthermore, strategic collaborations between major market players and well-known soft drink brands like Coca-Cola and Pepsi are anticipated to boost the consumption of flavored soda water among American consumers.

Europe will grow at the substantial pace. European consumers prioritize natural and healthier beverage choices, considering carbonated water as a wholesome substitute for sugary soft drinks. This aligns with the rising demand for healthier options. Additionally, the abundance of natural mineral springs in many countries has bolstered the popularity of carbonated water. Mineral water sourced from underground springs, naturally carbonated, is highly esteemed for its perceived health benefits.

Key Market Players & Competitive Insights

In the market, there is a blend of well-established companies and emerging newcomers. Many leading players are focusing on industry trends that have garnered widespread popularity.

Some of the major players operating in the global market include:

- AARKE AB

- CO-Z

- Drinkpod

- Hamilton Beach Brands Holding Company

- i-Drink Products Inc

- iSi GmbH

- Mr. Butler

- Mysoda

- SodaStream Inc.

- Sparkel Beverage Systems

Recent Developments

- In December 2022, Glacier Fresh, introduced the 'Sparkin Cold Soda Maker.' This home-use soda maker delivers chilled sparkling water with a simple button.

- In February 2022, Karcher revealed its investment in Mysoda, the Finnish manufacturer of sparkling water solutions, as part of a funding round. This investment aims to boost company's growth and leverage Karcher's expertise in the area.

Soda Maker Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 996.49 million |

|

Revenue forecast in 2032 |

USD 1769.29 million |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in soda maker market are AARKE AB, CO-Z, Drinkpod, i-Drink Products, iSi GmbH, Mysoda, SodaStream

The global soda maker market is expected to grow at a CAGR of 7.4% during the forecast period.

The soda maker market report covering key segments are type, end use, distribution channel, and region.

key driving factors in soda maker market are Growing awareness about health and wellness is driving a shift towards healthier beverage choices.

The global soda maker market size is expected to reach USD 1,769.29 million by 2032