Solar Encapsulation Market Share, Size, Trends & Industry Analysis Report

By Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM4285

- Base Year: 2024

- Historical Data: 2020-2023

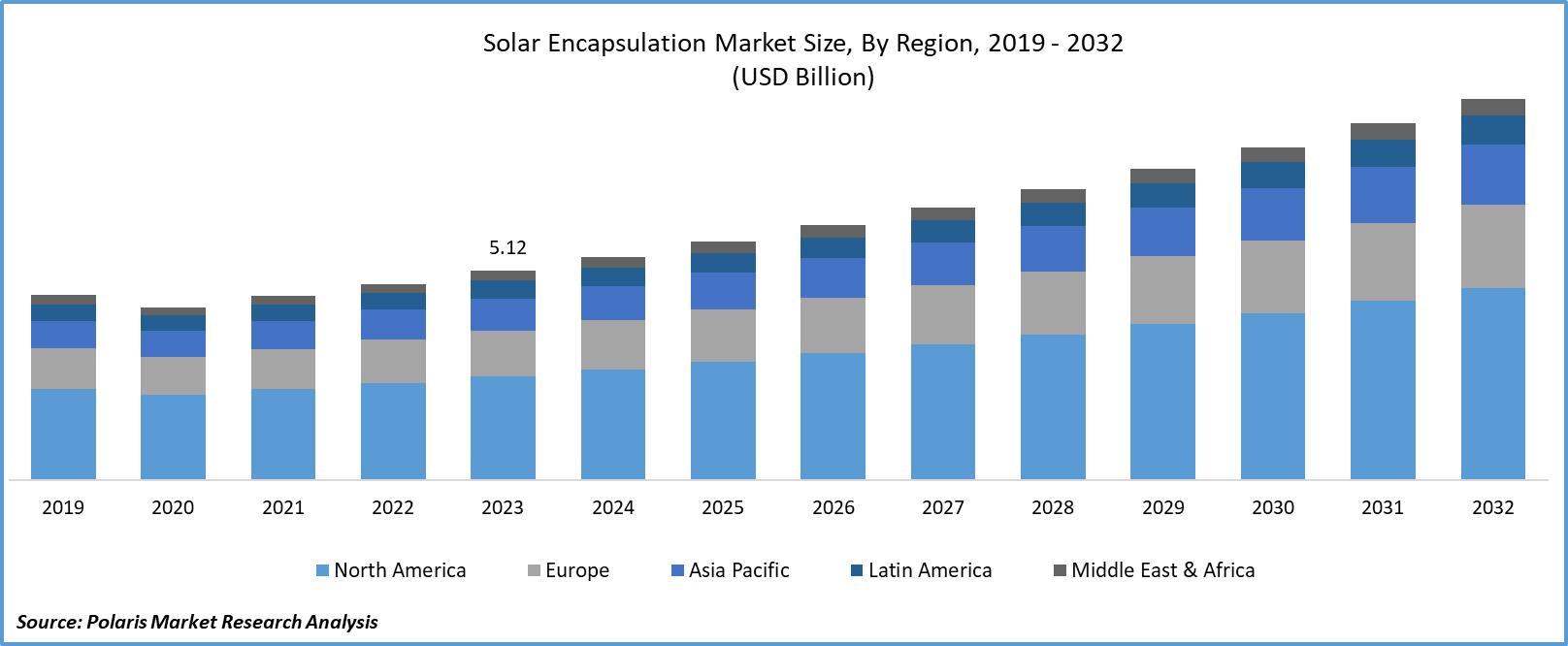

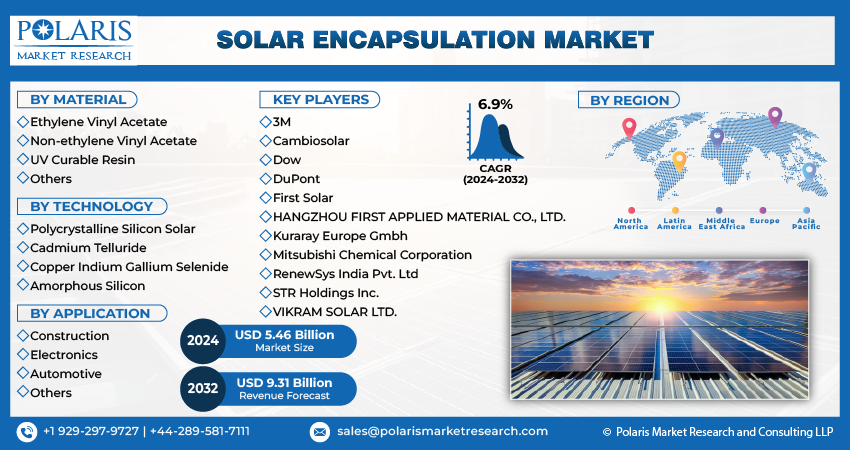

The global Solar Encapsulation Market was valued at USD 4.25 billion in 2024 and is expected to grow at a CAGR of 9.75% from 2025 to 2034. Strong government support for solar energy, along with rising investments in photovoltaic module durability and performance, is driving market expansion.

Industry Overview

Solar panels are shielded from weather fluctuations and corrosion by the solar enclosure. The glass covers of the solar cell inside the module and the glass cover of the solar module itself encapsulate the solar cells. The useful life of these PV installations is frequently increased by encapsulation. Encapsulation materials are usually flame retardant, corrosion resistant, or durable. Such encapsulation generally requires a large quantity of material and energy resources and is challenging to automate. These encapsulates are becoming more and more common in many industries, such as the automobile and construction sectors. Solar PV modules with encapsulation operate safely and affordably, saving users money on maintenance.

Moreover, Urbanization has raised the need for solar panels, which has raised the need for encapsulation. This may be the main factor propelling the market. Furthermore, during the forecast period, the existence of attributes like strong light transmittance, mechanical resistance, insulation, and mechanical resistance, along with growing awareness of the advantages of renewable energy, are anticipated to propel expansion in the worldwide solar encapsulation market.

Globally, there is a growing demand to reduce carbon footprints and a growing need for environmentally sustainable solutions. The market for solar encapsulation is expected to be driven primarily by the need created by the substantial shift toward renewable energy sources brought about by the depletion of conventional energy sources and growing environmental concerns.

To Understand More About this Research: Request a Free Sample Report

Construction companies are among the market's largest customers of solar encapsulation. Investments in R&D initiatives pertaining to solar encapsulation technology will be encouraged by the anticipated growth of the building sector. It is anticipated that the market for solar encapsulation will expand significantly throughout the forecast period because of the rising popularity of solar PV modules. As there aren't any alternatives to solar encapsulation technology at the moment, the expansion of PV modules will inevitably accelerate the advancement of this technology. These factors are expected to drive solar encapsulation market growth in the forecast period.

Key Takeaways

- Asia Pacific dominated the largest market and contributed to more than 35% of share in 2024

- The North America region is expected to witnesses fastest market during the forecast period

- By material category, ethylene vinyl acetate segment held the largest market share in 2024

- By application category, the construction segment accounted for the highest market share in 2024

What are the Market Drivers Driving the Demand for Solar Encapsulation Market?

Increasing Installation of Solar Panels Across the Globe is Projected to Spur the Product Demand

The overall growth of the solar industry directly impacts the demand for solar encapsulation materials. As more solar panels are installed globally, the need for effective encapsulation to protect these panels from external elements grows. Ongoing research and development in solar encapsulation technologies lead to the creation of more efficient and durable materials. Innovations such as better adhesives, improved materials, and advanced manufacturing processes contribute to the growth of the solar encapsulation market.

Supportive government policies, subsidies, and incentives for solar energy adoption can significantly boost the demand for solar encapsulation materials. Governments worldwide are increasingly focusing on renewable energy to reduce carbon emissions and promote sustainable development.

The rising global demand for energy, coupled with the need for cleaner and more sustainable sources, stimulates the growth of the solar industry. Encapsulation materials play a crucial role in ensuring the longevity and efficiency of solar panels in meeting this demand. The implementation of stringent quality standards for solar modules by regulatory bodies and industry associations reinforces the importance of reliable encapsulation materials. Manufacturers need to meet these standards, which, in turn, drives the demand for high-quality encapsulation solutions.

Which Factor is Restraining the Demand for Solar Encapsulation?

High Installation Cost Impedes the Market Growth

High installation costs can limit the accessibility of solar energy to a broader audience. Individuals and businesses with limited financial resources may find it difficult to afford the upfront expenses, hindering widespread adoption of solar technology. While financing options exist for solar installations, high installation costs may lead to less favorable financing terms, including higher interest rates. This can further discourage potential users from adopting solar technology.

Report Segmentation

The market is primarily segmented based on material, technology, application, and region.

|

By Material |

By Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Material Insights

Based on Material analysis, the market is segmented on the basis of non-ethylene vinyl acetate, ethylene vinyl acetate, and UV-curable resin. In 2023, the Ethylene Vinyl Acetate (EVA) segment held the largest revenue share. Due to its superior resistance to corrosion and delamination, ethylene-vinyl acetate solar encapsulation has become increasingly popular. Due to its superior barrier protection against humidity, UV radiation, and harsh environmental conditions, ethylene-vinyl acetate solar encapsulation increases the efficiency of solar modules.

EVA has been a widely used material in solar encapsulation for many years. Its adoption in the solar industry has a long history, and many solar modules have traditionally used EVA as the encapsulant. EVA provides mechanical and thermal stability, protecting solar cells from environmental factors and ensuring the longevity of the solar panels.

By Application Insights

Based on substrate analysis, the market is segmented on the basis of construction, electronics, and automotive. The construction segment accounted for the highest market share in 2024, primarily driven by the increasing population, urbanization, hospitals, and other growing constructions in developing areas due to the installation of solar. These increases in the use of solar encapsulation anticipate market growth over the forecast period.

These considerations include the remarkable advantages of solar cell encapsulation, such as greater attack strength, longer longevity of solar cells, and higher efficiency of encapsulants in module production processes, as well as the notable rise in demand for solar lights for constructions roads and road dividers, tunnels, and streets. Benefits for solar encapsulation are also anticipated from the public's increased awareness of renewable energy sources and the growing acceptance of solar as a dependable and endless source of electricity.

Regional Insights

Asia Pacific

In 2024, Asia Pacific dominated the largest market for the solar encapsulation market; the growing population in China, India, Japan, and other Asia Pacific regions have installed solar panels on a large scale, which results in the use of solar encapsulation vigorously. China is the leading installer of solar panels, followed by India and Japan. The government has also been taking initiatives in developing roads and infrastructure, which results in increasing the installation of solar to generate power energy. The solar encapsulation industry, has grown as a result of numerous firms migrating to the region in search of materials due to price fluctuations in solar materials in Europe.

North America

The North American region is expected to witness the fastest market during the forecast period in the solar encapsulation market; consumer desire for electric vehicles (EVs) is rapidly growing due to the industry-wide electrification trend and rising petroleum prices. In response to this trend, major manufacturers are putting a lot of effort into releasing EVs that can recharge themselves. The world's first solar-powered electric vehicle (EV), for example, will make its debut in 2022 and not require charging for the majority of daily use, according to American startup high-efficiency automobile company Aptera. It is anticipated that the release of these cars and the rising use of solar cells in automobiles will accelerate the North American market's growth during the forecast period.

Competitive Landscape

The solar encapsulation market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- 3M

- Cambiosolar

- Dow

- DuPont

- First Solar

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- Kuraray Europe Gmbh

- Mitsubishi Chemical Corporation

- RenewSys India Pvt. Ltd

- STR Holdings Inc.

- VIKRAM SOLAR LTD.

Recent Developments

- In March 2025, Jindal Poly Films completed the acquisition of Enerlite Solar Films, bringing its solar encapsulation film business in-house—signaling a major strategic move to control material supply and enhance proprietary backing sheet capabilities in India's burgeoning solar PV landscape

- In September 2022, GS Energy and Hanwha Solutions' Chemical Division unveiled a collaborative venture named H&G Chemical with the objective of constructing an ethylene-vinyl acetate (EVA) facility. Through the synergies of Hanwha Solutions' established production capabilities and the cost-effective raw materials from GS Caltex, a subsidiary of GS Energy, H&G Chemical aims to rapidly ascend to a prominent position among EVA producers.

Report Coverage

The Solar Encapsulation market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material, technology, applications, and their futuristic growth opportunities.

Solar Encapsulation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 4.66 billion |

|

Revenue forecast in 2034 |

USD 10.74 billion |

|

CAGR |

9.75% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Material, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |