South Korea Ocean Economy Market Size, Share, Trends, Industry Analysis Report

By Industry Type (Marine Transport and Shipping, Marine Tourism and Recreation, Fisheries and Aquaculture), – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6164

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

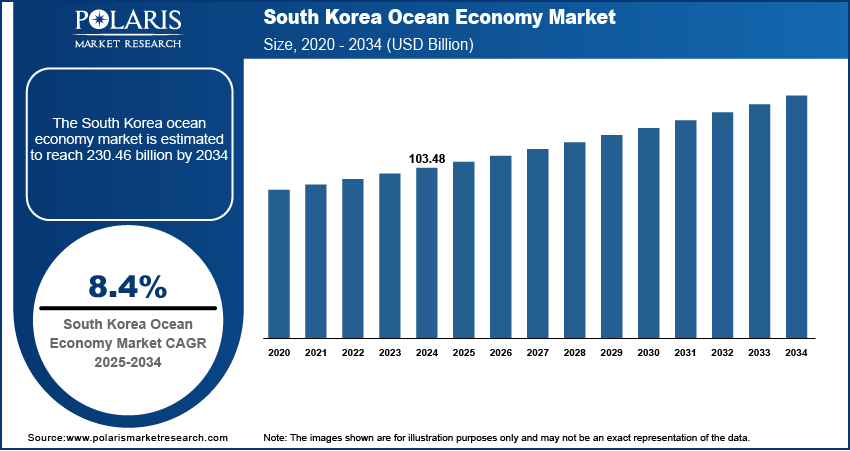

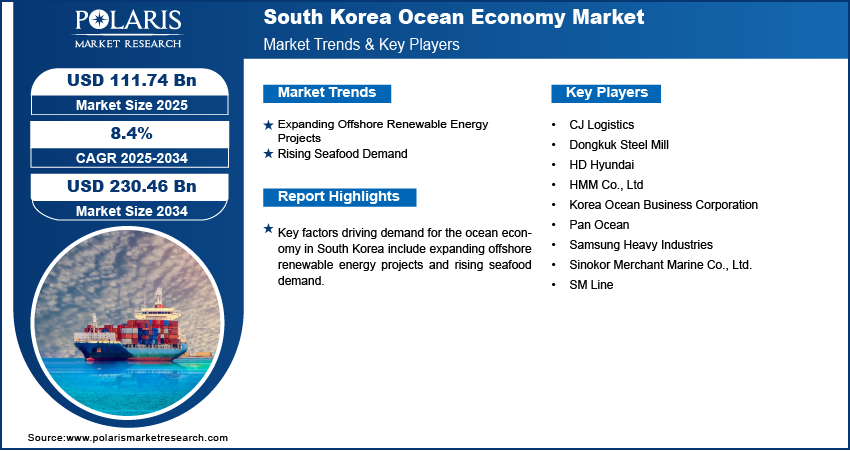

The South Korea ocean economy market size was valued at USD 103.48 billion in 2024, growing at a CAGR of 8.4% from 2025 to 2034. Key factors driving market expansion in South Korea include the expanding offshore renewable energy projects and rising seafood demand.

Key Insights

- The fisheries and aquaculture segment held 31.62% of the South Korea ocean economy market share in 2024 due to rising emphasis on food security.

- The offshore oil and gas segment is projected to register a CAGR of 8.8% from 2025 to 2034, owing to energy security concerns.

Industry Dynamics

- The expansion of offshore renewable energy projects in South Korea is driving market growth by increasing the demand for specialized vessels, port facilities, subsea cabling, and skilled labor.

- The rising seafood demand is also propelling the market revenue by driving higher production and investments in both wild capture and farmed fish operations.

- High capital investment requirements impede the market growth.

- The expanding e-commerce sector in South Korea is expected to create a sustainable market opportunity during the forecast period.

Market Statistics

- 2024 Market Size: USD 103.48 Billion

- 2034 Projected Market Size: USD 230.46 Billion

- CAGR (2025–2034): 8.4%

To Understand More About this Research: Request a Free Sample Report

The ocean economy refers to the sustainable utilization of marine resources for economic growth, encompassing industries such as shipping, fisheries, aquaculture, offshore energy, and coastal tourism. The regulatory landscape shaped by the Ministry of Oceans and Fisheries (MOF) enforces policies aimed at promoting blue growth while ensuring environmental protection. Key regulations, including the Marine Environment Management Act and the Fisheries Act, aim to balance economic activities with marine conservation. Opportunities in the market lie in expanding offshore wind farms, deep-sea mining, and eco-friendly smart ports. South Korea’s expertise in marine robotics and AI-driven aquaculture positions it as a key country in sustainable ocean industries, with potential for international collaboration in blue technology and carbon-neutral maritime solutions.

Drivers & Opportunities

Expanding Offshore Renewable Energy Projects: Governments and private companies in South Korea are investing heavily in offshore wind, tidal, and wave energy infrastructure, which is increasing the need for specialized vessels, port facilities, subsea cabling, and skilled labor, leading to market growth. These projects also require continuous environmental monitoring, marine engineering, and logistics support, thereby enhancing the demand for services within the ocean economy. Moreover, the expansion of renewable energy installations is supporting coastal economies by generating local employment and encouraging research and development in marine technology. This growth is strengthening the ocean economy’s role in achieving energy transition and climate goals.

Rising Seafood Demand: People in South Korea are increasingly preferring seafood for its nutritional value, which is driving higher production and investment in both wild capture and farmed fish operations, leading to rising adoption of services within the ocean economy. Governments and private stakeholders in the country are also expanding marine infrastructure, improving cold chain logistics, and adopting advanced aquaculture technologies to meet this growing demand. This expansion is generating employment, promoting exports, and strengthening related sectors such as marine equipment manufacturing and feed production, which is boosting South Korea ocean economy market growth.

Segmental Insights

Industry Type Analysis

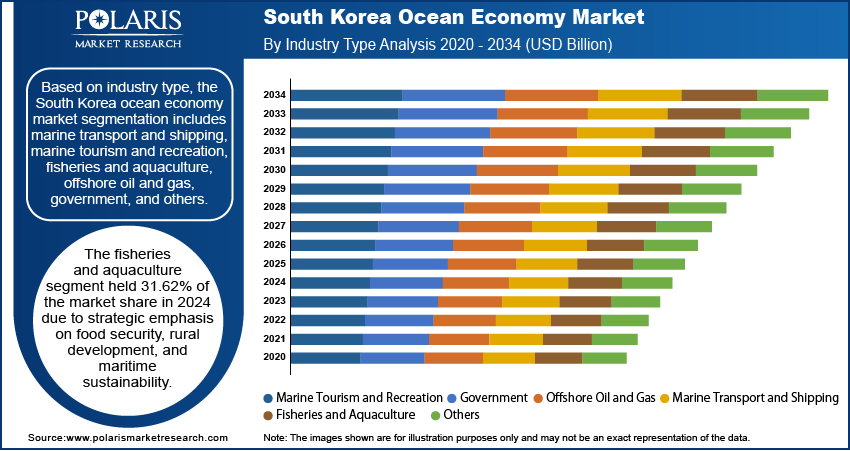

Based on industry type, the segmentation includes marine transport and shipping, marine tourism and recreation, fisheries and aquaculture, offshore oil and gas, government, and others. The fisheries and aquaculture segment held 31.62% of the South Korea ocean economy market share in 2024 due to strategic emphasis on food security, rural development, and maritime sustainability. The country’s long-standing fishing traditions, combined with advanced aquaculture technologies and government subsidies, have strengthened its position as a global leader in seafood production. Coastal regions such as Jeju, Busan, and the South Sea have seen a consistent expansion of fish farms and mariculture operations, particularly for high-demand species like abalone, seaweed, flounder, and bluefin tuna. The growing demand for healthy protein sources, both domestically and internationally, has further strengthened the segment's dominance.

The offshore oil and gas segment is projected to register a CAGR of 8.8% from 2025 to 2034, owing to increasing energy security concerns and the shift toward offshore exploration, particularly in deepwater and ultra-deepwater reserves. South Korea's expertise in offshore engineering and construction, led by firms such as Hyundai Heavy Industries and Samsung Heavy Industries, positions it as a key country in the offshore oil and gas industry. Government initiatives to reduce reliance on energy imports and develop domestic offshore fields, alongside rising investments in liquefied natural gas (LNG) infrastructure, are further expected to propel the market growth during the forecast period.

Key Players & Competitive Analysis

The South Korean ocean economy is highly competitive, driven by a mix of established conglomerates and specialized firms across shipping, logistics, shipbuilding, and steel production. Major players such as HMM Co., Ltd. and SM Line dominate the container shipping industry, while Pan Ocean and Sinokor Merchant Marine focus on bulk and tanker operations. CJ Logistics strengthens the supply chain with integrated logistics solutions, supporting maritime trade. In shipbuilding, HD Hyundai and Samsung Heavy Industries remain global leaders, leveraging advanced technology and eco-friendly vessel innovations. Dongkuk Steel Mill supplies critical materials for shipbuilding and offshore projects, reinforcing the industry’s backbone. The sector benefits from strong government support, including policies promoting green shipping and port modernization.

CJ Logistics; Dongkuk Steel Mill; HD Hyundai; HMM Co., Ltd; Korea Ocean Business Corporation; Pan Ocean; Samsung Heavy Industries; Sinokor Merchant Marine Co., Ltd.; and SM Line are a few major companies operating in the South Korea ocean economy industry.

Key Companies

- CJ Logistics

- Dongkuk Steel Mill

- HD Hyundai

- HMM Co., Ltd

- Korea Ocean Business Corporation

- Pan Ocean

- Samsung Heavy Industries

- Sinokor Merchant Marine Co., Ltd.

- SM Line

South Korea Ocean Economy Industry Developments

In September 2024, HMM Co. announced that it will spend 23.5 trillion won ($17.5 billion) by 2030 to nearly double its cargo capacity.

In June 2024, HMM and IKEA Supply Chain Operations signed an agreement to use HMM’s 'Green Sailing Service', a low-carbon ocean transport solution that will enable both companies to lower their environmental impact and contribute to the decarbonization of ocean transportation.

South Korea Ocean Economy Market Segmentation

By Industry Type Outlook (Revenue, USD Billion, 2021–2034)

- Marine Transport and Shipping

- Marine Tourism and Recreation

- Fisheries and Aquaculture

- Offshore Oil and Gas

- Government

- Others

South Korea Ocean Economy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 103.48 Billion |

|

Market Size in 2025 |

USD 111.74 Billion |

|

Revenue Forecast by 2034 |

USD 230.46 Billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 103.48 billion in 2024 and is projected to grow to USD 230.46 billion by 2034.

The market is projected to register a CAGR of 8.4% during the forecast period.

A few of the key players in the market are CJ Logistics; Dongkuk Steel Mill; HD Hyundai; HMM Co., Ltd; Korea Ocean Business Corporation; Pan Ocean; Samsung Heavy Industries; Sinokor Merchant Marine Co., Ltd.; and SM Line.

The fisheries and aquaculture segment dominated the market share in 2024.

The offshore oil and gas segment is expected to witness the fastest growth during the forecast period.