Southeast Asia Modified Polypropylene Market Share, Size, Trends, Industry Analysis Report

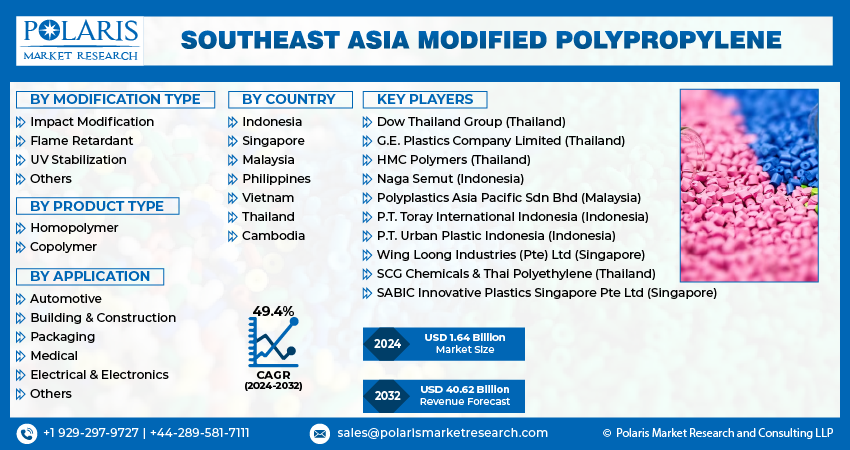

By Modification Type (Impact Modification, Flame Retardant, UV Stabilization, Others); By Product Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4588

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

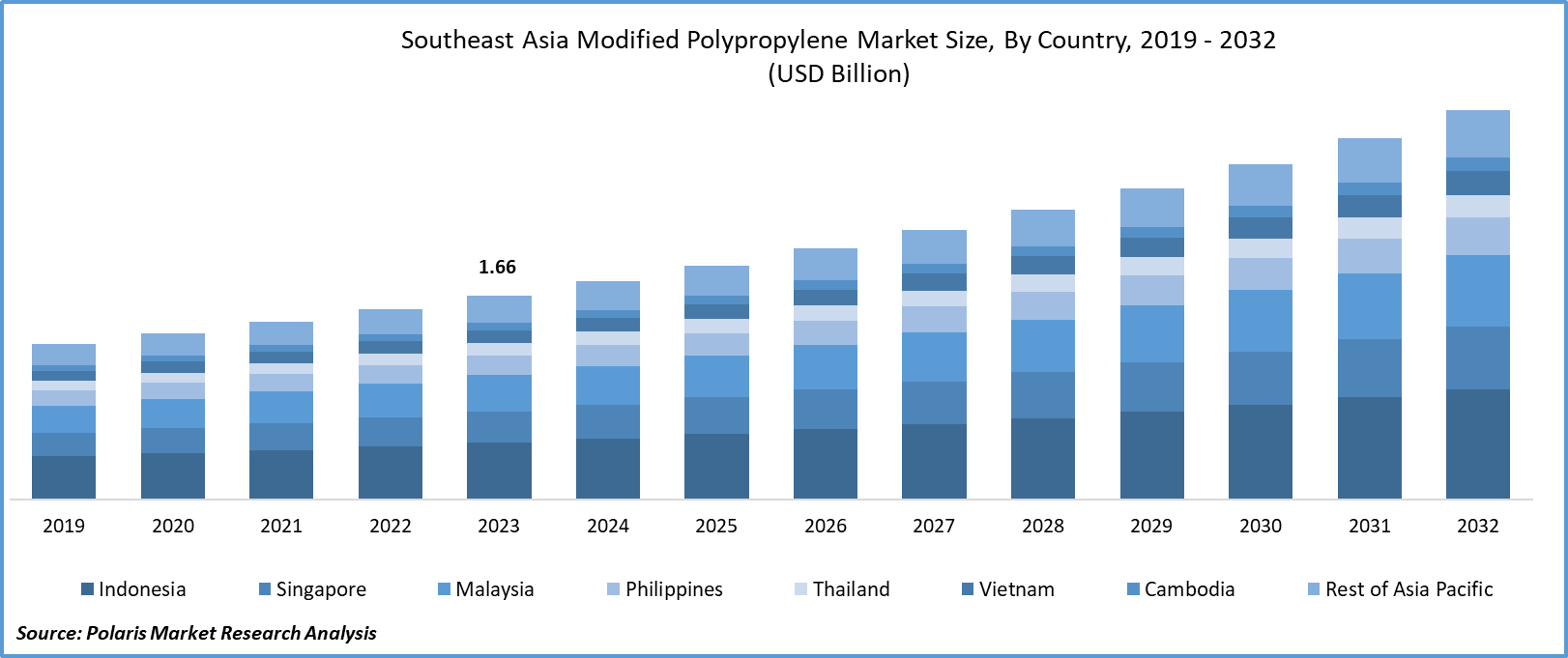

The southeast asia modified polypropylene market size was valued at USD 1.66 billion in 2023. The market is anticipated to grow from USD 1.78 billion in 2024 to USD 3.19 billion by 2032, exhibiting the CAGR of 7.5% during the forecast period.

Market Overview

Rising demand for efficient and sustainable packaging equipment is positively fueling the demand for modified polypropylene in Southeast Asia. This is attributable to the superior performance of modified propylene, such as its lightweight, barrier potential, rigidity, and longevity, which are driving its adoption in the packaging of goods, including food and beverage, consumer utilities, and many more. According to the data published by the World Economic Forum, the Philippines and Malaysia are the top two countries in global e-commerce retail growth, constituting 25% and 23%, respectively. This trend is exhibiting potential demand for modified propylene in the marketplace.

Furthermore, the growing research studies focusing on reviewing the use of modified polypropylene are expected to drive new growth potential in the study period.

- For instance, a 2023 study published in MDPI focused on the development of post-consumer recycled flexible polypropylene (PCPP) with enhanced thermal stability and processability. The study concluded that it has improved processability, crystallinity, and thermal stability.

To Understand More About this Research: Request a Free Sample Report

Moreover, the ongoing growth of automotive vehicle use in the region, specifically Singapore, with the significant uptick in disposable income among the population driven by increasing economic activities, is anticipated to propel demand for modified polypropylene in the foreseeable future.

Growth Drivers

Rising regularity challenges in the marketplace

With the growing number of stringent regulations on polymer usage driven by sustainability as a major concern, there will be enormous opportunities for modified propylene in the coming years. For instance, in July 2023, Eastman unveiled Advantis adhesion promoters, which include modified polypropylene and polyethylene polymers, to assist paint and coating users in complying with the regularity modifications. This is the outcome of regulatory challenges placed on cumene in the European Union.

Increased demand for modified polypropylene in electronics manufacturing

Modified polypropylene is considered a prominent material in the manufacturing of electronic gadgets due to its compatibility with electric components. The presence of countries focusing on developing the manufacturing of electronics in their region is facilitating the need for modified polypropylene. According to the Ministry of Industry and Trade report, Vietnam’s electronic sector reached the export target of over 114 billion USD in 2022, which is growing significantly at 7% annually, leading to a total of 30% of the nation.

Restraining Factors

The higher rate of input costs is expected to impede market growth

The price fluctuations of the raw materials incorporated in the modified polypropylene production process are leading to lower production activity by the manufacturers, causing price volatility in the marketplace, which is likely to encourage users to consider alternatives to the modified propylene on the market.

Report Segmentation

The market is primarily segmented based on modification type, product type, application and region.

|

By Modification Type |

By Product Type |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Modification Type Analysis

UV stabilization segment is anticipated to witness the highest growth during forecast period

The UV stabilization segment is likely to grow at a higher CAGR during the forecast period, primarily attributable to the need for higher-potential polymers to withstand extreme weather conditions in the automotive industry. A 2020 study published in ResearchGate focused on testing the UV stabilization properties by adding hindered amine light stabilizers (HALSs) & zinc oxide stabilizers to the polypropylene. It concluded that there is an improvement in the UV resistance and power hardness of the polymer.

The impact modification and flame-retardant segment is driven by the problems of utilizing polypropylene in multiple applications due to its intrinsic alkaline structure, leading to the probable catch of fire. A 2023 study tested the properties of polypropylene among modified PET fiber-based polypropylene and pure polypropylene and found that modified polypropylene has higher stiffness, greater impact resistance, and decreased shrinkage at higher temperatures.

By Product Type Analysis

Homopolymer segment held the largest market share in 2023

The homopolymer segment gained the largest market share in 2023 and is anticipated to boost its market position during the forecast timeframe. This is attributable to the wide range of applications in technological processing. The astonishing properties of modified polypropylene homopolymer, such as weldability, corrosion-freeness, rigidity, and chemical resistance, are promoting its adoption across a wider spectrum. It is used in the manufacturing of thermo-farming, blow molding, and sheet extrusion.

The copolymer segment is anticipated to grow at an optimal growth rate in the next few years, driven by its softness and durability in line with the polypropylene homopolymer. The higher rate of toughness and prominent stress crack resistance is gaining application in the production of automotive components, pipes, films, and others, contributing to the significant demand for modified polypropylene homopolymers.

By Application Analysis

Automotive segment registered an incredible revenue share in 2023

The automotive segment witnessed the largest share in revenue of the market in 2023, which is highly influenced by the rising need for environmentally friendly polymers in the marketplace, driven by stringent regulations by the nations. This emphasizes automobile manufacturers adopting recyclable materials in the production process, thereby boosting the demand for modified polypropylene in the coming years. As per 2023 industrial data, Thailand witnessed a rise in the production of cars by 1.78% in June.

Regional Insights

Indonesia region registered the largest share of the Southeast Asia modified polypropylene market in 2023

The Indonesia region received the largest share of the Southeast Asian modified polypropylene market and is projected to continue its growth trajectory in the coming years. This is attributable to the growing demand for sustainable plastics in automotive, construction, packaging, and electronic activities. The ongoing construction boom in the region is encouraging companies to invest a significant amount. For instance, Gravel received $14 million in funding from New Enterprise Associates for the construction sector. These initiatives are expected to promote construction activities in the region, driving demand for modified polypropylene in the long run.

The Singapore region is projected to grow at a faster rate in the study period with a notable CAGR, driven by the significant rise in the demand for polypropylene with flame retardant, UV stabilization, and impact modification properties driven by its necessity in the manufacturing of automobiles and electronics, which are witnessing significant demand from the population with the increased disposable income.

Key Market Players & Competitive Insights

The rising innovations will likely boost the competition

The Southeast Asia modified polypropylene market development is characterized by moderate fragmentation, with the presence of several market players focusing on efficient production with investment in research and development activities, driving competition with new product innovations in the global market.

For instance, in October 2023, Asahi Kasei announced the expansion of 3D printing filaments in North America, including a product portfolio of modified polyphenylene ether (mPPE) resin, XYRON. This is likely to enhance the supply chain in North America and influence Southeast Asia in the long run.

Some of the major players operating in the global market include:

- Dow Thailand Group (Thailand)

- G.E. Plastics Company Limited (Thailand)

- HMC Polymers (Thailand)

- Naga Semut (Indonesia)

- Polyplastics Asia Pacific Sdn Bhd (Malaysia)

- P.T. Toray International Indonesia (Indonesia)

- P.T. Urban Plastic Indonesia (Indonesia)

- Wing Loong Industries (Pte) Ltd (Singapore)

- SCG Chemicals & Thai Polyethylene (Thailand)

- SABIC Innovative Plastics Singapore Pte Ltd (Singapore)

Recent Developments in the Industry

- In November 2023, Pan Era Group and Milliken joined forces to produce recycled polypropylene in Indonesia with a view to promoting productivity by utilizing the additive technology solution of Milliken.

- In July 2023, Repsol, in collaboration with Quimidroga, unveiled its innovations in polypropylene compound, which can replace metal in technical applications, specifically in water treatment facilities.

Report Coverage

The Southeast Asia modified polypropylene market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, modification type, product type, application, and their futuristic growth opportunities.

Southeast Asia Modified Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.78 billion |

|

Revenue forecast in 2032 |

USD 3.19 billion |

|

CAGR |

7.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Volume in Kilo Tons, Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Southeast Asia Modified Polypropylene report covering key segments are modification type, product type, application and region.

Southeast Asia Modified Polypropylene Market Size Worth $3.19 Billion By 2032

Southeast Asia Modified Polypropylene Market exhibiting the CAGR of 7.5% during the forecast period.

Indonesia is leading the global market

key driving factors in Southeast Asia Modified Polypropylene Market are Increased demand for modified polypropylene in electronics manufacturing