Soy Protein Ingredients Market Share, Size, Trends, Industry Analysis Report

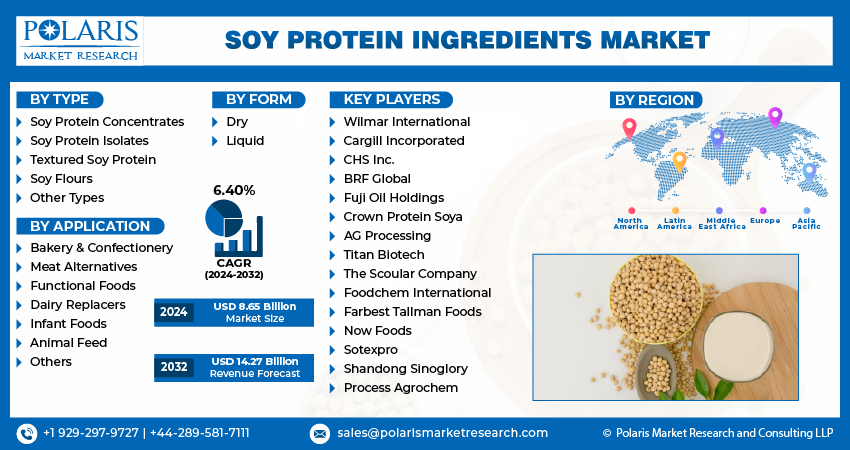

By Type (Soy protein Concentrates, Soy Protein Isolates, Textured Soy Protein, Soy Flours, and Other Types); By Form; By Application; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3110

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

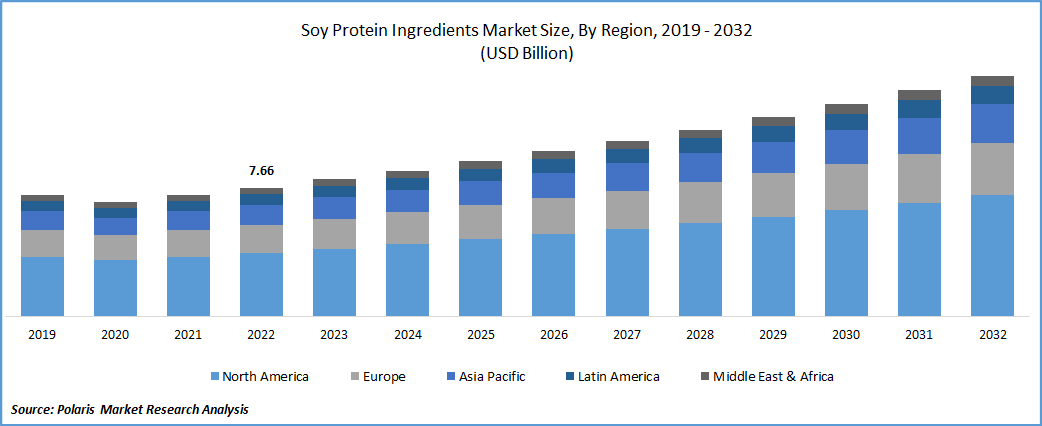

The global soy protein ingredients market was valued at USD 8.14 billion in 2023 and is expected to grow at a CAGR of 6.40% during the forecast period. The emerging trend of healthy food habits and the increasing number of gym professionals and fitness enthusiasts across the globe, coupled with the growing working population and increased awareness regarding the negative effects of consuming meat-based products regularly among people, are among the key factors driving the global market growth. In addition, the rapid growth in the R&D expenditures and technological advances incorporated by major market players have paved the way for the emergence of innovative soy protein products, creating a huge demand for the development and augmenting market growth.

Know more about this report: Request for sample pages

For instance, in December 2022, Bunge announced its plan to invest about USD 550 Mn to produce its textured soy protein concentrate. The new production facility will meet the rising consumer demand for the key ingredients used in the production of processed food, & feed products.

The change in the consumer perception of nutrition has to significantly broaden the consumer base and the number of people consuming plant-based protein products. The outbreak of the COVID-19 pandemic has significantly impacted the growth of the soy protein ingredients market. The spread of the deadly coronavirus has created immense pressure across many retail stores, supermarkets, and food suppliers due to imposed lockdowns and various other stringent regulations on trade activities. However, on the other hand, there has been a surge in the consumption of plant-based protein products due to the growing health concerns during the pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Soy protein ingredients are widely used in the manufacturing of meat replacements. They have gained high traction as an alternative to animal meat protein, especially red and processed meat, owing to their propensity to develop fibrous structures and superior gelation capabilities, a major factor expected to boost the market growth. Additionally, the increasing lactose-intolerant population and preferences for consuming cruelty-free food items among parents have further fueled the market expansion. Moreover, the growing popularity of various sports activities and the increasing number of sports institutions worldwide, along with the rapid rise in health and fitness centers, are further anticipated to create huge demand and growth opportunities for the market over the coming years.

Report Segmentation

The market is primarily segmented based on type, form, application, and region.

|

By Type |

By Form |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Soy protein concentrates segment accounted for the largest market share in 2022

The soy protein concentrates segment accounted for a significant global market share in 2022 and is likely to retain its position throughout the forecast period. The growth of the segment market can be mainly attributed to a negligible amount of cholesterol and saturated fats in soy concentrates, which further provides a nutrient-dense and high-quality protein that can be used alone or in combination with any other protein source. In addition, the growing prevalence and demand for soy protein concentrate in the animal feed and meat industries are also expected to fuel the segment's revenue growth.

The soy protein isolates segment is expected to grow at a considerable growth rate over the coming years on account of the high presence of protein content, very low-fat content, and no cholesterol, along with the growing awareness regarding its capabilities for lowering the risk of heart disease, breast cancer, and osteoporosis.

Dry segment held the largest market revenue share in 2022

The dry segment held a significant market revenue share in 2022, mainly accelerated by its lower chances of formulation errors, capability to effectively maintain the ingredient stability, ease of handling and transport, and lower operational costs. Moreover, dry soy protein contains all the essential amino acid types, making it a complete and high-quality protein. Along with this, various kinds of dry soy protein food ingredients, including tofu, edamame, and tempeh, might benefit from breast cancer and prostate cancer, which in turn, fuel the growth of the segment market over the coming years.

Functional foods segment is expected to witness highest growth over the anticipated period

The functional foods segment is projected to grow at a considerable CAGR over the anticipated period due to increasing consumer inclinations towards high-protein-rich food products and the widespread adoption of soy protein to minimize fat, improve baking properties, and enhance the overall product quality. In addition, the extensive growth and adoption of veganism have led to a significant increase in the food industry and a rising number of health-conscious consumers worldwide, which are also expected to stimulate market growth in the near future.

The meat alternatives segment is further projected to grow considerably and account for a healthy market share in 2022. Increasing prevalence among consumers to incorporate plant-based diets instead of meat products, as high consumption of red meats can result in type-2 diabetes and even cause esophagus cancer, the key factors influencing segment growth.

The North America region dominated the market in 2022

North America dominated the global market in 2022 and is expected to maintain its dominance throughout the forecast period. The regional market growth can be largely attributed to increased consumer awareness regarding the availability and benefits of plant-based products and ongoing research activities for introducing more improved soy protein-enriched products. In addition, the growing entry of new market players and start-ups in the regional market and the exponential growth of the nutraceuticals industry, especially in countries like the US, Canada, and Mexico, are pushing the market growth forward.

The Asia Pacific region is expected to emerge as the fastest-growing region in the global market over the coming years. The emerging trend of veganism and the shift in consumer preferences from meat-based products to plant-based products due to their wide range of health and environmental benefits, mainly in countries like India, China, and Indonesia, is one of the key factors propelling the demand and growth for soy protein ingredients in the region.

Competitive Insight

Some of the major players operating in the global soy protein ingredients market include Wilmar International, Cargill Incorporated, CHS Inc., BRF Global, Fuji Oil Holdings, Crown Protein Soya, AG Processing, Titan Biotech, The Scoular Company, Foodchem International, Farbest Tallman Foods, Now Foods, Sotexpro, Shandong Sinoglory, & Process Agrochem.

Recent Developments

- In February 2022, Benson Hill, a leading US-based food tech company, introduced TruVail, a new line of domestically sourced and non-GMO plant-based protein ingredients with several unique benefits. The new product line will include high-protein soy flour, soy protein concentrate, and texturized proteins for widespread use across various soy protein applications.

- In September 2022, Archer Daniel Midland established a new extrusion plant in Serbia that will expand the company’s production of its non-GMO soy protein. The new production facility will not only boost the supply of locally sourced soy protein in Europe.

Soy Protein Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.65 billion |

|

Revenue forecast in 2032 |

USD 14.27 billion |

|

CAGR |

6.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Wilmar International Ltd., Cargill Incorporated, International Flavors & Fragrances Inc., CHS Inc., BRF Global, Fuji Oil Holdings Inc., Crown Protein Soya Group Company, AG Processing Inc., Titan Biotech, The Scoular Company, Foodchem International Corporation, Farbest Tallman Foods Corporation, Now Foods, Sotexpro, Shandong Sinoglory Health Food, and Process Agrochem Industries. |

FAQ's

Key companies in soy protein ingredients market are Wilmar International, Cargill Incorporated, CHS Inc., BRF Global, Fuji Oil Holdings, Crown Protein Soya, AG Processing, Titan Biotech, The Scoular Company.

The global soy protein ingredients market expected to grow at a CAGR of 6.4% during the forecast period.

The soy protein ingredients market report covering key segments are type, form, application, and region.

Key driving factors in soy protein ingredients market are increase in health awareness among consumers and rise in inclination towards plant protein and veganism.

The global soy protein ingredients market size is expected to reach USD 14.27 billion by 2032.