Protein Characterization and Identification Market Size, Share, Trends, & Industry Analysis Report

By Application (Drug Discovery & Development, Clinical Diagnosis), By Product & Services, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2219

- Base Year: 2024

- Historical Data: 2020 - 2023

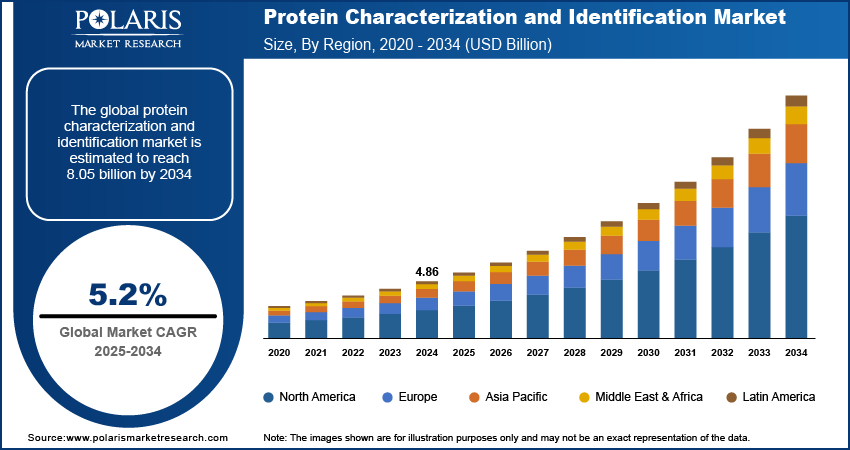

The global protein characterization and identification market was valued at USD 4.86 billion in 2024 and is expected to grow at a CAGR of 5,2% during the forecast period. The rapid technological advancements are driving the growth in the market are allowing for better research techniques, which is expanding the market.

Key Insights

- The drug discovery & development segment is expected to be the most significant revenue contributor due to rising R&D spending.

- The pharmaceuticals & biotechnology companies segment dominated with largest share due to rising demand for personalized medicine and biomarkers globally.

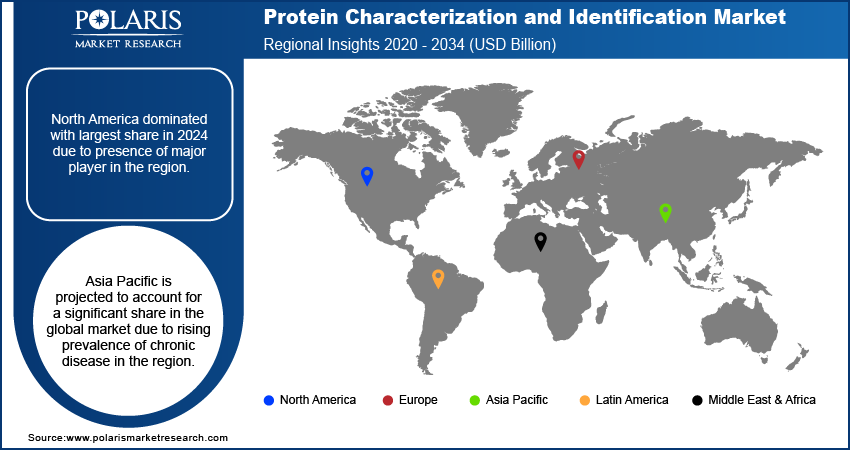

- North America dominated with largest share in 2024 due to presence of major player in the region.

- Asia Pacific is projected to account for a significant share in the global market due to rising prevalence of chronic disease in the region.

Industry Dynamics

- Rising research and development spending on drug discovery and development is fueling the growth.

- Growing number of strategic product launch, partnership and collaboration is boosting the expansion.

- Technological advancement is driving the growth.

- The high cost and operational expenses of advanced instruments, reagents, and data analysis is restraining the growth.

Market Statistics

- 2024 Market Size: USD 4.86 Billion

- 2034 Projected Market Size: USD 8.05 Billion

- CAGR (2025-2034): 5.2%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- AI helps in quicker and more accurate data analysis for large proteomics datasets.

- AI helps in predictive modelling and structure prediction. Prominent example is AlhpaFold.

- AI helps integrate proteomics data with genomics, transcriptomics, metabolomics, and others to build a more comprehensive picture of biological systems

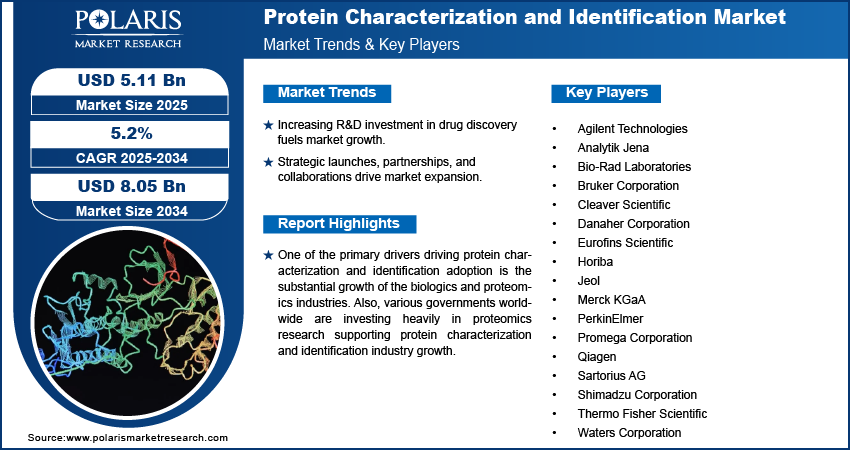

One of the primary drivers driving protein characterization and identification adoption is the substantial growth of the biologics and proteomics industries. Also, various governments worldwide are investing heavily in proteomics research supporting protein characterization and identification industry growth. The biopharmaceutical market's goal of blockbuster pharmaceuticals and recent technological improvements in studying genes will continue to be driven by these primary forces.

Furthermore, the major players focus on various strategies such as launching new products, partnerships, and collaborations, among others, driving the protein characterization and identification industry growth during the forecast period. For instance, in June 2021, Thermo Fisher Scientific has announced the launch of the new mass spectrometer for small molecule analysis. The Orbitrap IQ-X Tribrid mass spectrometer from Thermo Scientific was created with small-molecule structure elucidation of compounds and unknown chemicals in consideration.

Metabolomics and lipidomics research the detection of leachable/extractable contaminants, and forensic toxicology are among the many uses. The MS system uses the trusted Thermo Scientific Tribrid architecture to provide a unique, purpose-built AcquireX methodology for acquiring high-quality data. Thus, the launch of the mass spectrometer for protein identification and characterization is boosting the market growth.

However, sample preparation is an important step in isolating the analyte of interest for protein characterization and identification, as it helps to minimize interferences that could alter the result. Lack of understanding about the best technology to employ and how to prepare samples impacts outcomes and results in various direct and indirect costs for end-users. Besides, the high cost of instruments used for the detection, identification, and characterization could be a major restriction for the global market demand for protein characterization and identification.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The protein characterization and identification market have observed extensive developments in the last few decades supported by various factors such as the rising research and development expenditure for drug discovery and development in the market. The market for protein characterization and identification has benefited from the increasing emphasis on drug research and development. Protein analysis is a crucial stage in the development of pharmaceutical and biological products for identifying viable candidates. As a result, the acceptance of newer medication therapy has boosted the motivation to discover new and sophisticated drugs.

According to the Congressional Budget Office of the US, In 2019, the pharmaceutical sector spent USD 83 billion on research and development. The number of new medications granted each year has also surged during the last decade. From 2010 through 2019, the Food and Drug Administration (FDA) approved an average of 38 new drugs per year (with a high of 59 in 2018), which is 60% more than the previous decade's average.

The biopharmaceutical market as a whole spent an estimated USD 102 billion on research and development. One new procedure takes 10-15 years to create and costs USD 2.6 billion, not considering the expense of several failures. Only 12% of new molecular entities that enter clinical trials are approved by the United States Food and Drug Administration (FDA). Thus, the R&D investment by the major government and private institutions is the factor that is boosting the global protein characterization and identification industry growth.

Report Segmentation

The market is primarily segmented based on product & services, application, end-use, and region.

|

By Product & Services |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application market division, the drug discovery & development segment is expected to be the most significant revenue contributor in the global protein characterization and identification industry in 2024 and is expected to retain its dominance in the foreseen period. The market segment is expanding as a result of rising R&D spending and an increase in the number of clinical trials for advanced medicines development.

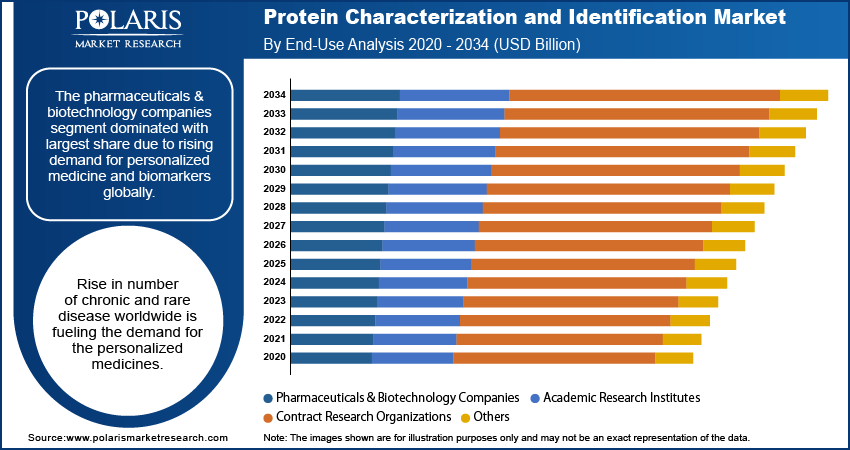

Insight by End Use

The pharmaceuticals & biotechnology companies segment dominated with largest share due to rising demand for personalized medicine and biomarkers globally. Rise in number of chronic and rare disease worldwide is fueling the demand for the personalized medicines. Companies need protein identification and quantification to discover biomarkers, monitor therapeutic responses, and support diagnostic tests. Moreover, rising investment in pharmaceutical and biotechnology companies is further driving the growth. This rise in investment support companies to spend capital on various services and tests, which in turn drives the demand, thereby driving the segment growth.

Geographic Overview

In terms of geography, North America had the highest revenue share in 2024 in the global protein characterization and identification market. The presence of prominent players, the availability of financing for breakthrough technologies from government organizations, and increased R&D spending in proteomics research are the major drivers driving protein characterization and identification industry expansion in the region. In August 2021, Metrohm USA and Canada, both manufacturers of high-precision instruments, have signed a partnership agreement with the Agilent to be a re-seller for varied products & services being offered.

Moreover, Asia Pacific is expected to witness a high CAGR in the global protein characterization and identification market in the forecast period. The rising frequency of chronic diseases, global growth by major protein characterization and identification industry participants, and increased market demand for high-quality analytical equipment for protein analysis can all be related to this rise. According to the first Longitudinal Ageing Study in India (LASI) released by the Union Ministry of Family and Health Welfare in January 2020, two out of every three older adults in India suffer from a chronic condition.

Multi-morbidity affects roughly 23% of the elderly population (aged 60 and over); older women are more likely to suffer multi-morbidity diseases. Cardiovascular diseases (CVD) and hypertension are the leading causes of chronic health problems in people aged 75 and up. In the age group under 45, about 73% is determined to be free of morbid conditions, while this percentage drops to 44% in 75 and over. The prevalence of diagnosed CVD is 19% in the 45-49 age group and 37% in over 75. A similar path is followed by chronic hypertension.

Hypertension affects about 18% of people aged 45 to 49, and it rises to 28 percent in those aged 60 to 64 and 35 % in those aged 70 to 74. Bone and joint problems, as well as diabetes, are common among the elderly. In India, diabetes affects 14 % over the age of 60 on average. As a result, the increased prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disease (CVD), among others, is driving protein characterization and identification industry growth over the projection period in the region.

Competitive Insight

Some of the major players operating in the global protein characterization and identification market include Agilent Technologies, Analytik Jena, Bio-Rad Laboratories, Bruker Corporation, Cleaver Scientific, Danaher Corporation, Eurofins Scientific, Horiba, Jeol, Merck KGAA, PerkinElmer, Promega Corporation, Qiagen, Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation.

Protein Characterization and Identification Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.86 billion |

| Market size value in 2025 | USD 5.11 billion |

|

Revenue forecast in 2034 |

USD 8.05 billion |

|

CAGR |

5.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product & Services, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Agilent Technologies, Analytik Jena, Bio-Rad Laboratories, Bruker Corporation, Cleaver Scientific, Danaher Corporation, Eurofins Scientific, Horiba, Jeol, Merck KGAA, PerkinElmer, Promega Corporation, Qiagen, Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation. |

FAQ's

• The market size was valued at USD 4.86 billion in 2024 and is projected to grow to USD 8.05 billion by 2034.

• The market is projected to register a CAGR of 5.2% during the forecast period.

• A few of the key players in the market are Agilent Technologies, Analytik Jena, Bio-Rad Laboratories, Bruker Corporation, Cleaver Scientific, Danaher Corporation, Eurofins Scientific, Horiba, Jeol, Merck KGAA, PerkinElmer, Promega Corporation, Qiagen, Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation

• The pharmaceutical and biotechnology dominated with largest share in 2024.

• The drug discovery and development segment is expected to be the most significant revenue contributor.