Specialty Carbon Black Market Size, Share, Trends, & Industry Analysis Report

By Grade (Conductive Carbon Black, Fiber Carbon Black, Food Contact Carbon Black, and Others), By Function, By Application, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5766

- Base Year: 2024

- Historical Data: 2020-2023

Overview

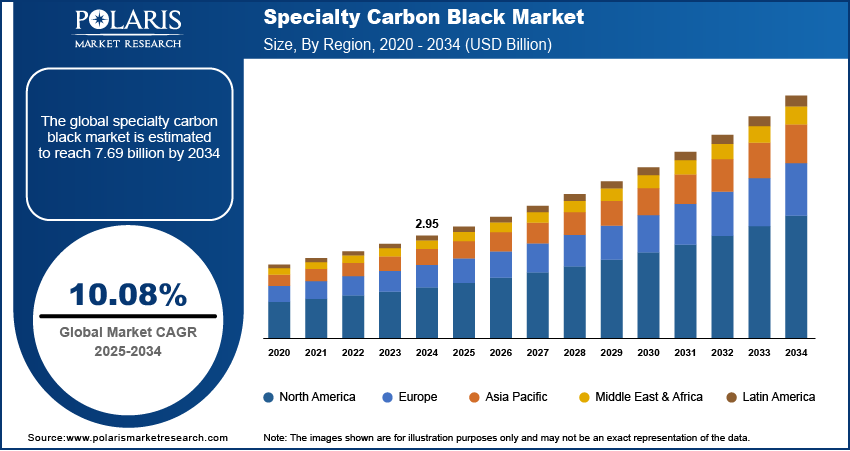

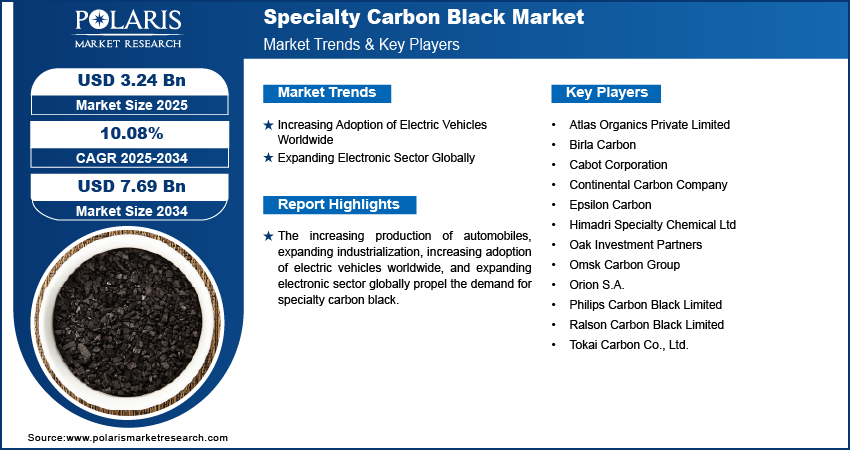

The global specialty carbon black market size was valued at USD 2.95 billion in 2024, growing at a CAGR of 10.08% during 2025–2034. Key factors driving demand for specialty carbon black include increasing production of automobiles, expanding industrialization, increasing adoption of electric vehicles worldwide, and expanding electronic sector globally.

Specialty carbon black is a high-purity, finely divided form of carbon produced to deliver specific performance characteristics across a wide range of industrial applications, such as tire manufacturing and others. Specialty carbon black is produced by the partial combustion of hydrocarbons in controlled environments and contains fewer impurities such as ash, sulfur, and metals compared to conventional carbon blacks, making it the purest form available. Specialty carbon black is known for its exceptional tinting strength, electrical and thermal conductivity, dispersibility, and resistance to ultraviolet (UV) radiation.

The increasing production of automobiles is driving the demand for specialty carbon black. Automotive manufacturers use specialty carbon black to reinforce rubber parts such as tires, hoses, seals, and gaskets, which require high durability and resistance to wear and tear. Moreover, manufacturers also use this material in automotive interiors and exteriors for coloring, tinting, and UV protection, helping maintain product longevity and visual appeal. Association of European Automobile Manufacturers, in its report, stated that 85.4 million motor vehicles were produced around the world in 2022, an increase of 5.7% compared to 2021. Therefore, as production of automobiles increases to meet growing consumer demand, they expand their procurement of rubber-based components that depend on specialty carbon black for structural integrity, leading to market growth.

To Understand More About this Research: Request a Free Sample Report

The specialty carbon black demand is driven by the expanding industrialization. Industrialization is driving the need for advanced rubber and plastic components for machinery, infrastructure, and equipment, all of which rely on specialty carbon black for reinforcement, conductivity, and UV protection. Manufacturers in the industrial sector are incorporating specialty carbon black into conveyor belts, gaskets & seals, and coatings to improve durability and resistance to harsh operating conditions. Rapid industrial growth is also fueling demand for high-quality plastics and polymers used in cables, pipes, and protective films, where specialty carbon black is needed to enhance electrical conductivity and weather resistance. Therefore, the expanding industrialization globally is driving the demand for specialty carbon black.

Industry Dynamics

Increasing Adoption of Electric Vehicles Worldwide

Electric vehicles (EVs) require advanced rubber components for battery housings, cables, hoses, and tires that withstand heat, friction, and environmental stress. Specialty carbon black meets these needs by strengthening parts while enhancing conductivity and thermal stability. Additionally, EV manufacturers use specialty carbon black in plastic components for shielding, insulation, and EMI protection. As per data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023. Therefore, as adoption of EVs increases to meet government compliance, the need for specialty carbon black increases in both structural and functional applications.

Expanding Electronic Sector Globally

Electronic manufacturers are heavily using specialty carbon black in cables, connectors, semiconductors, and casings to provide electrical conductivity, thermal stability, and electromagnetic shielding. Additionally, the growth of data centers and 5G infrastructure is fueling the production of high-performance electronic cables and coatings, further increasing the consumption of specialty carbon black. Hence, as the electronic sector expands globally, demand rises for smartphones, laptops, wearables, and smart home devices. This drives producers to demand specialty carbon black as it ensures device reliability and safety.

Segmental Insights

By Grade Analysis

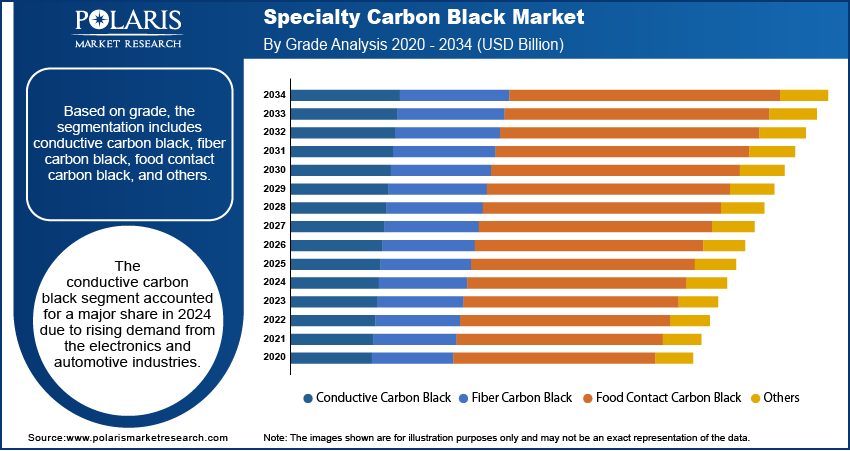

Based on grade, the segmentation includes conductive carbon black, fiber carbon black, food contact carbon black, and others. The conductive carbon black segment accounted for a major market share in 2024 due to rising demand from the electronics and automotive industries. The increasing adoption of EVs and the expansion of lithium-ion battery production boosted the need for conductive carbon black, as it enhances electrical conductivity in battery electrodes and antistatic coatings. Additionally, the growing use of conductive polymers in sensors, touch screens, and wearable technology further contributed to the segment's dominance. Stringent regulations promoting energy-efficient materials and the shift toward lightweight automotive components also contributed to its high adoption.

The fiber carbon black segment is expected to grow at a robust pace in the coming years, owing to its critical role in synthetic fiber production, particularly for textiles and industrial applications. Fiber carbon black improves UV resistance, durability, and tensile strength, making it crucial in sectors requiring long-lasting materials. Furthermore, the expansion of the construction and infrastructure industries, especially in emerging economies, is estimated to drive demand for fiber carbon black.

By Function Analysis

In terms of function, the segmentation includes UV protection, conductivity enhancement, coloring & tinting, and reinforcement. The UV protection segment is expected to grow at a rapid pace during the forecast period, owing to the rising concerns over material degradation from prolonged sun exposure. Industries such as automotive, construction, and packaging increasingly rely on UV-stabilized polymers to enhance product longevity. The growing demand for weather-resistant coatings, agricultural films, and outdoor textiles is further projected to propel carbon black adoption in the coming years. Additionally, the imposition of stricter environmental regulations promoting sustainable and durable materials is estimated to push manufacturers to integrate UV-protective additives, securing the segment’s growth during the forecast period.

By Application Analysis

Based on application, the segmentation includes plastics, printing inks, paints & coatings, batteries, adhesives & sealants, and others. The plastics segment held the largest share in 2024 due to extensive use across the automotive, packaging, and consumer goods industries. The rising demand for lightweight, durable, and UV-resistant plastic components in electric vehicles (EVs) and electronic devices contributed to specialty carbon black consumption. Additionally, stringent regulations promoting recyclable and high-performance plastic materials further contributed to the segment dominance. The expansion of e-commerce and flexible packaging solutions also played a key role in the segment’s dominance, as carbon black improves shelf-life stability in plastic films and containers.

By End-Use Industry Analysis

Based on end-use industry, the segmentation includes automotive, packaging, electronics, and construction. The electronics segment is projected to grow at a robust pace in the coming years, owing to the expansion of smart devices and renewable energy systems. The proliferation of 5G technology, wearable gadgets, and flexible displays is fueling demand for specialty carbon black in the electronic industry. Innovations in printed electronics and semiconductor packaging are also projected to drive further adoption, particularly in heat dissipation and electromagnetic shielding applications. Moreover, the renewable energy transition, particularly in solar panels and energy storage systems, is driving demand for specialty black carbon as these technologies need high-purity additives for efficiency and durability.

Regional Analysis

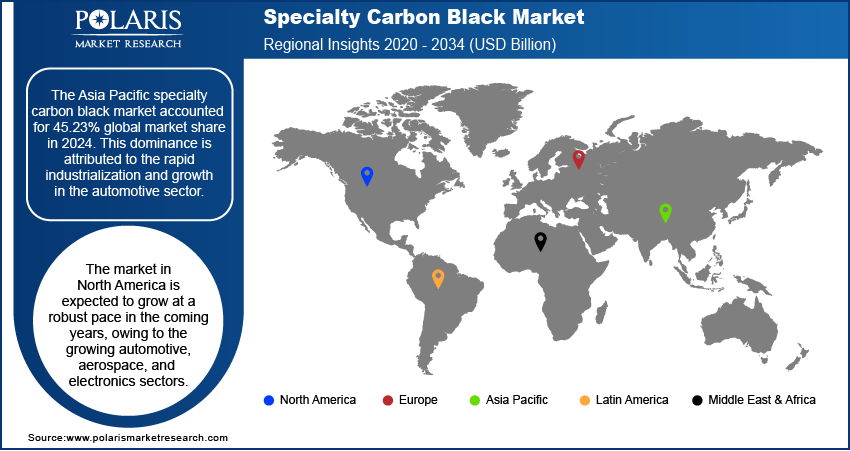

The Asia Pacific specialty carbon black market accounted for 45.23% global market share in 2024. This dominance is attributed to the rapid industrialization and growth in the automotive sector. Countries such as China, Japan, India, and South Korea are major consumers of specialty carbon black due to their expanding manufacturing sectors. Additionally, the rise in infrastructure development and the growing electronics industry in the region boosted demand for high-performance specialty carbon black in conductive polymers and lithium-ion batteries. Environmental regulations promoting sustainable materials in the region also pushed manufacturers to adopt specialty carbon black for UV protection and durability in various applications.

India Specialty Carbon Black Market Insight

In India, the demand for specialty carbon black is fueled by the expanding automotive and tire industries, along with growth in packaging, agriculture films, and industrial coatings. Government initiatives such as "Make in India" and increasing foreign investments in manufacturing are propelling demand. The rise in electric vehicle (EV) production is also contributing to market expansion in the country, as specialty carbon black is used in EV battery components and conductive materials. Furthermore, stricter environmental norms in the country are pushing industries to adopt high-quality carbon black for reduced emissions and enhanced product performance.

North America Specialty Carbon Black Market

The specialty carbon black market in North America is expected to grow at a robust pace in the coming years, owing to the growing automotive, aerospace, and electronics sectors. The region’s strong focus on sustainability and high-performance materials is also increasing demand for specialty carbon black in energy storage, coatings, and specialty polymers. The shift toward electric vehicles (EVs) and renewable energy solutions in the region is further boosting demand, particularly for conductive carbon black used in batteries and solar panels.

US Specialty Carbon Black Market Overview

The US is projected to hold a major share in North America during the forecast period, owing to the strong automotive sector and growing shift toward electric and hybrid vehicles. Additionally, the packaging industry’s need for UV-resistant and anti-static materials is contributing to market growth in the country. Investments in R&D for nanotechnology and polymer composites are further propelling demand for specialty carbon black in the US.

Europe Specialty Carbon Black Market

The market in Europe is driven by a strong emphasis on sustainability. The region’s automotive industry, particularly in Germany and France, relies on specialty carbon black for high-performance tires, coatings, and lightweight composites. The growing adoption of electric vehicles (EVs) in the region, especially in the UK and Germany, is also increasing demand for conductive carbon black in battery applications. Additionally, Europe’s advanced packaging and renewable energy sectors are utilizing specialty carbon black for UV protection and energy-efficient materials. The push toward circular economy practices in the region is further encouraging the use of specialty carbon black.

Key Players & Competitive Analysis Report

The global specialty carbon black market is highly competitive, characterized by the presence of established multinational players and regional manufacturers striving for market dominance through innovation, strategic expansions, and mergers & acquisitions. Major companies such as Cabot Corporation, Birla Carbon, and Orion S.A. hold significant market shares due to their extensive product portfolios, strong R&D capabilities, and global distribution networks. These players focus on developing high-performance carbon black grades for specialized applications, including conductive polymers, lithium-ion batteries, and high-end coatings, catering to industries such as automotive, electronics, and packaging.

A few major companies operating in the specialty carbon black industry include Atlas Organics Private Limited; Birla Carbon; Cabot Corporation; Continental Carbon Company; Epsilon Carbon; Himadri Specialty Chemical Ltd; Oak Investment Partners; Omsk Carbon Group; Orion S.A.; Philips Carbon Black Limited; Ralson Carbon Black Limited; and Tokai Carbon Co., Ltd.

Key Players

- Atlas Organics Private Limited

- Birla Carbon

- Cabot Corporation

- Continental Carbon Company

- Epsilon Carbon

- Himadri Specialty Chemical Ltd

- Oak Investment Partners

- Omsk Carbon Group

- Orion S.A.

- Philips Carbon Black Limited

- Ralson Carbon Black Limited

- Tokai Carbon Co., Ltd.

Specialty Carbon Black Industry Developments

January 2025: Epsilon Carbon, a global company in the carbon black industry, announced the launch of Terrablack, a High-Performing and environmentally friendly recovered carbon black for the tire and non-tire industries.

October 2023: Cabot Corporation announced the launch of a new product, MAJESTIC 710 specialty carbon black, suitable for use in water-based systems. It helps improve color performance with low formulation complexity.

October 2021: Cabot Corporation announced the launch of VULCAN 3-LP carbon black, a low polycyclic aromatic hydrocarbon (PAH) product for rubber applications.

Specialty Carbon Black Market Segmentation

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- Conductive Carbon Black

- Fiber Carbon Black

- Food Contact Carbon Black

- Other

By Function Outlook (Revenue, USD Billion, 2020–2034)

- UV Protection

- Conductivity Enhancement

- Coloring & Tinting

- Reinforcement

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Plastics

- Printing Inks

- Paints & Coatings

- Batteries

- Adhesives & Sealants

- Others

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Packaging

- Electronics

- Construction

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Carbon Black Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.95 Billion |

|

Market Size in 2025 |

USD 3.24 Billion |

|

Revenue Forecast by 2034 |

USD 7.69 Billion |

|

CAGR |

10.08% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.95 billion in 2024 and is projected to grow to USD 7.69 billion by 2034.

The global market is projected to register a CAGR of 10.08% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Atlas Organics Private Limited; Birla Carbon; Cabot Corporation; Continental Carbon Company; Himadri Specialty Chemical Ltd; Oak Investment Partners; Omsk Carbon Group; Orion S.A.; Philips Carbon Black Limited; Ralson Carbon Black Limited; and Tokai Carbon Co., Ltd.

The conductive carbon black segment dominated the market share in 2024.

The electronics segment is expected to witness the fastest growth during the forecast period.